Venture capital activity for Q3: Analysis for Q3 Vs. Q2

In Q3 2025, the total global VC funding reached $97B, marking the fourth consecutive quarter exceeding $90B and a robust 38.6% year-over-year increase. Q3 was characterized by extreme capital concentration with mega rounds ($500M+) capturing more than 30% of all funding and just 18 companies securing one-third of total capital deployed.

AI dominated with $45.1 billion(46.4% of total funding) driven by Antropic’s transformational $13 billion round. This quarter crystallizes a fundamental market restructuring toward fewer, larger deals to proven winners across strategic technology sectors.

Key Takeaways: Q3 2025 Analysis

- Market Stabilization at Elevated Levels: Q3 demonstrated that venture capital has recovered to pre-slowdown funding levels ($97B) and stabilized there.

- Extreme Capital Concentration: More than 30 percent of capital in mega-rounds and 18 companies capturing one-third of funding represent unprecedented selectivity. This trend intensified from Q2 to Q3.

- AI as Dominant Investment Theme: AI’s 46.4 percent share of funding reflects investor conviction in foundational technology transformation.

- Late-Stage Strength with Early-Stage Recovery: Late-stage funding captured $58.4B (60% of total). At the same time, early-stage showed 11% growth, suggesting investors are scaling proven winners while cautiously deploying capital in strategic early-stage opportunities.

- Bifurcated Deal Market: The market exhibits a clear division between mega-rounds ($500M+) capturing disproportionate capital and sub-$500M rounds serving the broader startup ecosystem.

- Sectoral Consolidation: Q3 saw consolidation around AI dominance compared to Q2’s more diverse sector landscape (defense, quantum, nuclear, stablecoins).

Q3 2025 Market Snapshot

Key Metrics

| Metric | Q3 2025 |

|---|---|

| Total Funding | $97B |

| Yoy Growth | 0.386 |

| QoQ Growth | 0.025 |

| Consecutive Quarters>$90B | 4th |

| Mega-rounds($500M) | >30% of total capital |

| Companies capturing 33% of funding | 18 firms |

| US Share of Global VC | ~62%($60B) |

Capital Concentration

Q3 revealed an unprecedented concentration of venture capital:

- More than 30 percent of total funding flowed into mega-rounds ($500M+)

- Just 18 companies captured approximately one-third ($32B) of all Q3 funding

- 11 of these 18 mega-deals closed in September alone, highlighting the lumpy, event-driven nature of capital deployment

- selective investor behavior because Capital concentration becomes more intense compared to earlier quarters.

This reflects a market where institutional capital flows unreasonably to proven category leaders with clear scale trajectories, while emerging and mid-market companies face fundraising challenges.

