Market volatility: Investor fear and uncertainty

This article will explore what market volatility is and how investors and companies can navigate volatile markets effectively.

As an investor, you must accept a certain level of market volatility to secure meaningful returns. No asset market on the face of the Earth can grow in a straight line forever. Also, to make outsized returns, you must take on outsized risks. Volatile markets often lead to asset mispricing, creating potential arbitrage opportunities.

That being said, volatile markets significantly increase portfolio risks. From the perspective of companies, market volatility can cut off access to capital and disrupt supply chains, triggering valuation decline through no fault of their own.

What is market volatility?

Volatility is the degree of variation in a particular asset’s price or a market’s index. When investors are uncertain about how to interpret market conditions, we observe high market volatility.

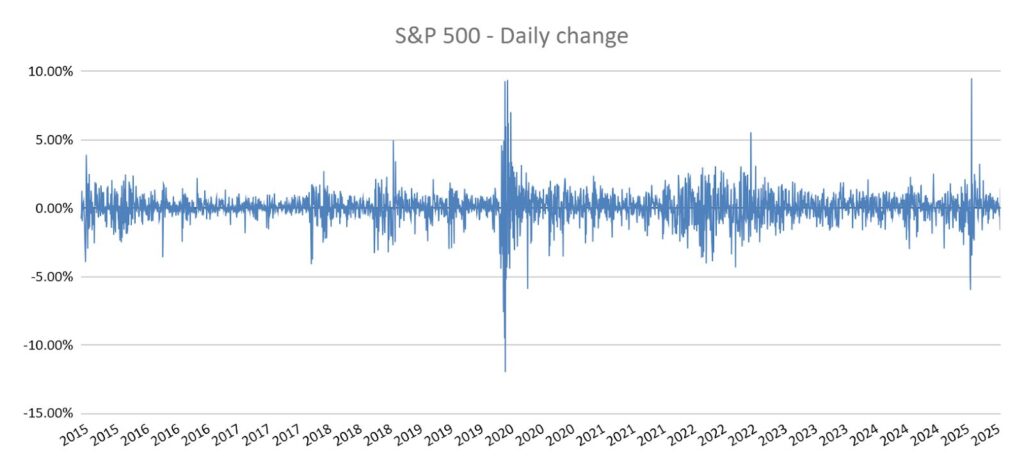

In recent times, high market volatility was experienced in April 2025 when the new tariff policies were introduced. When the new tariffs were announced, they disrupted America’s international trade setup, and it was difficult to predict how other countries would react; hence, volatility ensued.

Source: FRED

While we can spot periods of high volatility by observing the trends in daily change, volatility is typically measured as the standard deviation or variance. You can also find volatility indices such as the CBOE Volatility Index (VIX), which measure volatility based on trends in derivative prices.

How to protect a portfolio in volatile markets?

The three strategies that can help you protect your portfolio in volatile markets are as follows:

Diversification

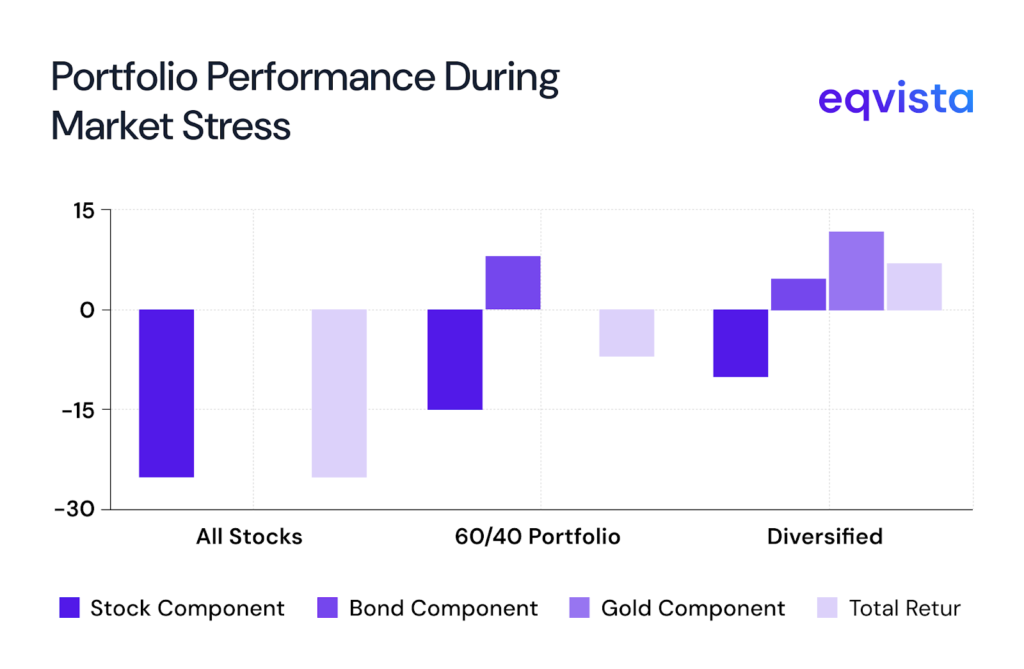

The worst timing to put all your eggs in one basket would be when markets are volatile. You do not want your entire portfolio to crash because of a single asset.

