409A Valuation for Series B Funded Startups

The purpose of this article is to provide an understanding of Series B funding and 409A valuation.

Series B funding is a type of financing round that’s usually the third stage of financing for a startup. The competitive fundraising environment for startups is driving both investors and founders to embrace a more aggressive investment strategy. At the same time, a 409A valuation is important for any startup founders planning to take Series B funding to ensure that the common shares’ value is fairly priced. The purpose of this article is to provide an understanding of Series B funding and 409A valuation.

Series B funded startups

As the third stage of financing, the Series B funding round is commonly used by startups that have raised seed and early venture funding rounds. This funding round is typically used for many purposes, including conducting the company’s business operations, launching new products or services, and supporting the company’s expansion. Usually, the total investment amount of Series B funding is between $7 to $10 million.

It’s important for an entrepreneur to have both a solid business plan and realistic financial projection in order to prepare for the upcoming round of funding. Thus, startups that secure Series B funding rounds are referred to as Series B funded startups. These startups are in their growth phase; however, they have already established their business plans and goals.

What are Series B-funded startups?

In essence, a Series B-funded startup can be defined as a startup that has committed capital from the previous round of funding (Seed and Series A Funding) and needs more money to continue the business expansion. Essentially, these startups are considered to be in their growth phase, and they’re ready to scale their business operations as a result of the capital injection during Series B funding.

The startup expansion and growth are driven by market demand and competitive advantages, while the business operations will be conducted as planned in the business model. At this stage, the startups are ready to hire more employees and grow their business operations in order to meet market demands and expand into new territories. Commonwealth Fusion, Svolt Energy Technology Co., Flink Food, and Forte are a few examples of organizations that were able to secure the highest Series B Funding in Q1 2022.

When to raise Series B funding for your startup?

You might be wondering when is the right time to raise Series B funding for your startup. The timing of your round is quite critical; there are many factors you need to consider in order to determine the best time to secure your Series B round. Here are a few scenarios that describe when the startups should raise Series B funding.

- You want to raise $7 to $10 million – When it comes to raising capital for your startup, $7 to $10 million is the threshold of Series B funding. At this stage, you have already secured a significant amount of funding from the previous round of financing. However, in order to facilitate further growth, you will need to raise more funds, and thus, this is when you should raise the Series B funding for your startup. It’s important that you have a clear and realistic plan in order to secure the capital.

- You have a compelling consumer base – While you’re raising capital for your startup, you must pay extra attention to the consumer base of your product or services. One of the major reasons that investors are willing to invest in Series B-funded startups is the growth potential of the market; if you have a great business model, it’s likely that investors will be interested in backing up your startup. If you’re certain that your startup can be a market leader in the future, you should consider Series B funding for your startup.

- Growth of the entire business – As the third stage of funding, the Series B funding round will propel your startup to the next level, allowing you to expand your business operations and meet the growing demand for your product or services. As a result, when you plan and strategize for the growth of your business operation, you should consider Series B funding.

- You have clear financials – In order to secure the Series B funding for your startup, you need to show that the actual financials of the startup are strong as well as a realistic financial projection is available. The investors will consider the financials and revenue of the startup, and if both are strong enough, Series B funding will be an attractive option for the investors. Hence, you should consider Series B funding when your finances are solid and realistic.

Challenges in raising Series B funding

Before you raise Series B funding for your startup, you should be prepared to face certain challenges, and as a result, you should have a clear plan to deal with these challenges. Here are some of the most common challenges raised during the Series B funding process.

- Clear vision and ideas – When it comes to raising Series B funding for your startup, it’s important that you have a clear vision and idea of the company as a whole. A lack of vision or idea will confuse the investors and make them question your business model. As a matter of fact, the investors will consider the vision and ideas as essential factors that will help them determine your company’s success. In addition, the investors will focus on your business plan, which should be well-crafted and concise, as this will help them understand your company’s value.

- Business life cycle – Investors will pay attention to the business life cycle of your startup, as this will help them assess your company’s growth potential. At the Series B funding stage, you will present a growth plan for your startup; hence, it’s important that you take into account several factors and assumptions related to the business life cycle. However, the competitive marketplace is quite dynamic; thus, you need to adjust your plan to meet the changing demands.