AI Dominance and Megadeals

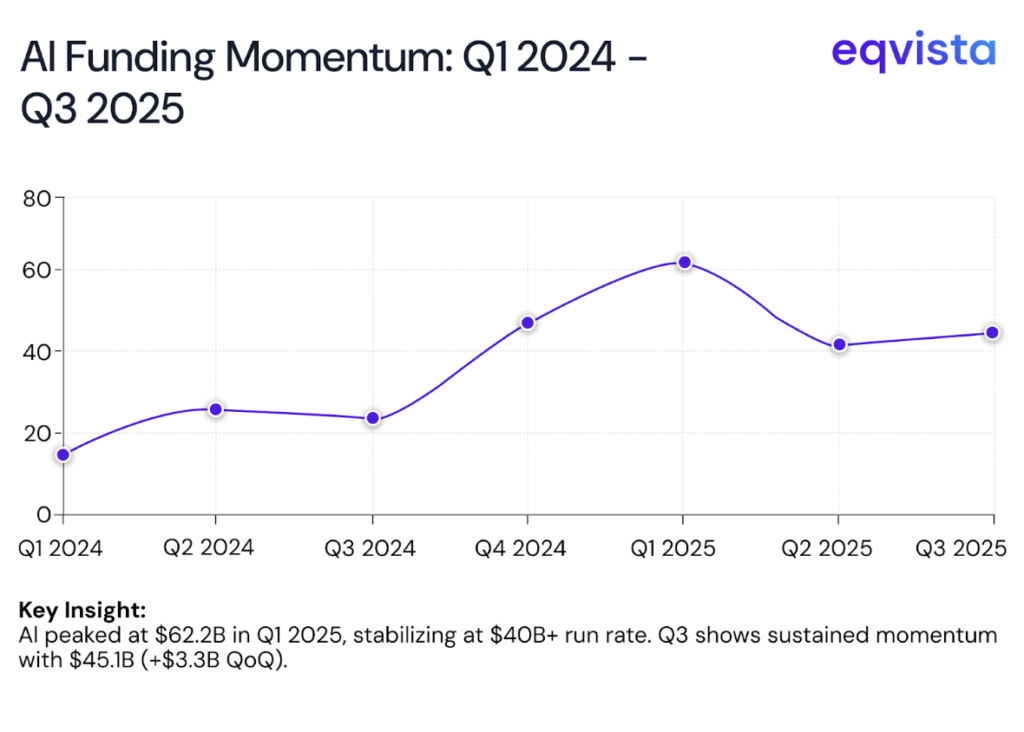

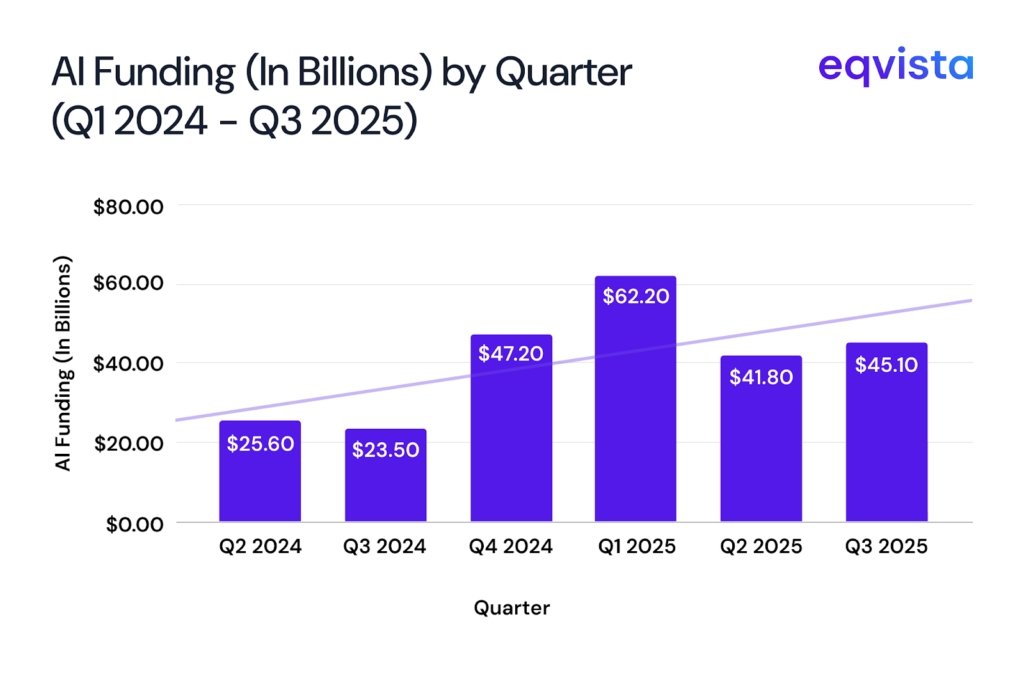

AI was the indisputable leader of Q3 2025, with funding growth accelerating and mega-deal activity reaching record levels.

Q3 AI Funding Shot

- Total AI Funding: $45.1B (46.4% of all global VC)

- Share of Total Venture Capital: Nearly half of all funding

- QoQ Growth: +$3.3B from Q2 ($41.8B)

- Notable Finding: Anthropic’s $13B round alone represented 29% of total Q3 AI funding

Largest Q3 Deals 2025

| Company | Amount Raised | Sector |

|---|---|---|

| Anthropic | $13B | AI (Foundation) |

| xAI | $5.3B | AI |

| Mistral AI | $2B | AI |

| Princeton Digital | >$1B | Infrastructure |

| Nscale | >$1B | — |

| Cerebras Systems | >$1B | Hardware / AI |

| Figure | >$1B | Robotics / AI |

| Databricks | >$1B | Data / AI |

| PsiQuantum | >$1B | Quantum |

September Concentration: 11 of the 18 mega-deals ($500M+) closed in a single month, demonstrating the extreme lumpiness of capital deployment and the event-driven nature of late-stage venture funding.

