Top 100 Funded Blockchain and Crypto Companies

Last Updated: June, 2024

Venture capitalists have placed massive bets on cryptocurrency startups in 2021, spending over $27 billion worldwide by the end of November last year. This is more than the total amount invested in all startups over the previous decade. Businesses whose future success is tied to the development of the cryptocurrency ecosystem made many investments. So why are venture capitalists interested in crypto seed funding and blockchain seed funding? What attracts VCs in blockchain and crypto companies, and which are the most funded crypto companies and most funded blockchain companies? This article will discuss the basics of technology in funded blockchain companies and how cryptocurrencies leverage this technology to allow Crypto Companies to grow with decentralized digital money.

Blockchain and Crypto Companies

Bitcoin, the de facto industry standard for cryptocurrencies, inspired an ever-growing army of followers and spinoffs. It established trends by heralding a wave of digital currencies based on a peer-to-peer decentralized network. As there are other cryptocurrencies besides Bitcoin, it is crucial to look into all tokens available to see which ones are doing well.

What is blockchain?

Blockchains are distributed databases or ledgers that are shared among computers on network nodes. Information can be stored digitally on a blockchain, which functions as a database. A blockchain’s innovation is that it can guarantee the security and integrity of a record of data without requiring a trusted third party to do so. Bitcoin and other cryptocurrencies rely on blockchain technology to reliably record transactions without a central authority.

Types of blockchains

There are different types of blockchains available, with each having its own function and unique features:

- Public blockchains – The Bitcoin and Ethereum blockchains are two of the biggest and most popular public blockchains. If you want to access a public blockchain, you can do so without any restrictions. Every person with access to the web can participate in a blockchain by submitting trades and signing up to be a validator. Such networks often provide financial rewards to individuals that protect them using a Proof of Stake or Proof of Work method.

- Private blockchains – If you want to participate in a private or permissioned blockchain, you need to be invited by the blockchain network’s administrators. Regulations state that only participants and validators are permitted access. The name Distributed Ledger (DLT) is frequently applied to private blockchains to differentiate them from other peer-to-peer decentralized database systems that aren’t open ad-hoc computation clusters.

- Hybrid blockchains – The hybrid blockchain incorporates both centralized and decentralized features. It is possible to change the blockchain’s precise operation by deploying either centralization or decentralization.

- Sidechains – A blockchain ledger that operates side by side with the main blockchain is referred to as a sidechain. Records from the main blockchain can be linked to and from the sidechain, where those entries often represent digital assets, allowing the sidechain to operate independently from the main blockchain. This can be done in different ways, such as employing alternate ways of keeping records, alternate consensus algorithms, and more.

How does blockchain work?

A blockchain is “a distributed database that has a steadily growing list of ordered records, called blocks,” which are “connected using encryption.” The blockchain records transactions in blocks, including a cryptographic hash of the preceding block, a timestamp, and data on the transactions that occurred in that block. A blockchain is a distributed, public, and distributed digital ledger that records transactions across several computers in such a way that the record cannot be updated retrospectively without also altering all following blocks and the consensus of the network. So, when a new transaction enters the blockchain database, it is distributed to linked peer-to-peer computers across the globe. These computers solve equations to legitimize the transaction; once confirmed, they are clustered into blocks. These blocks are chained in a long recorded history of transactions that become immutable.

Important Blockchain applications and their uses

More than 10,000 additional cryptocurrency systems are now active on the blockchain. However, it seems that using a blockchain to store information about other kinds of transactions is also a secure method and can be used by many companies in different sectors. Blockchain technology can greatly benefit the record keeping of banking and finance institutions, currency, healthcare, smart contracts, property records, supply chains, and voting.

Many large firms, including Walmart, Pfizer, AIG, Siemens, Unilever, and many others, have already used blockchain technology. To monitor the delivery of perishable foods, IBM created the Food Trust blockchain. It can follow a food product’s journey using the blockchain, from its origin through each stage along the way until its delivery. Food contamination can be traced back through all of the stops until it reaches its original location. Since these businesses can now see everything else the food may have come into touch with, problems may be identified far earlier, possibly saving lives.

