What is a Secondary Offering and How does it work?

Entrepreneurs usually seek investment or private funding to start their business. To raise capital, you will need to schedule meetings to pitch your ideas to venture capitalists or angel investors. If they like your idea and see potential, they will invest in your business in exchange for some equity in the company. Once you get your hands on the capital needed, you can start implementing strategies and ideas to take the business forward.

Secondary Offering

A secondary offering is when one investor chooses to sell a huge amount of their shares to another investor in the secondary market. When the company is considering a secondary offering, the main points that change here are the dilution of the existing shareholders and the share owned by the company. The trade-off for the company’s equity is that the company will raise more capital to fund its operations, and the share value will rise.

What is a secondary offering?

The sale of closely held or new shares by the company that has already made an initial public offering is called a secondary offering. In a secondary offering, either a significant shareholder sells a big part of the stock they hold or the company issues new shares. In a secondary offering, the company does not get cash in return from the sale of the shares, this is so because one investor who owns the shares sells it directly to another investor without the company being a part of this transaction.

Why do companies do secondary offerings?

Investors usually celebrate when a company with potential goes public, but there is often less interest when they come back for a secondary offering. Making a secondary offering can result in a slight fall in profits for the shareholders. This happens because the more parts of the company, the more split of the profits.

A majority of the time, a secondary offering occurs because the company needs capital. They might need the capital to finance operations, make acquisitions, repay debt, research & development, or even finance assets. This scenario is likely to occur when the shares are beaten or from major financial decisions.

In other cases, when a secondary offering is made, it is because shareholders want to sell out or sell a majority of the shares they hold. Founders or major shareholders offer their shares for sale due to a decrease of confidence in the business or making an exit for profit.

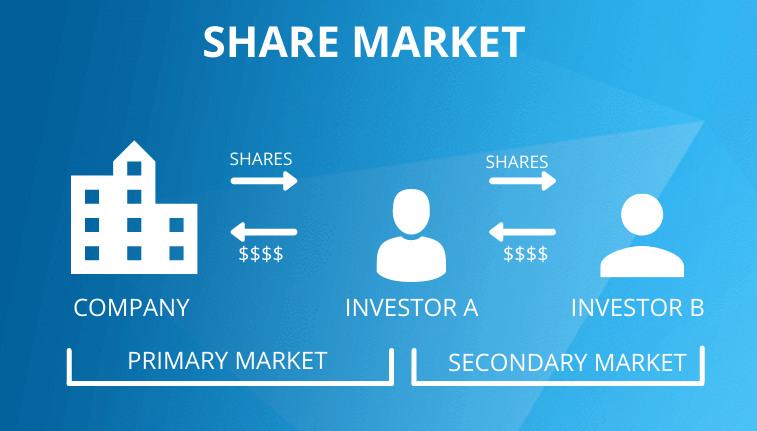

What is the difference between the primary and secondary markets?

The primary market vs secondary market are different places where different types of shares are traded. The primary market is the place where businesses issue new shares to investors in exchange for cash. Here the investors are directly buying shares from the company. The money attained is used for funding major activities such as financing assets, financing operations, or making acquisitions.

The key difference between primary and secondary markets is the way the stocks are procured. In the secondary market, shares of companies that are publicly traded are directly bought and sold between investors. The company does not get any money in this process because they are not issuing new shares. The company can get additional capital only if they issue new shares in the secondary market.

