Top AI Startups by Valuation

The artificial intelligence sector has experienced unprecedented growth, producing some of the most highly valued startups in technology history. With a combined market capitalization exceeding $1.2 trillion among the top-tier companies, the AI ecosystem represents a fundamental shift in how technology creates and captures value.

This analysis examines the current landscape of AI startups, their valuations, investment patterns, and emerging trends that will shape the industry’s future.

AI Market Overview and Scale

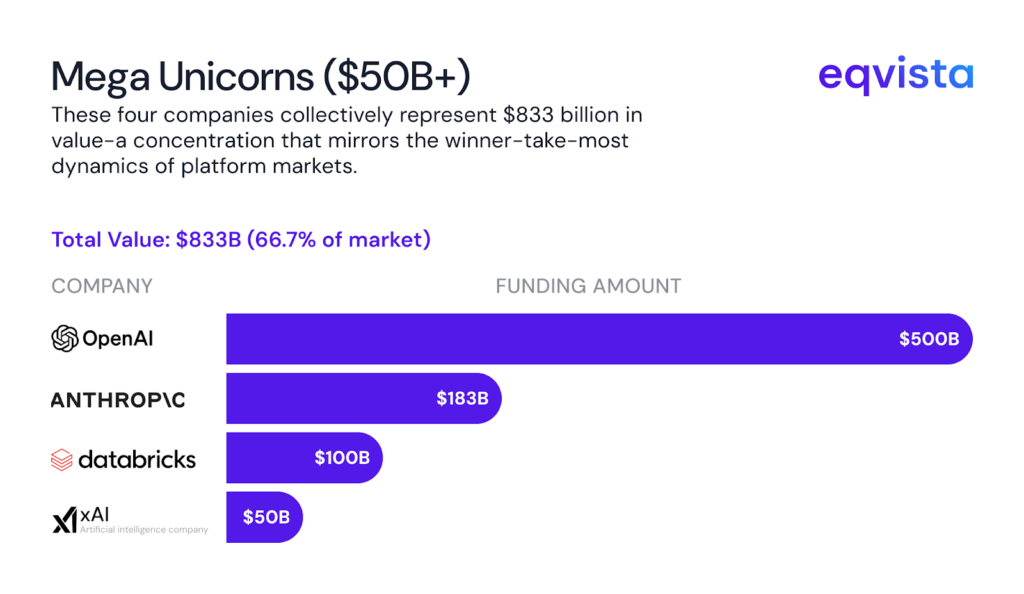

The AI startup ecosystem has reached extraordinary maturity levels, with the top 25 companies alone representing over $1 trillion in combined valuation. This concentration of value reflects both the transformative potential of AI technologies and the winner-take-most dynamics characteristic of platform markets. The sector’s rapid growth has created distinct tiers of companies, each representing different stages of market development and strategic positioning.

