State of Series A Funding in 2025

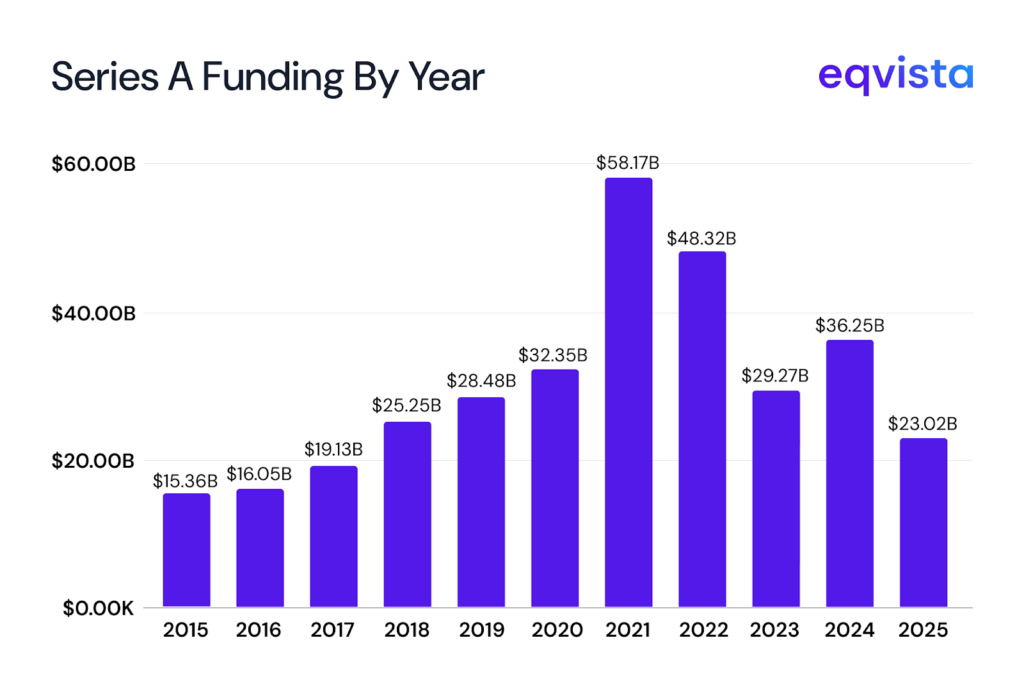

The US Series A funding landscape looks dramatically different from the peak years of 2020-22. In 2025, Series A funding has reached $23.02 billion through October, a significant decline from the $58.17 billion record set in 2021.

Series A Capital Deployment: A Decade in Review

Note: Data for 2025 is as of 31st October

Founders should view the zero-interest rate period as an anomaly, no matter how desirable it appears. From 2015 to 2021, Series A funding nearly quadrupled to reach an all-time high. Since then, the Series A funding market has recalibrated to more sustainable levels in 2025.

On the bright side, you do not need to compete against dozens of overvalued competitors raising funds on hype alone. Instead, you will face a more rational market where your metrics and execution matter more than ever.

Join us as we unpack the state of US Series A funding in 2025 in this article. This deep dive into Series A funding trends will help you determine whether you should accelerate your fundraising timeline or strategically wait for better conditions.

How Has Series A Funding Changed in 2025?

Monthly funding patterns in 2025 reveal an encouraging trend. After a slower summer where August hit a low of $1.78 billion, we saw momentum build through September and October. This late-year surge suggests investors are actively deploying capital and working to close deals before year-end.

