What are Evergreen Funds?

Evergreen funds are an accessible way to participate in private equity’s long-term growth with flexibility.

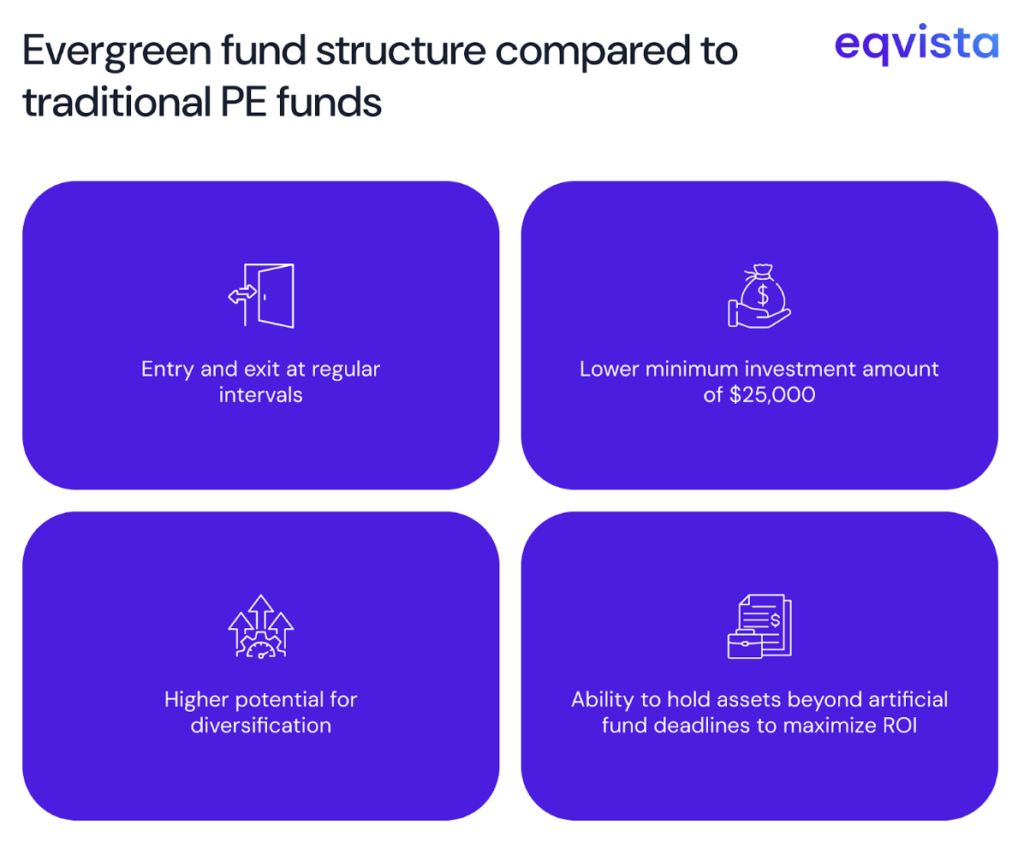

Evergreen funds are private equity funds that do not have a fixed fundraising schedule or a closing date. Instead, investors can enter and exit at regular intervals. Typically, new investors are onboarded every month, and exits of up to 5% of the fund’s net assets are offered every three months.

Thus, evergreen funds provide greater liquidity and flexibility to investors in comparison to traditional private equity funds, where exits are possible only when the fund closes, which may take at least 10 years.

What makes Evergreen Funds approachable?

Evergreen funds are more approachable for individual investors because the minimum investment amount of $25,000 is much lower than the $250,000 minimum for traditional private equity (PE) funds. This enhances the fundraising ability of evergreen funds, enabling better diversification.

The lack of a fixed closing date positions evergreen funds to deliver better returns than traditional PE funds. Since such funds do not need to sell all of the assets in their portfolios by a certain date, they can stay invested for a longer period to take full advantage of an asset’s potential ROI.

Why should I invest in an evergreen fund?

