How Companies Use Cap Table Automation for Equity Administration

Modern equity structures evolve quickly. A startup might begin with four founders and end its first year with 30 angel investors, a growing option pool, and several SAFE notes. As the company scales, the cap table becomes a living system that must instantly reflect new grants, vesting schedules, funding rounds, and conversions.

Manually performing these updates is risky. A single formula error in a spreadsheet can misstate ownership, trigger mispriced option grants, create compliance gaps, and erode investor trust. That’s why companies increasingly rely on automated cap table management software.

In this article, we explore how cap table automation transforms equity administration and how Eqvista’s cap table automation-driven features streamline the entire lifecycle of equity.

Why Cap Table Automation Matters in Equity Administration

Equity administration is essentially a continuous loop of issuance, vesting, conversion, compliance, investor communication, and scenario modeling. This loop speeds up as the company grows.

Manual equity management breaks down when:

- The company crosses 20-30 stakeholders

- Number of security types increases

- Valuation updates occur

- Option pools are expanded

Cap table automation solves these problems by reducing human errors, eliminating redundant work, and ensuring every change cascades across the entire cap table instantly.

Core Cap Table Automation Features Reshaping Equity Administration

The following automation capabilities of cap tables form the foundation of modern equity management:

Automated Share and Option Issuance

Instead of manually generating certificates, emailing PDFs, and updating spreadsheets, administrators can simply enter core inputs such as recipient, security type, and units. Then, the system generates and stores all required documents and immediately updates the cap table.

Automation of cap tables ensures issuances are consistent, compliant, and error-free. This reduces administrative time from hours to minutes. For companies expanding their team aggressively, this prevents bottlenecks in onboarding.

Automated Vesting and Milestone Tracking

Vesting schedules are one of the most error-prone components of equity management. Employees often have different vesting structures. Each batch of hires may have different vesting periods, vesting frequencies, vesting cliffs, and performance-related vesting conditions.

Automated vesting and milestone tracking eliminate the need to manually recalculate vested shares for every employee and ensure that cap tables reflect terminations, grants, exercises, and transfers accurately.

Automated Funding Round Modeling

If you approach investors with spreadsheets that need repeated manual edits for every proposed term, negotiations will slow down. Eqvista’s automated funding round modeling allows companies to simulate entire rounds by entering a few variables, such as pre-money valuation, investment amount, and option pool size.

The platform instantly calculates ownership changes, dilution, share counts, and valuation impact, enabling you to walk into negotiations with clarity.

Automated Rule 701 Compliance

Rule 701 compliance becomes critical once companies start issuing stock-based compensation. It requires you to track the total asset value, value of outstanding securities in each class, and the number of shareholders who are US residents, accredited investors, or non-accredited investors for each class of securities.

Any tracking errors can lead to hefty SEC penalties, such as the $160,000 penalty that was imposed on Credit Karma.

Automated Real-Time 409A Valuations

The fair market value (FMV) of stock options must be determined by 409A valuations. A 409A valuation is valid for 12 months or until a material event occurs. Eqvista’s Real-Time Company Valuation® automates FMV updates using AI-assisted valuation methods, enabling companies to maintain up-to-date stock pricing continuously. This is especially advantageous for high-growth startups and companies pursuing inorganic growth aggressively.

Automated Exit Modeling

When a company is building consensus for an exit, it must calculate how proceeds would be distributed across all stakeholders. This process, called waterfall analysis, is especially complex for startups since they have multiple types of securities.

Eqvista automates waterfall modeling with real-time data pulled directly from the cap table, guaranteeing accuracy and preventing investor disputes.