Pros and cons of blockchain

Given its intricacy, blockchain has almost limitless potential as a decentralized method of record-keeping. Blockchain technology may indeed possibly find uses beyond those mentioned above, ranging from improved user privacy and security to reduced processing costs and fewer mistakes. But there are some drawbacks as well. Let us look briefly into the pros and cons of this futuristic technology.

Advantages:

- Increased accuracy due to the absence of manual verification

- Decentralization makes it more difficult to interfere

- Cost savings via the abolition of third-party verification

- Gives residents of countries with volatile or weak governments a financial option and a method to safeguard their personal information.

- The transactions are quick, confidential, and safe.

- Utmost transparency

Disadvantages:

- Bitcoin mining has a high technological expense.

- Have been used in illegal operations in the past, such as on the dark web

- low transactional speeds

- Storage restrictions for data

- Regulation differs across jurisdictions and is still ambiguous.

Now that we understand blockchain technology and its uses, it’s important to understand a funded blockchain’s most popular sector- you guessed it right- the cryptocurrencies!

What is crypto?

The term “cryptocurrency” is used to refer to a broad category of digital or virtual currencies that take the form of tokens or “coins” and rely on cryptography to ensure the safety of financial transactions. Cryptography is a sophisticated branch of study that permits the creation and processing of digital currency as well as its transactions across decentralized systems via Crypto Companies that are funded. In addition to this key “crypto” component, there is significance to decentralization. Companies in the cryptocurrency industry typically develop their tokens in the form of code, with methods for generation and other laws.

The group of cryptocurrencies that are fashioned after Bitcoin is referred to as altcoins and in a few instances, shitcoins. These cryptocurrencies frequently attempt to position themselves as enhanced or updated versions of Bitcoin. Even though some of these altcoins could have some eye-catching characteristics, Bitcoin remains the most popular due to its security level. Some cryptocurrencies have entered the real world via credit cards and other initiatives, but the vast number remains exclusively digital.

Some of the main types of crypto

Bitcoin’s technology has enabled peer-to-peer payments without a third party since its 2009 launch. Although the most popular, Bitcoin has sparked a surge of blockchain-based coins and digital assets. Let’s look at some major cryptocurrencies–

- Bitcoin (BTC) – Bitcoin is the most popular and the first decentralized crypto to use blockchain technology to enable payments and online transactions. The blockchain technology of Bitcoin serves as a public ledger for all exchanges in the historical record of Bitcoin, replacing the need for a banking system to regulate the monetary availability in an economy or independent parties to confirm transactions. Due to the protection bitcoin provides, it is the dominating player in regard to use and monetary value despite the hundreds and thousands of rivals that have emerged. So far, no other cryptocurrency has leveled its capitalization and current valuation.

- Ethereum (ETH) – The most well-known alternative to Bitcoin is Ethereum (ETH). It is a decentralized software system that makes it possible to create and manage smart contracts and decentralized apps (dApps) that do not necessitate third parties’ control, intervention, or downtime. Ethereum uses Ether, a platform-specific token managed by cryptographic encryption, to power its apps. Crypto Companies that want to build and operate apps on the Ethereum network, as well as buyers who wish to purchase various digital currencies, seek ether (ETH), which functions as a mode of transportation on the Ethereum network. Ethereum’s goal is to create a decentralized financial services ecosystem that is accessible to anybody. Because people in certain nations lack governmental infrastructure and official identity to access products and services related to managing one’s money, such as current and savings accounts, mortgages, and insurance, this factor makes the prospects for such people more compelling.

- Litecoin (LTC) – A split in the Bitcoin blockchain led to the creation of the cryptocurrency Litecoin (LTC) in 2011. Initially, it was made to address the developer’s concerns that Bitcoin was becoming too centralized and to make it more difficult for large-scale Crypto Companies to monopolize the mining process. Despite the fact that it ultimately failed to prevent commercial miners from controlling a majority of Litecoin mining, the cryptocurrency has now developed into a mineable form and a peer-to-peer trading platform.