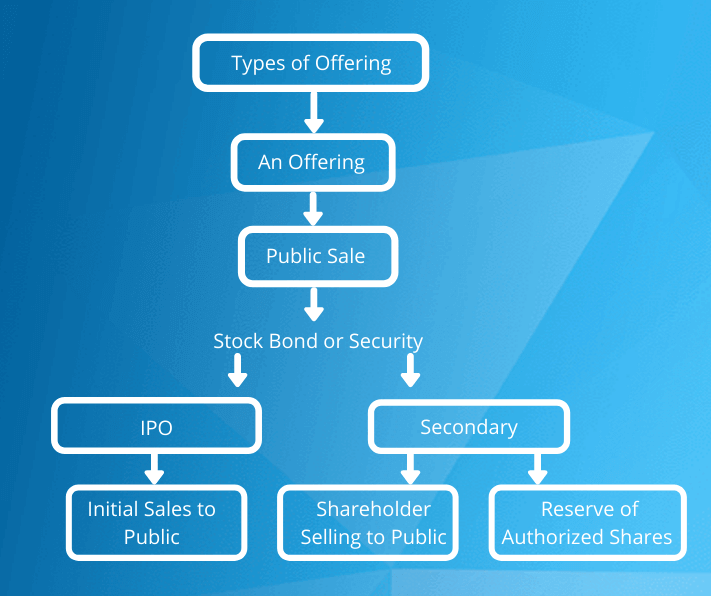

Types of Secondary Offering

In the secondary market, there are two types of offerings:

#1 Dilutive offering

In a dilutive offering, the company issues new shares, and the value of the existing shares dilutes. When the number of shares issued increases, it leads to dilution, causing the ownership percentage to fall. These securities are sold through Investment Banks. Issuing additional shares is an effective way of raising funds. After the Initial Public Offering, a dilutive offering increases the company’s overall value but decreases the initial investor’s earnings. Companies often do this to raise funds for growth.

Here are some Benefits of Dilutive offering:

- Irrespective of where the shares are issued, internally or in the open market, the company value increases in the market causing an additional inflow of funds. The value can increase by issuing outstanding shares.

- Dilution helps in increasing internal ownership. This is done by issuing additional shares to employees.

- An external shareholder will benefit without his stake being diluted if the company issues shares with a higher price.

Let’s take an example to see how it works. Suppose Zero incorporation had an initial public offering of 1 million with a profit this year of $80 million. The Earnings per share will be $80M/$1M = $80. The share price is $200 before the company issues 200,000 shares. This makes the Earnings per share drop $80M/$1.2M = $66.66.

Before the sale, the Price/Earnings ratio was $200/$80 = 2.5. The company will need to sustain an identical P/E ratio after the sale, making the stock price decrease to $66.66 x 2.5 = $166.65. The overall portion of a major stockholder will drop due to more shares, and the price per share will fall.

#2 Non-dilutive offering

In a non-dilutive offering, the company’s majority stockholders sell their holdings after the initial public offering. The non-dilutive offering does not involve the creation of new stock. Here the shareholders intend to gain profits by selling their shares. This process does not profit the business as the returns and profits go to the shareholder who sells their shares.

The company is not involved in this process as the shareholder sells the shares to another investor in the secondary market. Secondary offerings that are non-dilutive are a part of the exit strategy of investors in the business. Simply put, shareholders who acquired stock in the primary market sell them to raise capital to other investors in the secondary market. This offering is called a non-dilutive secondary offering.

Here are some benefits of non-dilutive offerings:

- A non-dilutive capital will ease the stress of managing daily operations with little funds available.

- Owners can raise enough funds which are beneficial for the business without investors being worried about their ownership percentage.

- Non-dilutive offerings attract longevity of the business through sustainability which is aligned with the goals of the business.

How does a Secondary Offering Work?

Companies that are privately owned or publicly traded always look for ways to expand. To expand in the international market, they will need to make acquisitions or gather funds. In an Initial Public Offering, underwriting businesses assist the company in determining how funds should be acquired. They ascertain the type of security, best time and price to sell, and the number of shares to be issued.

Secondary stock sales are made through the investment bank. To understand the concept better, let’s take a secondary offering example. George is a venture capitalist who bankrolled an early business, which means that he expects a part of its shares. The business is growing fast and needs to expand. To attain funds for expansion, the company opts to make an initial public offering. George will use this chance to make a profit depending on the market’s situation by selling some or all of his shares. Klaus, another investor, chooses to buy shares from the company’s IPO. The returns from the sale of the shares will go to the business; this is because the shares were sold as an IPO.

Due to the fast-growing market, the company needs an additional firm for production and decides to acquire a small business. Doing so will make them reach more consumers. They are planning to go global. In order to raise capital, the company will issue secondary offerings in an investment bank. Here the company either issues new shares that will result in a dilutive offering or they will choose non-dilutive offerings and not give up their ownership percentage. If the shareholders such as George and Klaus opt to sell their shares, the proceeds will come to them and not to the company. However, the share price will stay the same. This does not affect the company as they are not included in these transactions. Additionally, the company shares are not diluted as they do not issue more shares, and the total issued shares stay the same.

