Shareholders & Share Structure

Investing in a company can be tricky, mostly if you are new to investing and don’t know much on how to value a company or their shares.

If you are looking for a way to invest your money, often the best way is by investing in the shares of a company. You will need to do research on the different types of companies and how much you want to invest. Investing in a company can be tricky, especially if you are new to investing and don’t know much on how to value a company or their shares. However, after proper research, investing in shares of a company can be very rewarding.

Shareholders and share structure in a company

In becoming a new investor, you need to understand the ins and outs of investing, such as the difference between a traditional trading account and a Demat account. Other than this, you need to know about the types of share and the share structure of different companies. For example, Google has a multi-class share structure for its Group around the world. But what exactly is a multi-class, dual-class or a single-class share structure? Read on to learn more!

You were probably interested in investing after hearing about the large returns of shareholders on their investments. Well, investing in shares can earn a lot of profit, but it is vital to know all about the market volatility as well. This means that you would also encounter a lot of risk, as shares are subjected to wide fluctuations in the market. Nevertheless, the stock market provides you with excellent possibilities for getting more money on what you invest in, given you follow a systematic and correct approach.

What are shares and who are shareholders?

To better understand these two, let us first understand what a share is. A share is a portion of the company that are given to investors, who then become the shareholders of the company. In short, a company creates shares (“issues shares“) of stock for representing the ownership claims of the company. The following would give a much better explanation for what a shareholder and shares are.

Shares

A share is a unit of ownership interest in the financial asset or a company that provides for uniform distribution in the profits of the company (if there is profit) in the form of dividends.

Another definition of shares is the units in the corporation which the overall profits of the corporation is divided into. And those who hold these shares are called the shareholders of the company or members of the company.

A share is basically a moveable property and can be transferred between different shareholders. Share capital is not refundable unless the business is being wound up or there is a reduction of capital. And each company has a specific number of shares decided upon when it is created.

Shareholders

Shareholders are also called stockholders, and when they invest in a company to obtain an equity of the company, they become the owners of that corporation. When a company incorporates, the owner needs to file the corporate charter with the respective state and their rules and bylaws.

The most vital part of a company incorporation is the number of shares that the company is authorized to have, along with the par value of the shares. As soon as a new corporation issues shares, the investors become the shareholders of the company. All the records are kept in the balance sheet under the common stock equity account. These have the complete number of shares authorized, and also the shares outstanding in the company. Corporations normally do not issue all the shares immediately, and a significant number of the shares stay unissued. The unissued shares help the company raise equity funding in the future when needed. The ownership of shares allow the shareholders to have some specific rights that include:

- To obtain the annual financial statements of the company as soon as it is available for issuance;

- To earn dividends as soon as announced by the Board of Directors; and

- To vote for the corporation’s Board of Directors.

There can be a small or large number of shareholders, depending on the maximum number allowed in a company, which is also set in the charter.

By now, you might know that the shareholders purchase the shares in a company to earn a profit from the business either through the appreciation in the market price of the shares or the dividends given by the company. The shareholders also obtain control over the business by purchasing the shares and have a say in the decision of the company.

In case the business is about to be sold or liquefied, the shareholders of the corporation have the rights to any of the outstanding assets over debt. Basically, the creditors are given from the assets or proceeds of the company to cover the debts, and if there is anything left over, the remaining assets are then distributed amongst the shareholders as per their relative holdings of ownership of the company. If there aren’t any remaining assets after the creditors have been paid, the shareholders would not receive money back for their investments.

How are “shares” sold to the shareholders?

If you are planning to become a shareholder in a company, it is vital to understand that the value of stocks would fluctuate with the business prospects of its operations and the value of the assets owned by the corporation. Moreover, you can re-sell your shares as the corporation designs them in a way permitting you to do so.

The first sale of the company shares is called the primary distribution, and if the shares are sold again by the shareholder to another person, it is called a secondary market transaction. This kind of sale primarily transfers the ownership rights from one person to another, without any involvement of the company who originally issued the shares.

