Top Funded Startups in the US 2025

The US startup ecosystem in 2025 is setting new records, with billions investing in startup companies that span AI, infrastructure, energy, and more. This is transforming how founders build ventures and how investors spot opportunity, making equity management more crucial than ever.

For founders, the challenge is managing growth, raising capital, and keeping equity transparent and fair . For investors, accurate, real-time cap table data enables confident decisions and strengthens stakeholder trust.

Based on the latest funding data from 2025, we’re witnessing an unprecedented concentration of capital in transformative technologies that promise to define the next decade of global innovation.

Key Trends and Insights of Top Funded Startups

2025 is witnessing shifts across industries, driven by innovations and emerging markets that are reshaping the US startups.

The AI Revolution

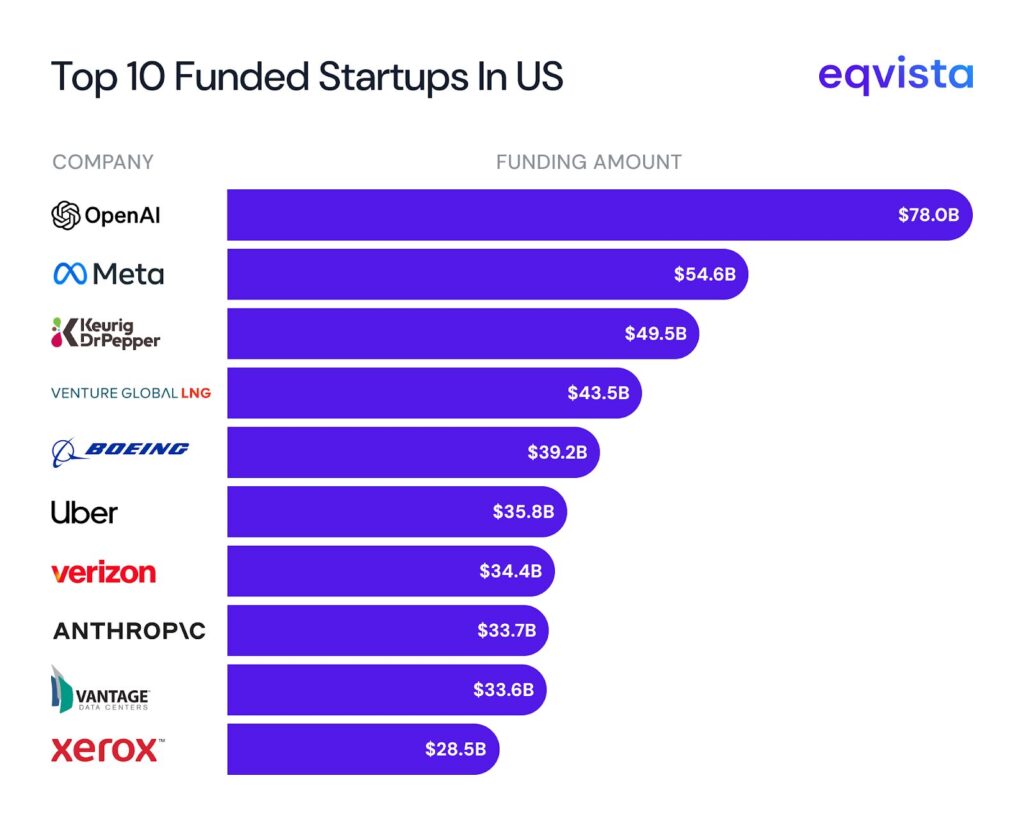

The dominance of AI companies in the top rankings is unmistakable. OpenAI (#1) and Anthropic (#8) together account for over $111 billion in funding, reflecting investors’ confidence that artificial intelligence will fundamentally transform the global economy. Both companies are focused not just on capability but on safety and alignment, a recognition that responsible AI development is paramount.

Infrastructure and Energy

A major portion of top-funded companies operate in infrastructure and energy sectors. From Venture Global LNG’s natural gas facilities to Vantage Data Centers’ AI-optimized campuses, investors are betting big on the physical infrastructure needed to power the digital economy. This trend shows the reality that software innovation requires substantial hardware investment.

Geographic Concentration

San Francisco continues to dominate as the epicenter of innovation, hosting OpenAI, Anthropic, and Uber among others. However, we’re seeing geographic diversification with major companies headquartered across the U.S., from Denver (Vantage Data Centers) to Arlington (Boeing) to Burlington (Keurig Dr Pepper).

The Maturity Spectrum

The top 10 funded startups list includes everything from industrial giants like Boeing and Xerox to recent AI startups like Anthropic. This mix demonstrates that substantial funding isn’t reserved for young startups, established companies continue to raise significant capital to fund expansion, innovation, and transformation.

