Apple Inc.: Top Shareholders and Capital Structure Analysis

Apple Inc. is one of the top five IT giants in the United States with a market capitalization of $3.445 trillion as of August 2025. The company’s ownership structure is characterized by institutional investors, with over 60% of shares held by major investment firms, while retail investors maintain a substantial 51.43% stake. Apple’s capital structure reflects a mature technology giant that balances strategic debt usage with strong cash generation capabilities.

Key Insights for Q3, 2025:

- Revenue Growth: Q3 2025 showed 10% YoY growth, the highest quarterly growth since December 2021

- Services Dominance: Services now represent 29.2% of revenue with over 1B paid subscriptions

- Global Reach: 2.35B active devices worldwide with strong performance across all regions

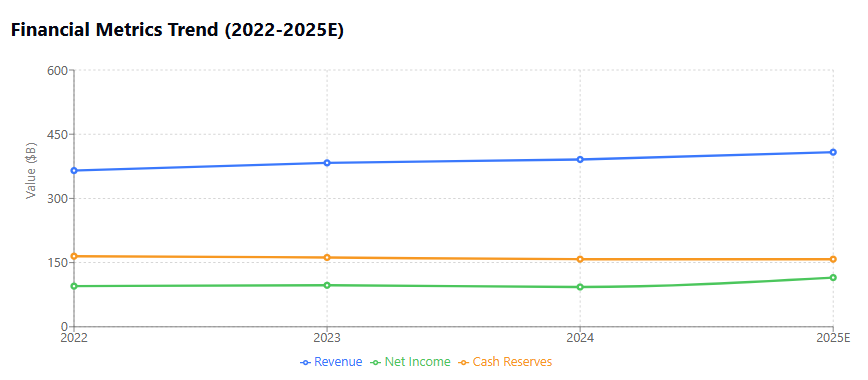

Apple’s Financial Highlights (2025)

- Annual Revenue: $391 billion in 2024, trending higher in 2025.

- Gross Margin: 46.82% (for nine months ended June 28, 2025), demonstrating Apple’s industry-leading profitability, driven by high-margin services and premium hardware.

- Net Income: $84.5 billion for the nine months ended June 28, 2025, up 7% YoY.

- Cash Reserves: $158 billion as of March 2025, maintaining one of the world’s strongest balance sheets.

- R&D Investment: 7.2% of total revenue is now dedicated to research and development, with an emphasis on AI, custom silicon, health devices, and spatial computing.

Recent Financial Performance

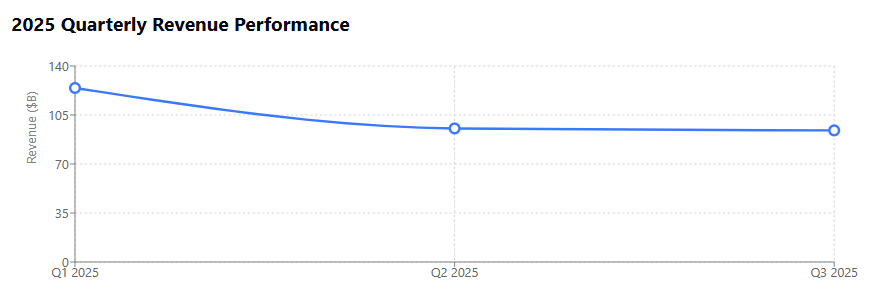

Latest Quarterly Results:

- Apple reported Q3 2025 results with revenue of $94.0 billion (up 10% year-over-year) and earnings per share of $1.57 (up 12% year-over-year)

- Q2 2025 revenue was $95.4 billion (up 5% year-over-year) with EPS of $1.65 (up 8% year-over-year)

- Q1 2025 results showed revenue of $124.3 billion (up 4% year-over-year) and EPS of $2.40 (up 10% year-over-year)

Key Observations

Apple continues to show consistent growth across quarters in 2025, with particularly strong performance in Services. CEO Tim Cook highlighted “double-digit growth in Services” Apple reports second quarter results – Apple in recent earnings commentary.

Apple’s Ownership Before Its IPO

When Apple went public on December 12, 1980, its ownership structure reflected its journey from startup to Silicon Valley success story:

- Steve Jobs: Held about 14% of Apple post-IPO (roughly 7.5 million shares). His stake was later diluted as more shares were issued to employees. When he departed Apple in 1985, Jobs sold his shares except for one.

