What is Distressed Debt?

Distressed debt can be an investment opportunity that allows you to effectively beat the market. In 2024, Brazil had a real interest rate of 35.1%, greater than the returns of the S&P 500, the Nasdaq, and the Nasdaq 100. With such returns, you could more than 20x your investment portfolio in just 10 years.

The catch? These returns are vulnerable to foreign exchange fluctuations, and governments or companies typically issue debt at such high interest rates only when they are under significant financial or economic distress.

What is Distressed Debt?

When companies face financial turbulence, their bonds often trade at steep discounts, creating potential opportunities for savvy investors. Distressed debt-securities from financially troubled companies or governments-can offer substantial returns, but requires careful analysis and risk management.

Distressed Debt: A High-Risk, High-Reward Investment Strategy for Investors

Distressed debt is the bonds or loans from entities in financial distress, often trading below 80 cents on the dollar. These securities offer high potential returns through two mechanisms:

- High coupon payments from bonds issued during distress

- Capital appreciation as discounted bonds recover toward par value

While these investments carry significant risk, they can provide portfolio diversification and outsized returns when selected carefully.

These debts trade at steep discounts, often below 40% of their face value, and are classified with credit ratings of CCC or lower, reflecting a major risk of bankruptcy. Because of this risk, distressed debt offers yields much higher than safer investments, which attracts specialized investors.

Distressed debt investors include hedge funds, private equity firms, and specialized debt funds. They have the expertise to manage such high-risk investments. Founders should be aware that distressed debt investors may take an active role in company decisions during restructurings, which can affect equity ownership.

What are the causes of Distress?

Distress arises from several factors, including operational challenges leading to cash shortages, an unsustainable debt burden, failed refinancing attempts, or violations of loan agreements. External factors like economic downturns or industry disruptions can also push companies into distress.

Investors buy distressed debt at significant discounts as a strategic move. By doing this, an investor may negotiate restructuring terms, convert debt into equity, or participate in bankruptcy proceedings. This investment approach requires deep due diligence and a tolerance for risks, as successful restructuring can result in substantial returns, while failure may cause complete losses.

What does distressed debt look like in practice?

Case study 1: WeWork Case studies for Distressed Debt

WeWork’s journey shows how quickly market sentiment can shift. In April 2018, they raised $702 million through bonds yielding 7.875%—reflecting investor optimism about the shared workspace model.

The Challenge: WeWork pioneered flexible workspace solutions but faced a serious mismatch between long-term lease obligations and short-term customer commitments. When the 2019 IPO attempt revealed concerning governance and financial metrics, investor confidence evaporated.

Market Response: By late 2019, bonds traded at 78 cents on the dollar. COVID-19 initially seemed to offer recovery hope—bonds recovered to 94 cents by December 2021 as vaccination rollouts suggested office space demand would return.

The Reality:By March 2023, Fitch downgraded WeWork to a “C” rating, and the company missed $95 million in interest payments by October 2023, filing for bankruptcy the next month.

Investor Takeaway: Structural business model challenges require more than market recovery. WeWork’s innovative approach to workspace wasn’t inherently flawed, but the capital structure couldn’t survive prolonged occupancy challenges.

Case Study 2: General Motors Distressed Debt

GM’s distressed debt story demonstrates how political factors can reshape outcomes. The automaker struggled with massive fixed costs that couldn’t be reduced quickly when demand collapsed during the Great Recession.

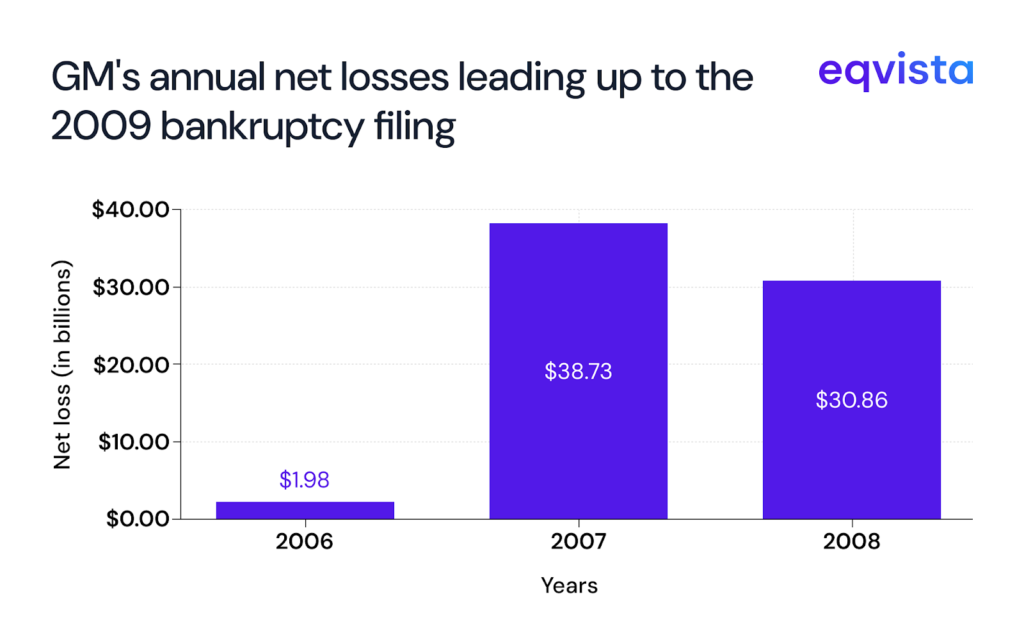

The Crisis: GM’s 8.375% bonds plummeted to 18.4 cents on the dollar by December 2008, as credit rating agencies slashed ratings to near-default levels. Between 2006 and 2008, the company lost $71.57 billion.

Government Response: The U.S. Treasury provided $19.8 billion in emergency funding, followed by an additional $30 billion restructuring package. GM filed for strategic bankruptcy on June 1, 2009.

The Recovery: Within 18 months, GM returned to public markets with a $15.8 billion IPO—one of the largest in U.S. history. The company streamlined operations by selling Saab and discontinuing the Saturn and Pontiac brands.

Investor Takeaway: In systemically important industries, government intervention can dramatically alter distressed debt outcomes. Political considerations matter as much as financial fundamentals.

Market Dynamics of Distressed Debt

Understanding the market dynamics can help founders navigate negotiations with creditors and investors during distress.

Distressed debt investing is risky; however, it also offers opportunities for outsized returns if the company successfully restructures or if assets are liquidated profitably. For founders, distressed debt impacts company control, financing flexibility, and the roadmap to recovery or exit during difficult financial times.

The market for distressed debt is less liquid and more complex than traditional debt markets. Trading volumes fluctuate with overall credit market health, and distressed debt investors often operate in a competitive environment.

Eqvista- Research-driven insights that enable confident decision-makers!

There’s much more to an investment opportunity than the advertised return on investment. Whether you are evaluating distressed debt from a startup, a large corporation, or a government, the key question is how realistic the path to recovery is.

For companies, this means assessing financial discipline and the strength of management. For countries, it means understanding macroeconomic resilience and policy direction.

Eqvista specializes in delivering balanced, actionable valuation insights that cut through the noise. Contact us to know more about our offerings!