Top 100 Funded Startups in the US 2025

Below are the top 100 funded U.S. startups with their last funding rounds in 2025.

| Organization Name | Total Funding Amount (in USD) | Last Funding Amount (in USD) | Last Funding Type |

|---|---|---|---|

| OpenAI | 78000120000 | 6600000000 | Secondary Market |

| Meta | 54608817488 | 26000000000 | Post-IPO Debt |

| Keurig Dr Pepper | 49518299712 | 7000000000 | Post-IPO Equity |

| Venture Global LNG | 43475000000 | 15100000000 | Post-IPO Debt |

| The Boeing Company | 39225043317 | 3000000000 | Post-IPO Debt |

| Uber | 35762450000 | 2250000000 | Post-IPO Debt |

| Verizon | 34390830999 | 2285638533 | Post-IPO Debt |

| Anthropic | 33740377627 | 13000000000 | Series F |

| Vantage Data Centers | 33612804010 | 1600000000 | Private Equity |

| Xerox | 28500000000 | 800000000 | Post-IPO Debt |

| Oracle | 25750000000 | 18000000000 | Post-IPO Debt |

| Intel | 24967500008 | 8900000000 | Post-IPO Equity |

| xAI | 22730921423 | 5318549402 | Corporate Round |

| Citi | 22293186871 | 6500000000 | Post-IPO Debt |

| Lowe’s | 22000000000 | 5000000000 | Post-IPO Debt |

| Rivian | 21928250000 | 1000000000 | Post-IPO Equity |

| Databricks | 21814821657 | 1000000000 | Series J |

| Realty Income Corporation | 21092527497 | 800000000 | Post-IPO Debt |

| CoreWeave | 19829699332 | - | Post-IPO Secondary |

| Carnival Corporation | 19491674409 | 1250000000 | Post-IPO Debt |

| Air Lease Corporation | 19132798532 | 12100000000 | Debt Financing |

| Medtronic | 18162821920 | 1759704182 | Post-IPO Debt |

| Warner Bros Discovery | 17500000000 | 17500000000 | Post-IPO Debt |

| Switch | 17351300000 | 659000000 | Debt Financing |

| Energy Transfer Partners | 17243569616 | 2000000000 | Post-IPO Debt |

| ADP | 17100000000 | 7050000000 | Post-IPO Debt |

| VICI Properties | 17070185000 | 1300000000 | Post-IPO Debt |

| Ford Motor | 16227000000 | 3000000000 | Post-IPO Debt |

| Scale AI | 15902620000 | 14300000000 | Corporate Round |

| ONEOK | 15870000000 | 3000000000 | Post-IPO Debt |

| Charter Communications | 15769404660 | 2000000000 | Post-IPO Debt |

| Charles Schwab | 15595749752 | 13111399752 | Post-IPO Secondary |

| Royal Caribbean Group | 15430000000 | 1500000000 | Post-IPO Debt |

| T-Mobile | 15370224359 | 2800000000 | Post-IPO Debt |

| Sempra Infrastructure | 15155000000 | 10000000000 | Secondary Market |

| Crusoe AI Data Center | 15000000000 | 11600000000 | Undisclosed |

| X (formerly Twitter) | 13869191511 | 1000000000 | Venture - Series Unknown |

| Strategy | 13779900000 | 27300000 | Post-IPO Secondary |

| Texas Instruments | 13610000000 | 1200000000 | Post-IPO Debt |

| Thermo Fisher Scientific | 13547155227 | 2500000000 | Post-IPO Debt |

| Lucid Motors | 13251999992 | 300000000 | Post-IPO Equity |

| Humana | 13074000000 | 5000000000 | Post-IPO Debt |

| Aligned | 13000000000 | 400000000 | Debt Financing |

| Alphabet | 12630240845 | 12630240845 | Post-IPO Debt |

| Amphenol | 12476550022 | 7500000000 | Post-IPO Debt |

| Digital Realty | 12295061780 | 983237535 | Post-IPO Debt |

| QXO | 12000000002 | 1999999990 | Post-IPO Equity |

| SpaceX | 11780343846 | - | Secondary Market |

| Acrisure | 11374000000 | 550000000 | Debt Financing |

| State Street Corporation | 11053500000 | 2000000000 | Post-IPO Debt |

| SoFi | 10767667367 | 1500000000 | Post-IPO Equity |

| FIS | 10500000000 | 8000000000 | Post-IPO Debt |

| Invenergy | 10463042552 | 1000000000 | Debt Financing |

| Corebridge Financial | 10246012158 | 1000000000 | Post-IPO Secondary |

| MPLX LP | 10150000000 | 4500000000 | Post-IPO Debt |

| Celanese | 10100000000 | 2600000000 | Post-IPO Debt |

| Boston Scientific | 10019555200 | 1575358867 | Post-IPO Debt |

| Lineage Logistics | 9902550000 | 500000000 | Post-IPO Debt |

