RSA vs RSU: All You Need to Know

There are two popular stock bonus structures in the market – restricted stock units (RSUs) and restricted stock awards (RSAs).

Over the past 10 years, firms have been changing the way they structure their corporate stock options and how these are used in the market. The reason behind this is the ever-changing rules and regulations that have impacted these companies. Currently, there are two popular stock bonus structures in the market – restricted stock units (RSUs) and restricted stock awards (RSAs).

This article will provide you with a better understanding of these two stock options and the difference between them. Either as a founder or employee of a firm, knowing how an RSA vs RSU functions as an incentive for employees in the company is important.

Understanding Restricted Stocks

Restricted stock options are very different from normal stock options. Regular stock options offer you the right to purchase a limited number of shares at a predefined price. But in this case, you do not become the owner of the shares until you have bought them. On the other hand, with restricted stocks, you own the shares from the first day they are issued.

The stocks are “restricted” as you will still have to earn them after they have been issued. A common restriction on these restricted stock include a vesting schedule, where the shares are earned over time. This type of plan incentivizes employees to stay with the company longer. And if an employee leaves the company early, the company can repurchase the stock back.

There are two main kinds of restricted stocks – Restricted Stock Units (RSUs) and Restricted Stock Awards (RSAs).

What is Restricted Stock Award or RSA?

A restricted stock award (RSA) is a type of equity compensation granted by a company to an employee. With an RSA, the employee receives company shares, but certain restrictions apply-typically, the shares are subject to a vesting schedule or performance conditions. The employee’s rights to the shares are limited until these restrictions lapse or the shares become fully vested.

To illustrate, let’s consider Tony, one of the first five employees at a startup. Because the company lacks sufficient capital to offer high salaries, it includes RSAs as part of Tony’s compensation package. Typically, these are granted to early employees before the company’s first major equity financing round, when the fair market value (FMV) of common stock is still low.

RSAs may be granted to Tony at no cost, at FMV, or a discount, depending on the company’s plan. On the grant date, Tony owns the shares but remains subject to forfeiture until they vest. The restrictions- such as the requirement to stay employed for a certain period – make these shares “restricted.”

What is Restricted Stock Unit or RSU?

A restricted stock unit (RSU) on the other hand is compensation offered to an employee as company stock, and received later when the vesting is complete, unlike RSAs given on the grant date. The restricted stock units are issued to an employee through a vesting plan and distribution schedule. The employees then get the shares when they meet the requirements in the plan. The requirements can include achieving performance milestones or staying with the company for a particular length of time.

When an RSU is granted to an employee, it does give them an interest in the company’s stock, but it does not have any tangible value until the vesting is complete.

Let us take an example. Larry is another employee in the same firm as Tony, but joins seven years later. At this point, the company has become very successful and the share price has increased. Along with a great salary, the company decides to offer Larry with RSUs as a part of their offer.

An RSU represents a promise to deliver common stock at a future date, which depends upon meeting the performance conditions and vesting schedule set forth in the plan. So, Larry would not get the shares until the conditions are met. Unlike RSAs, when an employee is granted an RSU, it is a promise to the employee from the company to give the shares at a later date.

Exactly when Larry would receive the RSU shares can be a specified date in the future, a liquidation event, a vesting date or a combination of these. The future date is set when the RSUs are granted. Additionally, unlike an RSA, the RSU holder does not have to pay anything to own the shares, apart from any relevant taxes.