| Company | Valuation ($B) | Country |

|---|---|---|

| OpenAI | $500 | United States |

| Anthropic | $183 | United States |

| Databricks | $100 | United States |

| xAI | $50 | United States |

| Safe Superintelligence | $30 | United States |

| Perplexity | $20 | United States |

| Scale | $13.8 | United States |

| Mistral AI | $13.25 | France |

| Celonis | $13 | Germany |

| Thinking Machines Lab | $10 | United States |

| Talkdesk | $10 | United States |

| Sierra | $10 | United States |

| Cognition AI | $9.8 | United States |

| VAST Data | $9.1 | United States |

| Anysphere | $9 | United States |

| Gong | $7.25 | United States |

| Groq | $6.9 | United States |

| Automation Anywhere | $6.8 | United States |

| ElevenLabs | $6.6 | United States |

| Snorkel AI | $6.35 | United States |

| Cyera | $6 | United States |

| SandboxAQ | $5.6 | United States |

| ContentSquare | $5.6 | France |

| Helsing | $5.3 | Germany |

| Collibra | $5.25 | Belgium |

| 6Sense | $5.2 | United States |

| Abnormal Security | $5.1 | United States |

| SambaNova Systems | $5 | United States |

| Icertis | $5 | United States |

| Checkr | $4.6 | United States |

| Glean | $4.6 | United States |

| Hugging Face | $4.5 | United States |

| Outreach | $4.4 | United States |

| Lightmatter | $4.4 | United States |

| OutSystems | $4.3 | United States |

| ThoughtSpot | $4.2 | United States |

| dbt Labs | $4.2 | United States |

| Vanta | $4.15 | United States |

| Dataminr | $4.1 | United States |

| AlphaSense | $4 | United States |

| Inflection AI | $4 | United States |

| MEGVII | $4 | China |

| Cerebras Systems | $4 | United States |

| Cohesity | $3.7 | United States |

| Dataiku | $3.7 | United States |

| o9 Solutions | $3.7 | United States |

| Highspot | $3.5 | United States |

| Together AI | $3.3 | United States |

| Vercel | $3.25 | United States |

| Aiven | $3.21 | Finland |

| Harvey | $3 | United States |

| Poolside | $3 | France |

| Clio | $3 | Canada |

| Zhipu AI | $3 | China |

| Lucid Software | $3 | United States |

| Physical Intelligence | $2.8 | United States |

| Baichuan AI | $2.77 | China |

| Abridge | $2.75 | United States |

| Sourcegraph | $2.62 | United States |

| Pendo | $2.6 | United States |

| TensTorrent | $2.6 | Canada |

| Quantexa | $2.6 | United Kingdom |

| Clari | $2.6 | United States |

| Lambda Labs | $2.5 | United States |

| Uniphore | $2.5 | United States |

| HoneyBook | $2.4 | United States |

| Biren Technology | $2.3 | China |

| Dialpad | $2.2 | United States |

| YITU Technology | $2.17 | China |

| Eightfold | $2.1 | United States |

| Synthesia | $2.1 | United Kingdom |

| Supabase | $2 | United States |

| Neo4j | $2 | United States |

| DeepL | $2 | Germany |

| Cohere | $2 | Canada |

| Liquid AI | $2 | United States |

| Hive | $2 | United States |

| Iterable | $2 | United States |

| ClickHouse | $2 | United States |

| VerbIT | $2 | United States |

| Kong | $2 | United States |

| H2O.ai | $1.7 | United States |

| Weka | $1.6 | United States |

| Apollo | $1.6 | United States |

| Cresta | $1.6 | United States |

| ASAPP | $1.6 | United States |

| Iluvatar CoreX | $1.5 | China |

| Jasper | $1.5 | United States |

| Matillion | $1.5 | United Kingdom |

| Airbyte | $1.5 | United States |

| Veriff | $1.5 | Estonia |

| SparkCognition | $1.4 | United States |

| AI21 Labs | $1.4 | Israel |

| Phenom People | $1.4 | United States |

| Salt Security | $1.4 | United States |

| TUNGEE | $1.3 | China |

| Clay | $1.25 | United States |

| BigID | $1.25 | United States |

| Enflame | $1.24 | China |

