Inside the VC Pulse: Making Sense of U.S. Funding Trends in November 2025

The funding market has been on fire owing to the AI revolution.

This makes it important to understand what is transpiring in the US VC market. This article aims to achieve the same goal using the November 2025 VC deals as its source.

Number of AI companies by funding type, funding raised and Multiples

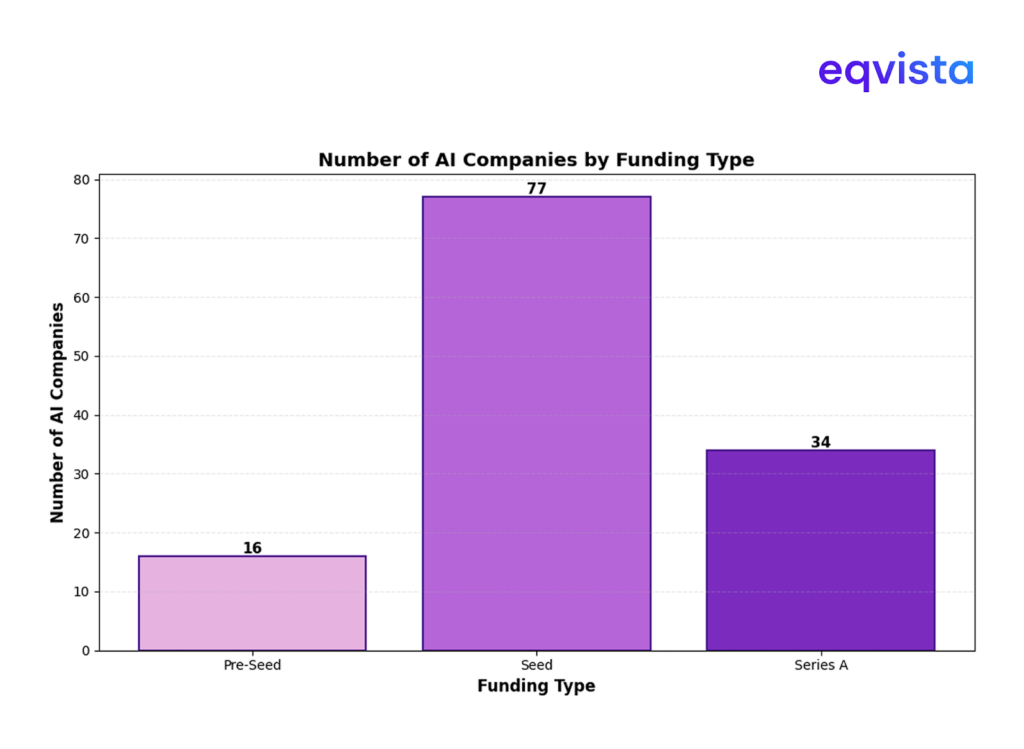

Figure 1: Frequency of AI companies by Funding Type, Data source: Crunchbase

In November 2025, data show that out of 189 seed companies, 77 were AI companies, out of 57 pre-seed companies, 16 were AI companies, and out of 81 Series A companies, 34 were AI companies. This would translate into 40%, 28%, and 41% market share for AI companies in Pre-Seed, Seed, and Series A, respectively.