| Hilton | 9500000000 | 1000000000 | Post-IPO Debt |

| Stripe | 9440247725 | - | Secondary Market |

| STACK Infrastructure | 9345407684 | 261676748 | Debt Financing |

| Norwegian Cruise Line | 9257289182 | 81289182 | Post-IPO Equity |

| Micron Technology | 8900410400 | 1750000000 | Post-IPO Debt |

| NextDecade | 8763500000 | 1700000000 | Post-IPO Equity |

| American Tower | 8678055069 | 575000000 | Post-IPO Debt |

| DataBank | 8574000000 | 875000000 | Debt Financing |

| Plug Power | 8572517109 | 370000000 | Post-IPO Equity |

| Intuit | 8518851000 | 4500000000 | Post-IPO Debt |

| General Motors | 8508505310 | 2000000000 | Post-IPO Debt |

| HUB International | 8500000000 | 1600000000 | Private Equity |

| Targa Resources Partners | 8250000000 | 1500000000 | Post-IPO Debt |

| EDF Renewable Energy | 7925729056 | 642550050 | Debt Financing |

| DTE Energy | 7770000000 | 600000000 | Post-IPO Debt |

| Brookfield Corporation | 7754606527 | 1250000000 | Post-IPO Debt |

| Expand Energy | 7750000000 | 3500000000 | Post-IPO Debt |

| Snap | 7594827880 | 541300000 | Post-IPO Debt |

| Affirm | 7570000000 | 750000000 | Post-IPO Debt |

| UnitedHealth Group | 7570000000 | 1570000000 | Post-IPO Equity |

| Freepoint Commodities | 7430000000 | 2300000000 | Debt Financing |

| Simon Property Group | 7300000000 | 1500000000 | Post-IPO Debt |

| Aspen Technology | 7300000000 | 7200000000 | Post-IPO Secondary |

| Vistra Corp. | 7250000000 | 2000000000 | Post-IPO Debt |

| TransDigm | 7183789999 | 2650000000 | Post-IPO Debt |

| Apollo | 7087507641 | 500000000 | Post-IPO Debt |

| NRG Energy | 6991000000 | 4900000000 | Post-IPO Debt |

| Duke Energy Florida | 6900000000 | 6000000000 | Secondary Market |

| Alexandria Real Estate Equities | 6850220000 | 550000000 | Post-IPO Debt |

| Tishman Speyer | 6831000000 | 331000000 | Debt Financing |

| Iron Mountain | 6773496685 | 1406606597 | Post-IPO Debt |

| Talen Energy | 6740000000 | 4290000000 | Post-IPO Debt |

| BlackRock | 6593099624 | 18056 | Post-IPO Equity |

| Pagaya | 6589250000 | 500000000 | Post-IPO Debt |

| BrightSpeed | 6506000000 | 13800000 | Grant |

| Enterprise Products Partners | 6500000000 | 2000000000 | Post-IPO Debt |

| Group 1 Automotive | 6500000000 | 3500000000 | Post-IPO Debt |

| Sunrun | 6449461000 | 510000000 | Post-IPO Debt |

| Williams | 6350000000 | 1500000000 | Post-IPO Debt |

| Blackstone Group | 6275000000 | 1200000000 | Post-IPO Debt |

| Anduril Industries | 6185300000 | 2500000000 | Series G |

| Southern Company | 6160000000 | 1750000000 | Post-IPO Equity |

Top 10 Funded Startups In US

These ten top funded startups in the US represent the forefront of innovation in 2025, having secured massive funding and reshaped sectors from artificial intelligence to infrastructure with groundbreaking advancements.

1. OpenAI – $78.0 Billion Total Funding

Leading the pack with an astounding $78 billion in total funding, OpenAI has cemented its position as the top-funded startup in US history. With its last funding round in October 2025 bringing in $6.6 billion through a secondary market transaction, the AI research company continues to attract massive investment. The company’s estimated revenue has now exceeded $10 billion, with backing from tech giants including Andreessen Horowitz, NVIDIA, and Sequoia Capital.

2. Meta – $54.6 Billion Total Funding

Meta has raised $54.6 billion in total funding, with its most recent post-IPO debt round in August 2025 securing $26 billion. The social technology company enables people to connect, find communities, and grow businesses through platforms spanning social media, virtual reality, and the metaverse. With revenue exceeding $10 billion and headquarters in Menlo Park, California, Meta continues to shape the future of digital connection.

