From the Venture Summit to Wall Street: Introducing Real-Time Private Equity Valuation

EQVISTA | NYSE: There is a famous saying… the journey is the reward, you work hard and have very high expectations but there are also moments which stand out. Last week, I went from introducing the first Real-Time Private Stock Valuation Index to a group of finance professionals at Javitz, to the NYSE closing bell for the Axos Public Closing.

We are all fortunate to be building amazing companies. It’s very hard, it hurts, not just the result, but most of the journey is the reward, and we finally figure it out once we get to the finish line…I just heard this a few weeks ago…and it still resonates with me. Building a company is incredibly challenging, but the skills you learn are more important than the results. Why? Because now you know that you can repeat every success.

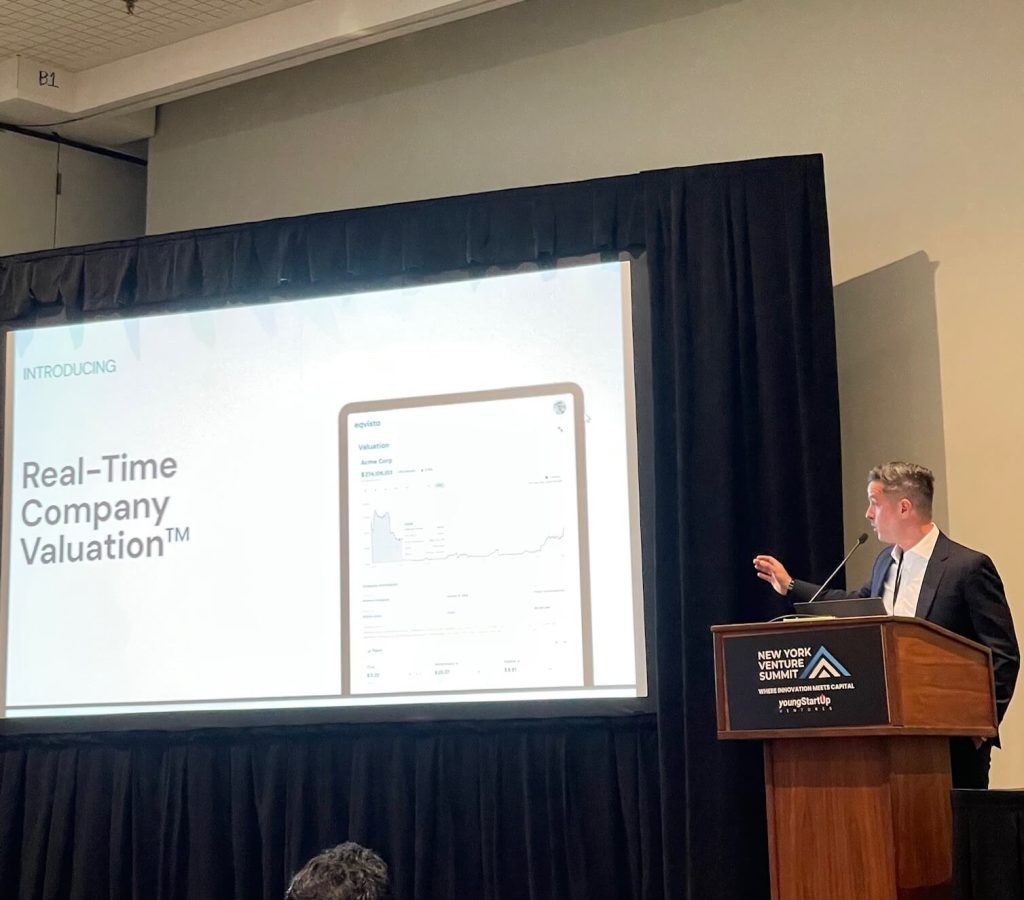

Last week at Venture Summit NYC, we were selected as Top Innovator in our category and I had the chance to introduce something big:

Real-Time Company Valuation – think of it as a stock ticker for private companies.

It works for any private company, regardless of size, revenue, or stage – even small startups with just a few hundred thousand in revenue.

The exciting part?

Your valuation is live.

You get a real-time valuation graph, market comparables, industry benchmarks, and even a “hype factor”.

We price your stock as if you were exiting today – no discounts, no games. Just what your company would be worth on the open market.

And we’re just getting started.

It gives you instant clarity for M&A, fundraising, or internal alignment.

Open it to your shareholders, and they’ll see your value move – live!

Your cap table becomes a dashboard. Your chart becomes a story.

Imagine sitting at dinner and saying:

“Here’s our company. Here’s what it’s worth. This is what we’re building – together”.

We have done $200B in client assets valuations, adding $3B monthly, which puts us as one of the fastest-growing asset administration companies in the market! Isn’t that crazy? So we have trained our model to value the stock price of any company, and quote it live!

We all go through multiple struggles in building a company, but there are moments when you realise that you have been rewarded. It doesn’t have to be a new round, exit, bonus or new deal. It can be a moment when you realize everything is playing out well.

Last week at the Venture Summit NYC, I had the privilege of unveiling something transformative, Real-Time Company Valuation. Just moments after showcasing how our platform brings private company equity to life with live pricing, I had to dash out- – straight to the New York Stock Exchange for the closing bell. A powerful day for private markets.

Yes, I unveiled the first real-time stock price for privately-owned companies, only to speed down to 11 Wall Street, where the public magic happens. Moving from the Venture Summit NYC, taking the stage and opening the first true private market, to ringing the bell at the NYSE! When I was standing at the podium presenting the real-time for the private market and then a few hours later at the NYSE trading floor, I reminded myself that everything I have been through makes so much sense and is so worth every sacrifice.

To all builders, there are special moments, your first big client, money raised, an exit, but there are also the moments when you present your product as a game changer, and that’s the reason we try so hard and never give up!

PS: Special thanks to Axos David Park and Ashish. My co-product builders Colin, Martin Bargl, Tom Novo, Brayton, Jakub Vele, Ram, Nimish. And thank you to Jamie for being my +1.