Quick Guide on Small Business Valuation

Valuing a small business is important for reasons such as to gauge future revenue, the current market value of assets and capital structure compositions.

Business valuations are integral to the profitability of a company. Be it for the company’s internal use or preparations for a sale, business valuation reports act as a quick guide and check on the company’s financial health.

Small Business Valuation

The definition of small business differs based on the type of industry. Based on the categorization in the North American Industry Classification System (NAICS), the US Small Business Administration (SBA) periodically issues a table of standards that outline industry-based small business classifications. Irrespective of the industry, business valuations are an important component of company operations. Here are some important reasons as to why founders must consider small business valuations.

Top Reasons to value your small business

Valuing a small business is important for reasons such as to gauge future revenue, the current market value of assets, capital structure compositions, and many more. Suitable valuation techniques are used to arrive at a near-exact estimation. Let us look at some basic reasons for such valuations:

- Issuing shares – Small business valuation methods determine the actual price of a company’s stock. A periodic valuation is a healthy practice to track and manage stock prices. Based on the company’s current worth in the market, the management can decide to issue new shares, buy back some, increase, or decrease the pricing.

- Buying a business – It is common knowledge that the true value of a business is finally what the buyer agrees to pay. The business founder tends to shoot for the moon and the investor prefers the best possible economic return on investments. A reliable small business valuation report ensures that factors such as market forces and potential income are taken into account that helps to arrive at a reliable valuation; one that is fair to both the business owner and the investor.

- Selling a Business – Selling a business does not happen overnight. If the sale is pre-planned, as in the case of a planned exit or acquisition, more often than not a strategy is in place. But if a founder decides to sell the business under circumstances beyond a planned acquisition, preparations must start at least 2 years in advance. Small business valuation acts as a reality check for the company. Based on the outcome, the management undertakes the necessary actions to steer the business towards a profitable sale.

- Funding – A small business valuation report is the baseline for fundraising strategies. Investors refer to these reports to evaluate the company’s performance and future potential. A good valuation that also promises future growth potential must be backed by a realistic business plan. It is in the best interests of the company to keep a valuation realistic. An inflated valuation may initially win a massive investment, but it will soon fall short of its forecasted goals and eventually settle for meager second-round funding. This is a poor reflection of a company’s performance metrics.

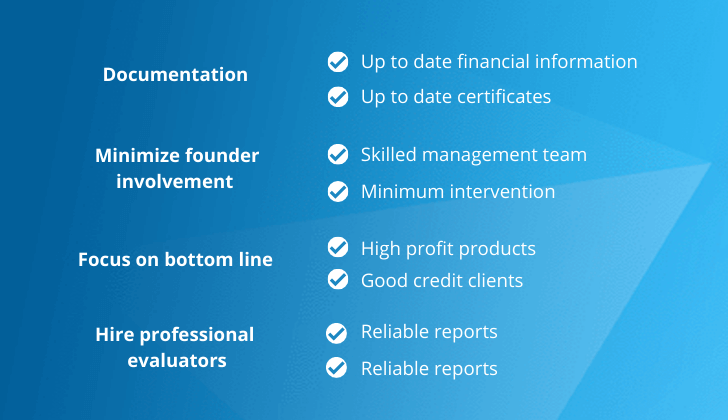

How to maximize your small business valuation?

Apart from the valuation methods, founders must consider the following precautionary measures while preparing for a valuation. These factors, when periodically monitored, have a positive impact on maximizing a small business valuation:

- Hire professional evaluators – Small business valuation is best done by engaging a professional company valuation firm. Apart from a reliable 409a valuation report, their expertise helps in building new profitable strategies as well. It is in the best interest of a company, especially a small business, to do a periodic valuation as a health check for the business. Any preventive measures required can be acted upon on time.

- Focus on bottom-line – Cash flow of a business is the baseline for valuation. Investors find a company attractive based on its profits, not just high sales. $10 million in sales and $7 million in earnings is much better than $20 million in sales and $7 million in earnings. Thus, a small business must focus on those products and services that bring them the highest profits. Also, a few stable clients with good payment terms are much better than multiple clients with bad credits. A small business must re-strategize to ensure the profitability of their business well in advance of valuing the small business

- Minimize Founder’s involvement – Valuation of a business is higher when company management is skilled enough to function independently of its founder. When a business is sold, the founder either moves on to other ventures or takes up a strategic role in the new setup. Thus, independent management is an asset and maximizes a small business valuation. It indicates the strength and expertise of the management team of operating with minimum interventions.

- Documentation – Paperwork must be clean, there are no two ways about it. A minimum of 5 years’ financial statements must be up-to-date. Based on the purpose of the valuation, some other types of documents such as copies of business licenses, permits, deeds, certifications, live contracts with insurers, creditors, vendors, and clients may also be required. Business owners must make a habit of the practice of documentation from the start of the company operations. It minimizes the time and effort of backtracking or worse, missing documentation .