- Cardano (ADA) – An “Ouroboros proof-of-stake” cryptocurrency called Cardano (ADA) was developed using a research-based methodology by a funded Crypto Company involving a group of mathematicians, engineers, and cryptography professionals. Cardano distinguishes it from other PoS competitors and other well-known cryptocurrencies as a system that is heavily supported by research. Cardano’s blockchain has been called the “Ethereum killer” due to claims that it is more capable than Ethereum’s. By developing competitive Defi products like Ethereum’s and offering a remedy for voter fraud, chain interoperability, and legal contract tracking, among other things, Cardano intends to become the worldwide financial platform. Cardano held the eighth-largest market value on September 18, 2022, at $15.9 billion, and each ADA was trading for about $0.47.

- Polkadot (DOT) – A distinct PoS coin called Polkadot (DOT) aims to foster interoperability across different blockchains. Its technology is intended to link oracles and blockchains with and without authorization, enabling crypto companies to collaborate under a single platform. Polkadot’s fundamental component is the relay chain, which enables interaction between various networks. Additionally, it paves the way for parachains, which are specialized blockchains that issue their own tokens for specific applications. Developers working with Ethereum can create new blockchains, but they must also provide their own security procedures, as the safety of the network increases with the size of the blockchain. Known as shared security in Polkadot, this approach was developed with the hope of resolving the security issue.

How does crypto work?

Most people invest in cryptocurrencies in the same way they would invest in stocks or precious metals, but cryptocurrency may also be used to buy everyday items and services. Satoshi Nakamoto, who originally proposed the fundamentals of the first cryptocurrency, Bitcoin, described cryptocurrency as “an electronic payment system based on cryptographic proof instead of trust”. Transactions that are validated and documented on a blockchain serve as cryptographic proof.

There is no central bank or government that controls the value of a cryptocurrency like the United States dollar or the European euro. Instead, holders and businesses of various cryptocurrencies distribute these duties widely across the internet.

How to use cryptos?

You can use cryptos to make secure purchases using a cryptocurrency wallet. Programs like “hot wallet” which interacts with the blockchain and enables users to transfer and receive their stored crypto, are often used by people for this purpose. People must keep in mind that transactions take time to complete since some kind of process is required to verify them.

Even while you may purchase a variety of products and services with cryptocurrencies, especially Litecoin, Bitcoin, or Ethereum, you could also utilize them as an alternate investment choice to bonds or stocks. According to most financial professionals who specialize in cryptocurrencies, Bitcoin, the most widely used safe, decentralized money, has evolved into a store of value similar to gold. It is often described as “digital gold”.

Importance of crypto

In terms of money, cryptocurrencies offer a brand-new, decentralized framework. In this system, transactions among two or more parties are governed by trust rather than by centralized middlemen like banks and financial organizations. Therefore, a cryptocurrency-based system eliminates the risk of a single point of failure, like a large bank, triggering a domino effect of crises around the world, as occurred in 2008 when American institutions collapsed.

The remittance industry is testing one of the most publicized applications of cryptocurrency. Presently, cryptocurrencies like Bitcoin serve as intermediary currencies, which speeds up international monetary transactions. Therefore, fiat money is changed into Bitcoin (or another cryptocurrency), transferred across international borders, and then turned back into the intended fiat currency. The process of sending money abroad is simplified, and the associated costs are reduced with this method.

With the requirement for an intermediary like a credit card or bank provider eliminated, the direct movement of money among parties involved is made simpler by cryptocurrencies. The transactions are quicker than traditional money transfers for the same reason.

The fact that cryptocurrency investments can be profitable comes as no surprise. Over the last ten years, the value of cryptocurrency markets has surged, reaching approximately $2 trillion at one time. Bitcoin has had a market value of over $550 billion since May 2022.

What is the difference between Blockchain and Cryptocurrency?

Frequently, “blockchain” and “cryptocurrency” are used synonymously. However, there is a substantial difference between the two. To keep track of all the crypto transactions, the blockchain technology used by cryptocurrencies serves as a digital ledger. In spite of this, blockchains have various applications outside the realm of cryptocurrency transactions, such as the recording and retrieval of health records, logistical data, and financial documents. In addition, each cryptocurrency has its own unique market value. There is no measure of value for a blockchain.

