QSBS for SaaS Companies: Qualification Considerations

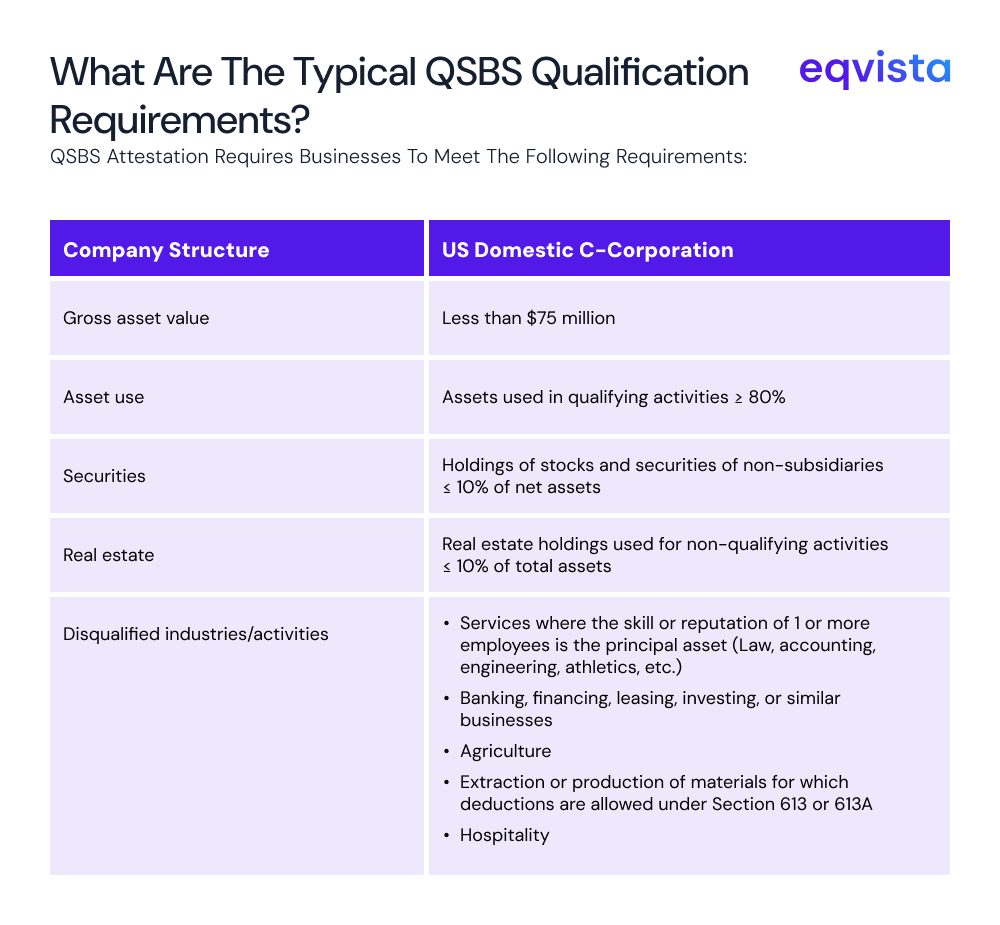

Investing through the qualified small business stock (QSBS) route allows investors to exclude capital gains of up to $15 million or 10x the investment basis, whichever is greater. These benefits are limited to certain businesses with gross asset values up to $75 million. This makes QSBS attestation particularly important to raise funds as an early-stage founder.

However, most early-stage SaaS startups are not set up correctly to qualify for QSBS treatment. In this article, we will explore QSBS qualification requirements and why they are particularly challenging for SaaS startups.

Why Is the QSBS Qualification More Challenging for SaaS?

The primary reason why SaaS startups may miss out on QSBS benefits lies in how they start out. Suppose you establish a US domestic C-corporation, aiming to build a SaaS business. Your long-term objective is to build a software capable of providing a service with minimal human intervention.

However, before pushing out a pure-SaaS offering, you launch a traditional service offering to generate revenue and cover your expenses.

This setup will create problems when:

- More than 20% of your assets (by value) are used to provide the traditional service offering

- Value of real estate holdings used for traditional service offering exceeds 10% of your total assets

- Skill or reputation of your employee(s) becomes your principal asset

QSBS Qualification Strategies for Saas Founders

The following strategies can improve your chances of QSBS qualification as a SaaS startup:

Minimize Real Estate Holdings

Most SaaS businesses are asset-light in the early stage. So, since the denominator (total assets) is small, they can easily go over the 10%-limit for real estate holdings. Most startups avoid purchasing real estate to conserve cash reserves. As a SaaS startup, you may want to go a step further and avoid prepaid leases.

If you hold prepaid leases while pursuing both SaaS and traditional service routes, you will need to provide a reasonable explanation for allocating value between qualifying (software development) activities and non-qualifying (traditional service) activities.

Unfortunately, there is little to no documentation on such value allocation. To sidestep this uncertainty completely, you can simply avoid prepaid leases.

Execute a Complete Transition

Most founders cannot afford extended bootstrapping periods, and without the QSBS advantage, they may struggle to raise funds. Starting as a traditional service business becomes a practical choice, allowing you to build a reputation and accumulate capital before pivoting to SaaS.

If you take this route, execute the transition perfectly. Once you’re ready to make the shift, optimize your headcount and asset mix. Businesses that transition are QSBS-eligible if they meet asset use requirements during the investment period.

Delay fundraising until after completing your pivot from services to pure SaaS, ensuring your asset composition clearly reflects qualifying activities.

This strategic patience can preserve millions in potential tax savings for your investors, making your equity more attractive.

Maintain Detailed Documentation

If your business is involved in qualifying as well as non-qualifying activities, you must track asset allocation meticulously from day one. Document how each asset contributes to qualifying versus non-qualifying activities. This creates a clear audit trail and provides essential evidence during attestation.

You should also maintain detailed records of software development costs and headcount allocation.

Liquidate and Restructure

If you’ve been operating a service business and want to pivot to SaaS with QSBS benefits, consider liquidating your existing entity and forming a new C-corporation. This clean-slate approach eliminates the complexity of proving asset reallocation and transition timing.

When you liquidate the old service firm, close out all non-qualifying activities definitively. The new C-corporation starts with a clear foundation. There will be no historical baggage of service-based operations and no risk of failing the asset use tests during fundraising.

Instead of liquidating by the sale of assets, consider taking over the old firm’s assets. Then, ensure that the new C-corporation issues stock in exchange for property other than shares. This allows you, the founder, to qualify for QSBS benefits yourself while avoiding any tax liabilities arising out of asset sales.

While this approach requires careful legal and tax planning, it provides the cleanest path to QSBS eligibility. The restructured entity avoids the gray areas that plague transitioning companies, giving investors confidence in the company’s QSBS qualification.

Eqvista – Securing Your SaaS Company’s QSBS Advantage!

For SaaS founders, QSBS qualification represents a powerful tool to attract investors and maximize returns at exit. However, the transition from service-based revenue to pure SaaS presents unique compliance challenges that can disqualify your stock if not handled properly.

The difference between QSBS qualification and disqualification often comes down to precise asset valuation and documentation.

Eqvista’s valuation experts specialize in QSBS attestation for tech companies. We provide accurate and defensible attestations that enable investors to confidently claim their tax exclusions. Contact us to know more!