In contrast, when you diversify your portfolio, the losses from a part of your portfolio could be recovered by the rest of your portfolio, mitigating the risk exposure from any single asset. To diversify effectively, you should allocate capital across assets whose prices are inversely related or are unrelated.

For instance, when the stock market is volatile, gold and bond prices increase as investors move their capital out of the stock market and into these safe-haven assets.

By investing across multiple regions and asset classes, you can achieve a high level of diversification.

Periodic investing

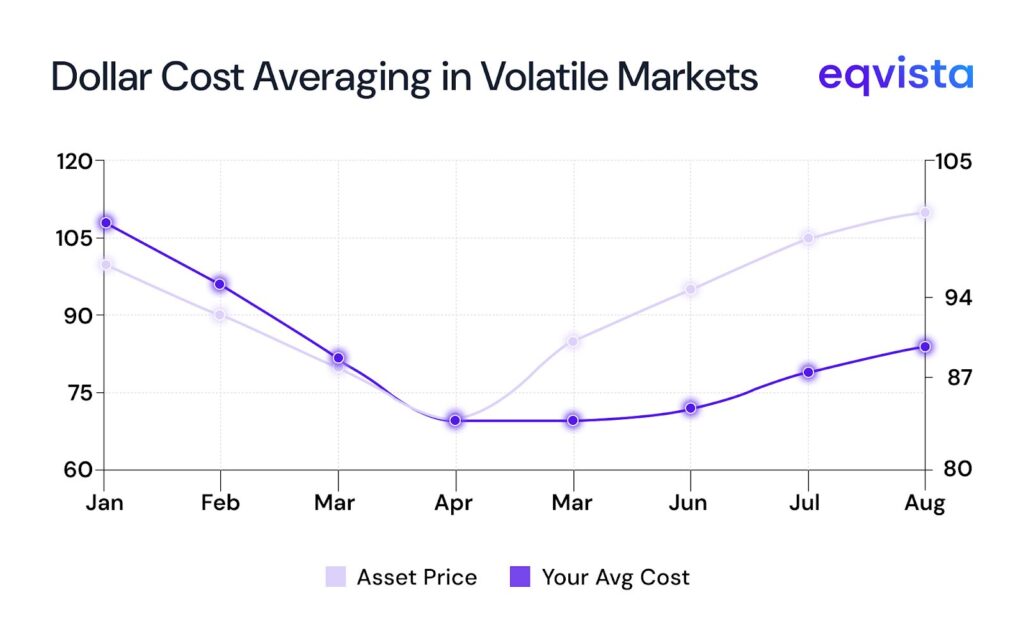

Asset price movements can be extremely unpredictable. Through fundamental and technical analysis, you could develop a sense of the fair price for an asset. But various inefficiencies and irrational behaviors make it impossible to accurately predict price movement.

So, instead of trying to buy assets at a supposed low, you should consider investing a fixed amount periodically.

In contrast, when you invest a fixed amount periodically, your overall investment cost, or entry point, is averaged out. In the world of mutual funds, this strategy has been popularized as Automatic Investment Plans (AIPs).

At the very least, this strategy allows you to avoid buying at high prices.

Hedging with derivatives

Experienced investors who understand the relationship between option prices and underlying asset prices can try to hedge their portfolio’s risk with options. If you wish to protect yourself against a drop in an asset’s price, you could utilize put options. As far as option-based hedging goes, this is a fairly straightforward strategy that only requires you to estimate whether the option premium is fair.

There are other, advanced derivative-based hedging strategies that allow you to optimize the risk exposure and expected returns. However, these strategies require a deep understanding of markets and can be damaging if executed incorrectly.

What can businesses do to attract funds in volatile markets?

Raising funds in volatile markets can be extremely challenging as even the most daring investors turn risk-averse. To improve your chances of raising funds in such critical junctures, consider leveraging the following strategies:

Improve financial transparency

You can reduce the perceived risk of your business by being transparent about your financial condition. Instead of letting potential investors assume the worst-case scenario, you should present the reality.