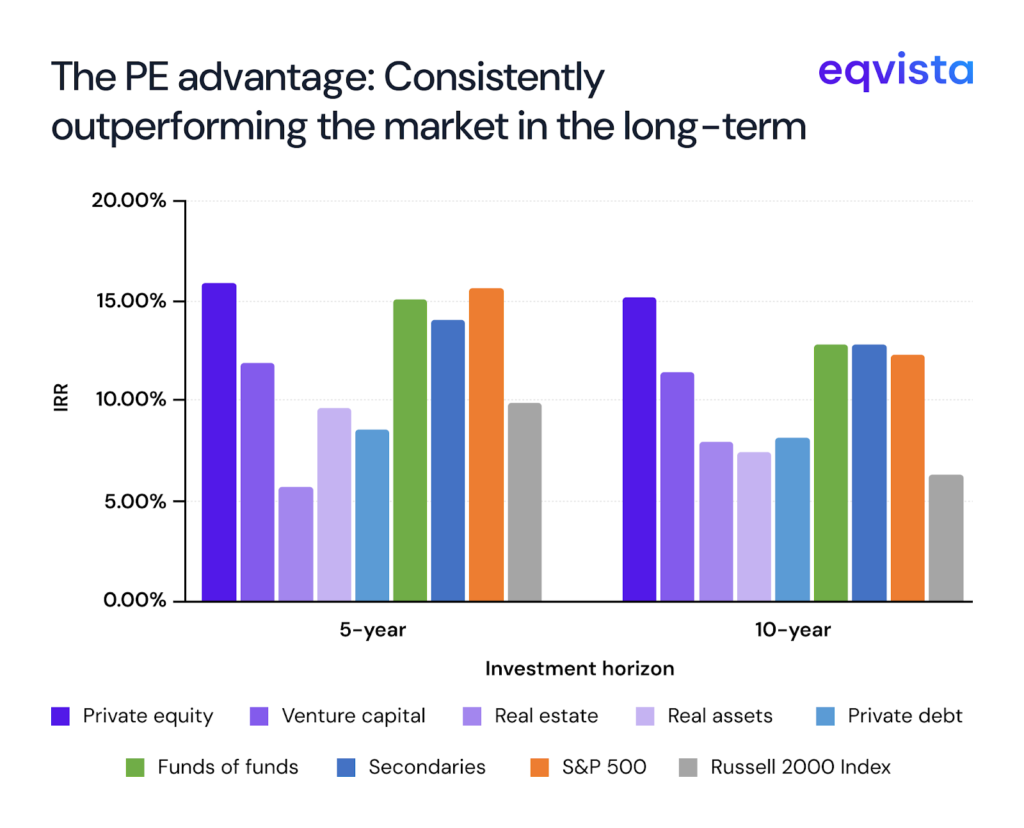

If we compare the internal rates of return (IRRs) for PE funds to index returns and IRRs of other types of funds, we see that PE funds outperform every strategy or index in the long term.

Evergreen funds are the most accessible alternatives for directly gaining exposure to this asset class. If you invest in funds of funds (FoFs), you could indirectly get exposure to private equity. But in such funds, your control over private equity allocation is limited, and you’ll incur two layers of fees. Your returns will be reduced by fees paid to the FoF managers as well as the underlying fund managers.

Benefits of evergreen funds

Evergreen funds strike a balance between liquidity, flexibility, and long-term investing, which leads to the following advantages:

- Simplified cash flow management – Evergreen funds onboard investors and provides exits on a regular basis. Essentially, in traditional private equity funds, you can only invest the amount you will not need for at least a decade, but the commitment is a lot more lenient in evergreen funds.

- Simplicity in tax reporting – Evergreen funds simplify tax reporting for fund managers by issuing standard Form 1099 to investors instead of complex K-1s. This reduces filing complexity and speeds up tax preparation.

- Flexibility to realign portfolio with market trends – Evergreen funds give investors the flexibility to reallocate capital and adjust their portfolios as opportunities shift. That matters because no one can reliably predict which sectors will lead the next decade.

How to evaluate an evergreen fund?

Since evergreen fund investments are sizable financial commitments, you should only trust managers with an exemplary record of professionalism and performance. Evaluate how the evergreen fund fits into your investment portfolio based on the sector, stage, and geographic focus of the fund.

Evergreen funds can also invest in asset classes such as real estate and infrastructure. Check if the fund’s asset allocation aligns with your investment goals and risk tolerance.Verify the frequency of exits provided to investors and the limits on such proceeds.

Check if the fund regularly updates its NAV and publishes reports that enable informed decision-making. Compare costs with other PE funds and funds of funds (FoFs).

What are the typical investment strategies for evergreen private equity funds?

Most of the evergreen funds invest in private equity. But these funds are also known to invest in:

- Venture capital – Venture capital is a subsection of private equity that involves startup investments. We often think of private equity and venture capital as two distinct investment avenues because of the differences in expected growth rates, risk, and investor involvement, among other factors.

- Real estate – Commercial and residential real estate can generate steady rental income while also appreciating in value over time. The combination of reliable cash flow and long-term capital gains makes real estate an attractive option for evergreen funds.

- Infrastructure – Infrastructure assets such as power grids, roads, public transportation, water, and waste management often deliver inflation-protected, stable returns. Because their performance typically has low correlation with traditional equity or debt, they add meaningful diversification to a portfolio.

- Natural resources – Natural resources form the basis of all production. Hence, investing in them allows you to mitigate exposure to industry cycles and enjoy long-term stability.

Eqvista – Enabling informed decisions every step of the way!

Evergreen funds are an accessible way to participate in private equity’s long-term growth with flexibility. But you must choose the right fund based on fees, liquidity, and strategic fit. If you have a portfolio comprising such sophisticated investment products, periodic professional valuations from Eqvista can help you streamline portfolio management. Contact us to learn more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!