IPO Readiness Checklist

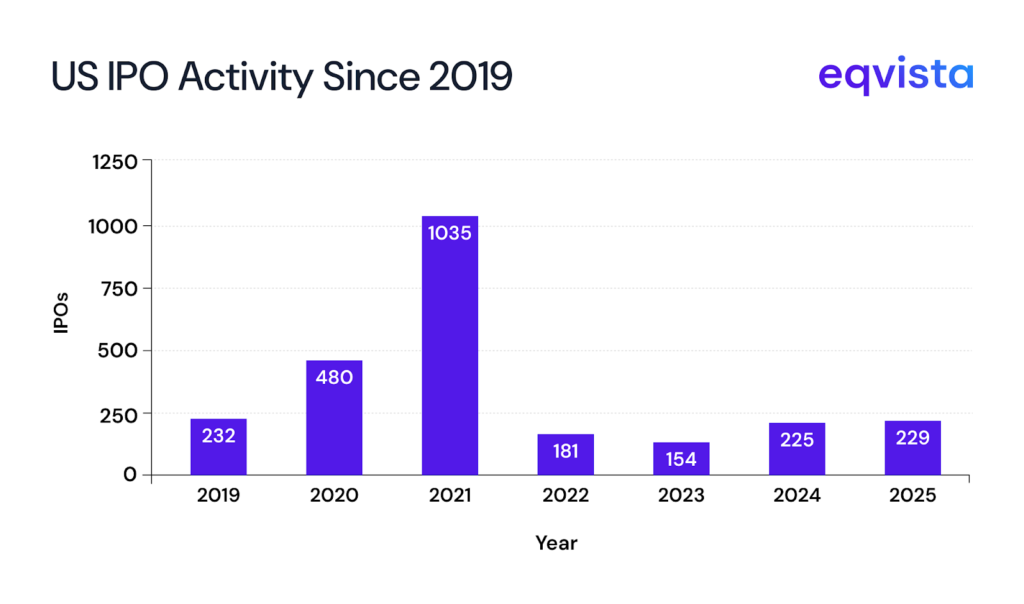

The general consensus is that uncertain market conditions have held back a number of companies from going public. While the number of initial public offerings (IPOs) has risen steadily since 2023, activity remains far below the highs of 2020 and 2021.

Due to such market conditions, many companies have ended up with elongated IPO timelines.

In such an environment, it is critical for companies to reassess whether they continue to meet regulatory requirements and investor expectations so they can act quickly when market windows open.

For this very purpose, we’ve compiled an IPO readiness checklist in this article to help companies prepare with agility and confidence.

How to ensure a smooth IPO?

A company must meet certain rigorous reporting and governance standards to qualify for an IPO. Beyond compliance, it’s also wise to strengthen investor confidence by simplifying ownership structures and establishing a clear valuation track record.

Hence, IPO preparation typically takes 12 to 18 months of focused efforts.

Improve the quality of financial statements

Most private companies operate with relatively lightweight accounting and bookkeeping processes. But going public raises the bar significantly.

You must improve the quality of your financial records to be able to compile the following financial statements:

- Annual audited financial statements

- Balance sheets for the two most recent fiscal years

- Comprehensive income, cash flows, and changes in stockholders’ equity statements for the three most recent fiscal years

- Independent auditor’s report

- Interim unaudited financial statements (for all quarters since the most recent audited financial statements)

- Balance sheet

- Comprehensive income, cash flows, and changes in stockholders’ equity statements

- Financial statements of acquired businesses

- Audited financial statements for the most recent one or two fiscal years (depending on significance)

- Unaudited interim financial statements for all subsequent quarters

If your revenue in the most recent fiscal year is below $1.235 billion, you may qualify as an Emerging Growth Company (EGC) and go public with only two years of audited financial statements, rather than the standard three.

Furthermore, to comply with SEC requirements, companies must ensure that the financial statements included in their IPO documents are current and not considered stale. The following table summarizes the key staleness dates by filer type and reporting period:

| Staleness dates | ||

|---|---|---|

| You can go public using these financial statements | By this date | If you are a… |

| 2024 Q3 financial statements | 14th February 2025 (45 days after year-end) | 1. IPO registrant 2. Delinquent Filer 3. Loss Corporation |

| 3rd March 2025 (60 days after year-end) | Large Accelerated Filer | |

| 17th March 2025 (75 days after year-end) | Accelerated Filer | |

| 31st March 2025 (90 days after year-end) | Any other filer | |

| 2024 Year-end financial statements | 9th May 2025 (129 days after year-end) | 1. Large Accelerated Filer 2. Accelerated Filer |