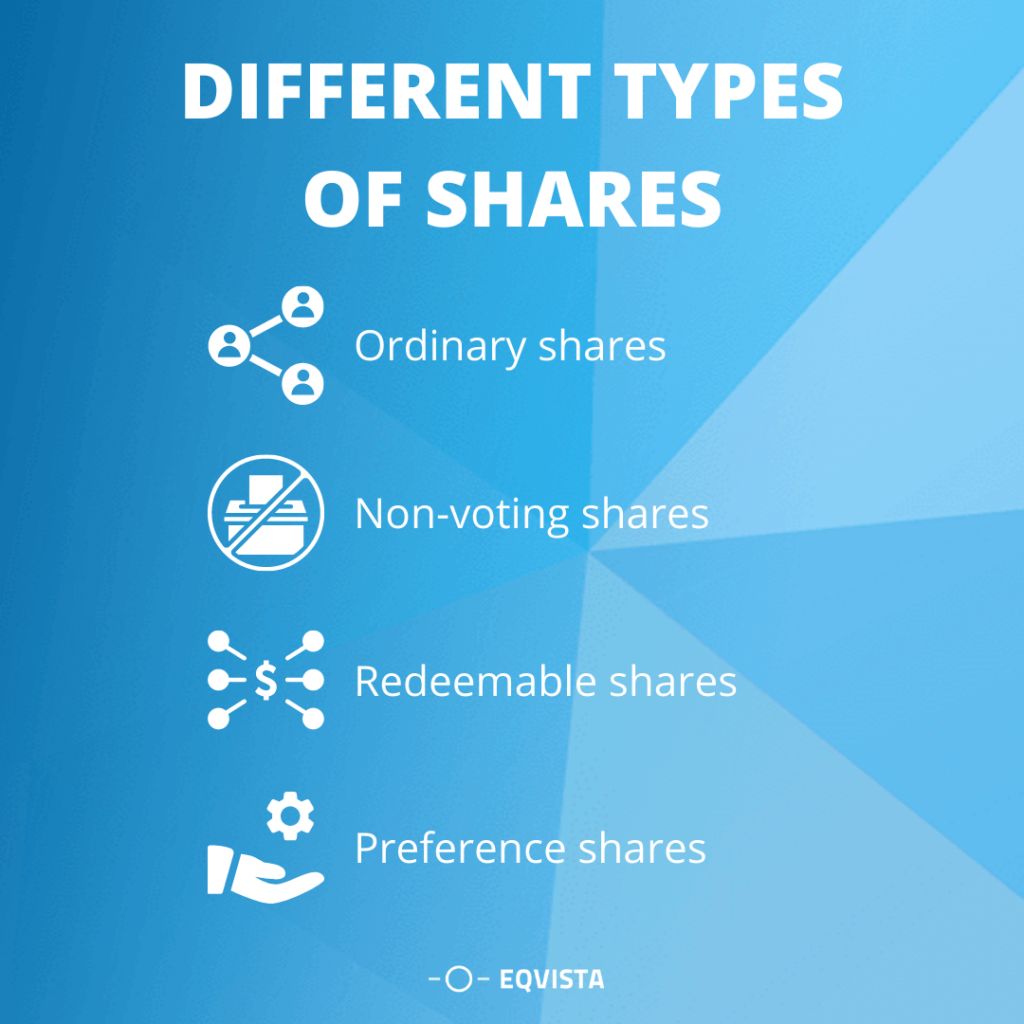

Different Types of Shares

Now that you have understood all about shares and the shareholders, let us understand the different types of share that are available in the stock market.

Ordinary shares

Ordinary shares are the most basic types of shares, which is divided with an equal par value and has the same obligations and rights as other ordinary shares. The rights include the rights to receive dividends and the rights to be a part of the management of the company by voting for the shareholders at the Annual general meeting.

The rights of ordinary shareholders to get dividends are normally subject to the rights of the preference shareholders and bondholders.

In short, the owners of these shares have the following rights:

- receive equal dividends;

- carry one vote per share; and

- divide the remaining assets between themselves after the pending debt has been covered if the business is liquidated.

Moreover, a company can create different alphabetized classes of ordinary shares like Class A, Class B, Class C shares, etc. These classes are made for organizing and building different rules for different types of shareholders and the directors to vary dividend payments.

Non-voting ordinary shares

Non-voting shares carry no rights to attend a general meeting or to vote. These types of shares are issued to the employees of the company so that they can receive their remuneration as dividends. This process is tax-efficient for the employee as well as the company.