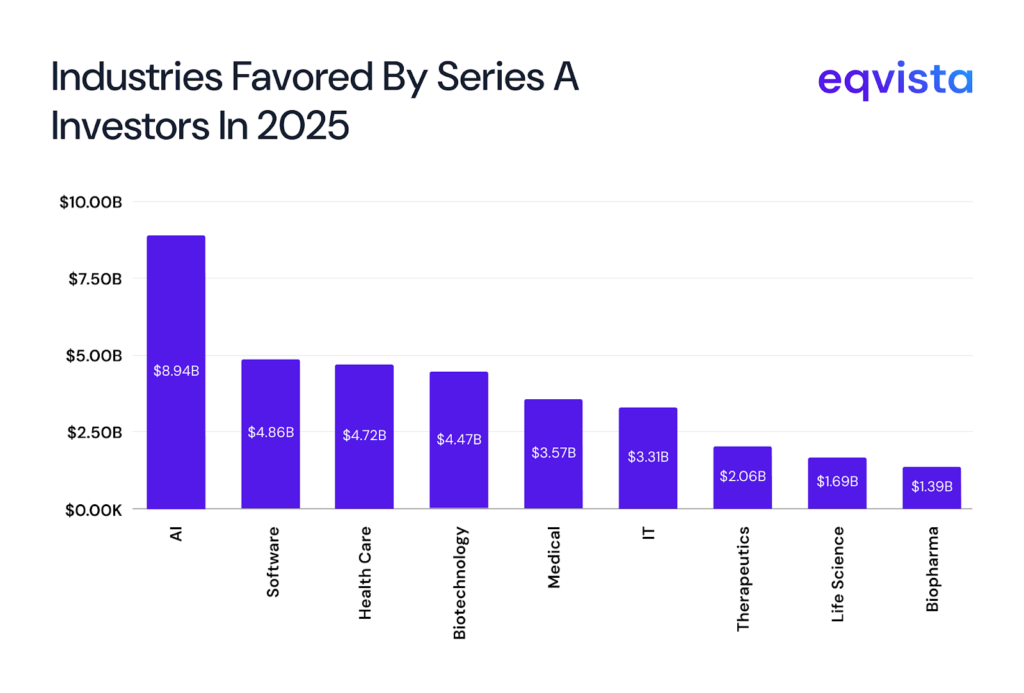

AI Dominates, But Traditional Sectors Still Command Billions

AI companies have captured $8.94 billion in Series A funding, nearly double the $4.86 billion raised by traditional software companies. If you’re building in the AI space, you’re operating in the most competitive but also the most capital-rich environment.

However, you shouldn’t assume that Series A funding is concentrated in AI and software startups.

Healthcare ($4.72 billion), Biotechnology ($4.47 billion), and Medical technologies ($3.57 billion) collectively represent nearly $13 billion in Series A funding. If you’re innovating in these sectors, you have access to substantial capital from investors who understand the long development cycles and regulatory pathways inherent to your industry.

Where Series A Dollars Are Flowing in 2025

Note: Many startups identify with multiple sectors, so their funding appears in multiple categories

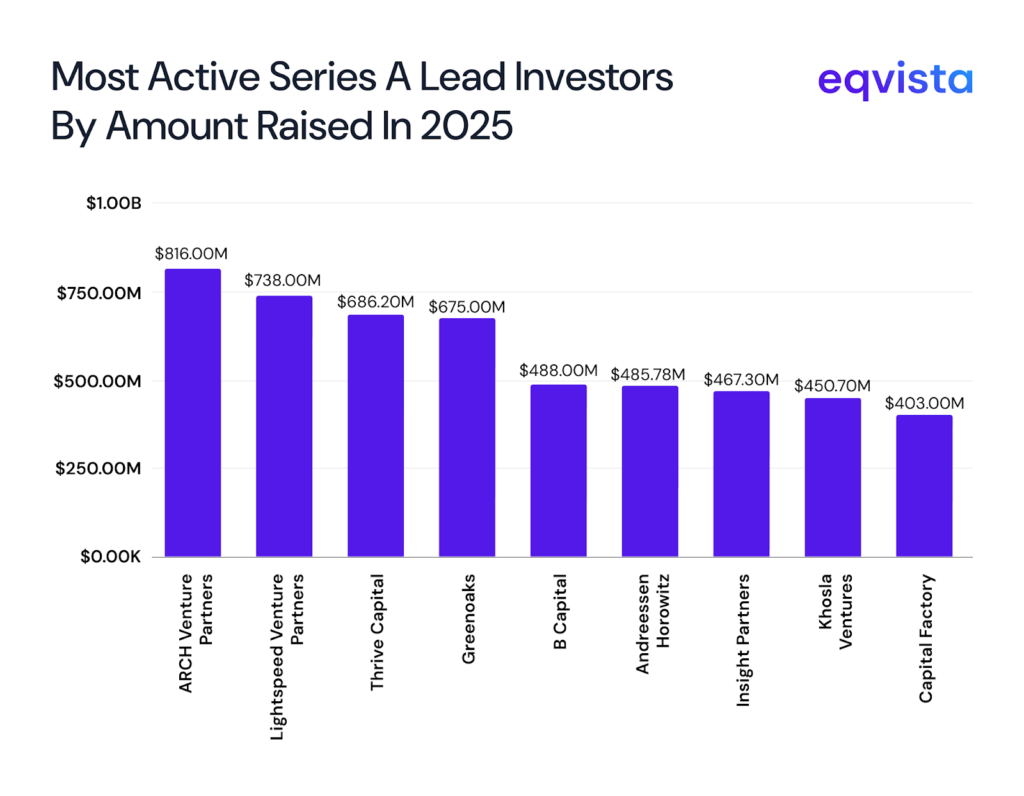

These Series A Investors Are Actually Writing Checks in 2025

Startups about to raise early-stage funding must know which investors are actively deploying capital in 2025. Most notably, ARCH Venture Partners led $816 million worth of Series A investments, followed by Lightspeed Venture Partners ($738 million) and Thrive Capital ($686.2 million).