Why are venture capitalists eager to invest in blockchain and crypto companies?

As of late November 2021, more than $27 billion had already been invested in funded Crypto Companies worldwide by venture capitalists, which is more than they had put into them in the preceding ten years put together. The venture capital divisions of Crypto Companies, whose continuing development will be reliant on the ecosystem’s expansion, made a large portion of the investments. The main reasons that VCs are willing to fund blockchain and cryptocurrency businesses are:

- The open-source database system that underpins cryptocurrencies, and blockchain technology, is expected to advance the internet and ultimately help usurp the current IT behemoths and gatekeepers.

- Coinbase and other cryptocurrency businesses present the future of start-ups as one where the finest businesses are all built on web3 blockchain technology.

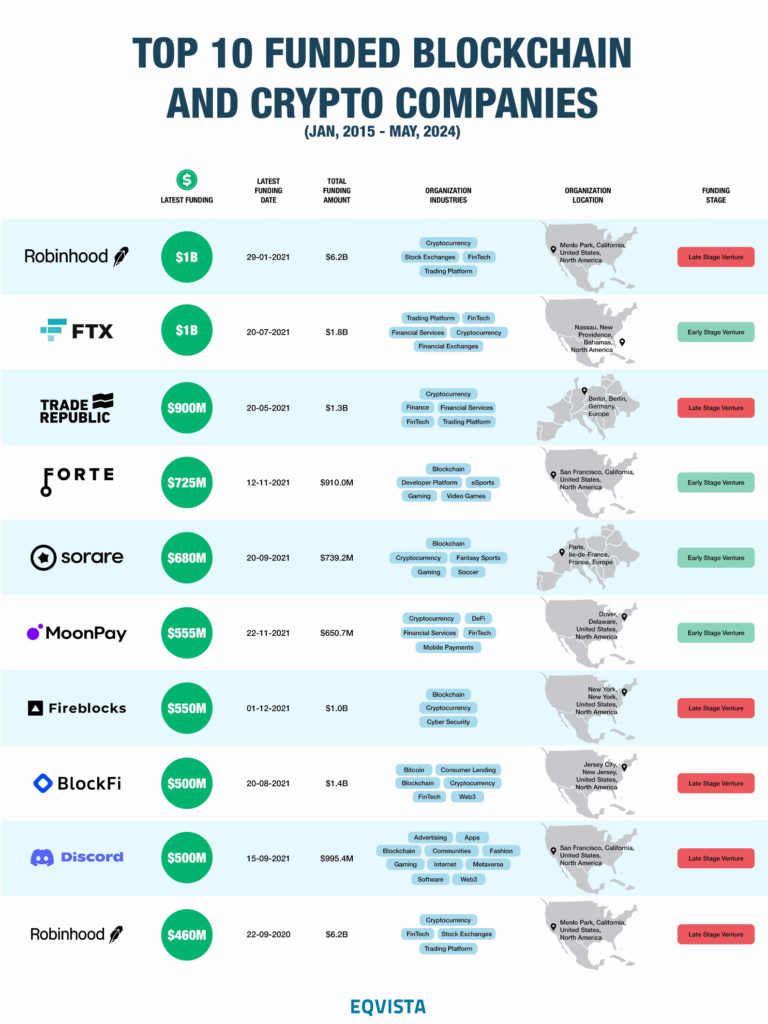

Top 100 Funded Blockchain & Crypto Companies

The blockchain and crypto industry has grown immensely in the past few years, with more and more companies popping up from time to time. Below are the top 100 funded blockchain and crypto companies in the industry:

| S. No. | Company Name | Latest Funding | Latest Funding Date | Total Funding Amount (in USD) | Funding Stage |

