What Role Do Seasonal Fluctuations Play in Cash Flow Forecasting for Startups?

There’s a financial adage that goes something like, “Revenue is vanity, profit is sanity, but cash is reality,” and more rightly so. A 2015 study shows that nearly 90% or even more startups fail, of which 29% fail due to cash crunches. Cash issues are the second most common reason for failures after the lack of market need for a product/service.

Unsatisfactory levels of cash flows resulted in the denial of funding at least once in the last two years for successive rounds in most of the cases. Recently, insufficient funding has been attributed to 29% of startup failures, making it one of the most important reasons for failures.

This post aims to highlight the factors contributing to seasonal fluctuations in cash flow and how they can be modelled for forecasting, leading to sustainable growth.

Impact of Seasonal Fluctuations on Cash Flow Forecasting for Startups

Cash flows can fluctuate due to funding periods, seasonal sales variability, and large capital expenditure requirements. We look at some of the most important reasons for fluctuation in detail here.

- Revenue Variability: Seasonal variations in sales are common for large companies and startups alike. However, startups generally have less diversified sources of revenue, leading to more volatile variations. Some startups may see revenue increase during Christmas, while others, such as ice cream vendors, may see sales shoot up during summer.

- Expense Timing and Increases: Operational expenses tend to be less variable, and changes do not affect cash flows significantly. However, large capital expenditures can affect the solvency and existence of the company. This is usually the case when large machinery or debt service requirements crop up.

- Working Capital Management: Poor working capital management/planning can also put a startup in jeopardy. This is more of an operational issue when current assets cannot service the current liabilities. Keeping track using solvency ratios such as the current ratio or the cash ratio is important to avoid such pitfalls.

- Cash Flow Timing Challenges: The median period of corpus that startups have at their disposal is around 27 days, which means that any delay in cash inflow can lead to insolvency. It is therefore imperative that cash flow timings are taken into consideration. This can be done by providing discounted payment terms or an upfront payment discount.

- Forecast Accuracy and Scenario Planning: Cash flow variability based on historical fluctuations can be relatively easier to forecast. Fluctuations outside of periodical variations, say an unanticipated decline, can throw off the planning model. One of the best ways to overcome this is to include extreme tail events in the scenario analysis.

- Mitigation Strategies in Forecasting: Mitigation of extreme events in modelling by regular monitoring and updating of assumptions and incorporating buffer stock can enhance the accuracy of financial projections. Comparing forecasts with actual requirements, using different methods such as time series, econometric models, and statistical simulations, can help in managing seasonal fluctuations for startups.

Key Roles of Seasonal Fluctuations in Cash Flow Forecasting for Startups

Industries and companies face periodic fluctuations in revenue and cash flows regularly. Identifying the fluctuation is one of the first steps towards modelling cash flows. This is further supported by:

Planning for High and Low Periods

We have already seen how a startup’s cash reserve can be pretty thin. With high volatility in cash, there are bound to be periods of high and low cash reserves. This needs planning to utilise cash excess when available and save on expenses during lean cash periods. One important way to do so is to build up a cash reserve, which can be hard for startups, but is important.

Consider a bakery around Christmas, it receives significant order volume in the week before Christmas and New Year. The sales volume plummets in early January, but rent, heating, and other expenses need to be paid. Planning and setting aside cash reserves from orders can help sustain the bakery for a long time.

Avoiding Cash Shortfalls

Seasonal sales cycles can create cash flow challenges, especially if startups mistake peak season revenues for the norm. While reserves do help sustain businesses, setting aside more than required can lead to capital costs. Even with a positive working capital, cash shortfalls can happen, for example, when inventory is lying idle or increased receivables.

Planning needs to be supplemented by cash reserves and a budgetary buffer. Startups must plan ahead by building cash reserves during peak times, managing expenses carefully, and considering flexible staffing or inventory strategies to bridge gaps during off-seasons. This can further be boosted by opening a line of credit, which saves capital costs and can also free up some reserves.

Optimizing Working Capital

Seasonal peaks often require increased investment in inventory, staffing, or marketing before revenue is realized, tying up working capital. It can help free up excessive cash that can remain unused or caught up in operations. This is done by improving the cash conversion cycle, which is the time from making an investment and receiving cash from the sale.

Reducing the time for receivables and delaying the payables is one of the simplest ways to do so. Startups must plan ahead by building cash reserves during peak times, managing expenses carefully, and considering flexible staffing or inventory strategies to bridge gaps during off-seasons. This needs to be complemented by inventory management, which avoids any held-up inventory.

Supporting Strategic Decisions

Startups are faced with more frequent strategic decisions when compared to already stable and established companies. The ability to model fluctuations and provide an accurate forecast of future cash flows can help startups enhance profits by taking strategic decisions. A better clarity on future cash flows can surely help.

