Valuation of Crypto Assets – All you need to know

Understanding how crypto assets underlying technology works is critical to understanding how crypto assets derive their value.

As the crypto market grows, businesses that can effectively value and manage their crypto assets will be better positioned to navigate this new financial frontier. The market size in 2023 ranges from approximately USD 604.37 million to USD 1.06 billion. The market is expected to grow substantially, with forecasts suggesting it could reach between USD 4.18 billion and USD 17.19 billion by 2033 and 2036, respectively. This reflects a compound annual growth rate (CAGR) of approximately 21.35% to 24.6% during the forecast periods.

The ability to provide accurate, transparent, and compliant valuations is becoming increasingly important for businesses operating in or adjacent to the crypto space.

If you are a business owner and your business holds cryptocurrencies on its balance sheet or is considering investing in crypto assets, this article is worth reading.

What is Crypto Valuation?

Crypto valuation refers to the process of determining the fair value or worth of cryptocurrencies and crypto-related assets. Unlike traditional assets that have established valuation methods, cryptocurrency valuation is complex and still evolving due to the relatively new and volatile nature of digital assets.

Why do Crypto assets need to be valued?

Crypto assets are digital assets that produce a medium of exchange for financial transactions using cryptography techniques. To safeguard financial transactions, manufacture new units, and validate asset transfers, the money is encrypted (secured) using cryptography. It is considered a DeFi, or decentralized finance, as it does not rely on intermediaries such as banks in order to make transactions.

Regardless of its current market price, the underlying value of a crypto asset is determined during its valuation. Crypto valuation faces unique difficulties, including extreme price volatility, regulatory uncertainty, technological risks, limited historical data, and the speculative nature of many projects. Many cryptocurrencies lack fundamental business models or revenue streams, making traditional valuation metrics difficult to apply. This needs to be valued for several important business and regulatory reasons:

- Financial Reporting – Businesses holding these assets need accurate valuations for financial statements and accounting purposes. Proper evaluation is crucial for balance sheet reporting and determining the fair value of holdings. It is especially useful at times of calculating gains/losses on crypto transactions.

- Taxation – Valuation is essential for tax compliance and reporting. Businesses must determine the fair market value of crypto assets for tax purposes, which helps in calculating capital gains/losses on transactions and reporting holdings accurately on tax returns for crypto taxes.

- Business Operations – For companies using or transacting in crypto, valuation is necessary for pricing products/services in crypto. Also, it is important while determining appropriate compensation when paying in crypto.

- Strategic Planning – Valuation helps businesses in assessment of the potential of blockchain and crypto technologies. It helps to make decisions about integrating this into business models and evaluate potential mergers, acquisitions, or partnerships in the crypto space.

Crypto valuation encompasses a range of considerations that impact taxation, financial reporting, investment decisions, and regulatory compliance.

Types of crypto assets that need a valuation

The nature of a crypto asset determines its value, with the most important distinction being whether the asset offers its owner the right to a stream of future cash flows or not. This has been demonstrated on three different types of tokens: security tokens, utility tokens, and cryptocurrencies.

Security tokens

Represent ownership in underlying assets, similar to traditional securities. They are subject to regulatory frameworks and often provide rights to dividends or profit-sharing. When you purchase a security token, you are effectively becoming a major shareholder, and the amount you invest is directly influenced by the company’s valuation.

Considerations

- Future cash flows from the underlying asset can be estimated and discounted.

- Valuation can be benchmarked against similar securities in traditional markets.

Utility or MAG tokens

Platform tokens like BNB (Binance), UNI (Uniswap), and LINK (Chainlink) derive value from their utility within specific ecosystems. Valuation depends on platform usage, fee generation, and token economics.

Governance tokens give holders voting rights in decentralized protocols. Their value relates to the protocol’s success and the power/influence the governance rights provide.

Native Cryptocurrencies

Bitcoin needs valuation as digital gold and store of value, while Ethereum requires assessment both as currency and as fuel for smart contracts. Their network effects, adoption rates, and technological capabilities drive value. Examples are Bitcoin (BTC) and Ethereum (ETH).

DeFi Tokens

Decentralized exchange tokens, lending protocol tokens, and yield farming tokens require valuation based on protocol revenue, total value locked (TVL), and fee generation potential.

NFTs and Digital Assets

Non-fungible tokens need individual valuation based on rarity, utility, community, and market demand – often highly subjective and speculative.