These shares are issued to:

- avert commitment to a fixed dividend by issuing preference shares, also called preferred stock;

- prevent dilution of the original investors or the founder’s control over the firm; and

- prevent an attempted takeover by diffusing shareholding and diminishing the equity of the firm.

Redeemable shares

These types of shares are issued under the assumption that the corporation may repurchase them someday in the future. The company might even fix the date when they would redeem the shares back. For instance, the company can put a clause that the shares would be redeemed after five years from the day it’s issued.

As a matter of fact, the price of redeemed shares are normally the same as the price of the share when it was issued, but not in all cases. This might be a method of creating an explicit agreement with an external investor.

Keep in mind though that the shares can be redeemable by the company at any time. This process is normally carried out with non-voting shares of the staff of the company. This is in case the employees leave their position in the company, their shares can be taken back by the company at the same value.

Preference shares

Preference shares are the next types of shares, which are similar to non-voting shares. However, the shareholders are guaranteed dividends from the company. There are two types under this:

- Cumulative Preference Shares

- Non-Cumulative Preference Shares

Non-cumulative preference shares don’t have the rights to obtain or claim the dividends that are foregone. On the other hand, cumulative preference shares permit the shareholders to get the payment before the ordinary shareholders.

Cumulative preference shares

A cumulative preference share is given in the form of dividends to the shareholders, before the debt is paid off to the creditors, in case the company has liquidated or is falling under massive debt. Cumulative preference shares are always paid before any other shareholders are paid their dividends or equity profits.

Difference between shareholders and directors

The directors and shareholders have different roles in the company. For a simple explanation, the directors manage the company, and the shareholders own the business by holding the shares of the company. Unless the company articles say so, the directors do not have to be a shareholder, and the shareholders do not have to be the directors.

However, private companies often confuse the separation of law between the shareholders and directors. For instance, when a private company is founded by two or three people, they often call themselves the partners in the business. When in actuality, all three of them are represented in the company as both shareholders and directors.

But that is not where things get complicated. The bigger problem arises when there are decisions that have to be taken by the directors in the board meetings and some other decisions taken by the shareholders through resolutions or written at the general meeting, and these are not followed as per the law. Further, there are some decisions that need to be taken by the directors with the consent of the shareholders.

And since the directors and the shareholders tend to be the same people in the private company, things do not go per what the Companies Act or the company’s articles of association has allowed.