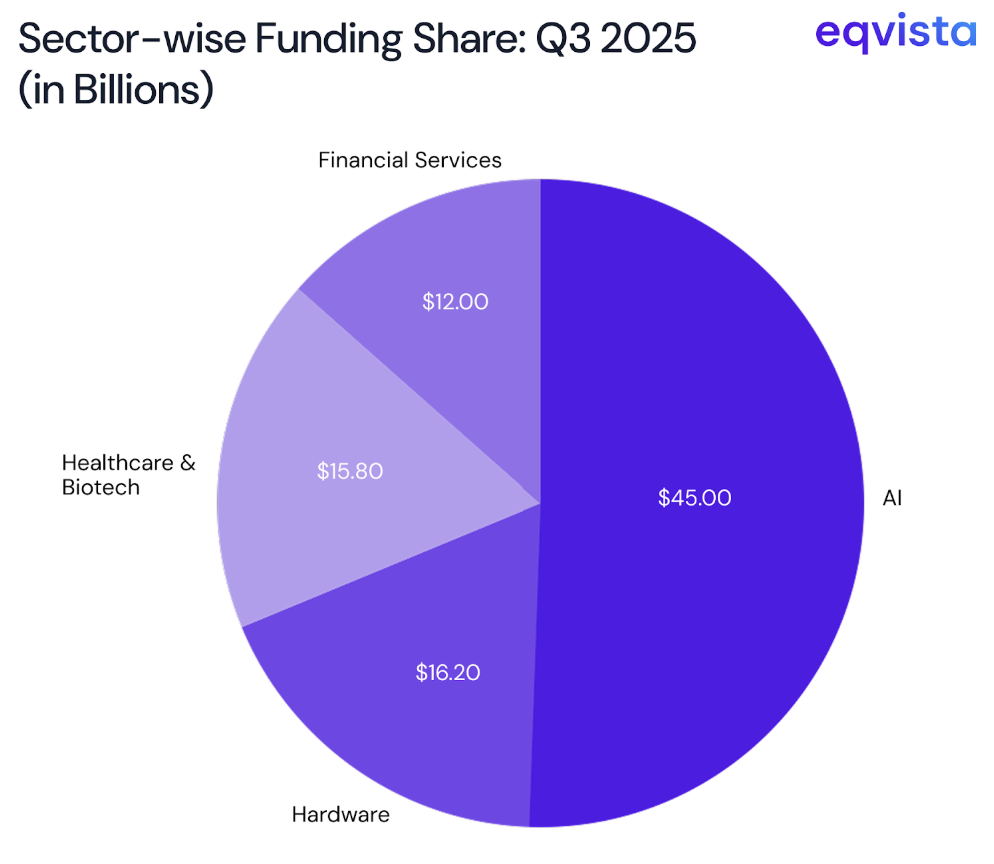

Sector Performance: Q3 2025 Breakdown

Sector-wise Funding Distribution

| Sector | Funding (in Billions) | Share of Total | Key Characteristics |

|---|---|---|---|

| AI | $45.00 | 46.40% | Dominant; foundation models, applied AI, robotics |

| Hardware | $16.20 | 16.70% | Semiconductors, Quantum computing, infrastructure |

| Healthcare & Biotech | $15.80 | 16.30% | Third-largest sector; steady investment |

| Financial Services | $12.00 | 12.40% | Fourth largest, stablecoins and fintech |

Overwhelming Dominance of AI

AI’s 46.4 percent share of total venture funding represents a shift in capital allocation priorities. The sector encompasses of,

- Large language models and generative AI platforms (Foundation Models).

- Enterprise software, autonomous systems, robotics (Applied A).

- Data platforms, computing hardware, training infrastructure (AI Infrastructure).

The concentration of AI funding reflects investor judgement, that this technology represents a foundational transformation comparable to previous paradigm shifts.

Investment Stage Dynamics: Q3 2025

Q3 reveals the market is increasingly bifurcated between late-stage mega rounds and modest early-stage recovery.

Funding by Stage

| Stage | Q3 2025 Funding | YoY Growth | QoQ Change | Number of Companies | Notes |

|---|---|---|---|---|---|

| Late Stage | $58B | 66.00% | Slight increase | 450+ | Strongest driver of YoY gains |

| Early Stage | $30B | 10.00% | 10.00% | 1,700+ | Larger Series A/B in AI, energy, quantum |

| Seed | $9B | Slight increase | - | 3,500+ | Up from $8.5B YoY; subject to reporting lag |

Q3 demonstrated a market heavily weighted toward late-stage mega-rounds, with early-stage funding showing renewed momentum, particularly in frontier technology sectors (AI, quantum, energy, defense). In contrast, seed funding remained stable above year-over-year levels.