Crypto Valuation Approaches

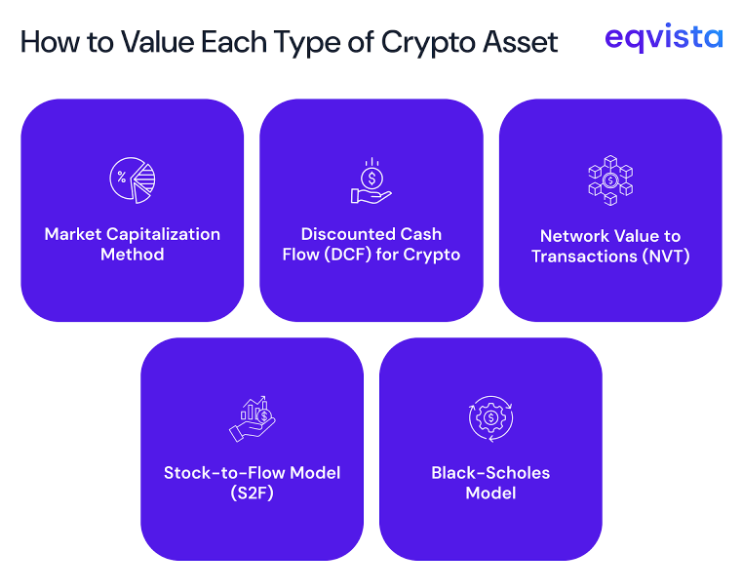

The type of decision-making and distribution rights connected with security token ownership vary, but all share one fundamental aspect: the right to future distributions. Under the market and income approaches, this allows for the use of classic valuation methodologies. Each method helps determine the accurate valuation of crypto assets, yet they have various different processes.

Market Capitalization Method

The current price per coin/token is multiplied by the total size of the supply. It allows one to judge how large different crypto assets are, working the same way as market caps in equities do.

Example: When Token A is priced at $2 and consists of 50 million tokens, the market cap becomes $100 million.

Discounted Cash Flow (DCF)

It is used for crypto projects with predictable cash flows (e.g., DeFi tokens). DCF estimates value by projecting future earnings and discounting them back to present value using a discount rate.

Example: Let’s say a DeFi token is estimated to bring in $5M each year for 5 years, assuming a 10% discount rate.

| Year | Cash Flow ($) | Discount Factor {1/((1+r)^n)} | Present Value ($) |

|---|---|---|---|

| 1 | 5,000,000 | 0.9091 | 4,545,500 |

| 2 | 5,000,000 | 0.8264 | 4,132,000 |

| 3 | 5,000,000 | 0.7513 | 3,756,500 |

| 4 | 5,000,000 | 0.683 | 3,415,000 |

| 5 | 5,000,000 | 0.6209 | 3,104,500 |

| Total Present Value | $18,953,500 |

Network Value to Transactions (NVT)

In a way, the NVT Ratio is much like the PE ratio in stocks. It compares market cap (Network Value) to daily or monthly transaction volume. If a company’s NVT is high, this could indicate the stock is overvalued.

Example: Coin C has a market cap of $200 million and averages transactions totaling $2 million every day. NVT Ratio = (200,000,000)/(2,000,000) = 100.

Stock-to-Flow Model (S2F)

This method measures the scarcity of assets, and is used primarily for Bitcoin. It divides the current stock (supply) by the flow (production).

Example: The number of Bitcoins in circulation is just over 19 million, with 328,500 added each year. The S2F indicates a ratio of 57.8. This S2F value can be turned into a price curve that shows a possible valuation.

Black-Scholes Model

The Black-Scholes Model uses several variables, including the current price of the asset, strike price, time to expiration, volatility and a risk-free interest rate, to figure out the price of options. The model was originally designed for use in traditional financial markets, but it is now used to price Bitcoin options on exchange platforms.

Example: A Bitcoin call option has a strike price set at $10, the token price is $12, volatility is 60%, maturity is one year and the risk-free rate is 2%. The Black-Scholes model estimates it could be priced at $3.81 per option.

Make informed investment decisions through accurate cryptocurrency valuation

69 percent of current crypto holders are profiting from their investments 2025 Cryptocurrency Adoption and Consumer Sentiment Report, indicating improved market conditions that affect valuation confidence and adoption rates.These developments suggest crypto valuation is becoming more institutionalized and standardized as regulatory frameworks mature.

Whether your organization holds crypto on its balance sheet, is considering investment, or requires valuations for compliance and reporting, consider experts who can help you unlock the potential of crypto assets.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!