Which factors determine the choice of valuation method for IPOs?

The Securities and Exchange Commission places various stringent financial disclosure requirements on companies filing for IPOs.

IPO pricing is a highly negotiation-driven process. The final IPO price is influenced by extensive discussions among the company’s management, the underwriters, and prospective investors during the roadshow. Each party brings its own perspective to the table. Some explicitly propose a valuation they believe is fair, while others focus on challenging or refining key assumptions such as growth rates, margins, and risk factors.

Over multiple rounds of feedback and debate, these views gradually converge as participants align on both market-wide conditions and company-specific fundamentals. Only then are financial models finalized to translate this consensus into an IPO price range.

As a best practice, the participants validate the result by cross-checking valuations across multiple methodologies to ensure the price is defensible. Also, instead of choosing one methodology over the rest, weighted averages are taken to ensure that the final IPO range represents a balanced view.

Why is the asset approach rarely used for IPO pricing?

You can think of the asset approach as the sum-of-all-parts approach to business valuation. It involves subtracting the liabilities from the assets to arrive at the valuation. However, balance sheets often do not fully capture the cash flows a business can potentially generate.

Asset approach can be accurate for companies heading for dissolution or businesses that derive most of their value from their assets. This cannot be used unless you’re valuing a business going public as a last-ditch attempt to stay afloat, a bank, a real estate business, or an investment company.

How does market sentiment impact IPO valuation methodology?

After eliminating the asset approach, we are left with the income and market approaches to business valuation.

In bullish markets, the market approach allows companies to secure higher exit valuations for early investors in the name of aligning valuations with market expectations. However, this strategy can backfire in bearish markets.

In such scenarios, companies can establish a higher base valuation through the income approach, which is seen as a pragmatic and conservative view of business value. Market sentiment also impacts growth rate assumptions. Investor optimism is often the result of positive macroeconomic and sectoral trends.

How Market Conditions Shape IPO Pricing

Different IPO valuation methods appeal to investors depending on market sentiment and economic outlook.

| Category | Bull Markets | Bear Markets |

|---|---|---|

| Investor Mindset | • Expect strong growth • More risk-tolerant • Focus on future earnings potential | • Expect slower growth • Lower risk tolerance • Focus on fundamentals and cash flow |

| Preferred Valuation Approach | Market Approach | Income Approach |

| Why This Works | • High comparable market multiples • Strong demand inflates valuation • Easier to justify premium pricing | • Emphasis on intrinsic value • Lower or uncertain growth expectations • Investors need proof of financial resilience |

| Result | Higher IPO pricing and larger exits | More conservative IPO pricing |

Market Approach v/s Income Approach Example

Since hitting its 52-week low in April 2025, the Nasdaq Composite has increased by more than 50%, which is a clear sign of a bull market. Let’s assume that this momentum will continue in the future.

Now, suppose Tarsalis, a biotech company, is going public, and we have the following information about this company.

| Particulars | Current | Expected growth rate over 5 years |

|---|---|---|

| Annualized sales | $2.00B | 10% |

| Overhead costs | $500.00M | 0% |

| Operating costs | $500.00M | 5% |

| Terminal value | $2.00B | N.A. |

Since we are assuming bullish market conditions to continue, the market approach should fetch a better valuation. Let’s check this hypothesis.

Market Approach

Below is a list of biotech companies with annualized sales comparable to Tarsalis.

| Company name | Sales | Market Cap |

|---|---|---|

| BioNTech | $3.70B | $26.62B |

| EXACT Sciences | $3.08B | $19.42B |

| Medpace Holdings | $2.36B | $17.41B |

| ICON PLC | $8.10B | $13.94B |

| Tempus AI | $1.11B | $12.26B |

| Exelixis | $2.29B | $12.23B |

| Charles River Laboratories | $4.02B | $11.00B |

| Bio-Techne | $1.22B | $10.90B |

| Alkermes Plc | $1.52B | $5.15B |

| ACADIA | $1.05B | $4.49B |

| Fortrea Holdings | $2.76B | $1.47B |

| Novavax | $1.06B | $1.26B |

| P3 Health Partners | $1.44B | $23.78M |

Now, we can calculate the sales-based market valuation multiple by dividing the total market cap by the total sales.