Global Distribution and Geographic Concentration

U.S. Market Dominance

- U.S. Funding: $60B (approximately 62% of global VC)

- Global Total: $97B

- Regional Note: The Americas remained the overwhelming center of venture capital activity, reflecting the concentration of AI companies, defense technology investment, and institutional capital in the United States

Deal Characteristics and Market Structure Evolution

Deal Volume Trends

| Metric | Q3 2025 | Context |

|---|---|---|

| Total Q3 deals | ~6,000 | Lowest since Q4 2016 |

| 2025 Projected Annual | ~25,000 | 50% of 2022 peak volumes |

| Median Deal Size | $3.5M(q2 record) | Shift towards late-stage deals |

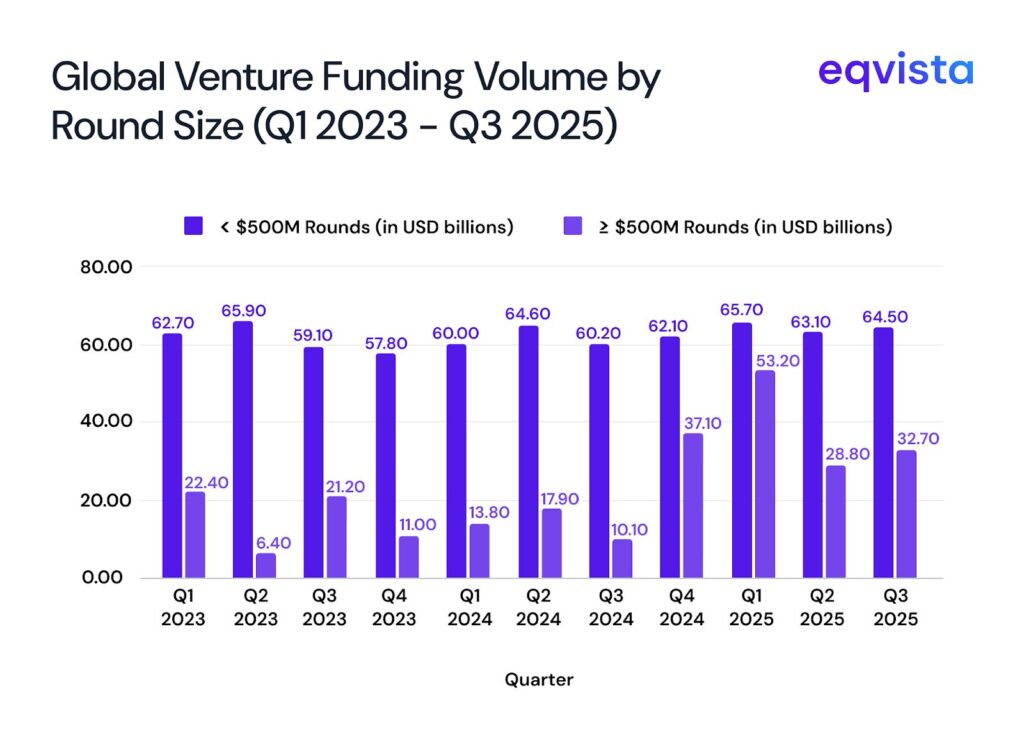

Round Size Distribution; Bufurcated Market

| Round Size | Q3 2025 Funding | % of Total | Trend |

|---|---|---|---|

| <$500M | $64.5B | 66.4% | Stable; majority of deal count |

| >$500M | $32.7B | 33.6% | Intensifying concentration |

The market exhibits a clear bifurcation: mega-rounds ($500M+) increasingly capture capital disproportionate to deal count, while sub-$500M rounds remain substantial in absolute terms but face headwinds from investor selectivity and larger median check sizes.

Q3 vs Q2 Comparative Analysis

In 2025, venture capital activity in Q2 and Q3 shows a great shift in investor behavior and funding priorities. As the market moves from broad-based deal-making to a more focused deployment of capital, the past two quarters have seen a concentration in larger, later-stage investments.