|---|---|---|---|---|---|

| 1 | Robinhood | $1.0B | 29-01-2021 | $6.2B | Late Stage Venture |

| 2 | FTX | $1.0B | 20-07-2021 | $1.8B | Early Stage Venture |

| 3 | Trade Republic | $900.0M | 20-05-2021 | $1.3B | Late Stage Venture |

| 4 | Forte | $725.0M | 12-11-2021 | $910.0M | Early Stage Venture |

| 5 | Sorare | $680.0M | 20-09-2021 | $739.2M | Early Stage Venture |

| 6 | MoonPay | $555.0M | 22-11-2021 | $650.7M | Early Stage Venture |

| 7 | Fireblocks | $550.0M | 01-12-2021 | $1.0B | Late Stage Venture |

| 8 | BlockFi | $500.0M | 20-08-2021 | $1.4B | Late Stage Venture |

| 9 | Discord | $500.0M | 15-09-2021 | $995.4M | Late Stage Venture |

| 10 | Robinhood | $460.0M | 22-09-2020 | $6.2B | Late Stage Venture |

| 11 | Yuga Labs | $450.0M | 22-03-2022 | $450.0M | Seed |

| 12 | DriveWealth | $450.0M | 20-08-2021 | $550.8M | Late Stage Venture |

| 13 | Gemini | $423.9M | 18-11-2021 | $423.9M | Early Stage Venture |

| 14 | FTX | $420.7M | 21-10-2021 | $1.8B | Early Stage Venture |

| 15 | FTX | $400.0M | 26-01-2022 | $1.8B | Late Stage Venture |

| 16 | FTX US Derivatives | $400.0M | 26-01-2022 | $400.0M | Early Stage Venture |

| 17 | Celsius Network | $400.0M | 12-10-2021 | $903.8M | Early Stage Venture |

| 18 | Ledger | $380.0M | 10-06-2021 | $577.0M | Late Stage Venture |

| 19 | Robinhood | $363.0M | 10-05-2018 | $6.2B | Late Stage Venture |

| 20 | Anchorage Digital | $350.0M | 15-12-2021 | $487.0M | Late Stage Venture |

| 21 | Celsius Network | $350.0M | 24-11-2021 | $903.8M | Early Stage Venture |

| 22 | BlockFi | $350.0M | 19-02-2021 | $1.4B | Late Stage Venture |

| 23 | Robinhood | $323.0M | 22-07-2019 | $6.2B | Late Stage Venture |

| 24 | Robinhood | $320.0M | 13-07-2020 | $6.2B | Late Stage Venture |

| 25 | Fireblocks | $310.0M | 27-07-2021 | $1.0B | Late Stage Venture |

| 26 | Dapper Labs | $305.0M | 30-03-2021 | $612.5M | Late Stage Venture |

| 27 | Mysten Labs | $300.0M | 08-09-2022 | $336.0M | Early Stage Venture |

| 28 | OpenSea | $300.0M | 05-01-2022 | $427.2M | Late Stage Venture |

| 29 | Bakkt | $300.0M | 16-03-2020 | $857.5M | Early Stage Venture |

| 30 | Blockchain.com | $300.0M | 24-03-2021 | $600.0M | Late Stage Venture |

| 31 | Paxos | $300.0M | 29-04-2021 | $543.5M | Late Stage Venture |

| 32 | Amber Group | $300.0M | 15-12-2022 | $628.0M | Late Stage Venture |

| 33 | Coinbase | $300.0M | 30-10-2018 | $1.8B | Late Stage Venture |

| 34 | Robinhood | $280.0M | 04-05-2020 | $6.2B | Late Stage Venture |

| 35 | Trade Republic | $268.0M | 03-06-2022 | $1.3B | Late Stage Venture |

| 36 | Bitpanda | $263.0M | 17-08-2021 | $554.0M | Late Stage Venture |

| 37 | CoinSwitch | $260.0M | 06-10-2021 | $300.6M | Late Stage Venture |

| 38 | Marqeta | $260.0M | 21-05-2019 | $530.1M | Late Stage Venture |

| 39 | Bitso | $250.0M | 05-05-2021 | $314.5M | Late Stage Venture |

| 40 | Black Banx | $250.0M | 01-07-2018 | $382.3M | Late Stage Venture |

| 41 | Alchemy | $250.0M | 28-10-2021 | $563.9M | Late Stage Venture |

| 42 | Dapper Labs | $250.0M | 21-09-2021 | $612.5M | Late Stage Venture |

| 43 | Hyperchain Technologies | $234.1M | 04-06-2018 | $249.5M | Early Stage Venture |