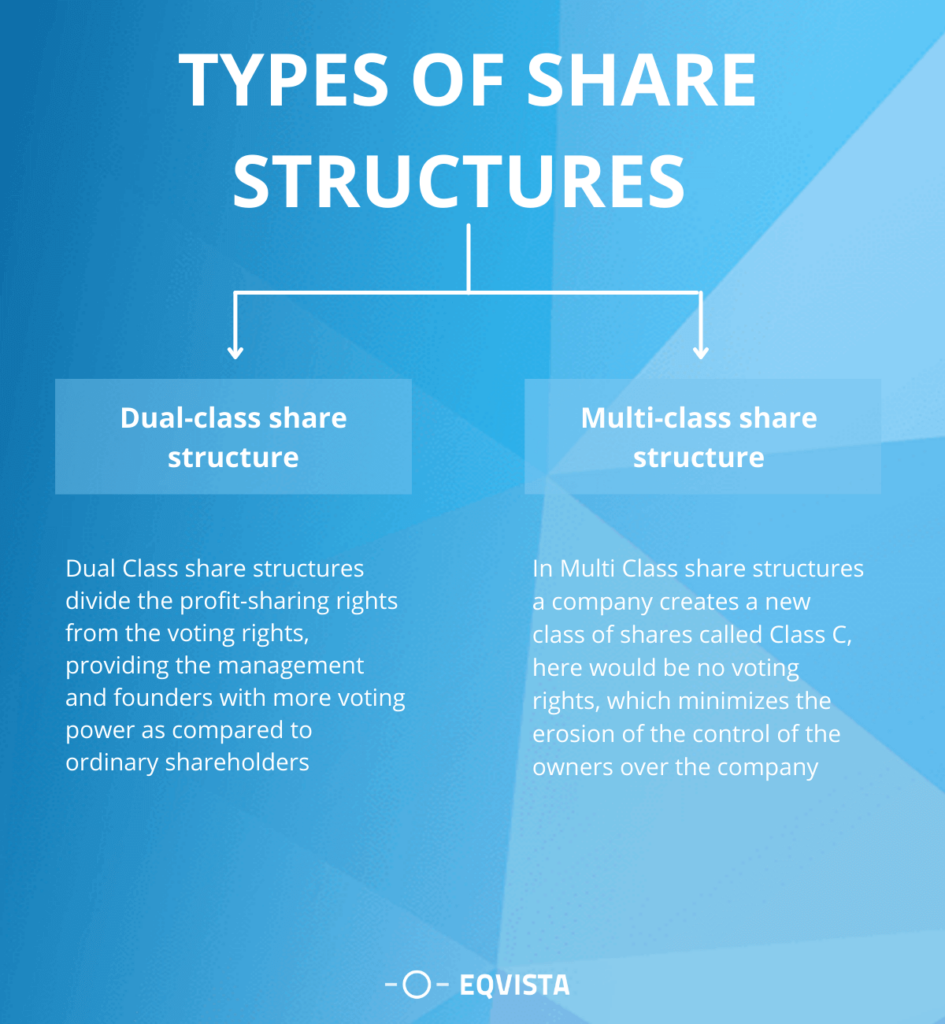

What is a share structure?

A share structure is the type, series, and classes of shares that the company has been authorized. For any company, there is at least one class of shares. A share class can have one or more series of shares if the restrictions and special rights connected to the class give this inclusion. All types of shares mentioned above can have classes within them with some rights and restrictions for each class.

For instance, a corporation can have the shares with the name Class A preference shares. And let us say that there are about 10,000 shares in this class with the par value of $1 and no special rights and restrictions attached. This makes one class of share. Along with this, let us say the same company has 500 Class B preference shares, with the par value of $2 and the restriction to vote. Like these, there can be classes or series of shares in a company forming the share structure.

There are two main types of share structures:

Dual Class Share Structure

Dual Class share structures divide the profit-sharing rights from the voting rights, providing the management and founders with more voting power as compared to ordinary shareholders. And due to this, the founders can enjoy the following benefits:

- A dual-class share structure guards the founders of the company against takeovers; particularly as soon as the company goes public.

- The owners who have a long-term view of the business would be protected by the impulses of the shareholders and investors who focus more on short-term gains.

- The founders would be able to focus on the growth and innovation in the business without the trouble of the shareholders interfering with their vision and goal.

Multi-Class Share Structure

Other than the single share structure or a dual-class share structure, there can be a multi-class share structure as well. Let us say a company creates a new class of shares called Class C. And in this class, there would be no voting rights, which minimizes the erosion of the control of the owners over the company. In short, a company can have many classes of shares to make their company evolve better as per the needs of the business.

Overall, a company can easily create the share structure best for the firm. This share structure would help the company differentiate between the directors and shareholder’s roles in a much better way.

Importance of Organized Share Structure & Cap Table

Comprehending the share structure is an important part not only for internal use for the list of shares and shareholders, but is equally important for outside investors in determining the value of equity and for due diligence. How well organized your share structure is will also show how well you manage and run your company.

By having an organized share structure, this will show the essential information of the shareholders, such as the total shares outstanding, the shares issued, purchased and authorized to owners and investors. All of this information will be shown in something called a Capitalization Table, or Cap table for short.

The Cap Table will function as the master ledger to show all the current share holdings.

Also, investors will review your cap table, and be able to recognize the value of your company, and if there are any areas that require their attention. They will also be able to understand if they invest in your company, how many shares they may get, and how this will affect the overall dilution on the shares held by the current owners.

For these and many other reasons, it’s important for you to keep an organized share structure and updated Cap table for your company.

How can Eqvista help manage company shareholders?

With a better understanding of what shares, share structure and shareholders are, you now understand their importance and how it would affect the future of your company. With the shares, you would also need a proper cap table to hold all the information regarding how many shares there are, who they have been issued to and how many shares are left to be issued. To understand this better, you need to know all about the cap table. Check out the next article for this!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!