Filing ERS return with HMRC

In this article, we will guide you through the complete process of filing ERS returns with HMRC, from initial preparation to post-submission confirmation.

If your company issues stock-based compensation such as stock options, restricted stock units, or even one-off equity awards, you must file Employment-Related Securities (ERS) returns by 6th July every year.

His Majesty’s Revenue and Customs (HMRC) requires employers to file ERS returns regardless of whether any transactions occurred during the tax year. Late filing of nil as well as normal ERS returns carries the same penalties. In fact, if you’re over 9 months late, the penalty increases with each passing day.

Understanding Your ERS Filing Obligations

Before diving into the mechanics of filing, you must understand when and why these returns are mandatory.

Who Must File?

If you operate any employment-related securities schemes, you must submit an annual return. This obligation applies to:

- Share option plans

- Restricted stock units

- Share incentive plans

- One-off awards or gifts of shares

- Any other arrangement where employees receive securities in connection with employment

If you cannot file ERS returns, you can authorise an agent to file these returns on your behalf.

When Filing Is Always Required

Many employers mistakenly believe they can skip years with no activity. However, HMRC unambiguously has the completely opposite position.

You must submit a return or nil return in all circumstances, including when you have made only a single award with no ongoing scheme activity or when no reportable transactions have occurred during the period. Returns are also required in special situations such as erroneous registrations, duplicate registrations, or cases where late-filing penalties from previous years are under appeal.

The absence of an HMRC reminder does not waive your obligation. Employers remain responsible for tracking deadlines independently.

ERS Critical Deadline

You must submit your ERS return by 6th July following the end of the tax year. For the tax year ending 5th April 2025, your deadline would be 6th July 2025. Missing this deadline exposes you to penalties that escalate in the following manner:

| Timeline/condition | Deadline | Penality | Total penalty(Cumulative) | Notes |

|---|---|---|---|---|

| Missed deadline | After 6th July 2025 | £100 automatic penality | £100 | Applies immediately after missing the deadline. |

| 3 months late | By 6th October 2025 | £300 penalty | £400 | Additional charge for continued delay. |

| 6 months late | By 6th January 2026 | #ERROR! | £700 | Further penalty for non-compliance. |

| 9+ months late | After 6th April 2026 | £10 per day | £700 + ( £10 number of days after 6th April 2026) | Delay penalty until return is submitted. |

If your scheme has ended and you have entered a final event date in the HMRC system, you must still submit any outstanding returns up until the date the scheme terminated.

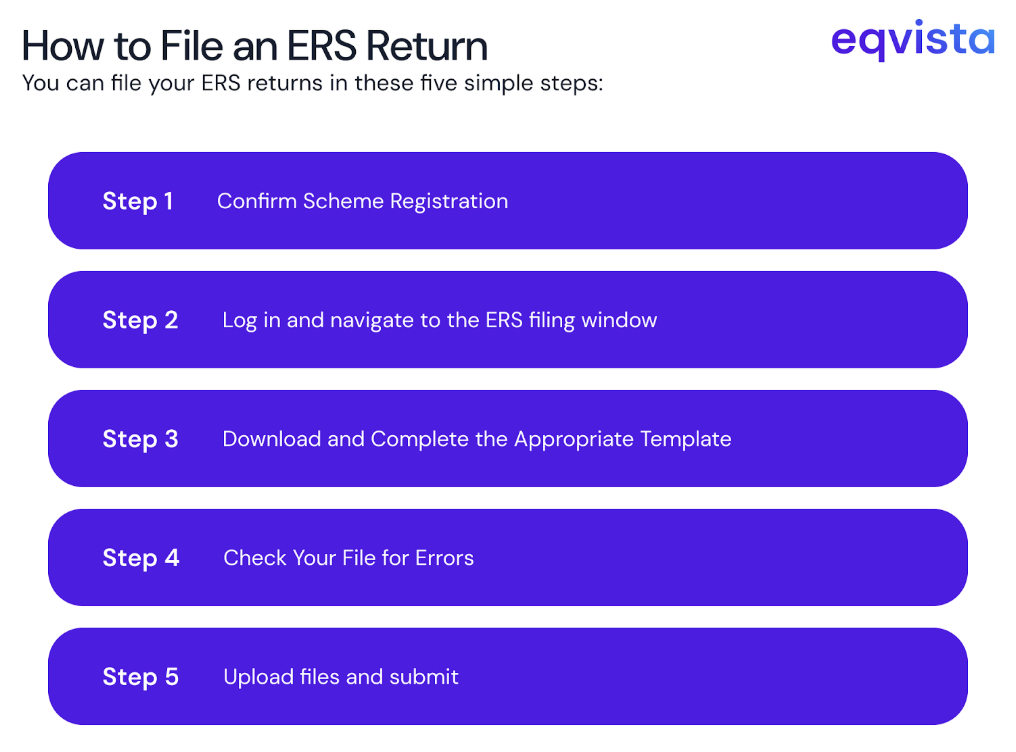

How to File an ERS Return

You can file your ERS returns in these five simple steps:

Step 1: Confirm Scheme Registration

Before you can submit a return, you must have registered your ERS scheme with HMRC. If you have not completed this registration, you cannot proceed with filing. The registration process establishes your scheme in HMRC’s system and generates the reference numbers you will need for annual reporting.

Step 2: Log in and navigate to the ERS filing window

Using your Government Gateway user ID and password, log in to HMRC, go to ‘View schemes and arrangements’, and select the ERS scheme you want to file returns for. Then, you must simply select ‘Submit annual returns’ for the relevant tax year and fill in the information requested by the website.

If you are submitting a nil return, select ‘no’ when asked about ‘reportable events’ and skip steps 3 and 4. If not, move to step 3.

Step 3: Download and Complete the Appropriate Template

Download and fill in the relevant template for your specific scheme type. Currently, HMRC provides templates for the following schemes:

- Enterprise Management Incentives (EMI)

- Company Share Option Plan (CSOP)

- Save As You Earn (SAYE)

- Share Incentive Plan (SIP)

- Non-tax advantaged share schemes

Each template requires specific information about reportable events during the tax year, including:

- Actual market value (AMV)

- Unrestricted market value (UMV)

- Key dates

- Number of securities involved in each transaction

- Employee name

- Exercise price

Step 4: Check Your File for Errors

Material inaccuracies arising out of carelessness or deliberate ones can attract penalties of up to £5,000.

Some common errors you should check for include incorrect date formats and mathematical errors in calculations.

Another frequent mistake is failing to declare when the shares were part of the largest class of equity of your company. This error occurs most often in companies relying on manually maintained spreadsheets for tracking equity.

Without automated cap tables, it’s easy to overlook changes in share class composition as new securities are issued and converted during the tax year.

Step 5: Upload files and submit

Once you have checked your completed return template, save it locally on your computer before submitting it. Then, you will see a confirmation receipt with the date and time of your ERS return filing. You can save this confirmation receipt for recordkeeping purposes.

Eqvista – Simplifying Equity Compliance!

ERS reporting represents just one aspect of equity management compliance. Companies issuing securities to employees must also maintain accurate cap tables, track vesting schedules, generate share certificates, and provide regular reporting to stakeholders.

Eqvista’s comprehensive equity management platform integrates all these functions into a single system. Our software automatically tracks reportable events throughout the tax year, generates pre-filled templates for HMRC submission, and maintains complete audit trails for all equity transactions.

Contact us to learn how we can streamline your equity compliance obligations!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!