3. Keurig Dr Pepper – $49.5 Billion Total Funding

The coffee and beverage company has accumulated $49.5 billion in total funding, including a substantial $7 billion post-IPO equity round in October 2025. Founded in 1981 and focused on distribution and sourcing, Keurig Dr Pepper operates from Burlington, Massachusetts, with major backing from Morgan Stanley, Apollo, and BDT & MSD Partners.

4. Venture Global LNG – $43.5 Billion Total Funding

This Washington, D.C.-based energy company has raised $43.5 billion, with its most recent $15.1 billion post-IPO debt round closing in July 2025. Venture Global LNG develops, constructs, and operates liquefied natural gas export facilities, positioning itself at the intersection of energy infrastructure and global trade.

5. The Boeing Company – $39.2 Billion Total Funding

The aerospace giant has secured $39.2 billion in total funding, with $3 billion raised through post-IPO debt in August 2025. Founded in 1916 by William Edward Boeing and now headquartered in Arlington, Virginia, Boeing manufactures, services, and repairs commercial airplanes, defense products, and space systems.

6. Uber – $35.8 Billion Total Funding

The ride-sharing pioneer has raised $35.8 billion since its founding in 2009, with a $2.25 billion post-IPO debt round in September 2025. Operating from San Francisco and backed by Menlo Ventures, Sequoia Capital, and TPG, Uber develops and operates a ride-sharing mobile application.

7. Verizon – $34.4 Billion Total Funding

The telecommunications giant has accumulated $34.4 billion in total funding, including a $2.3 billion post-IPO debt round in July 2025. Verizon provides broadband and telecommunications services, offering information and entertainment services from its New York headquarters.

8. Anthropic – $33.7 Billion Total Funding

Founded in 2021 by Daniela and Dario Amodei along with other AI researchers, Anthropic has raised $33.7 billion, with a massive $13 billion Series F round in September 2025. The San Francisco-based AI research company focuses on the safety and alignment of AI systems with human values, with backing from Menlo Ventures, General Catalyst, and TPG.

9. Vantage Data Centers – $33.6 Billion Total Funding

This Denver-based data center company has raised $33.6 billion, including a $1.6 billion private equity round in September 2025. Founded in 2010, Vantage designs and develops data center campuses for large cloud providers, AI enterprises, and tech-driven businesses.

10. Xerox – $28.5 Billion Total Funding

Rounding out the top ten, Xerox has secured $28.5 billion in total funding, with an $800 million post-IPO debt round in March 2025. The Connecticut-based company produces and supplies network printers, copiers, and fax machine equipment.

Notable mentions outside the top 10 funded startups in the US include Oracle ($25.8B), Intel ($25.0B), xAI ($22.7B), and Citi ($22.3B), all of which have raised over $20 billion in total funding. The breadth of this top funded startups list illustrates the diverse nature of American innovation and the wide array of sectors attracting significant investment.

Looking Forward

As we progress through 2025, several trends seem poised to accelerate:

- AI Infrastructure: The enormous capital requirements for AI development will continue driving investment in both the software (OpenAI, Anthropic) and hardware (data centers, semiconductors) layers.

- Energy Transition: Companies focused on renewable energy, carbon capture, and sustainable infrastructure are attracting increasing attention as climate concerns drive policy and investment decisions.

- Healthcare Innovation: Biotechnology and pharmaceutical companies continue to secure substantial funding for breakthrough therapies and medical technologies.

- Financial Technology: The continued evolution of FinTech is evident in the funding levels for companies reimagining banking, payments, and financial services.

The top funded startups in the US of 2025 represent the sectors and technologies that will define our economic future. From artificial intelligence to aerospace, from energy infrastructure to e-commerce, these companies are building the foundations of tomorrow’s economy.

As we watch these giants evolve, we’re witnessing not just business success stories, but the very transformation of how we work, communicate, travel, and live.

Power Your Equity Journey with Eqvista

The extraordinary scale of startup funding in 2025 highlights the importance of equity clarity and strategic ownership. For founders, seamless cap table management means less time on admin and more focus on building world-changing companies. For investors, transparency and real-time equity data are vital to smarter, faster decisions in a competitive funding environment.

Eqvista’s equity management platform bridges the gap, giving founders intuitive control and investors the insights they demand. Enjoy rapid onboarding, secure compliance, automated valuations, and effortless stakeholder communication all in one platform.

Ready to manage your equity with confidence? Sign up with Eqvista today and lead the next wave of innovation.