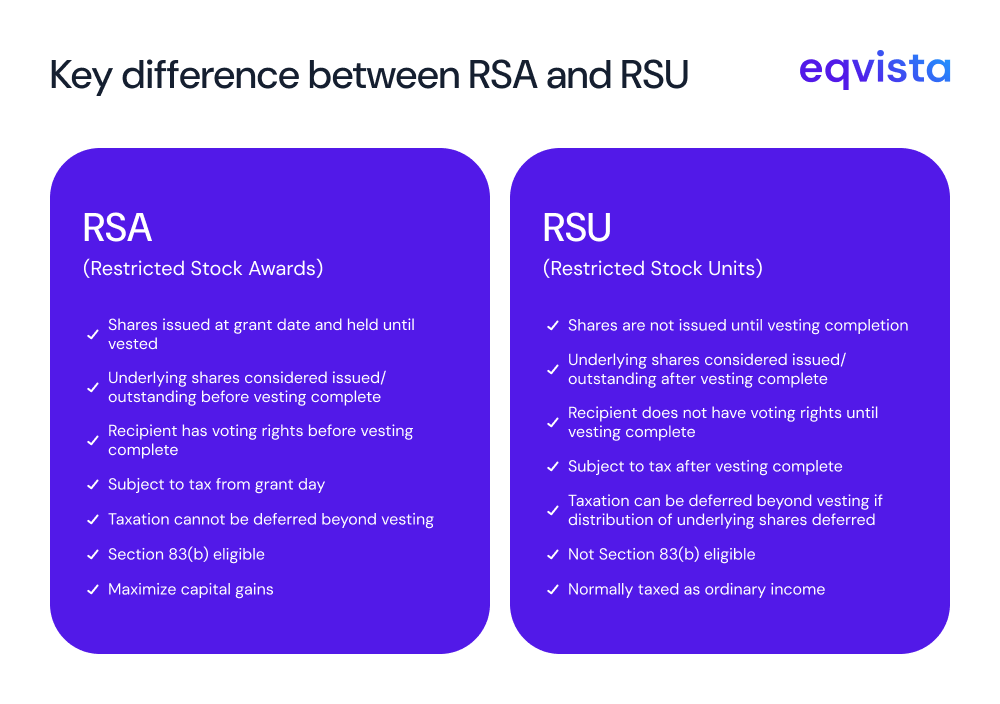

Key difference between RSA and RSU

Even though an RSA and RSU are types of restricted stocks, they have many significant differences. RSAs grant actual shares at the time of grant (with restrictions), often requiring a purchase, and confer ownership rights immediately, but with risk of repurchase if vesting is not met. RSUs are a promise of shares in the future, require no purchase, and confer ownership only upon vesting, with no rights or value until that point.

These structural differences affect tax treatment, timing of ownership, and the employee’s rights during the vesting period

First off, an RSA is a grant which gives the employee the right to buy shares at the FMV, at no cost, or at a discount. On the other hand, an RSU is a grant valued in terms of company stock, but you do not actually get the shares until the restrictions lapse or vest.

| Feature | RSA | RSU |

|---|---|---|

| When shares are issued? | At grant (subject to vesting /repurchase) | At vesting /settlement |

| Purchase required | Sometimes(FMV,discount,or no cost) | No purchase required |

| Vesting conditions | Usually time-based (sometimes milestone) | Time based ,milestone, or double-trigger |

| Taxation | At grant (if 83(b)election ,else at vesting | At vesting |

| 83(b) election | Allowed | Not allowed |

| Forfeiture/repurchase | Unvested shares subject to repurchase | Unvested units forfeited |

| Deferral of statement | Rare | Possible if plan allows |

In short, there are a lot of differences between an RSA vs RSU, which is why it’s good to research more about these restricted stocks before issuing them in your company.

Vesting: RSA & RSU

RSA and RSU vesting are different to a great extent. Vesting means that the person getting the shares will have to earn the shares over a period of time.

RSA vesting

- RSAs are typically subject to vesting requirements, which can be based on the passage of time or the achievement of company or individual performance milestones.

- Within 30 days of the grant, an 83(b) election is not filed if each vesting event triggers ordinary income tax on the difference between the fair market value (FMV) at vesting and the purchase price.

- Once vesting requirements are met, the shares become fully owned by the employee, and any subsequent profits and deficits are treated as capital gains or losses when the shares are sold.