Understanding these trends gives valuable insight into how strategic themes, deal sizes, and sector preferences are reshaping the future of venture financing.

Summary of Trends

| Metric | Q3 2025 | Q2 2025 | Change | Analysis |

|---|---|---|---|---|

| Total Funding | $97B | $94.6B | +2.5% QoQ | Modest QoQ increase; strong YoY growth |

| Deal count | Concentrated Rounds | 6,028 (lowest since Q4 2016) | Stable | Consistent with pattern of fewer, larger deals |

| YoY Growth | 0.386 | _ | Strong | Reflects ongoing recovery from 2022-2023 slowdown |

Interpretation: Q3 demonstrates that venture capital has stabilized at historically high funding levels without significant quarter-over-quarter expansion. The 2.5 percent QoQ growth masks robust underlying strength (38.6% YoY), indicating market normalization rather than overheating.

Capital Concentration Comparison

| Aspect | Q2 2025 | Q3 2025 | Evolution |

|---|---|---|---|

| Mega-round share($500M+) | High(hard tech,defense focused) | >30% of total;18 firms took 33% | Intensified concentration |

| Deal structure | Concentrated rounds | Concentrated Rounds | Unchanged pattern but accelerated |

| September effect | - | 11 of 18 mega deals | New phenomenon highlighting lumpiness |

Key Finding: While Q2 showed concentrated capital patterns, Q3 revealed even more extreme concentration. The phenomenon of 11 mega-deals closing in a single month (September) demonstrates that capital flows have become increasingly event-driven and lumpy.

Sector Evolution: Q2 TO Q3

| Q2 2025 Dominant Sectors | Q3 2025 Dominant Sectors | Shift |

|---|---|---|

| AI, Defense Tech, Stablecoins, Quantum, Nuclear Energy (diverse) | AI (46%), Hardware (16.7%), Healthcare (16.3%), Fintech (12.4%) (consolidated) | AI dominance strengthened; sectoral consolidation. |

Analysis: Q2 showed more sectors with defense, quantum, and nuclear energy competing for the attention of investors. Q3 witnessed AI as the dominant investment theme, with other sectors becoming secondary.

Global Venture Funding Volume by Round Size (Q1 2023 – Q3 2025)

| Quarter | < $500M Rounds (in USD billions) | ≥ $500M Rounds (in USD billions) |