- Steve Wozniak: Owned about 7-8% just after the IPO, with earlier shares sold due to personal reasons, including a divorce settlement.

- Mike Markkula (early angel investor): Received about one-third of Apple in exchange for his investment and guidance, playing a pivotal role in Apple’s growth. Markkula reportedly owned roughly 26% at IPO after dilution.

- Employees and Other Early Investors: Together, employees and early institutional/venture investors owned the remaining shares.

- Ronald Wayne: No longer held a stake, having sold his 10% back for $800 in 1976.

Current Capital Structure (2025)

Apple’s common stock and APIC now exceed $83 billion (as of late 2024), with over 15.55 billion shares outstanding following multiple stock splits over the decades. The bulk of shares is held by institutional investors, with relatively small percentages in executive or board hands.

Apple’s financial model leverages significant but manageable debt. Total liabilities as of the latest filings (2025) exceed $300 billion, supporting both innovation investment and shareholder returns. Apple’s debt-to-equity ratio is now around 154.49%, reflecting its matured financial position but remaining within accepted bounds for a tech giant. The balance between equity and debt capital supports Apple’s global scale and ongoing share buyback programs.

Apple grants restricted stock units (RSUs) to employees worldwide—including retail and AppleCare—in line with its inclusive approach to equity ownership. The company allocates significant annual share-based compensation, with vesting schedules typically spanning three years.

| Apple Inc. Capital Structure (Sept. 2024, $ millions) | |

|---|---|

| Particulars | Amount (In millions) |

| Non-current liabilities | |

| - Term debt | $85,750 |

| - Other non-current liabilities | $45,888 |

| Total non-current liabilities | $131,638 |

| Shareholders’ equity | |

| - Common stock & APIC | 83,276 |

| - Accumulated deficit | -$19,154 |

| - Accumulated other comprehensive loss | -$7,172 |

| Total shareholders’ equity | $56,950 |

| Total liabilities & equity | $364,980 |

Top Shareholders (2025)

Apple is currently one of the world’s largest businesses by market value. Institutional shareholders form the major chunk of equity holders with more than 60% outstanding shares in the company. Here is a summary about who are Apple’s top institutional shareholders as of June, 30, 2025.

| Holder | Shares held | Percentage of Shares |

|---|---|---|

| Vanguard Group Inc | 1.42B | 9.54% |

| Blackrock Inc. | 1.15B | 7.74% |

| State Street Corporation | 601.25M | 4.05% |

| Geode Capital Management, LLC | 354.75M | 2.39% |

| FMR, LLC | 306.76M | 2.07% |

| Berkshire Hathaway, Inc | 280M | 1.89% |

| Morgan Stanley | 233.2M | 1.57% |

| JPMORGAN CHASE & CO | 214.61M | 1.45% |

| Price (T.Rowe) Associates Inc | 202.72M | 1.37% |

| NORGES BANK | 189.8M | 1.28% |

Individual Shareholders

Since its inception, the Apple team has seen considerable changes in leadership positions. These transitions have enabled the company to be led by talented people who steered the business through various highs and lows. Here is a snapshot of team members.

Board of Directors as of August 2025:

| Name | Designation |

|---|---|

| Timothy D. Cook | Chief Executive Officer and Director |

| Arthur D. Levinson | Director and Chairman of the Board |

| Wanda Austin | Director |

| Alex Gorsky | Director |

| Andrea Jung | Director |

| Monica Lozano | Director |

| Ronald D. Sugar | Director |

| Susan L. Wagner | Director |

Executive management as of August 2025:

Senior executives include Jeff Williams (COO), Luca Maestri (CFO), and other SVPs spanning engineering, operations, retail, and software.