RSU vesting

- RSUs also follow vesting schedules, commonly time-based (e.g., 25% per year over four years) or performance-based (e.g., tied to company milestones or individual targets).

- In private companies, RSUs may have “double-trigger” vesting, requiring both a time-based condition and a liquidity event (like an IPO or acquisition) before vesting and settlement.

- Once RSUs vest, they are settled and converted into shares or cash, per company plan rules. At this point, the employee receives the shares and owes ordinary income tax on the FMV at vesting.

For example, a liquidation condition states that the company has to be acquired or undergo an IPO before the shares would vest. The employees would need to satisfy the time-based vesting schedule and the liquidation condition before their shares would be vested. In short, RSU vesting has many more conditions as compared to RSA vesting.

Tax Treatment: RSA & RSU

As RSAs and RSUs have a lot of differences when it comes to the vesting conditions and the termination events, the same is true when it comes to how they are taxed.

RSA Taxation

- Taxed as ordinary income on the value of shares at grant unless an 83(b) election is filed, in which case taxation occurs at grant, immediately the holding period for capital gains begins.

- 83(b) election allows potential for long-term capital gains tax treatment if shares appreciate.

RSU Taxation

- Taxed as ordinary income when shares vest, based on their value at that time.

- Not eligible for an 83(b) election.

- Employers must withhold taxes upon vesting (e.g., federal withholding at 22% up to $1M, 37% above that).

Typical Use Cases

- RSAs are favored by early-stage startups when the FMV is low, minimizing tax burden and purchase cost for employees.

- RSUs are more common in mature or public companies, where the FMV is higher and companies prefer not to require employees to purchase shares.

Pros and Cons of RSA and RSU Taxation

RSAs and RSUs use vesting schedules to incentivize retention and performance, but differ in timing of ownership, taxation, and risk of forfeiture.

| RSA | RSU | |

|---|---|---|

| Pros | ||

| Cons |

It is important for both the owners and employees to know all about the taxation rules of these forms of equity compensation. It would help the employees save a lot of money for taxes, as whenever the company pays their employees in salary, benefits, or equity, the employee would owe tax to the IRS.

Section 83(b) Election

As per the 83(b) election, an employee can choose to pay all the ordinary income tax upfront to the government for the RSA obtained. When you receive RSAs, you typically do not own the shares outright until they vest. Normally, you would pay ordinary income tax on the value of the shares as they vest.

However, with a Section 83(b) election, you can pay tax on the value of all the restricted shares at the time of grant rather than as they vest. This can be advantageous if you expect the value of the shares to increase, as you pay tax when the value is lower, and any future appreciation is taxed as capital gains when you sell the shares.

How Does 83(b) Election Works for RSAs?

- Without 83(b) Election – Normally, you pay ordinary income tax on the value of the shares as they vest. If the stock price rises over time, your tax bill increases because you’re taxed on the higher value at each vesting event.

- With 83(b) Election – You pay ordinary income tax on the FMV of all the shares at the time of grant, even though they haven’t been vested yet. Any future appreciation is taxed as capital gains when you eventually sell the shares, which usually has a lower tax rate.

It is important to note that there is a 30-day deadline from the grant date to file an 83(b) election. After this time passes by, the employee will not be able to file the election.

Summary:

- RSAs: Eligible for 83(b) election.

- RSUs: Not eligible for 83(b) election; you are taxed when the RSUs vest and convert to shares.

Issue and manage your shares with Eqvista!

RSAs and RSUs are vital for attracting and retaining talent, each serving different company needs. RSAs offer early ownership and tax benefits ideal for startups, while RSUs provide simple, cost-free equity grants common in mature companies.

Understanding the differences between these equity instruments is important for structuring competitive compensation packages and maximizing both company and employee value. To ensure your equity plans are optimized and compliant, partner with Eqvista experts in equity management and valuation, who can help you design, administer, and scale your equity compensation with confidence. Contact us today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!