| 44 | MasterClass | $225.0M | 23-04-2021 | $461.4M | Late Stage Venture |

| 45 | Monad | $225.0M | 09-04-2024 | $244.0M | Early Stage Venture |

| 46 | Public | $220.0M | 15-02-2021 | $308.5M | Late Stage Venture |

| 47 | Blockstream | $210.0M | 24-08-2021 | $424.0M | Early Stage Venture |

| 48 | FalconX | $210.0M | 10-08-2021 | $477.0M | Late Stage Venture |

| 49 | Blockdaemon | $207.0M | 26-01-2022 | $431.3M | Late Stage Venture |

| 50 | Immutable Systems | $200.0M | 07-03-2022 | $277.4M | Late Stage Venture |

| 51 | Figure | $200.0M | 20-05-2021 | $1.5B | Late Stage Venture |

| 52 | Matter Labs | $200.0M | 16-11-2022 | $308.0M | Late Stage Venture |

| 53 | Ripple | $200.0M | 20-12-2019 | $293.8M | Late Stage Venture |

| 54 | Binance.US | $200.0M | 06-04-2022 | $200.0M | Seed |

| 55 | Helium | $200.0M | 19-02-2022 | $364.8M | Late Stage Venture |

| 56 | Aptos | $200.0M | 15-03-2022 | $350.0M | Seed |

| 57 | Aleo | $200.0M | 07-02-2022 | $298.0M | Early Stage Venture |

| 58 | Alchemy | $200.0M | 08-02-2022 | $563.9M | Late Stage Venture |

| 59 | Bithumb | $200.0M | 15-04-2019 | $219.2M | Early Stage Venture |

| 60 | Robinhood | $200.0M | 17-08-2020 | $6.2B | Late Stage Venture |

| 61 | DeSo Foundation | $200.0M | 21-09-2021 | $200.0M | Seed |

| 62 | 2TM | $200.0M | 01-07-2021 | $250.3M | Early Stage Venture |

| 63 | Amber Group | $200.0M | 21-02-2022 | $628.0M | Early Stage Venture |

| 64 | Helix | $200.0M | 01-03-2018 | $403.0M | Early Stage Venture |

| 65 | Forte | $185.0M | 12-05-2021 | $910.0M | Early Stage Venture |

| 66 | Bakkt | $182.5M | 31-12-2018 | $857.5M | Early Stage Venture |

| 67 | Copper | $181.0M | 12-10-2022 | $281.0M | Late Stage Venture |

| 68 | 1inch Limited | $175.0M | 01-12-2021 | $189.8M | Early Stage Venture |

| 69 | Autograph | $170.0M | 19-01-2022 | $205.0M | Early Stage Venture |

| 70 | Bitpanda | $170.0M | 16-03-2021 | $554.0M | Early Stage Venture |

| 71 | Chainalysis | $170.0M | 11-05-2022 | $536.6M | Late Stage Venture |

| 72 | Uniswap | $165.0M | 13-10-2022 | $176.0M | Early Stage Venture |

| 73 | Blockdaemon | $155.0M | 21-09-2021 | $431.3M | Early Stage Venture |

| 74 | Sky Mavis | $152.0M | 05-10-2021 | $311.0M | Early Stage Venture |

| 75 | Republic | $150.0M | 19-10-2021 | $214.0M | Early Stage Venture |

| 76 | Aptos | $150.0M | 25-07-2022 | $350.0M | Early Stage Venture |

| 77 | Genies | $150.0M | 12-04-2022 | $267.0M | Late Stage Venture |

| 78 | KuCoin | $150.0M | 10-05-2022 | $180.0M | Early Stage Venture |

| 79 | Sky Mavis | $150.0M | 06-04-2022 | $311.0M | Late Stage Venture |

| 80 | Discord | $150.0M | 21-12-2018 | $995.4M | Late Stage Venture |

| 81 | Mythical Games | $150.0M | 04-11-2021 | $297.0M | Late Stage Venture |

| 82 | Trust Machines | $150.0M | 03-02-2022 | $150.0M | Seed |

| 83 | FalconX | $150.0M | 22-06-2022 | $477.0M | Late Stage Venture |

| 84 | Optimism | $150.0M | 17-03-2022 | $178.5M | Early Stage Venture |