| Lila Sciences | $1.23 | United States |

AI Startup Valuation Tiers

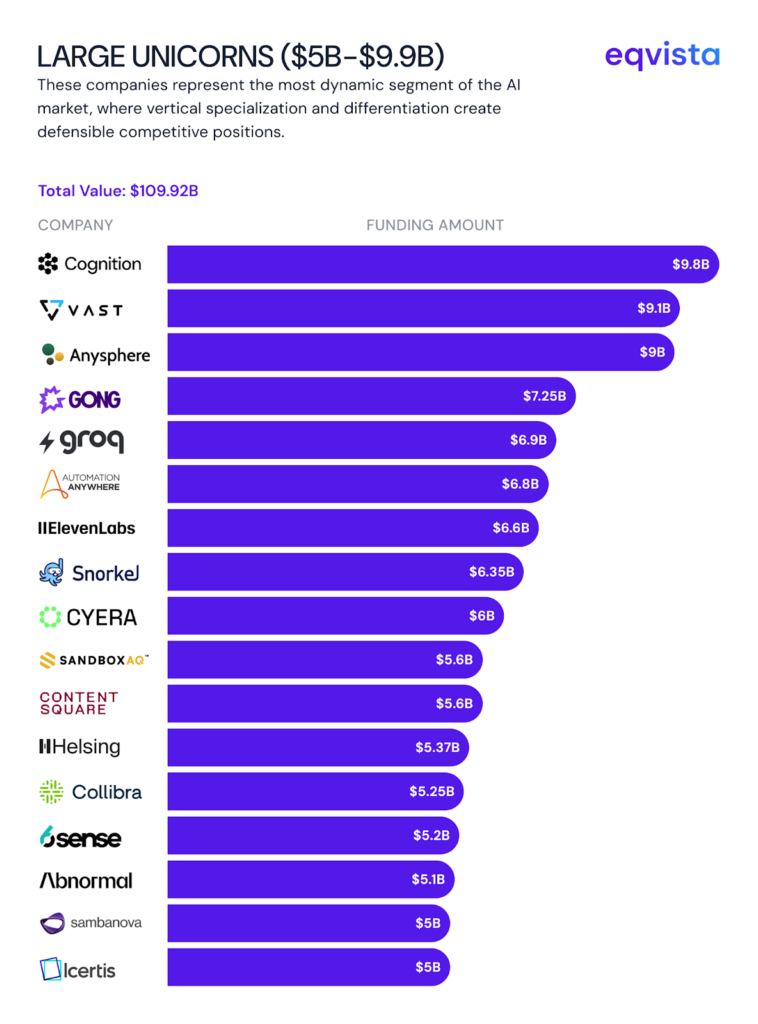

The AI market is dominated by four mega unicorns that collectively control 66.7% of the total market value among top startups. The super unicorn tier includes eight companies valued between $10-49.9 billion, while the large unicorn category encompasses companies valued between $5-9.9 billion, representing the most dynamic segment of the AI market.

Investment Landscape and Venture Capital Dynamics

Venture investors play a crucial role in shaping the AI landscape. The most active and influential VC firms in AI, ranked by the number of high-value portfolio companies. These investors frequently appear in the cap tables of the most successful AI companies and are seen as key drivers of sector growth. Their presence signals strategic bets on foundation model platforms, enterprise B2B solutions, and infrastructure arms races, especially around specialized chips and computing resources.

Where Capital Flows: The VC Landscape

Venture capital concentration among top-tier firms shapes the entire AI ecosystem. The most active investors have emerged as gatekeepers and strategic guides for the sector’s development.

Sequoia Capital leads with investments spanning from OpenAI and xAI to emerging vertical AI companies. The firm’s portfolio demonstrates a thesis focused on foundational AI technologies and platforms.

Andreessen Horowitz follows with comprehensive coverage across the AI stack, backing infrastructure companies like Databricks and xAI as well as application-layer innovators.

Google Ventures/CapitalG represents strategic corporate venture capital, with investments reflecting both financial returns and strategic positioning in the AI ecosystem.

Valuation Efficiency Metrics and Financial Analysis

The AI sector exhibits unprecedented valuation efficiency metrics that highlight the capital-light nature of many AI businesses.

Valuation per Employee (Estimated)

These metrics demonstrate how AI companies can create massive value with relatively small teams, primarily through intellectual property and algorithmic advantages rather than traditional labor-intensive models.

- OpenAI: ~$2B per 1,000 employees

- Anthropic: ~$6.1B per 1,000 employees

- Traditional Tech: ~$0.5-1.5M per employee

Revenue Multiple Analysis (Estimated)

The sector exhibits varying revenue multiples based on business model and market position.

- Foundation Models: 50-100x revenue multiples

- Enterprise AI: 20-40x revenue multiples

- Vertical AI: 15-25x revenue multiples

Strategic Insights & Trends

Healthcare, legal tech, and security AI solutions are rising quickly, with many startups creating bespoke applications for these industries. Companies like Harvey ($3B), Abridge ($2.75B), and Abnormal Security ($5.1B) demonstrate the viability of vertical specialization.

As generative AI models grow, competition is heating up for hardware (GPUs, chips) needed to run them efficiently. Companies like Groq ($6.9B), Cerebras Systems ($4B), and Lambda Labs ($2.5B) are challenging NVIDIA’s dominance.

European and international companies are gaining significant traction. Mistral AI ($13.25B, France), Celonis ($13B, Germany), and Helsing ($5.37B, Germany) are building strong alternatives to US champions, while Chinese companies like Zhipu AI ($3B) and Baichuan AI ($2.77B) continue to advance.

The open versus closed AI debate continues with companies like Hugging Face ($4.5B) representing open-source approaches while OpenAI leads closed commercial models.

