How Eqvista Supports Public Companies in Mergers, Acquisitions, and Key Transactions

Public companies pursuing inorganic growth face two major compliance burdens. They must balance ongoing financial reporting obligations under GAAP with the requirement to provide adequate transparency to stakeholders when acquiring private sector companies.

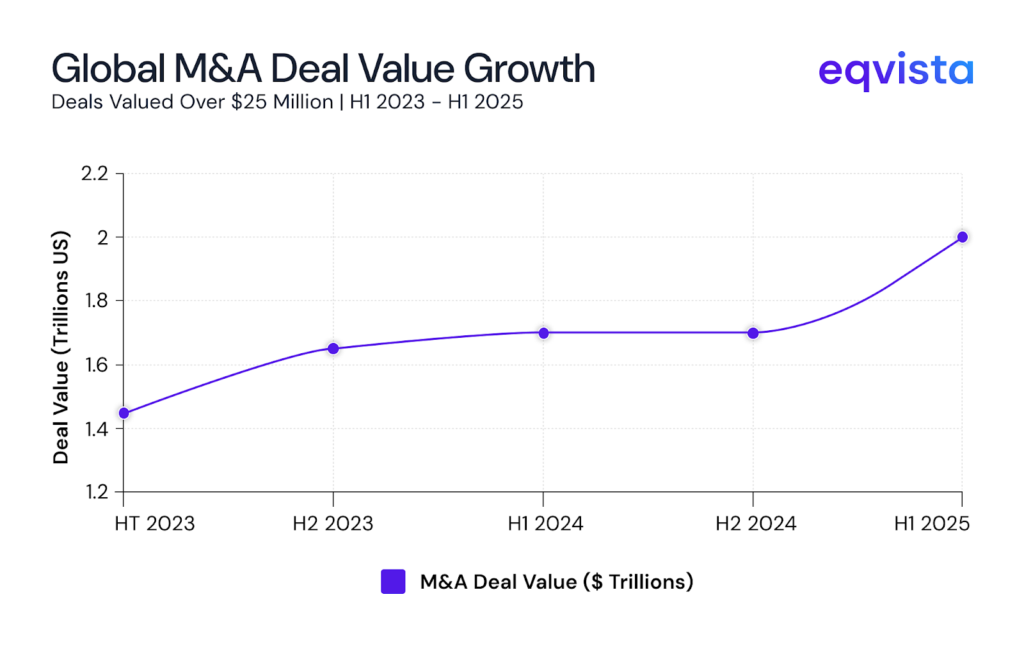

As M&A competition intensifies, the need to meet these already onerous requirements with speed and defensibility has grown sharply. Global M&A deal value reached $2 trillion in the first half of 2025, up 22% from the same period last year. In the US alone, 51% of the companies that responded to PWC’s survey are actively pursuing deals, while another 30% have paused or are reevaluating transactions due to tariff uncertainty.

Companies that can move quickly while staying compliant will gain a tangible strategic advantage.

This almost entirely hinges on the quality of a single document, specifically the fairness opinion. It helps management demonstrate to shareholders and regulators that the deal price is appropriate and often must be compiled within days rather than weeks. The complexity and time-sensitivity of this work are reflected directly in the normally sky-high advisory fees.

