Inside the VC Pulse: U.S. Funding Trends in December 2025

In December, the number of companies raising Pre-Seed, Seed, and Series A funding declined by 6% compared to the previous year. Meanwhile, the number of AI companies being raised has grown by 7% in the same time frame.

The overall slowdown is in line with what we have been witnessing in the last quarter.

AI’s Grip Falters But Still Visible

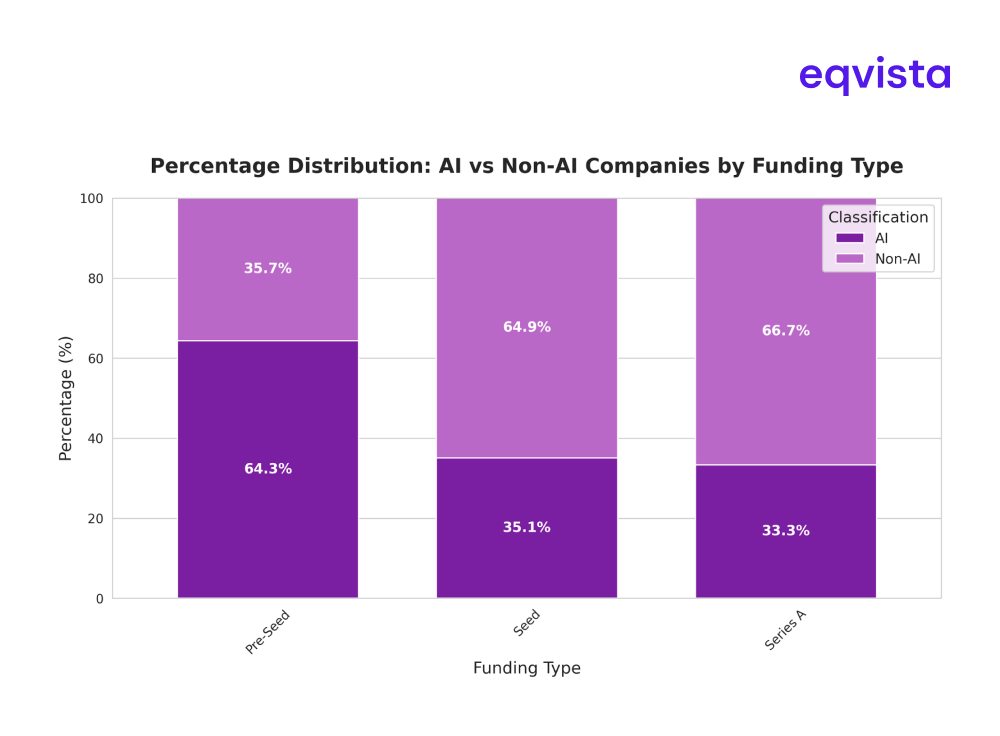

Figure 1: Number of AI companies by Funding Type, Data source: Crunchbase

In prior months, AI-led companies dominated the funding landscape in terms of percentage share. This trend eased somewhat in December, yet AI continues to capture a decent portion of the market. As data shows, in Seed and Series A, about 1/3rd of all raise was AI companies.

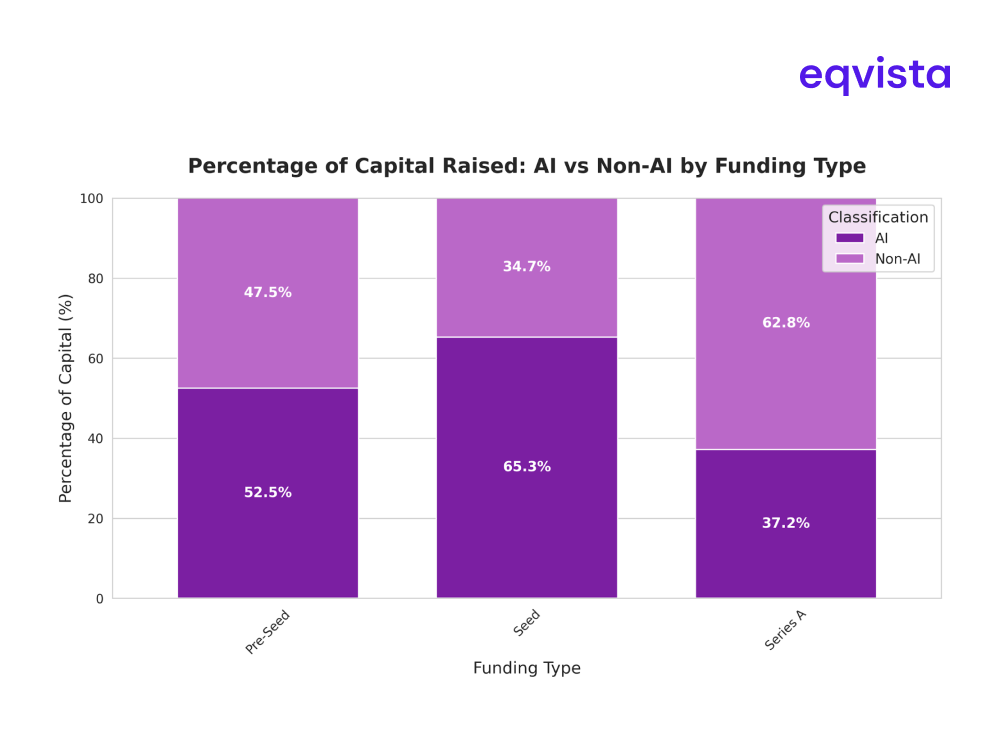

Figure 2: Capital Raise Percentage of AI Companies by Funding Type, Data source: Crunchbase