Often, investors assume the worst in volatile markets. But the reality is that the stock market often bounces back from periods of high volatility. It is the uncertainty that breeds and inflates investor fears. So, chances are that your company’s financial condition is a lot better than what investors would assume.

Offer attractive entry points

The entry point should be attractive enough to offset the increased market risk. At the same time, you must be careful not to disillusion existing investors or cause excessive dilution.

So, the ideal equity funding strategy in this context would be raising a bridge financing round at a discounted valuation from existing investors. If you structure your pitch well, you can position this deal as a win-win situation. You get to continue chasing your vision while investors reduce their average share purchasing price.

Also, a bridge financing round limits the dilution, and when the markets are stable, you can raise your next round at a stronger, recovered valuation.

Demonstrate risk management

In a market where uncertainty is fueling investor fears, clarity in strategy will help you differentiate yourself from competitors. But, before hearing your risk management strategy, investors will want to know how well you understand the market conditions and their impact on your business.

A lack of information in volatile markets pushes investors to assume the worst. So, quantify your risk exposure and help investors connect the dots.

Then, you must present a detailed plan on how you would maneuver your business out of the crisis. This plan should include contingencies for every likely scenario and the resulting valuation outcomes.To help your investors build more context, you should also present a market outlook and contrast it with your company’s expected performance.

Explore debt financing

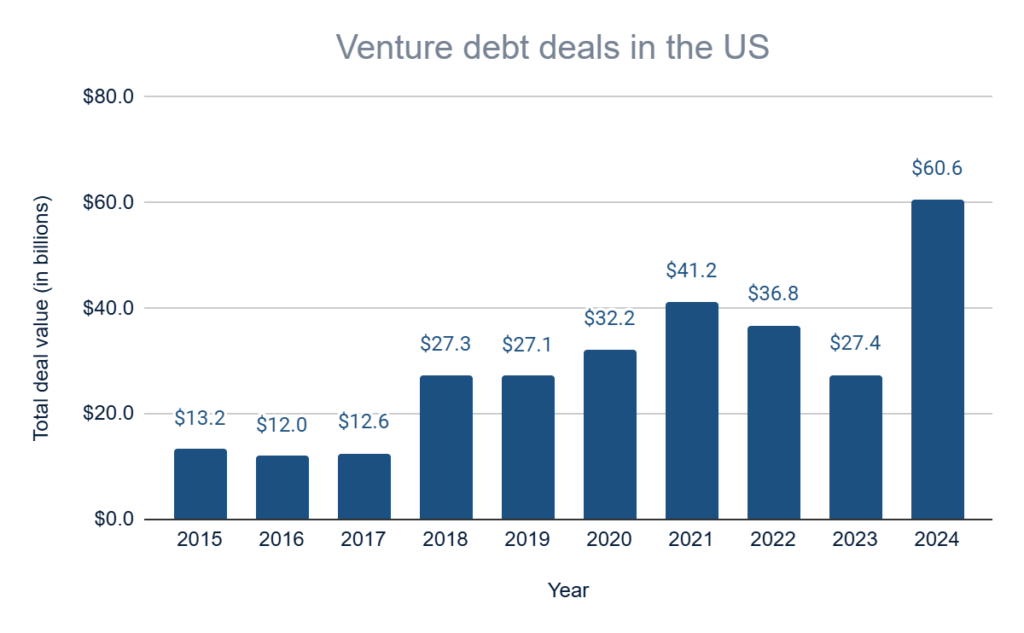

Debt can benefit startups by encouraging stronger financial reporting, offering low and fixed costs, and avoiding equity dilution. Startups are starting to rely on debt financing to keep operating until they can raise equity funding at favorable terms.

For the past decade, the value of venture debt deals in the US has been steadily rising, and in 2024, it more than doubled to $60.6 billion.

Source: NVCA

In a recent webinar, we investigated what makes debt attractive for startups, especially those in the software-as-a-service (SaaS) industry. We found that VC-backed startups that optimized their debt grew faster than others.

So, startups must not overlook the importance of debt in their capital mix, especially in volatile markets when equity can be expensive.

Eqvista – Data-backed decision-making at your fingertips!

Whenever our economy stands at an inflection point, market volatility increases. While these events heighten risks, they can also be opportunities for making outsized returns or outperforming competitors.

Successfully navigating these periods requires the right mindset and strategies grounded in data-driven insights.

Eqvista can assist with the latter. Our detailed and accurate valuation reports help investors gauge portfolio risks and enable companies to identify and quantify risks and opportunities. Contact us to know more about our services!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!