Emerging Patterns

- Vertical AI Specialization: Healthcare, Legal, Security leading

- Infrastructure Arms Race: GPU alternatives and specialized chips

- International Competition: Europe and Asia building alternatives

- Developer Tools Boom: Anysphere ($9B), Vercel ($3.25B), and Supabase ($2B) showing strong growth

- AI-Native Enterprise Software: Companies like Cognition AI ($9.8B) and Sierra ($10B) reimagining business processes

Investment Opportunities & Gaps

Underinvested Areas

Several areas remain underinvested despite significant market potential.Despite manufacturing’s scale and potential for AI optimization, few companies have achieved significant valuations in this space. While cloud-based AI dominates current valuations, edge computing applications represent a significant underexplored opportunity.

As regulatory requirements increase, companies focusing on AI governance, auditing, and compliance represent emerging opportunities.Energy efficiency and environmental impact considerations create opportunities for companies developing more sustainable AI solutions.

Areas identified as underinvested include:

- AI for Manufacturing: Limited representation

- Edge AI Solutions: Few dedicated companies

- AI Governance/Compliance: Emerging regulatory need

- Sustainable AI: Energy efficiency focus

- AI for education: Few large-scale players in transforming education

Overinvested Areas

Conversely, generative AI, sales/marketing AI, and generic AI platforms are seen as crowded or overvalued, and startups focused purely on consumer-facing products are considered riskier bets.

- Generative AI Chat: Crowded foundation model space

- Sales/Marketing AI: Multiple similar solutions

- Generic AI Platforms: Undifferentiated offerings

Future Outlook (2025-2027)

Foundation model leaders may merge, and vertical AI companies could become acquisition targets for incumbents. Europe and Canada are likely to expand their share of top AI startups, challenging the current US dominance.

Companies with clear revenue models will thrive, while pure research plays may struggle to commercialize. Growing needs for compliance and governance will fuel new segments of the AI market.

The top AI startups are reshaping the global tech landscape with explosive valuations, high-profile investors, and rapid expansion into new verticals and geographies. As new application areas emerge and the competitive field evolves, investors and founders should watch for signs of consolidation, increased regulatory scrutiny, and opportunities in segments not yet saturated.

For Investors

While foundation models dominate current valuations, diversification across vertical applications and infrastructure may provide better risk-adjusted returns. Investors should consider opportunities beyond the US market, particularly in Europe and other regions developing local AI capabilities. Early investment in underrepresented areas like manufacturing AI and governance solutions may offer outsized returns.

For Entrepreneurs

Rather than competing directly with foundation model giants, entrepreneurs should focus on specific industry applications where they can build defensible moats. The growing AI ecosystem creates numerous infrastructure and tooling opportunities that don’t require competing with well-funded platform companies. Entrepreneurs outside the US should consider building locally-optimized solutions that can compete effectively in their regional markets.

For Enterprises

Enterprises should carefully evaluate AI platform choices, considering both current capabilities and long-term strategic positioning. The maturity of AI solutions in many vertical applications favors buying over building for most enterprises. Companies across all industries should develop AI strategies to remain competitive in an increasingly AI-powered economy.

Conclusion: The Winners and The Rest

The AI startup landscape has reached a tipping point. With $1.1 trillion concentrated among the top companies, we’re witnessing the emergence of a new economic order where four mega unicorns are pulling away from the field.

While OpenAI, Anthropic, Databricks, and xAI have built formidable moats, the real opportunity lies beyond foundation models. Vertical AI applications, infrastructure solutions, and emerging categories like governance and edge computing represent the next frontier for value creation.

The winners of tomorrow won’t be the companies with the biggest models—they’ll be those that solve real problems with sustainable business models. As the market matures, execution will trump experimentation, and revenue will matter more than research papers.

The AI revolution is no longer coming. It’s here, and these companies are writing its rules.

Managing Your AI Startup’s Equity and Valuation

As AI startups scale rapidly and valuations soar, managing cap tables, equity grants, and valuations becomes difficult. Eqvista’s equity management software are designed for high-growth startups:

- Cap Table Management: Track ownership, manage multiple funding rounds, and model dilution scenarios

- 409A Valuations: Get IRS-compliant valuations for your stock options

- Equity Plan Administration: Issue and manage stock options, RSUs, and other equity instruments

- Digital Stock Certificates: Issue and track stock certificates securely

- Investor Relations: Keep investors informed with real-time portfolio access

Trusted by thousands of startups navigating complex equity structures, Eqvista simplifies the financial infrastructure so you can focus on building your company. Get started now.