| 14th May 2025 (134 days after year-end) | Any other filer | |

| 2025 Q1 financial statements | 7th August 2025 (129 days after Q1-end) | 1. Large Accelerated Filer 2. Accelerated Filer |

| 12th August 2025 (134 days after Q1-end) | Any other filer | |

| 2025 Q2 financial statements | 6th November 2025 (129 days after Q2-end) | 1. Large Accelerated Filer 2. Accelerated Filer |

| 12th November 2025 (134 days after Q2-end) | Any other filer | |

Increase the frequency of 409A valuations

Companies preparing for an IPO lack an extensive trading history, making their stock prices appear unpredictable to investors who depend on technical analysis. One practical workaround is to increase the frequency of 409A valuations.

Since these valuations are highly standardized and incorporate all material information into a company’s assessment, they can effectively serve as a proxy for historical stock price data.

Besides, these valuations are needed whenever a material event occurs. So, during the transformative pre-IPO phase, you would inevitably conduct them more often.

Establish a robust corporate governance system

In the public equity market, companies are held to a higher governance standard. To begin with, in addition to a board of directors, publicly listed companies must establish the following committees:

| Governance bodies | Responsibilities |

|---|---|

| Audit committee | |

| Compensation committee | |

| Nominating and Corporate Governance Committee (NCGC) |

Rather than scrambling to create these committees and draft their charters at the last minute, it’s best to establish them gradually in the run-up to your IPO.

Simplify ownership

The public equity market is open to investors who are much less sophisticated than private equity participants. There is a need to simplify the investment products. This is why only 10% of IPOs since 1980 have had dual-class share structures.

When a company’s equity structure includes multiple share classes, value allocation becomes challenging. These challenges will magnify if the company has complex securities such as warrants and convertible debentures.

So, before your IPO, you should negotiate the conversion of any complex and convertible securities.

Build the right team

Going public is a complex process that requires much more than strong financial performance. Hence, you must build a strong IPO team comprising finance professionals, legal counsel, auditors, and investor relations experts.

The role of this team would be to ensure that the company meets the regulatory and exchange requirements as per the set timeline. If building a full in-house IPO team feels premature, you should at least engage experienced external advisors and bankers. They can help you design a realistic IPO timeline based on market conditions for maximizing the chances of a successful debut.

SOX compliance

From the point your company files a registration statement with the SEC and as long as it stays a public company, it must comply with the Sarbanes-Oxley (SOX) Act.

SOX compliance ensures accurate financial reporting, strong internal controls, and transparency. Companies must implement and document robust processes, IT controls, and risk assessments before going public to build investor trust and meet regulatory requirements. Early SOX readiness not only aids in a smooth IPO but also demonstrates accountability and ultimately supports long-term success in the public markets.

Cybersecurity standards

Companies registered with the SEC must disclose material cybersecurity events in Form 8-K, or Form 6-K for foreign issuers, within 4 business days of determining materiality. Delays in such disclosures are permissible only in matters of national security.

In their annual filings, such companies are required to describe the process for identifying and managing cybersecurity risks, the roles of management and the board in overseeing such a process, and the impact of past incidents.

ESG reporting requirements

ESG investments already account for $6.5 trillion in US assets, and this market is only expected to grow going forward. Also, the SEC has issued a rule requiring registrants to provide standardized disclosures on climate-related risks, mitigation strategies, financial impacts, and the processes established to address them.

So, failing to meet these reporting requirements not only limits access to ESG-focused investors but also increases exposure to potential SEC scrutiny and investigations.

Final Thought: Which kind of IPO is right for your company?

While traditional IPOs can be expensive, they give you the best chance to make a successful market debut. On the other hand, if your company already enjoys strong visibility and does not need to raise new capital, a direct listing may be a more cost-effective alternative since it avoids underwriter fees.

Meanwhile, the outcome of a SPAC IPO hinges largely on the sponsor’s reputation and ability to attract investors. Such IPOs also carry the risk of insufficient funds being raised to complete an acquisition.

Eqvista- Simplifying compliance and reinforcing trust!

IPOs are arguably the biggest equity change in a company’s lifetime. In the lead-up to this milestone, companies must also manage a series of smaller but complex changes, such as converting securities.

To navigate this dynamic period smoothly, consider using Eqvista’s cap table solution. It helps you streamline conversions, maintain compliance with investment agreements, and build consensus among stakeholders. Get in touch with us to learn more!