- Compelling revenue model – Generally, when it comes to raising Series B funding for your startup, the investors will be interested in your revenue model. The revenue model of your startup will help them determine the level of success and, thus, the future prospects of your business. Therefore, it’s essential that you evaluate and analyze the revenue model of your startup in order to convince investors.

- Compelling business plan with deep market research – Finally, when it comes to raising the Series B funding, you need to have in-depth market research and analysis. The business plan that you have to present should include all the major factors that will help investors determine the success of your startup. Properly framed and organized, the business plan will help you present the right foundation and structure for investors, thereby allowing you to secure Series B funding.

How to get Series B funding for your startup?

Well, there is no one-fit-all solution to provide you with the necessary information and data you will need to successfully raise your Series B funding. However, with a proper strategy, planning, and analysis, you will be able to successfully raise Series B funding for your startup. With a clear vision and mission, detailed plan, solid financials, data-driven market analysis, an experienced management team, and, most importantly, an eye-catching pitch deck, you’ll be well on raising your Series B funding.

Additionally, it is essential to conduct a business valuation in order to estimate the total value of your startup and thus present the best value to investors. As long as you are clear and confident about your business idea and you can present a compelling case to investors, you will be able to get Series B funding for your startup.

409A valuation in Series B funded startups

A 409A valuation is a measure that determines the fair market value (FMV) of common stock for private companies. The Internal Revenue Service (IRS) requires a 409A valuation report every year due to the fact that the equity-related transactions are fair and reasonable. Thus, if you intend to raise Series B funding for your startup, you will want to consider the 409A valuation report.

This means that some investors may want to know the FMV of the company’s common stock prior to making the investment decision. Overall, 409A valuation for Series B funded startups is an advantageous tool that may help you secure Series B funding for your startup.

Do Series B funded startups require a 409A valuation?

The role of 409A valuation in getting Series B funding is quite significant since it will provide you with the necessary information and data that will help investors make an investment decision. In addition, when a startup wants to grant stock-based compensation, the 409A valuation report is required to pay the fair and reasonable compensation amount. Ultimately, whether or not you need a 409A valuation report depends entirely on your needs and goals. However, if you’re seeking Series B funding, then a 409A valuation report may be an attractive option to consider.

How does 409A valuation work in Series B funded startups

The IRS requires that you conduct a fair market value of the common stock on an annual basis for your startup. As a result of this, the company is required to post a 409A valuation report in order to comply with the IRS. Following are some of the key characteristics of a 409A valuation.

- Determine the FMV – With the help of the 409A valuation report, you will be able to determine the FMV of the common stock. Whether you’re a potential startup seeking Series B funding or granting common stock-based compensation, the FMV of stock is an essential factor that should be taken into account.

- Backsolve approach – As you conduct a 409A valuation, you can use a “backsolve method” to estimate the value of the common stock of a company. This method is used in cases when the startup has a complex capital structure or no recent transaction related to common stock is available. As such, the most recent price paid by the investor in the form of preferred shares is taken into account, and then the FMV of common shares is calculated.

- Determine the price of common stock – From issuing stock options to employees to raising Series B funding, calculating common stock price is essential. Therefore, calculating common stock price is important whether you have a simple or complex capital structure.

- Independent evaluation – Usually, 409A valuation is conducted by an independent appraisal professional in order to ensure that the valuation is fair, reasonable, and objective. This means that the valuation is done without any influence, bias, or conflicts of interest. As a result, the appraisal professional will be able to properly value and analyze your startup stock, allowing you to conduct a proper 409A valuation.

How does revenue growth percentage at the Series B funding round affect valuation?

Well, in order to secure Series B funding, most startups need to have high growth potential. Typically, when a startup wants to raise Series B funding, it will face the challenge of convincing investors about its potential in the market. As such, the revenue growth percentage at the Series B funding round is important.

While the effect of the revenue growth percentage on the valuation of your startup may vary, in most cases, the valuation will be highly correlated to the growth percentage of a company. As a matter of fact, valuation is based on a company’s projections, growth, and future potential. Accordingly, the better the growth potential of your startup, the higher the valuation that may be expected, and vice versa.