Top Series A Lead Investors by Amount Raised

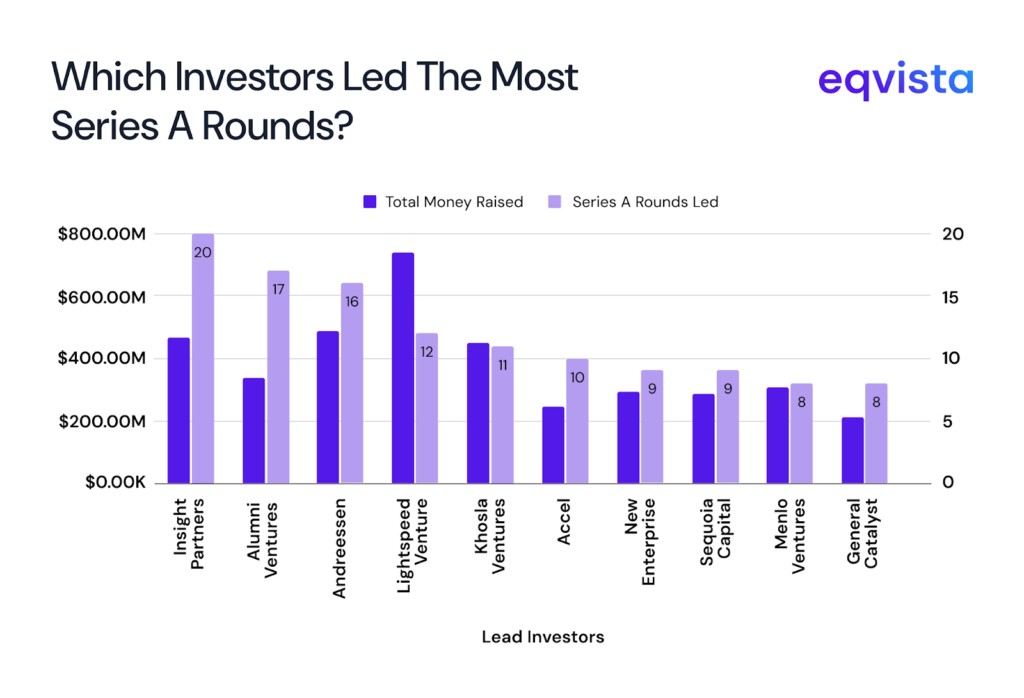

You should also pay attention to deal velocity. Certain firms are writing smaller checks across more companies. For instance, despite deploying $467.3 million, Insight Partners led 20 Series A rounds. Similarly, Alumni Ventures led 17 rounds with $336.9 million deployed, while Andreessen Horowitz led 16 rounds with $485.78 million.

Most Active Series A Lead Investors by Deal Count

Interestingly, $1.94 billion was raised across 128 Series A rounds without disclosed lead investors. For 64 of these rounds, no investors were disclosed, probably to keep investor relationships confidential. But the other 64 rounds represent cases where the startup did not need to depend on VC firms leading the round or raised funds through syndicates. This suggests you have more flexibility in deal structure than you might assume.

The Mega-Rounds That Are Redefining Series A in 2025

So far, in 2025, the biggest Series A round involved Tempo, a blockchain and cryptocurrency payments company, raising a staggering $500 million at a $4.5 billion pre-money valuation. AI and robotics companies captured three of the top five spots. These mega-rounds signal where investors see transformative potential, but they also raise the competitive bar in these sectors.

2025’s Largest Series A Rounds

| Organization Name | Organization Industries | Pre-Money Valuation | Money Raised |

|---|---|---|---|

| Tempo | Blockchain, Cryptocurrency, Payments | $4.50B | $500M |

| Apptronik | Artificial Intelligence (AI), Industrial Automation, Machinery Manufacturing, Robotics | Not disclosed | $403M |

| Field AI | Enterprise Software, Robotic Process Automation (RPA), Robotics | $1.69B | $314M |

| Kardigan | Biopharma, Health Care, Medical | Not disclosed | $300M |

| Lila Sciences | Artificial Intelligence (AI), Life Science, Software | $1B | $235M |

Key takeaways for founders

Founders about to raise early-stage funding should ensure that their strategy aligns with the following trends:

- Late-year momentum in September and October suggests investors are actively seeking deals

- AI, healthcare, and biotechnology startups have the benefit of a capital-rich environment

- Optimize chances of fundraising success by understanding what the most active investors, such as Insight Partners, Alumni Ventures, and ARCH Venture Partners, are looking for

- Ample opportunities for creative deal structures, as evidenced by the $1.94 billion raised without disclosed lead investors

Eqvista- Empowering Data-Driven Decisions for Fundraising Timelines!

The Series A landscape in 2025 demands strategic precision. You’re operating in a market that has recalibrated from historic highs but still channels billions toward promising companies. You should view the current environment not as a fundraising winter, but as a more selective market where your fundamentals and execution will differentiate you from competitors.

Eqvista’s Real-Time Company Valuation® can be instrumental in funding negotiations by helping you validate your performance against market benchmarks and model different fundraising scenarios for optimal equity decisions. Ready to make strategic decisions backed by real-time data? Contact us to schedule a demonstration!