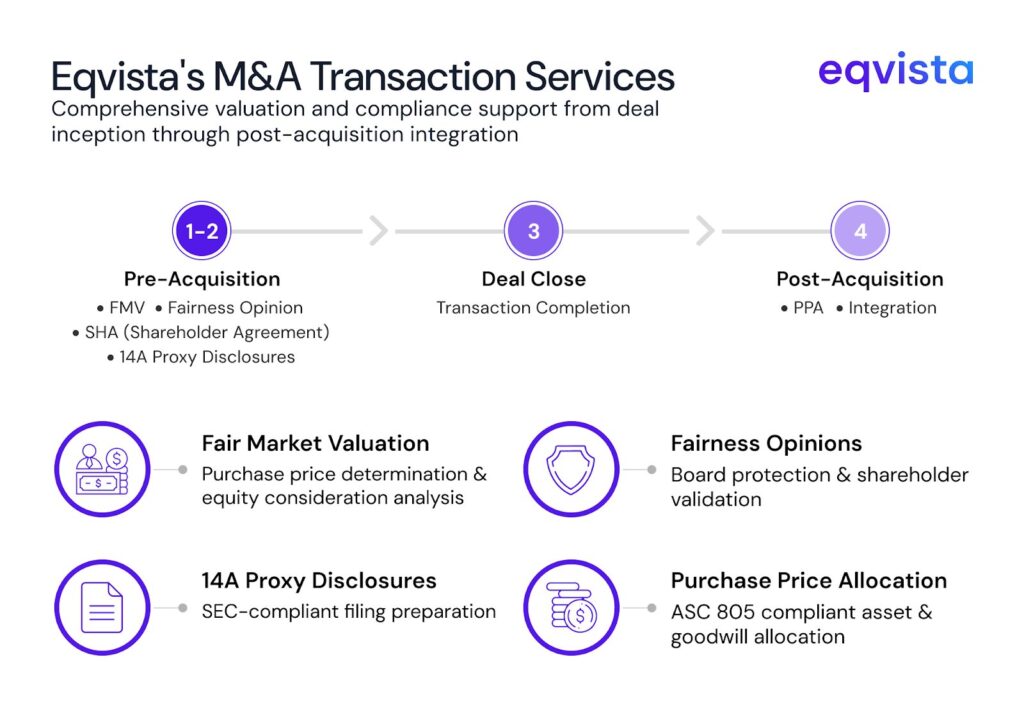

Against this backdrop, Eqvista delivers a comprehensive valuation and reporting solution for M&A transactions and ongoing GAAP compliance that maintains the highest industry standards while delivering 60-70% cost savings compared to traditional providers.

The M&A Transaction Support

M&A transactions demand clarity before the deal closes and precision after it closes.

When Eqvista’s Services Apply

Eqvista supports public companies across a wide range of transaction scenarios:

For Corporate Development Teams

- Public companies acquiring private companies

- Mergers, acquisitions, or sale of substantially all assets

- Tender offers

- Reverse mergers and SPACs

For Boards & Management

- Going-private transactions (management buyouts, insider-led)

- Boards requiring independent deal validation

- Private companies acquiring public companies

For Finance & Legal Teams

- Legal teams preparing post-merger filings

- Audit teams supporting public reporting

Whether you’re navigating a complex merger, preparing for a shareholder vote, or managing post-acquisition accounting, Eqvista delivers the valuation and compliance support you need.

Pre-Acquisition Support

Once your team has identified the right acquisition target, the next crucial challenge is determining a price that creates value rather than adversely affecting it. Paying the wrong price can erase the very synergy the deal was meant to generate. Shareholders and board members remain acutely focused on this risk.

This is where rigorous valuation analysis becomes essential. A well-supported assessment helps internal teams model the economics of the transaction, strengthens negotiations, and provides decision-makers with a grounded view of the target’s intrinsic and strategic value.

It also provides the analytical foundation for the fairness assessments required in SEC DEFM14A filings, where financial projections from the seller must be evaluated objectively.

Valuation isn’t just a compliance requirement. It is the backbone of sound due diligence and informed decision-making.

Post-Acquisition Support

Once the acquisition closes, the focus shifts from pricing to reporting, and the clock usually starts immediately. Under ASC 805, companies must recognize acquired assets, assumed liabilities, goodwill, intangible assets, and any bargain purchase gains at fair value, as defined by ASC 820. Most businesses can choose a measurement date up to a year after the acquisition date and record entries accordingly. But public companies don’t have the same leeway because of quarterly reporting obligations.

This process requires careful modelling and a clear linkage between the purchase price and the reported values.