Market valuation multiple = Total market cap ÷ Total sales = $136.17 billion ÷ $33.71 billion = 4.039566301 ≈ 4.04

Now, we can calculate Tarsalis’ valuation as follows:

Tarsalis valuation = Market valuation multiple × Annualized sales = 4.04 × $2 billion = $8.08 billion

Income Approach

Based on the cash flow-related information mentioned earlier, we can make the following projections for Tarsalis.

| Particulars | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|

| Annualized sales | $2.20B | $2.42B | $2.66B | $2.93B | $3.22B |

| Overhead costs | $500.00M | $500.00M | $500.00M | $500.00M | $500.00M |

| Operating costs | $525.00M | $551.25M | $578.81M | $607.75M | $638.14M |

| Net cash flow (D = A - B - C) | $1.18B | $1.37B | $1.58B | $1.82B | $2.08B |

Assuming a discount rate of 10%, let’s calculate the discounted cash flows, the sum of which will be the company’s valuation.

| Particulars | 2026 | 2027 | 2028 | 2029 | 2030 | 2030 (Terminal value) |

|---|---|---|---|---|---|---|

| Annualized sales | $2.20B | $2.42B | $2.66B | $2.93B | $3.22B | - |

| Overhead costs | $500.00M | $500.00M | $500.00M | $500.00M | $500.00M | - |

| Operating costs | $525.00M | $551.25M | $578.81M | $607.75M | $638.14M | - |

| Net cash flow | $1.18B | $1.37B | $1.58B | $1.82B | $2.08B | $2.00B |

| Discounting factor | 1.1 | 1.21 | 1.331 | 1.4641 | 1.61051 | 1.61051 |

| Discounted cash flows | $1.07B | $1.13B | $1.19B | $1.24B | $1.29B | $1.24B |

Thus, we can arrive at a valuation of $7.17 billion for the company.

Verdict

Under the income approach, which is the more grounded approach of the two, Tarsalis’ valuation is constrained by conservative growth and discount rate assumptions. In contrast, prevailing market conditions support a higher valuation under the market-based approach.

How does the company stage impact valuation methodology?

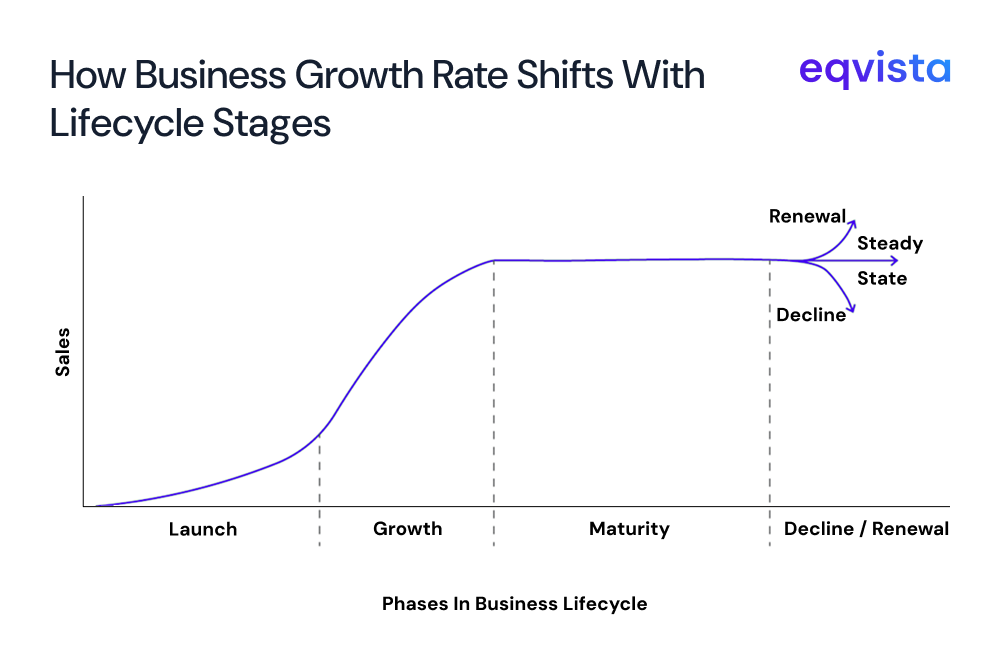

A company’s growth rate does not stay constant throughout its lifecycle. As the product is gaining traction in the market, the business experiences mediocre but steady growth. If the company reaches critical mass, its growth rate rises swiftly.

After this, the business can either continue generating revenue steadily, or face decline due to factors like the inability to pivot in line with changing customer needs.

Another factor that changes with the business lifecycle stage is the business’s risk level.

In the venture capital world, investors are often told that 90% of all startups will fail. In contrast, large financial institutions are often touted as being too big to fail. Between early-stage startups and large banks, there are numerous differences such as market share, business models, financial health, and revenue.

Eqvista – Value you can bank on!

The Securities and Exchange Commission (SEC) places various stringent financial disclosure requirements on companies filing for initial public offerings (IPOs). However, there is no standard IPO pricing methodology to be followed by filers.

The securities watchdog implicitly recognizes that there are diverse types of businesses, each requiring unique valuation approaches. So, instead of regulatory scrutiny, the choice of valuation methods for IPOs often depends on what would appear convincing to investors. Investors exhibit various biases, and IPO filers must align with their ever-evolving, and sometimes irrational, views to ensure IPO subscription.

It is crucial for companies filing for IPOs to access a pricing mechanism like Eqvista’s Real-Time Company Valuation®. Our software provides real-time, market-aligned valuation insights that can help you optimize IPO timing and test if your IPO pricing methodology aligns with market expectations. Contact us to know more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!