| 85 | Paxos | $142.0M | 16-12-2020 | $543.5M | Late Stage Venture |

| 86 | Golden Technology | $141.3M | 21-10-2019 | $151.9M | Early Stage Venture |

| 87 | LayerZero Labs | $135.0M | 30-03-2022 | $293.3M | Early Stage Venture |

| 88 | CoinDCX | $135.0M | 19-04-2022 | $247.0M | Late Stage Venture |

| 89 | Fireblocks | $133.0M | 18-03-2021 | $1.0B | Late Stage Venture |

| 90 | Magic Eden | $130.0M | 21-06-2022 | $170.0M | Early Stage Venture |

| 91 | TaxBit | $130.0M | 12-08-2021 | $253.4M | Early Stage Venture |

| 92 | iTrustCapital Inc. | $125.0M | 19-01-2022 | $128.0M | Early Stage Venture |

| 93 | HashCash Consultants | $125.0M | 04-09-2017 | $150.0M | Early Stage Venture |

| 94 | AMINA Bank AG | $120.3M | 12-01-2022 | $245.2M | Late Stage Venture |

| 95 | LayerZero Labs | $120.0M | 04-04-2023 | $293.3M | Early Stage Venture |

| 96 | RARIO | $120.0M | 21-04-2022 | $120.0M | Early Stage Venture |

| 97 | Digital Asset | $120.0M | 21-04-2021 | $307.2M | Late Stage Venture |

| 98 | Opn | $120.0M | 09-05-2022 | $260.4M | Late Stage Venture |

| 99 | Earn.com | $116.0M | 10-03-2015 | $121.1M | Early Stage Venture |

| 100 | Worldcoin | $115.0M | 25-05-2023 | $244.0M | Late Stage Venture |

| 101 | Tools For Humanity | $115.0M | 25-05-2023 | $115.0M | Late Stage Venture |

| 102 | Black Banx | $115.0M | 01-05-2017 | $382.3M | Early Stage Venture |

| 103 | Vivid | $114.4M | 07-02-2022 | $204.9M | Late Stage Venture |

| 104 | Pintu | $113.0M | 07-06-2022 | $154.0M | Early Stage Venture |

| 105 | Exohood Labs | $112.0M | 21-02-2024 | $112.0M | Late Stage Venture |

| 106 | Blockchain.com | $110.0M | 14-11-2023 | $600.0M | Late Stage Venture |

| 107 | Figment | $110.0M | 20-12-2021 | $164.0M | Late Stage Venture |

| 108 | Circle | $110.0M | 15-05-2018 | $1.1B | Late Stage Venture |

| 109 | Lukka | $110.0M | 14-01-2022 | $201.3M | Late Stage Venture |

| 110 | Robinhood | $110.0M | 26-04-2017 | $6.2B | Late Stage Venture |

| 111 | Rain | $110.0M | 18-01-2022 | $222.7M | Early Stage Venture |

| 112 | Ledger | $109.0M | 30-03-2023 | $577.0M | Late Stage Venture |

| 113 | Phantom | $109.0M | 31-01-2022 | $118.0M | Early Stage Venture |

| 114 | Coinbase | $108.1M | 10-08-2017 | $1.8B | Late Stage Venture |

| 115 | Prime Trust | $107.0M | 22-06-2022 | $176.0M | Early Stage Venture |

| 116 | Talos | $105.0M | 10-05-2022 | $145.0M | Early Stage Venture |

| 117 | Zero Hash | $105.0M | 12-01-2022 | $169.9M | Late Stage Venture |

| 118 | Figure | $103.0M | 05-12-2019 | $1.5B | Late Stage Venture |

| 119 | EigenLabs | $100.0M | 22-02-2024 | $164.4M | Early Stage Venture |

| 120 | BitGo | $100.0M | 16-08-2023 | $171.5M | Late Stage Venture |

| 121 | NEO | $100.0M | 16-05-2019 | $100.2M | Early Stage Venture |

| 122 | Discord | $100.0M | 30-06-2020 | $995.4M | Late Stage Venture |

| 123 | Dexzbitz Exchange | $100.0M | 11-05-2022 | $135.0M | Early Stage Venture |

