Tax Deadlines 2026: Essential Filing Requirements for LLCs and Corporations

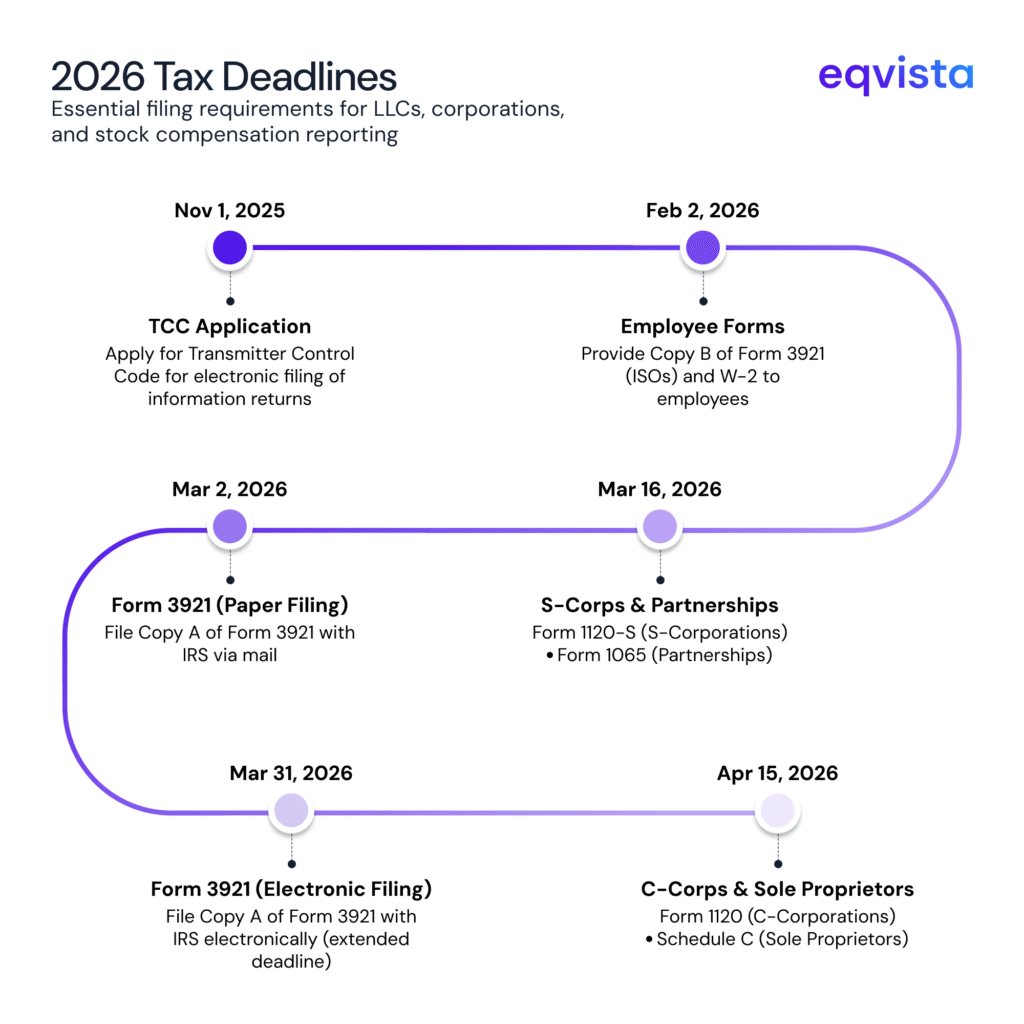

As we approach 2026, founders must prepare for critical tax filing deadlines, missing which could trigger penalties. To ensure that businesses with complex structures and sole proprietors have ample time to file tax forms, the Internal Revenue Service (IRS) has different tax filing deadlines for businesses with different corporate structures.

So, C-corporations and sole proprietors typically have more time to file tax forms than partnerships and S-corporations.

An unfortunate outcome of this measure is the confusion regarding tax deadlines.

For businesses that issue stock-based compensation, additional reporting requirements add another layer of complexity to tax compliance.

Hence, in this article, we will outline the key tax deadlines for 2026, covering annual income tax returns for various business structures and the tax forms required for reporting employee stock compensation transactions.

Note: LLCs follow the deadline of their tax election: Single-member LLCs use Schedule C (April 15), multi-member LLCs use Form 1065 (March 16), or follow S-Corp/C-Corp deadlines if elected.

