What Are the Key Steps in Applying the 4-Step Acquisition Method Under ASC 805?

Private equity firms may find relief in the fact that global dry powder has steadily declined since 2023, reaching $2.52 trillion by July 1, 2025. While global M&A volumes fell 9% in the first half of 2025 on a year-on-year (YoY) basis, the stabilization of tariffs and trade policies could pave the way for renewed deal activity.

If your firm is among those positioned to drive this rebound, it is essential for you to refamiliarize yourself with ASC 805, the accounting standard on business combinations.

In this article, we will review the 4-step acquisition method under ASC 805 and also briefly discuss how acquired parties should maintain their accounts.

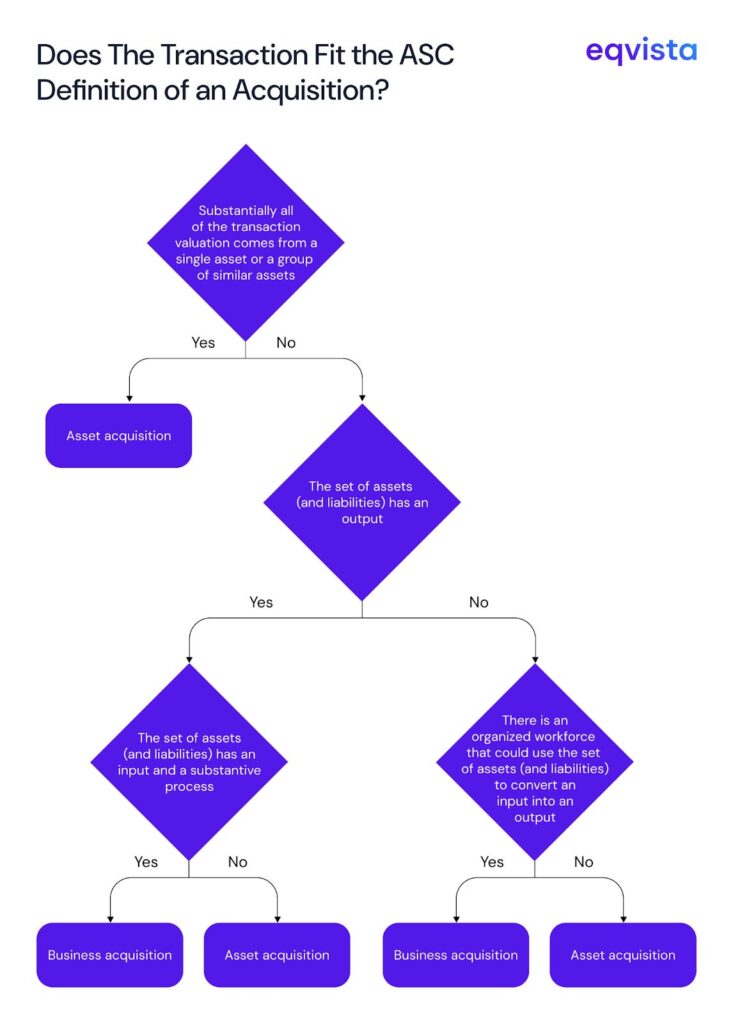

Does The Transaction Fit the ASC Definition of an Acquisition?

The ASC 805 accounting guideline is applicable only when the transaction meets the ASC definition of business acquisition. Certain transactions may be termed as asset acquisitions. You can use the following decision tree to identify the category a particular transaction belongs to:

4-Step Acquisition Method Under ASC 805

You can account for a business combination under ASC 805 by taking the following steps:

Identify the Acquirer

If the transaction can be classified as a business acquisition under the ASC framework, then you must identify the acquirer. In cash acquisitions, identifying the acquirer is straightforward. The entity that transfers the cash is the acquirer.

However, you may need to exercise considerable judgment in case of share swap acquisitions. In such cases, the party that gains control over the other through voting power is considered the acquirer.

In a business combination involving Special-purpose Acquisition Companies (SPACs), ASC 805 applies only when the SPAC is identified as the acquirer. SPACs do not meet the definition of businesses under the ASC framework. So, the acquisition of a SPAC is seen as a reverse recapitalization.

Identify the Acquisition Date

Acquisition date is defined as the date on which the acquirer gains control of the acquired party. Typically, the closing date, i.e., the date on which the acquirer transfers the consideration, receives the assets, and assumes the liabilities, is the date on which the acquirer obtains control.

Recognize and Measure Assets and Liabilities

You need to recognize and measure the fair value of assets acquired, liabilities assumed, and any non-controlling interests in the acquired party as per the acquisition date and measured at their fair value following formula:

Consideration Transferred =

Cash and Assets

Cash and other assets paid to acquired party

+

Contingent Obligations

Present value of committed future payments

+

Equity Instruments

Fair value of stocks and equity issued

In certain situations,when the acquired party’s accounting contained errors or did not follow GAAP principles, the acquirer can consider the terms of acquired contracts to measure the fair value.

Recognize and Measure Goodwill

The final step in this accounting process is recognizing and measuring the goodwill or bargain purchase gain as of the acquisition date. First, you must calculate the total value of the acquired party as the sum of fair values and any equity interest previously held by the acquirer in the acquired party.

Then, you must calculate the net assets by subtracting the fair value of liabilities assumed from the fair value of identifiable assets acquired.

If the net assets are greater than the total value of the acquired party, you must recognize the difference as the bargain purchase gain. If the total value of the acquired party is greater than the net assets, you must recognize the difference as goodwill.

How Should the Acquired Party Prepare Its Accounts?

If the acquired party prepares its own separate financial statements, it can either retain the old carrying amounts for its assets, liabilities, and other items or use the acquirer’s fair value measurements, which is referred to as pushdown accounting.

The acquired party can make this choice it must fulfil the following requirements:

- Must retrospectively apply pushdown accounting starting from the acquisition date

- It must issue disclosures explaining the change

- Companies registered with the SEC must file a preferability letter with the SEC

Once pushdown accounting is applied in financial statements that have been issued or are available to be issued, it cannot be reversed.

Benefits of Pushdown Accounting

- Alignment with the acquirer’s financial statements – The acquirer will find it easier to prepare consolidated financial statements if the acquired party chooses pushdown accounting.

- Reflection of the current fair value – Rather than reflecting outdated historical amounts, it is always better to present the latest fair value assessment of assets and liabilities.

- Improved financial reporting transparency – Lenders, investors, and regulators will see the same financial statements as the acquirer, improving financial reporting transparency and stakeholder relationships.

- Improved tracking of post-acquisition performance – The acquirer’s management can better evaluate the performance of the acquired party if pushdown accounting is chosen.

Eqvista- Deciphering Value With Precision!

ASC 805 centers around the recognition and measurement of considerations, assets, liabilities, non-controlling interests, goodwill, and bargain purchase gain at fair value on the acquisition date. Whenever the ASC framework requires fair value measurement, you must refer to ASC 820, which is also known as the Fair Value Measurement Standard.

Due to the interconnected standards, accounting compliance can be a complex and challenging process. Hence, it is best to rely on a credible valuation expert, such as Eqvista, for a fair and accurate assessment of value. Contact us to know more!