Despite the slight decline in the number of deals, the overall slowdown in capital raised has been moderate. Investors continue to deploy significant funding, with AI-focused companies remaining a key beneficiary. While deal frequency has tapered, the sector’s ability to attract large rounds has ensured that AI businesses continue to command a disproportionate share of total capital.

As the data shows, at the Seed stage, the capital raised by AI companies is roughly twice their share in terms of deal frequency, highlighting their ability to attract larger funding rounds relative to non-AI peers.

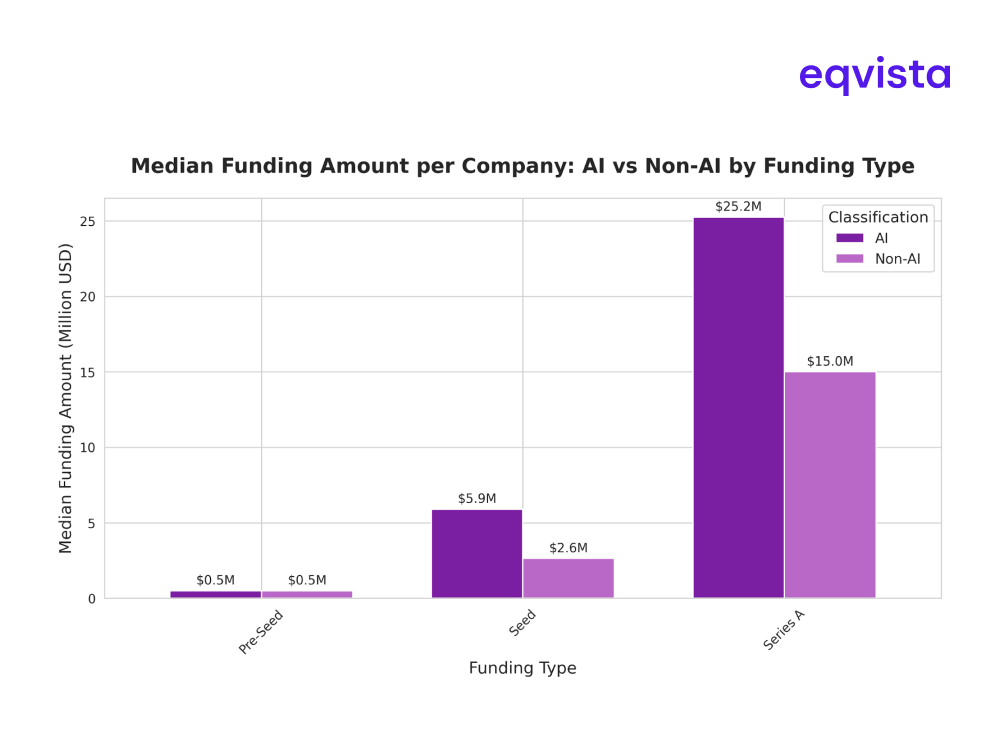

Figure 3: Raise Premium of AI Companies by Funding Type, Data source: Crunchbase

A comparison of median funding across stages highlights the fundraising advantage of AI companies. In Pre-Seed rounds, AI startups raised about the same median amount as non-AI companies. The gap widened in Seed rounds, where AI firms secured roughly twice as much on median terms. In Series A, AI companies raised approximately 68% more than their non-AI counterparts.

The above pattern suggests that AI businesses are particularly effective at attracting larger funding as they scale.

Geographical Concentration: Hubs Dominance Widens

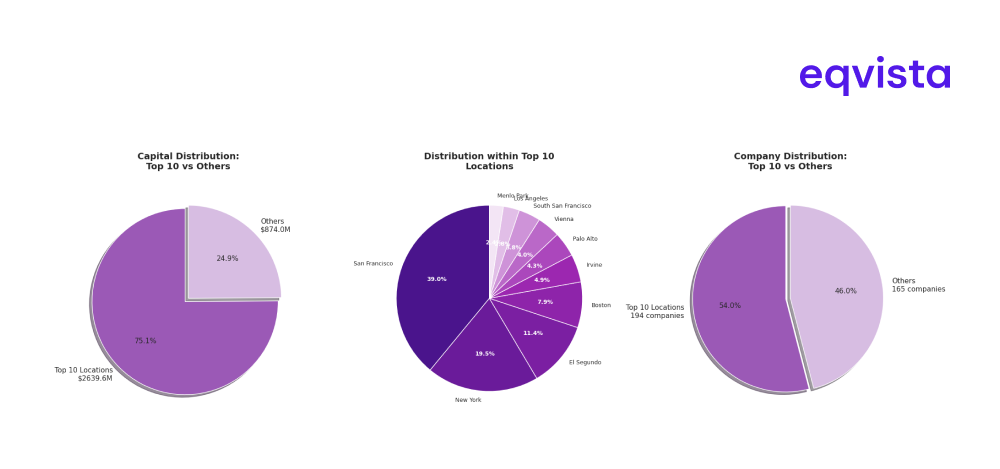

Figure 4: Top 10 Cities and their share by Frequency in Capital Raise, Data source : Crunchbase