| Name | Designation |

|---|---|

| Tim Cook | Chief Executive Officer (CEO) |

| Katherine Adams | Senior Vice President and General Counsel |

| Eddy Cue | Senior Vice President, Services |

| Craig Federighi | Senior Vice President, Software Engineering |

| John Giannandrea | Senior Vice President, Machine Learning and AI Strategy |

| Greg “Joz” Joswiak | Senior Vice President, Worldwide Marketing |

| Sabih Khan | Chief Operating Officer (COO) |

| Deirdre O’Brien | Senior Vice President, Retail + People |

| Kevan Parekh | Senior Vice President and Chief Financial Officer (CFO) |

| Johny Srouji | Senior Vice President, Hardware Technologies |

| John Ternus | Senior Vice President, Hardware Engineering |

| Jeff Williams | Senior Vice President, Design, Watch, and Health |

| Mike Fenger | Vice President, Worldwide Sales |

| Lisa Jackson | Vice President, Environment, Policy and Social Initiatives |

| Luca Maestri | Vice President, Corporate Services |

| Isabel Ge Mahe | Vice President and Managing Director, Greater China |

| Tor Myhren | Vice President, Marketing Communications |

| Adrian Perica | Vice President, Corporate Development |

| Kristin Huguet Quayle | Vice President, Worldwide Communications |

| Phil Schiller | Apple Fellow |

Business Segments & Revenue Composition

Apple’s market capitalization in August 2025 is around $3.45 trillion and is the world’s third-largest company in terms of market cap. For the 2024 fiscal year, Apple’s global annual revenue was $391,035 million.

The Product and Service-wise bifurcation for revenue was as under:

- iPhone – $201,183 million

- Mac – $29,984 million

- iPad – $26,694 million

- Wearables, Home and Accessories – $37,005 million

- Services – $96,169 million

Each device benefits from Apple’s ecosystem of support, updates, and practical Mac optimization tips to sustain optimal performance.

Here are some of the important Apple products in the market today:

| Category | Details |

|---|---|

| iPhone | Smartphones (iOS): iPhone 16 Pro, iPhone 16, iPhone 15, iPhone 14, iPhone SE |

| Mac | Personal computers (macOS): MacBook Air, MacBook Pro, iMac, Mac mini, Mac Studio, Mac Pro |

| iPad | Tablets (iPadOS): iPad Pro, iPad Air, iPad, iPad mini |

| Wearables, Home & Accessories | Wearables: Apple Watch Ultra 2, Series 10, SE (watchOS); AirPods, AirPods Pro, AirPods Max, Beats; Apple Vision Pro (visionOS) Home: Apple TV (tvOS), HomePod, HomePod mini Accessories: Apple-branded and third-party accessories |

| Advertising | Third-party licensing + Apple’s own ad platforms |

| AppleCare | Fee-based technical support, repair/replacement, extended coverage (accidents, theft, loss) |

| Cloud Services | Storage & sync across Apple devices + Windows PCs |

| Digital Content & Subscriptions | App Store (apps/digital content) Subscriptions: Apple Arcade, Apple Fitness+, Apple Music, Apple News+, Apple TV+ |

| Payment Services | Apple Card (credit card), Apple Pay (cashless payment service) |

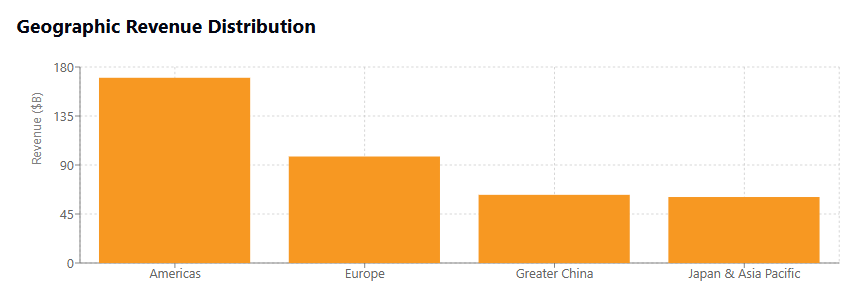

Geographic Revenue Breakdown (2024)

- Americas: 42.7% of revenue, demonstrating Apple’s continued dominance in its home market.

- Europe: Approximately 25.9% of revenue, with strong presence across the EU.

- Greater China: Accounts for 17.1% of revenue, showing robust growth and recovery.

- Japan & Rest of Asia Pacific: Combine for approx. 14.2%.

Apple’s Winning Formula: Stability Meets Agility

Apple Inc.’s shareholder structure and capital framework reflect a mature, well-established technology leader. The company successfully balances the interests of diverse stakeholders while maintaining financial flexibility through strategic debt usage and strong cash generation. The institutional ownership provides stability, while retail participation ensures broad market accessibility.

The company’s capital structure supports continued growth investments while returning substantial value to shareholders through dividends and share repurchases. With a moderate debt relative to its cash generation capability, Apple maintains the financial strength necessary to navigate market uncertainties and capitalize on emerging opportunities.