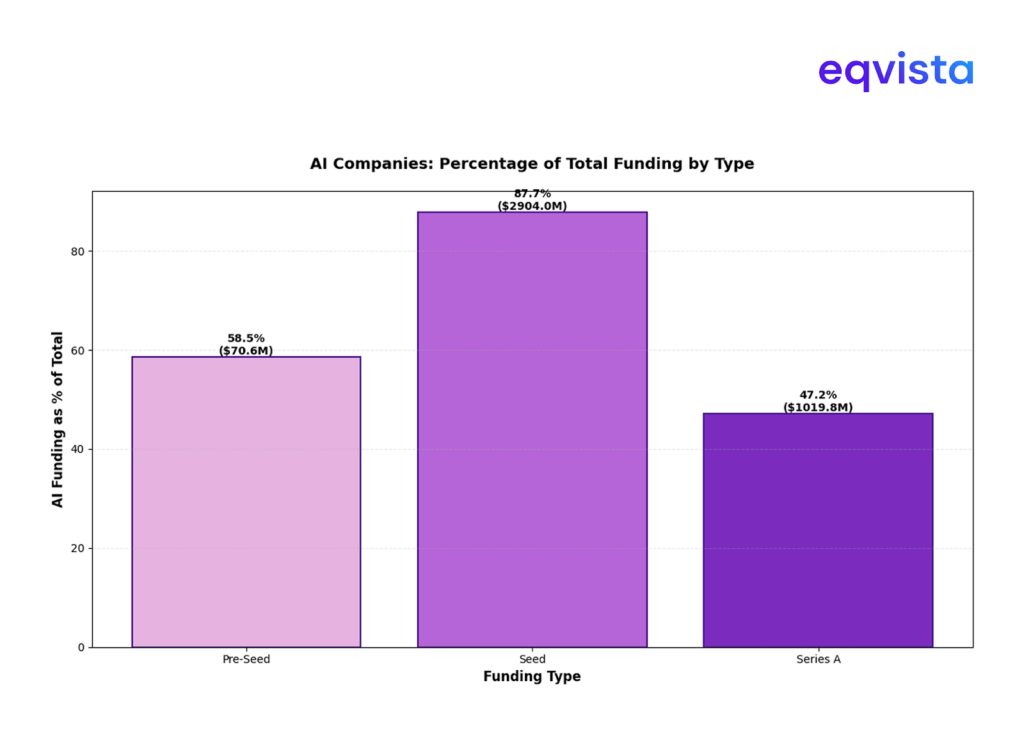

Figure 2: Capital Raise of AI Companies by Funding Type, Data source: Crunchbase

When accounting for total capital raises, the chart above shows that AI businesses have punched above their weight. This trend has been visible all across the past few months. AI companies in the Pre-seed stage raised ~1.5x their weight, Seed stage 3.1x their weight, and Series A stage 1.2x their weight.

Figure 3: Raise Premium of AI Companies by Funding Type, Data source: Crunchbase

On a median basis relative to non-AI companies, AI companies raised 2.48x in the pre-seed stage, 2x in the Seed stage, and 1.67x in the Series A stage.

Last Funding Amount by Industry

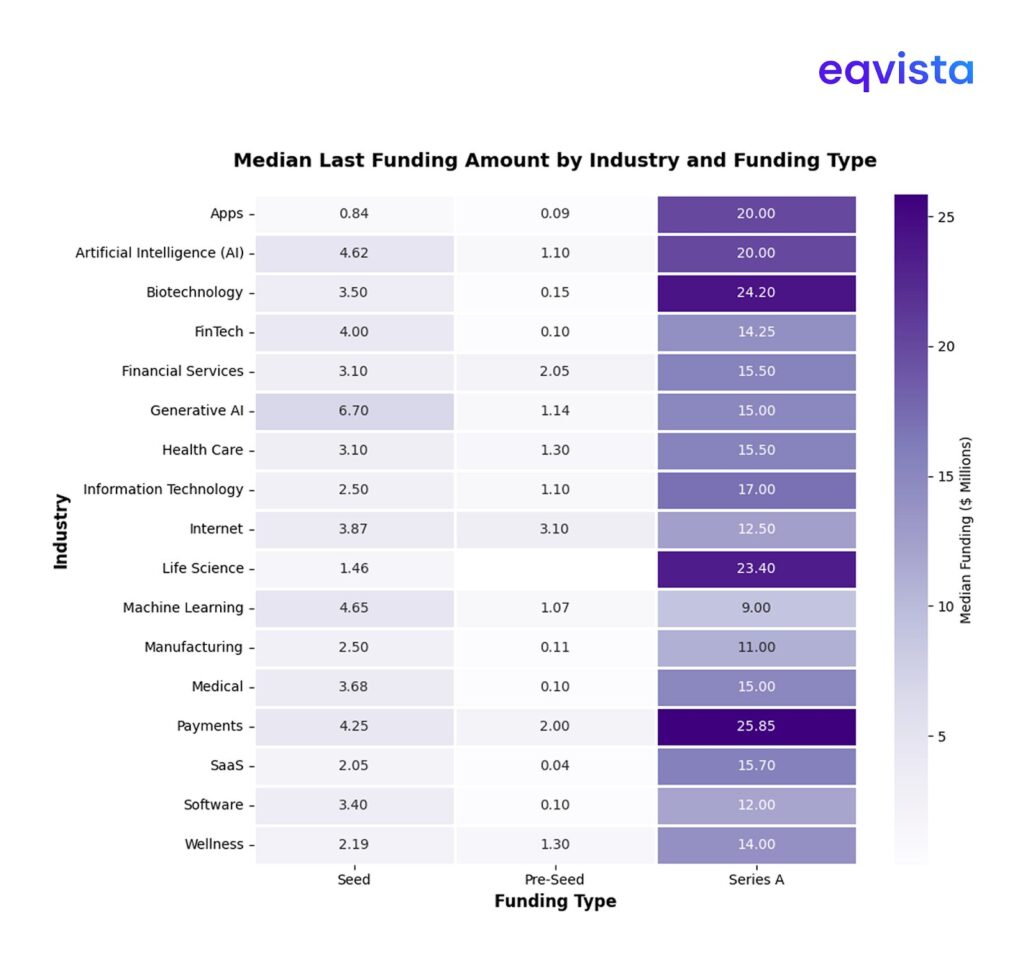

Figure 4: Median Last Funding Amount, Data source: Crunchbase

In the pre-seed space, internet companies, financial services, and payments did better than most. In terms of the last funding round in the seed stage, Generative AI, Machine Learning, and AI dominated the space. Lastly, in Series A payments, biotechnology and life sciences did well.