Annual Income Tax Return Forms and Deadlines

Different business structures face different filing requirements and deadlines. The forms and dates applicable to your business depend on how your entity is classified for tax purposes.

S-Corporations: Form 1120-S

Deadline: March 16, 2026

Any business registered as an S corporation and businesses that elect to be S corporations must file Form 1120-S. This form is used to report income, gains, losses, deductions, and credits for a particular tax year.

The March16 deadline applies to most S corporations using a calendar year for corporate taxation. If an S-corporation elects a different fiscal year, it must file Form 1120-S by the 15th day of the third month following the end of its tax year.

So, if your tax year ends in March, you must file by 15th June.

Partnerships: Form 1065 and Schedule K-1

Deadline: March 16, 2026

American partnerships, as well as foreign partnerships conducting business in the US or receiving income from the US, must report their annual income via Form 1065. This form provides the IRS with a comprehensive overview of the partnership’s financial activities for the tax year.

Additionally, each individual partner must prepare and file Schedule K-1, which should show the partner’s share of income, deductions, credits, and other items.

You must ensure that all information is consistent across Form 1065 and Schedule K-1 for smooth audits.

C-Corporations: Form 1120

Deadline: April 15, 2026

C-corporations file Form 1120 to report income, gains, losses, deductions, and credits, and to calculate the corporation’s income tax liability. Unlike S-corporations, C-corporations are taxed as separate entities, meaning the corporation itself pays taxes on its income.

The 15th April deadline applies to C-corporations using the calendar for corporate taxation. Other C-corporations must file by the 15th day of the fourth month following the end of their tax year.

Sole Proprietors: Schedule C

Deadline: April 15, 2026

Income or loss from a business or professional practice operated as a sole proprietor must be reported using Schedule C, which is filed as an attachment to Form 1040.

An activity qualifies as a business for Schedule C purposes if your primary purpose for engaging in the activity is income or profit, and you are involved in the activity with continuity and regularity. This distinguishes business activities from hobbies or occasional transactions.

Tax Filing Requirements for LLCs

Limited liability companies (LLCs) do not have a designated form for federal income tax filing. Instead, the applicable tax forms and deadlines depend on how the LLC has elected to be taxed.

A single-member LLC is, by default, not treated as a separate entity and files Schedule C as part of the owner’s individual tax return. In contrast, multi-member LLCs are treated as partnerships by default and must file Form 1065.

However, an LLC can elect to be taxed as an S corporation or a C corporation. If an LLC elects S-corporation status, it must file Form 1120-S by 16th March 2026. If it elects C-corporation status, it must file Form 1120 by 15th April 2026.

Tax Forms and Deadlines for Employee Stock Compensation

Businesses that issue stock-based compensation face additional reporting requirements listed below:

Transmitter Control Code (TCC)

Deadline: November 1st 2025

If your business plans to file at least 10 information returns electronically, you must apply for a Transmitter Control Code (TCC). The TCC is necessary for electronic filing, and hence, the IRS strongly encourages businesses to apply for a TCC. To file returns electronically in 2026, you must request a TCC via the IRS’s Filing Information Returns Electronically (FIRE) application by 1st November 2025.

Copy B of Form 3921 and Form W-2

Deadline: February 2, 2026

Companies that offer incentive stock options (ISOs) must file Form 3921 with the IRS for each ISO exercise. By 2nd February 2026, companies must provide Copy B of Form 3921 to employees who exercised ISOs during the previous year.

By the same date, companies must also provide Copy B of Form W-2 to employees. Form W-2 is the wage and income statement that reports annual compensation and tax withholdings. Providing these copies on time allows employees to prepare their individual tax returns accurately.

Form 3921 Filing with the IRS

Deadline: 2nd March 2026 (paper filing) or 31st March 2026 (electronic filing)

After providing Copy B to employees, companies must file Copy A of Form 3921 with the IRS. If filing via mail, the deadline is 2nd March 2026. However, businesses filing electronically have until 31st March 2026.

Electronic filing is generally recommended as it provides a longer deadline and reduces the risk of processing errors.

Eqvista- Ensuring Tax Compliance for Your Business

Meeting tax deadlines requires careful planning and organization. Business owners should maintain accurate financial records throughout the year and work with qualified tax professionals to ensure all forms are prepared correctly and filed on time.

For businesses with complex structures or those issuing equity compensation, professional guidance becomes even more critical. Eqvista offers comprehensive support for ESOP-related tax filings. Contact our team to ensure your business meets all 2026 tax deadlines!