409a valuation case study for series B funding rounds

Let’s say there is a company, called Webserve, who specializes in providing data cloud services. After significantly expanding their operations and size in the market, the company is ready to take on further investment after the Series A, with a Series B investment.

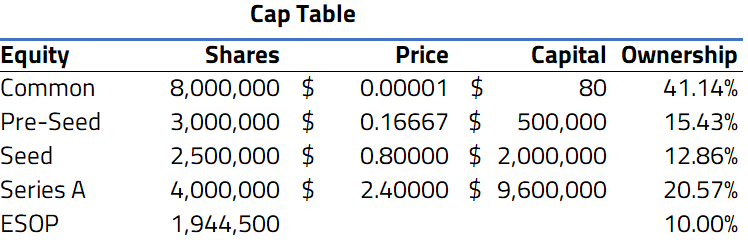

Here is a look at how their simple cap table looks like before the seed funding

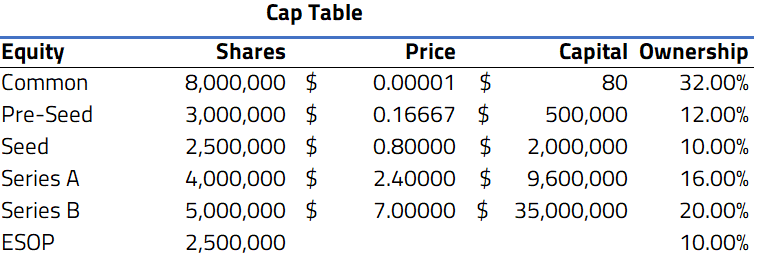

The company then decided to take on its initial investment in the form of a seed funding round, from angel investors. The total amount of the funding was $35,000,000 to support the company to expand its operations and headcount. With this investment, the share price buy-in was $7.00 per share. Here is a look at the cap table post-funding:

Increase ESOP from 1,944,500 to 2,500,000 to maintain a 10% ESOP for employees and for increased options for incoming headcount in the coming 12 months.

For a 409a valuation for Series B funded startups, as their funding round set the valuation of the company for VCs to invest in, this too set the share price for their shares.

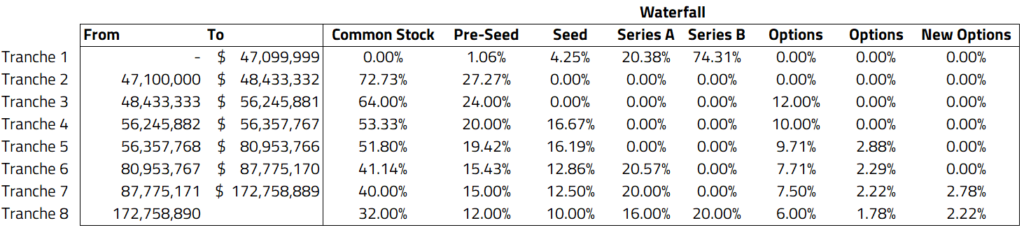

Therefore, we can base off this scenario to conduct a backsolve approach based on their cap table. In order to conduct this analysis, payout “Tranches” would be set up according to the amount paid back to investors, in this case on their $35,000,000 investment. After this, the remaining amounts would be split according to their ownership percentage.

In this case, 100% of the payout from 0 to $35,000,000 would be paid to the stakeholders in the company’s investments. The remaining tranches of 2-8 would be according to each breakpoint for payout according to the cap table, and put through a stock option pricing model (OPM) to attribute values to each equity class.

According to this cap table and the inputs, the common share price would be $2.58 after DLOM, as shown below:

Common Share price: $2.58

This share price would reflect around 36.86% value after DLOM of the seed funding round of $7.00. This is an example on how to get a 409a valuation for Series B funded startups, and find the common share value to be used for future use, such as stock option exercise pricing.

Raise Series B Funding by getting a 409A valuation with Eqvista!

If you’re looking to secure Series B funding for your startup, proper planning and preparation are essential. In fact, a good business plan will go a long way in helping you secure Series B funding for your startup. Additionally, the role of a 409A valuation report in Series B funded startups is quite important. Are you looking for a 409A valuation for your startup? Eqvista can help you to get one for your startup. With the help of their qualified and experienced professionals, they will be able to conduct an accurate 409A valuation report. Get in touch with our team now!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!