Top 10 Cities Contribute 52% of the US deals

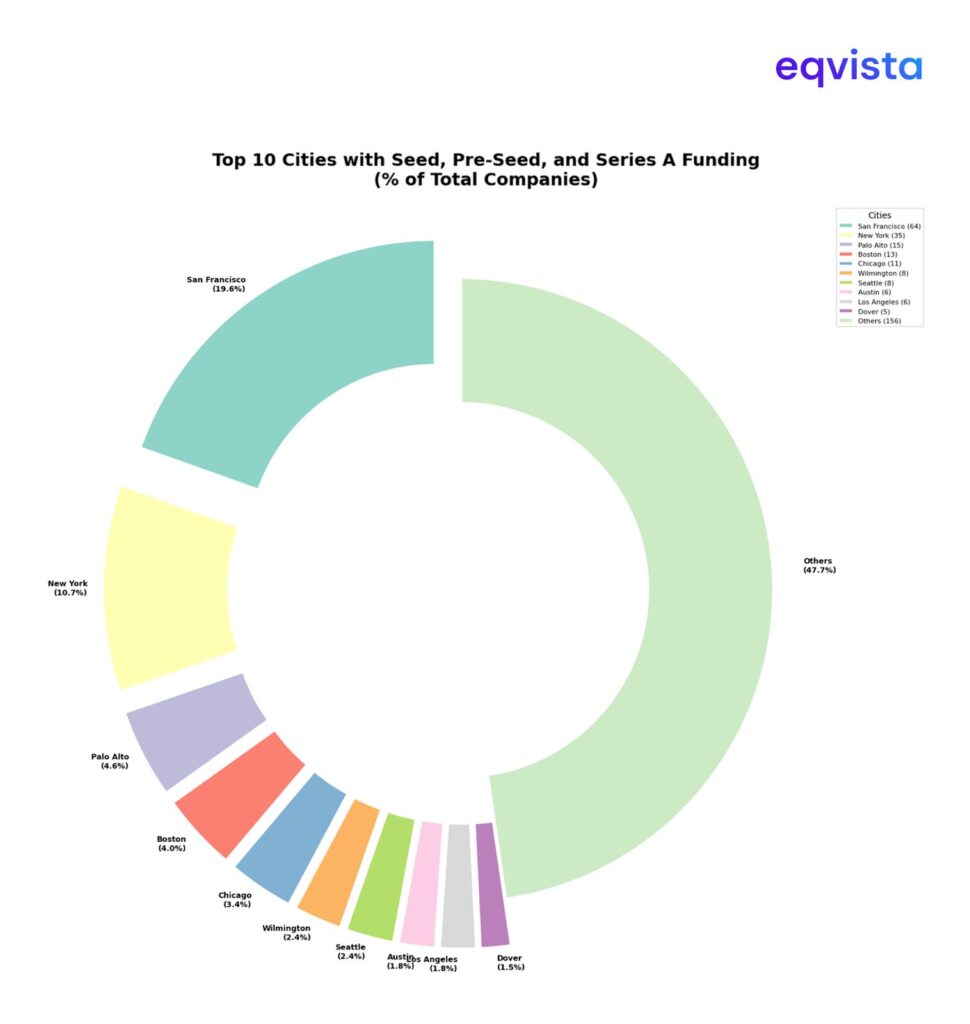

Figure 5: Top 10 Cities and their share by Frequency in Capital Raise, Data source: Crunchbase

In an endeavor to understand the geographical concentration of deals, we find that 19.6% deals were in San Francisco, 10.7% in New York. Further, about a third of all AI deals were in San Francisco.

From Founded to Funded: Early-Stage Timelines

Founded to fund maps of how fast startups are raising funds.

November data shows that, on a median basis, it took 1 year for a company from its founding date to receive its first (pre-seed) investment. Whereas it took 2.1 years on a median basis for a company to receive a seed round and 3.8 years for Series A.

Figure 6: Years to become funded from founded, Data source: Crunchbase

In the pre-seed space, AI, IT, and SaaS had the lowest duration of this metric, raising money in 0.9 years. In the seed space, recruiting raised money in 0.9 years, and Financial Service and AI were joint 2nd with 1.9 years from founded to funded.

Further, in Series A space, the medical industry took 2.4 years, Biotechnology 2.8 years, and Artificial Intelligence 2.9 years.

Looking Ahead: What November’s Slowdown Signals for 2026

October saw a slowdown in pre-seed, seed, and Series A deals, as reported earlier. This month, the slowdown continued, with deals dropping by 18% in pre-seed space, a 30% drop in seed space, and a 29% drop in Series A. This drop is on top of an already slowing October.

If we compare the month on a yearly basis, there is a 50% drop in pre-seed round, a 14% drop in seed round, but on the flip side, there is 22% growth in Series A. Further, on comparing the entire 11 months of 2025 vs the 11 months in 2024, we find a flat year with only 1% growth in the frequency of deals of pre-seed, seed, and Series A combined

The above data highlights a simple truth: markets breathe in cycles, and the current flavour is one of consolidation after years of remarkable growth. Yet even in this quieter season, the undercurrent of innovation keeps moving—slow, steady, inevitable.