Assume a new age food delivery app wants to integrate Google Maps into its order and delivery, but needs to make a decision based on its costs. An accurate future cash flow forecast based on expected sales can help the founders go ahead with costly integration or wait for later. Waiting more than required can be a fight for survival if the startup is not an early mover in the market.

Enhancing Forecast Accuracy

Seasonal fluctuations can be modelled into simulations to enhance the accuracy. When the fluctuations occur at a regular interval, they are easy to forecast, rather than when they are irregular. Coming back to our example, any bakery can easily anticipate seasonal demand during Christmas and New Year’s Eve.

Mitigating Risks

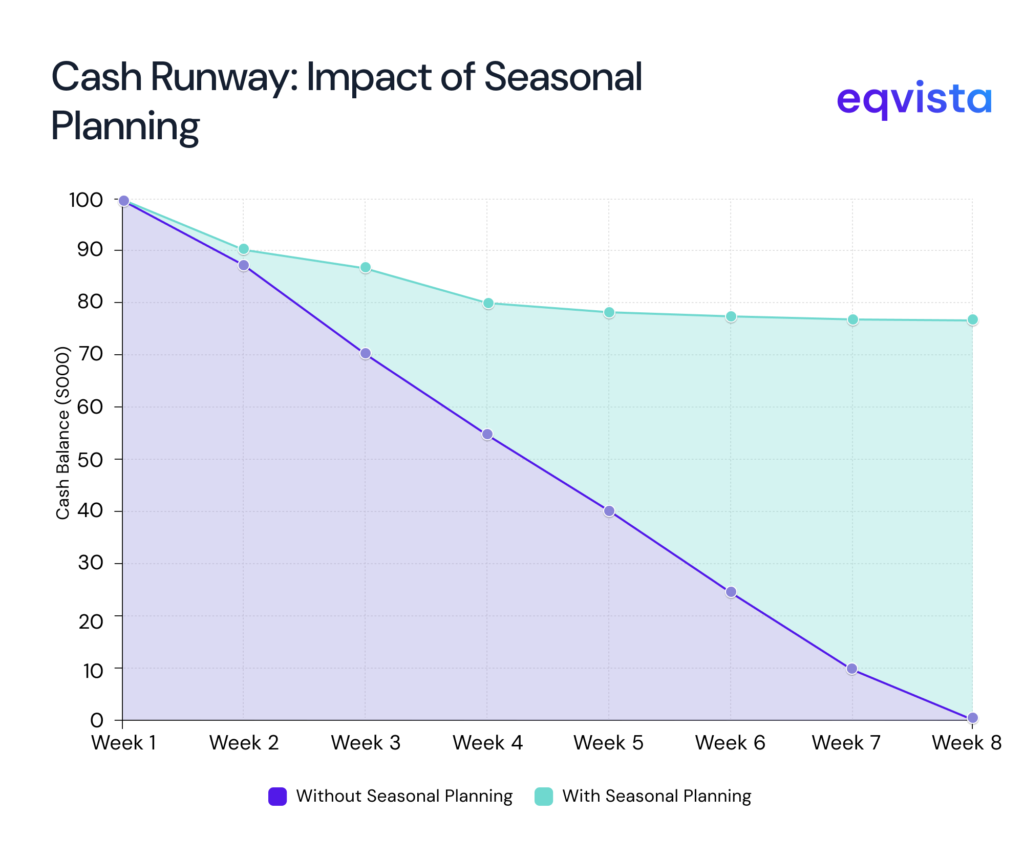

Seasonal fluctuations modelled correctly into forecasting simulations can help mitigate solvency and operational risks. When a startup knows that there is a possibility of a cash crunch, it can reduce its cash burn ratio to match the inflows or available funding.

Tools like scenario analysis, rolling averages, and real-time forecasting platforms enable founders to refine their financial strategies and prepare for both predictable and unexpected changes in cash flow.

Eqvista – Your Partner in Navigating Seasonal Cash Flow Fluctuations

Many small businesses lack guidance in forecasting cash flows by incorporating seasonality, as scenarios and simulations can be too quantitative. Taking outside help from experts can be necessary to avoid a business shutdown. Cash flow issues can be detrimental to the survival of the startup, and therefore, accurate forecasting and management are top priorities for any organisation. With cash flow issues being a major cause of startup failures, planning and accurate forecasting can make a big difference.

Eqvista’s team of certified analysts help you overcome these challenges with expert guidance and customized financial solutions. Don’t leave your startup’s future to chance. Partner with Eqvista today to build robust cash flow models that empower your business to grow confidently through every season. Contact us today!