Instead of piecing together disparate assumptions or rushing to reconcile numbers near filing deadlines, companies can benefit from Eqvista’s well-structured analyses that align the deal model with GAAP reporting requirements. These valuations also support ASC 718-compliant stock-based compensation expensing during the transition period.

When done effectively, this work simplifies the entire post-deal reporting process, reduces audit friction, and gives management confidence that disclosures are fully defensible and compliant.

What Eqvista Delivers

Eqvista’s approach is built for public companies that need precision, speed, and cost-efficiency without compromising independence or audit confidence. Our offering is designed to be a complete solution, not an add-on service.

Here’s what sets Eqvista apart:

Complete Valuation and Disclosure Services

From initial price-setting through post-acquisition reporting, Eqvista supports the entire deal lifecycle. We provide fair value analyses, purchase price allocations, and fairness opinions for both investor disclosures and auditor reviews.

Big 4 Audit-Ready Documentation

Eqvista’s documentation stands up to Big 4 and IRS scrutiny. Our reports are designed to be technical, transparent, and fully defensible. Our conviction is that thorough reporting reduces audit questions, shortens review cycles, and enables management to make highly consequential capital decisions confidently.

100% Independent, Objective, Defensible

Throughout the deal cycle, Eqvista carefully calibrates the scope of work and interactions to maintain complete independence and objectivity. This ensures our work can be used seamlessly for M&A filings, board materials, regulatory compliance and auditor review without any conflict-of-interest concerns.

Rapid Response Team Availability

Eqvista’s agile and direct support ensures that clients get immediate support when timelines compress or regulatory deadlines shift. Whether it’s a last-minute scenario analysis or a next-day valuation review, our team is structured to meet the pace of real-world transactions.

60-70% Cost Savings vs. Big 4

Traditional advisory models are expensive, often due to overhead, partner-heavy staffing, or success-fee structures. Eqvista is different. Our model replaces inflated costs with efficiency, delivering the same rigorous analysis while reducing costs by 60-70%. For public companies managing recurring transactions and ongoing GAAP reporting, these savings can be transformative as they free capital for strategic initiatives rather than compliance overhead.

Comprehensive Service Offering

Eqvista’s M&A support includes four core deliverables designed to meet regulatory requirements and support sound decision-making:

- Fair Market Valuation (FMV): Market-based valuation of the acquired entity, with defensible methodology, sector benchmarking, and integration assumptions that withstand shareholder, regulatory and auditor scrutiny.

- Fairness Opinion: Independent valuation-based opinion for the board of directors, validating that the terms of the transaction are fair from a financial point of view and support fiduciary responsibility to shareholders.

- Disclosure Documentation: SEC-ready language and data sets that inform and feed directly into 10-Q, 8-K, and other public reporting materials, including 14A proxy disclosures.

- Purchase Price Allocation (PPA): ASC 805-compliant PPA model, allocating purchase price across tangible and intangible assets (IP, goodwill, etc.) to ensure accurate GAAP reporting. These deliverables work together to provide a complete solution—from initial valuation through final regulatory filings.

Choose Eqvista for pre-acquisition clarity and post-acquisition precision!

As M&A activity accelerates and compliance expectations tighten, public companies need a partner that can support them with speed, accuracy, independence, and cost-efficiency.

Eqvista delivers valuation and disclosure support built for today’s environment. Our offerings are comprehensive enough for complex transactions, precise enough for auditors, and efficient enough to keep teams focused on strategy rather than compliance.

Whether you need a trusted valuation partner for your next transaction or your last one, Eqvista is ready to help.

Next Steps…

Connect with our team to understand why public companies should transition to Eqvista for both transaction support and ongoing compliance.

Schedule a consultation to explore how we can support your next acquisition with Big 4-level rigor, delivered with greater responsiveness and significantly lower cost.

Request a custom cost comparison for your M&A pipeline to see precisely how much you can save while maintaining, and often elevating, the quality of your due diligence and reporting.