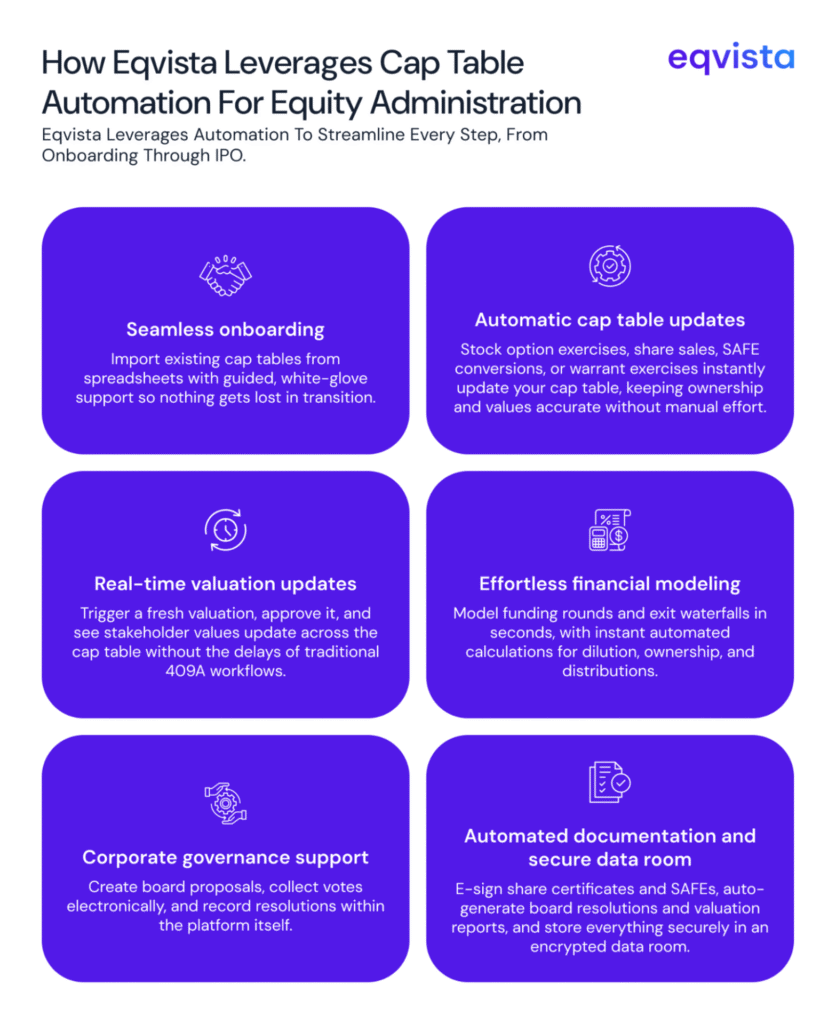

How Eqvista Leverages Cap Table Automation for Equity Administration

Eqvista leverages automation to enhance simplicity and user experience at every step of the way, right from onboarding until IPO, in the following manner:

- Seamless onboarding: Our spreadsheet import tools enable you to migrate existing cap tables effortlessly, and white-glove onboarding support ensures that no important details are lost in transition.

- Automatic cap table updates: Every stock option exercise, share sale, SAFE conversions, and warrant exercise is reflected in your cap table instantly. Ownership percentages and stakeholder values update automatically without manual intervention.

- Real-time valuation updates: Request a new Real-Time Company Valuation®, review and approve the report, and watch as stakeholder values update seamlessly across your cap table. This eliminates the weeks of waiting and manual data entry associated with traditional 409A valuations and cap table updates.

- Effortless financial modeling: Model funding rounds and exit waterfalls in seconds rather than hours. Automated calculations show dilution impact, ownership changes, and distribution waterfalls instantly.

- Corporate governance support: Create board proposals, collect votes electronically, and record resolutions within the platform itself.

- Automated documentation and secure data room: E-sign share certificates and SAFE agreements, and generate board resolution records, valuation reports, and other equity-related documentation, which is then stored securely in an encrypted data room.

Eqvista- Cap table Automation That Scales with You!

Cap table automation is foundational for companies navigating multiple stakeholders, complex funding instruments, accelerated hiring, and growing compliance requirements.

Eqvista centralizes equity administration and automates every major workflow, including:

- Share issuance and e-signing

- Option vesting

- Rule 701 compliance

- Form 3921 filing

- Funding and exit modeling

- Real-Time Company Valuation®

- Secure onboarding and data reconciliation

By eliminating manual work and reducing errors, Eqvista enables founders, CFOs, and legal teams to focus on strategy instead of spreadsheets.

Ready to automate your entire equity lifecycle? Contact us to get started.