| 124 | ZYBER 365 | $100.0M | 25-07-2023 | $100.0M | Early Stage Venture |

| 125 | Offchain Labs | $100.0M | 31-08-2021 | $123.7M | Early Stage Venture |

| 126 | Chainalysis | $100.0M | 23-11-2020 | $536.6M | Late Stage Venture |

| 127 | TaxBit | $100.0M | 07-01-2021 | $253.4M | Early Stage Venture |

| 128 | CoinTracker | $100.0M | 27-01-2022 | $101.6M | Early Stage Venture |

| 129 | OpenSea | $100.0M | 20-07-2021 | $427.2M | Early Stage Venture |

| 130 | Matrixport | $100.0M | 02-08-2021 | $138.0M | Late Stage Venture |

| 131 | Chainalysis | $100.0M | 24-06-2021 | $536.6M | Late Stage Venture |

| 132 | Candy Digital | $100.0M | 21-10-2021 | $138.4M | Early Stage Venture |

| 133 | Chainalysis | $100.0M | 26-03-2021 | $536.6M | Late Stage Venture |

| 134 | Discord | $100.0M | 17-12-2020 | $995.4M | Late Stage Venture |

| 135 | StarkWare Industries | $100.0M | 25-05-2022 | $273.0M | Late Stage Venture |

| 136 | Mineplex | $100.0M | 11-10-2022 | $125.5M | Late Stage Venture |

| 137 | Pixel Vault | $100.0M | 02-02-2022 | $105.1M | Early Stage Venture |

| 138 | 5ire | $100.0M | 14-07-2022 | $121.0M | Early Stage Venture |

| 139 | CoinList | $100.0M | 26-10-2021 | $119.2M | Early Stage Venture |

| 140 | Helix | $100.0M | 15-08-2015 | $403.0M | Early Stage Venture |

| 141 | Amber Group | $100.0M | 20-06-2021 | $628.0M | Early Stage Venture |

| 142 | MasterClass | $100.0M | 20-05-2020 | $461.4M | Late Stage Venture |

| 143 | Berachain | $100.0M | 12-04-2024 | $142.0M | Early Stage Venture |

| 144 | Worldcoin | $100.0M | 23-03-2022 | $244.0M | Early Stage Venture |

| 145 | Aztec | $100.0M | 15-12-2022 | $119.1M | Early Stage Venture |

| 146 | Fnality International | $97.1M | 14-11-2023 | $160.4M | Early Stage Venture |

| 147 | The Sandbox | $93.0M | 02-11-2021 | $97.0M | Early Stage Venture |

| 148 | Sygnum | $90.0M | 06-01-2022 | $130.3M | Early Stage Venture |

| 149 | CoinDCX | $90.0M | 10-08-2021 | $247.0M | Late Stage Venture |

| 150 | Halborn | $90.0M | 19-07-2022 | $90.0M | Early Stage Venture |

| 151 | CertiK | $88.0M | 29-03-2022 | $300.2M | Early Stage Venture |

Manage VC funding for your blockchain and crypto companies with Eqvista!

Put your trust in the pros when it comes to handling venture capital investment in your blockchain and cryptocurrency company. Eqvista offers a technique called “business valuation” to estimate the monetary worth of a firm. A business valuation is a tool that may help you calculate the worth of your company, taking into account its assets, earnings, and other aspects. At Eqvista, we have a highly skilled valuation team that can help you estimate the worth of your business. Value acquisition has emerged as a critical component of every successful business strategy. Get in touch with us if you’re interested in hearing more about the services we provide regarding valuation.