Funding remains heavily concentrated in a few major U.S. innovation centers. The top 10 locations together captured over 75% of the total capital raised.

San Francisco led with nearly 30% of total funding, followed by New York at about 15%. Other California hubs—including El Segundo, Irvine, Palo Alto, South San Francisco, Los Angeles, and Menlo Park—together contributed roughly 22%. Boston and Vienna, Virginia, accounted for smaller shares, while the remaining regions collectively represented about 25% of total funding.

This concentration underscores that while investment opportunities exist nationwide, capital continues to flow predominantly toward established tech and innovation hubs.

Early-Stage Insights and Broader Context

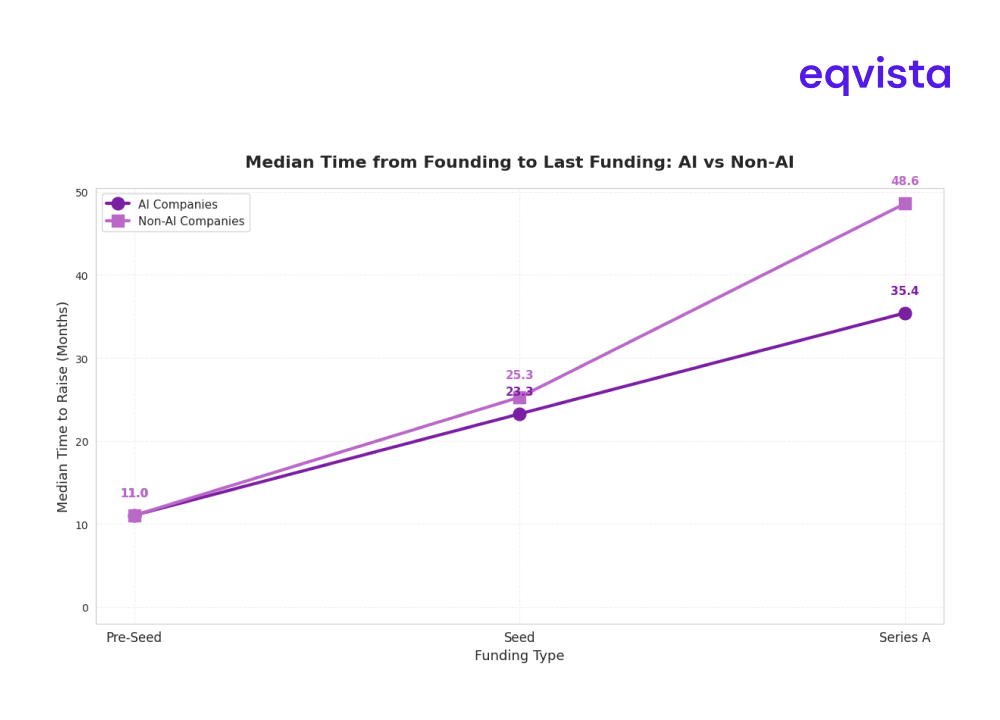

Figure 5: Median Time for Fundraising Based on December Fundraising Data, Data source : Crunchbase

Analysis of funding timelines reveals that AI companies tend to raise capital more quickly than non-AI firms, particularly as they move beyond early stages.

- Pre-Seed rounds: Both AI and non-AI companies show a median time of 11 months, indicating similar initial fundraising speed.

- Seed rounds: AI startups accelerate, reaching funding in a median of 23 months, compared with 28 months for non-AI companies—showing a clear speed advantage.

- Series A rounds: The gap widens further, with AI firms achieving funding in 35 months on median, versus 49 months for non-AI companies.

These trends suggest that AI companies are not only able to attract larger investments but also do so more efficiently, enabling them to accelerate growth and scale faster than their non-AI peers.

What This Means for Founders and Investors

December’s data indicates a moderate slowdown in U.S. early-stage funding, both in terms of deal frequency and capital deployment. While the pace of fundraising has eased compared to previous months, AI companies continue to outperform non-AI peers, raising larger amounts more quickly and maintaining a disproportionate share of total capital.

The concentration of funding in established tech hubs further highlights that while opportunities remain nationwide, investors are cautiously directing capital toward proven innovation centers and high-potential AI ventures. Overall, the slowdown is noticeable but not severe, suggesting a period of measured adjustment rather than a sharp contraction in the early-stage investment landscape.