Valuation of Small Business

As we see, small businesses must have a strategic approach to business valuation. This process cannot be treated as an ad-hoc exercise. A methodical approach gives the small business a fighting chance to maximize its valuation. Having realized this, business owners must also be wary of some important factors that sway valuation outcomes.

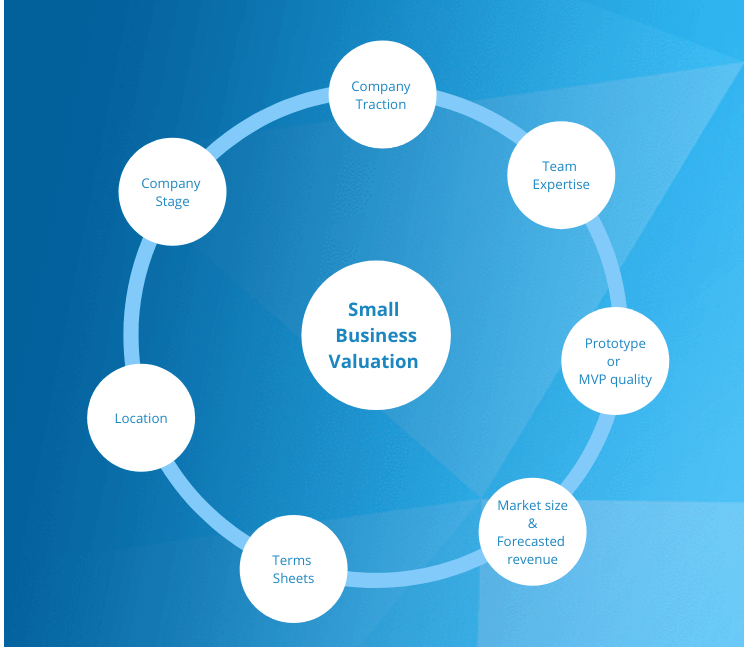

Factors that impact the valuation of a small business

Small business valuation reports are affected by many internal and external factors. Investors scouting to fund a profitable business make their decisions only after accounting for all the impacting forces. Most often investors have their calculation methods to ensure the profitability of their deals. This approach may very well contradict the founder’s who are trying their best to arrive at the highest valuation possible for their company. Here are some common factors that may impact the valuation of a small business:

- Company traction – Traction is a crucial point for small business valuation. Traction indicates the adaptability of the products or services delivered by the business. Founders can choose to demonstrate traction by showing revenues, customers, and evolving new user bases. Customers who have used the product or service and provided positive feedback are assets to a company’s valuation. A pipeline of beta users demonstrating a promise of converting into customers is an additional advantage. Traction can also be shown in terms of valuable partnerships. A good team of service partners increases the overall valuation of the business.

- Team expertise – A good founding team is an asset to every business. Founders and the core management team with prior entrepreneurial experience automatically increase the small business valuation. Investors are more likely to fund companies that have a team with relevant experience and technical know-how required by the company to operate in the current stage as well as to propel it forward to the next ones.

- Prototype or MVP quality – A functional prototype with early adopters is a differentiating factor in the valuation of a small business. A business stands out from competition based on how efficient and profitable their prototype production and gross margins are. In the case of unique technology, a strong IP indicates that technology is well guarded and assures investors against knowledge theft. Business valuation is widely affected by the possibilities of design and technology duplication.

- Market Size and Forecasted Revenue – The industry of a small business’s operation matters in its valuation. If it is a new market, the time required by the business to gain the projected market share matters in their overall valuation no matter how large the profit potential is. Similarly, in a highly competitive market, business owners must be realistic about their market share projections. From an investor’s perspective, the valuation of a small business is profitable when the business promises a profit of at least a few billion dollars in the most economic way and in the shortest time frame.

- Term sheets – Small business valuation reports are affected by the number of term sheets a company receives from investors. The more the better. It demonstrates a high value of the product and services that the business is offering and its relevance to the industry. A small business holding multiple terms sheets is in a good position to negotiate profitable deals and this factor increases their valuation.

- Location – The valuation of a small business varies with the location of the company and the regions they serve. Regions with high economic activity are more profitable and vice versa.

- Company stage – Founders must be mindful of the stage their business is in. In this case, it helps to think like an investor. Why should an investor buy your business? This question acts as a guide to decide the best time to sell a business. The industry of operation also matters. The popularity of the industry and its growth potential has a direct impact on the business. Thus it is better to work hard at first building a corporate structure for the small business, ensure all the necessary licenses, permits, and patents are in place well before planning a small business valuation.

Get Your Small Business Valuation Report from Experts

Small business valuation reports are a cumulative analysis of multiple factors. Though founders always aim for the highest possible valuation, valuation reports must reflect the reality of their industry. Hence engaging professional business evaluators is advised. They not only provide company 409a valuation reports, but from their expertise of working with multiple companies spanning different industries, they are in a better position to suggest the strategic changes needed to maximize the company valuation.

Our team of valuation experts at Eqvista are among the best suited for this process. We are experienced in closely working with various companies, issuing and managing their cap tables, company shares, and valuations reports. Here is the full range of our expertise.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!