Difference between Secondary Offering and Follow-On Offering

There is often confusion between secondary offering and follow-on-offering. Here is the difference between them. A follow on offering is also known as a dilutive secondary offering or a subsequent offering. The company issues more new shares in the market, resulting in the dilution of the shares in a follow-on offering.

The offering in the secondary market that is non-dilutive is a secondary offering. The secondary market offering differs from a secondary offering on the primary market. In simple terms, it is the offering that is made in the secondary market after the IPO in the primary market. A follow-on offering is the second offering in the primary market. The confusion comes from the dilutive (follow-on) and non-dilutive secondary offering.

Risk of Investing in Initial Public Offerings (“IPOs”)

Some of the risks investors face while investing in Initial Public offerings are:

- Possibility of not getting the desired shares – There is a big risk factor investing in an IPO that you might not be able to get your hands on the desired amount of company shares. This is because a limited number of investors can apply for it, and the company also allots shares on a proportionate basis. If you are a small investor, you either get a tiny portion of the shares or do not get them at all.

- Variables encourages Profitability – As an investor, it is possible that you buy pre-IPO shares from a company, but this does not guarantee good profits. This is because many variables affect the price of the shares in a company. Some of these variables are as follows: industry of the business, performance of related businesses, the past performance, and others. A slight issue with one variable can drop the price of the shares drastically. Thus they are unpredictable.

- Less Historical data – Usually there is not much data by which you can evaluate a private company that is going public. This is so because they have fewer reporting requirements since they are private. Investing in them can be a gamble if you do not know much about the company.

- Overheated Market for IPOs – Generally, the market is waiting for initial public offerings. Investors are sitting in hopes of buying the shares and flip them for profit. With these high hopes, they even invest in companies that fail to generate profit. A majority of the time, regular investors will not get their hands on the initial public offering. They can only get the shares later when the demand is high, and the price has risen drastically due to the demand.

How does secondary offering affect the stock price?

A secondary offering often affects the share price of the company. Generally, when a business decides to issue more shares through a secondary offering, it has a negative impact on the price of the shares.

Usually, the company will issue stocks through an IPO. Let us take an example here to see how it impacts the company from the beginning. A company called Mikel Inc. issued 200,000 shares through an IPO and raised $2 million. There are over a couple of investors that are now stockholders or owners of the company. The net income of the company in the first year of operations is $220,000. The most common way of measuring the profitability of a company is through earnings per share. This method allows the comparison of the figures for the company to be meaningful. So in the first year that the company is publicly owned, the EPS is $1.1 ($220,000/200,000 shares). Simply put, each share’s worth through earnings of the company Mikel Inc. is $1.1.

Things have been looking good for Mikel Inc. This incites management to go for a secondary offering to raise equity capital for the operations. They go ahead and issue a second offering successfully. In the secondary offering, the company issued 60,000 new shares. This offering produces additional equity of $66,000. Mikel Inc runs well for one more year, making profits of $160,000. This is good news for the company but not for the initial investors. If you look at this scenario from the original investors’ perspective, you will see that the initial investors’ ownership has fallen due to the increase in the number of shareholders. This fall in the ownership percentage of the original investors is called dilution.

During the second year, the company Mikel Inc has 260,000 shares (60,000 from the secondary offering and 200,000 from the IPO). The share claim on the profit this year is $0.61 ($160,000/260,000 shares). When you compare this with the first years’ EPS of $1.1, it is a drastic drop. The initial shareholders’ earning per-share value fell by 62% from the first year due to dilution.

Interested in a Secondary Offering for Your Company?

IPOs might look attractive, but they are not the best option for investors. Investors need to research and look out for opportunities with great attention to detail to increase stock market wealth. It is best to look out for capitalization and dilution by keeping an eye on the earnings per share. A secondary offering is the better alternative to IPOs as it presents investors with less risk of a drop in EPS.

Keeping an eye on the capitalization table and earnings per share can be an easier task by using the right tools. Eqvista provides investors with various tools that assist in different ways, such as Cap table management. To learn more about our app, contact us today!