|---|---|---|

| Q1 2023 | 62.7 | 22.4 |

| Q2 2023 | 65.9 | 6.4 |

| Q3 2023 | 59.1 | 21.2 |

| Q4 2023 | 57.8 | 11 |

| Q1 2024 | 60 | 13.8 |

| Q2 2024 | 64.6 | 17.9 |

| Q3 2024 | 60.2 | 10.1 |

| Q4 2024 | 62.1 | 37.1 |

| Q1 2025 | 65.7 | 53.2 |

| Q2 2025 | 63.1 | 28.8 |

| Q3 2025 | 64.5 | 32.7 |

Stage-Wise Investment Trends

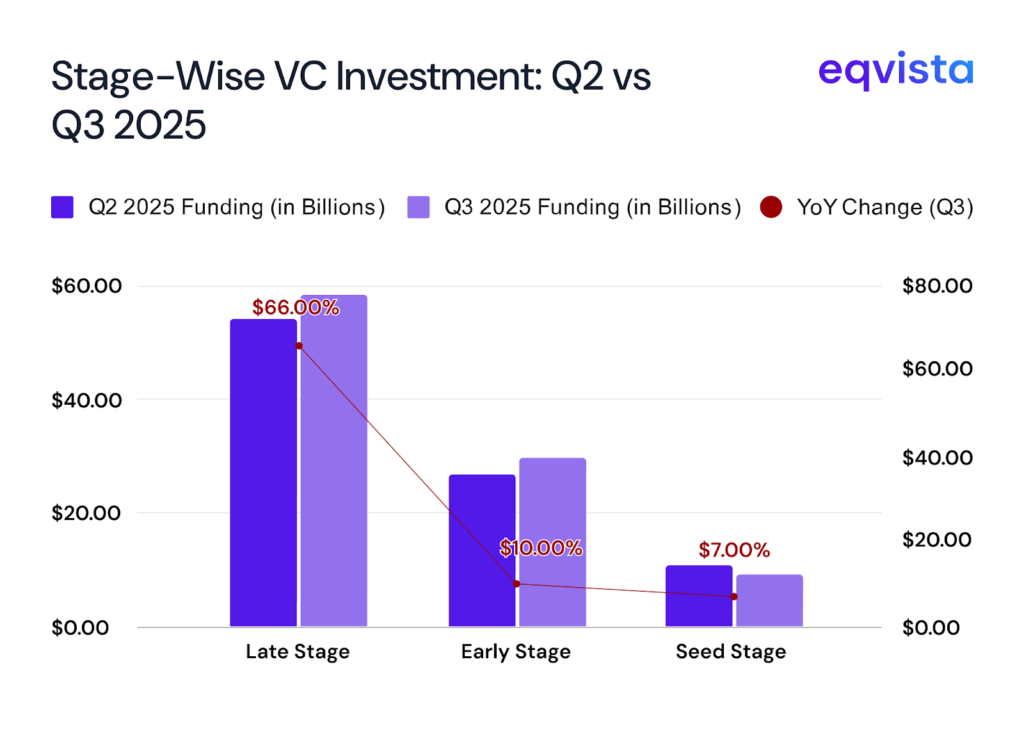

Stage-Wise VC Investment: Q2 vs Q3 2025

| Stage | Q2 2025 Funding | Q3 2025 Funding | Change | Analysis |

|---|---|---|---|---|

| Late Stage | $54.30 | $58.40 | +7.5% QoQ, +66% YoY | Continued strength; mega-deals drive growth |

| Early Stage | $26.80 | $29.80 | +11% QoQ, +10% YoY | Recovery emerging; renewed interest in Series A/B |

| Seed Stage | $10.80 | $9.10 | -15.7% QoQ, +7% YoY | Slight contraction; remains elevated YoY |

Stage Comparison: Q3 shows late-stage mega-round intensity accelerating while early-stage demonstrates renewed confidence, though seed funding contracted slightly—a pattern consistent with investors concentrating capital in proven opportunities.

AI Funding Trajectory: Q2 TO Q3

| Metric | Q2 2025 | Q3 2025 | Change |

|---|---|---|---|

| AI Funding | $41.8B | $45.1B | +$3.3B(+7.9%) |

| Share of Total VC | 44% | 46.40% | +2.4 percentage points |

| Largest deal | Scale AI ($14.3B) | Antropic ($13B) | Different companies;similar scale |

Interpretation: AI funding has stable at elevated but not peak levels. While the $13B Anthropic round was the largest of the quarter, the field of mega-deals has widened (xAI $5.3B, Mistral $2B, plus eight companies raising >$1B), suggesting AI capital is diversifying beyond single dominant companies.

Deal Count and Market Structures

| Metric | Q2 2025 | Q3 2025 | Implication |

|---|---|---|---|

| Total Deals | 6,028 | ~6,000 | Stable; consistent with low levels since Q4 2016 |

| Projected 2025 Annual | ~25,000 | ~25,000 | 50% of 2022 peak; structural decline |

| Average check size | Increasing | Increasing | Market moving to larger, fewer deals |

Market Structure Evolution: Q2 and Q3 demonstrate that the venture capital market has undergone permanent structural change. Rather than a cyclical trough in deal count, the 2022-2023 slowdown appears to have reset investor behavior toward larger checks and greater selectivity. The consistency of deal counts between Q2 and Q3 suggests this new structure has stabilized.

2026 and Beyond: What Next For VC?

Foundational AI models, applied AI applications, and infrastructure will remain primary capital allocation themes as investors develop ideas in ROI and commercial viability.Defense technology, quantum computing, and energy sectors will maintain elevated valuations and capital access due to geopolitical and macroeconomic priorities.

Improved IPO markets and acquisition activity could create capital recycling opportunities and provide liquidity events for mature venture investors.

The bifurcated market structure—mega-rounds to category leaders and starved capital for mid-market companies—will likely persist as investor behavior has structurally shifted toward concentrated bets.

Startups outside strategic technology sectors or lacking clear market differentiation will require exceptional operational discipline, defensible market positions, and demonstrated ability to achieve meaningful scale to access capital at competitive valuations.

For founders fitting in this new landscape, understanding cap table management and equity structuring has become critical. Solutions like Eqvista provide essential infrastructure for startups to manage complex ownership structures, track dilution across funding rounds, and maintain cap table transparency.