NEA Investment Portfolio 2025: Strategic Shifts in Technology and Life Sciences

New Enterprise Associates (NEA) has maintained its position as a leading investor across multiple sectors, making it one of the world’s famous venture capital firms. Founded in 1977, NEA has built an impressive track record with over 280 portfolio companies reaching IPO and 99 achieving unicorn status. The firm’s portfolio includes leaders like Cloudflare, Coursera, and Plaid.

In 2025, NEA’s investments reflect changing market dynamics and emerging scope in AI, software, and life sciences. This analysis examines NEA’s investment patterns in 2025 and discusses key trends and priorities.

Key Investment Themes

- AI and Enterprise Software Dominance: NEA increased its exposure to AI and enterprise software companies, participating in landmark deals for ElevenLabs ($180M Series C) and Synthesia ($180M Series D), both leaders in generative AI technology.

- Healthcare Innovation: The firm maintained its strong presence in life sciences, and digital health solutions. Key investments comprise Tune Therapeutics and Abcuro , both progressing innovative treatments.

- Fintech Evolution: NEA continued supporting financial technology innovation with major investments in Plaid ($575M) and established players adapting to changing regulatory and market conditions.

2025 NEA’s Investment Landscape

Throughout 2025, NEA capital across 70 companies shows large growth in both sector focus and stage preference. The firm’s investments ranged from early-stage to late-stage growth equity, with total funding exceeding $5.8 billion across the portfolio.

| Sr. No | Organization Name | Funding Type | Announced Date (Jan 2025 - 10 Dec 2025) | Money Raised in Round (in USD) |

|---|---|---|---|---|

| 1 | Wonder | Series D | 2025-05-06 | 600000000 |

| 2 | Plaid | Venture - Series Unknown | 2025-04-03 | 575000000 |

| 3 | Clio | Series G | 2025-11-10 | 500000000 |

| 4 | Strive Health | Series D | 2025-09-09 | 300000000 |

| 5 | Chaos | Series C | 2025-04-30 | 275000000 |

| 6 | Uniphore | Series F | 2025-10-22 | 260000000 |

| 7 | Abcuro | Series C | 2025-02-12 | 200000000 |

| 8 | ElevenLabs | Series C | 2025-01-24 | 180000000 |

| 9 | Synthesia | Series D | 2025-01-15 | 180000000 |

| 10 | Tune Therapeutics | Series B | 2025-01-12 | 175000000 |

| 11 | TAE Technologies | Venture - Series Unknown | 2025-06-02 | 150000000 |

| 12 | Splice Bio | Series B | 2025-06-11 | 135000000 |

| 13 | Sakana AI | Series B | 2025-11-17 | 129281563 |

| 14 | ORIC Pharmaceuticals | Post-IPO Equity | 2025-05-28 | 125000000 |

| 15 | FIRE1 | Series B | 2025-01-07 | 120000000 |

| 16 | Ouro Medicines | Series A | 2025-01-10 | 120000000 |

| 17 | SetPoint Medical | Series D | 2025-08-11 | 115000000 |

| 18 | Veza | Series D | 2025-04-28 | 108000000 |

| 19 | Horizon3.ai | Series D | 2025-05-22 | 100000000 |

| 20 | Instabase | Series D | 2025-01-17 | 100000000 |

| 21 | Perplexity | Venture - Series Unknown | 2025-07-18 | 100000000 |

| 22 | Orbis Medicines | Series A | 2025-01-06 | 93200023 |

| 23 | X4 Pharmaceuticals | Post-IPO Equity | 2025-08-12 | 85000000 |

| 24 | CHARM Therapeutics | Series B | 2025-09-02 | 80000000 |

| 25 | Mojo Vision | Series B | 2025-09-04 | 75000000 |

| 26 | Spyglass Pharma | Series D | 2025-06-02 | 75000000 |

| 27 | Avenzo Therapeutics | Series B | 2025-09-04 | 60000000 |

| 28 | Allay Therapeutics | Series D | 2025-06-05 | 57500000 |

| 29 | House Rx | Series B | 2025-11-12 | 55000000 |

| 30 | Vori Health | Series B | 2025-03-11 | 53000000 |

| 31 | Fabric8Labs | Venture - Series Unknown | 2025-11-13 | 50000000 |

| 32 | Aetherflux | Series A | 2025-04-02 | 50000000 |

| 33 | Swift Navigation | Series E | 2025-07-23 | 50000000 |

| 34 | Factory | Series B | 2025-09-25 | 50000000 |

| 35 | Metronome | Series C | 2025-02-25 | 50000000 |

| 36 | Samaya AI | Series A | 2025-05-14 | 43500000 |

| 37 | Slash | Series B | 2025-05-20 | 41000000 |

| 38 | Affinia Therapeutics | Series C | 2025-10-07 | 40000000 |

| 39 | Music AI | Series A | 2025-01-22 | 40000000 |

| 40 | Arkestro | Series B | 2025-05-14 | 36000000 |

| 41 | Firestorm | Series A | 2025-07-16 | 35000000 |

| 42 | CoreStory | Series A | 2025-10-28 | 32000000 |

| 43 | Wispr Flow | Series A | 2025-06-24 | 30000000 |

| 44 | Brale | Seed | 2025-09-18 | 30000000 |

| 45 | Courtyard | Series A | 2025-07-24 | 30000000 |

| 46 | NG.CASH | Series B | 2025-07-14 | 26500000 |

| 47 | Forethought | Series D | 2025-05-13 | 25000000 |

| 48 | Flox | Series B | 2025-09-25 | 24887984 |

| 49 | Tailor | Series A | 2025-05-20 | 22000000 |

| 50 | Kaizen Labs | Series A | 2025-10-30 | 21000000 |

| 51 | Clockwork Systems | Series A | 2025-09-10 | 20575000 |

| 52 | Bluefish Labs | Series A | 2025-08-20 | 20000000 |

| 53 | Cambium | Series A | 2025-02-24 | 18500000 |

| 54 | Zania | Series A | 2025-09-30 | 18000000 |

| 55 | Glacier | Series A | 2025-04-28 | 16000000 |

| 56 | BNTO | Series A | 2025-01-01 | 15000000 |

| 57 | Aurelian | Series A | 2025-08-27 | 14000000 |

| 58 | Ceramic | Seed | 2025-03-05 | 12000000 |

| 59 | QuoteWell | Series A | 2025-10-08 | 12000000 |

| 60 | Popai Health | Seed | 2025-11-03 | 11000000 |

| 61 | Accordance | Seed | 2025-09-08 | 10000000 |

| 62 | Elion | Seed | 2025-08-06 | 9300000 |

| 63 | Djust | Series A | 2025-10-01 | 8213051 |

| 64 | August | Seed | 2025-08-05 | 7000000 |

| 65 | Translucent AI | Seed | 2025-08-06 | 7000000 |

| 66 | Genie | Seed | 2025-07-22 | 5800000 |

| 67 | Foresight Data | Seed | 2025-06-26 | 5500000 |

| 68 | LizzyAI | Seed | 2025-12-02 | 5000000 |

| 69 | PortfolioPilot | Seed | 2025-09-01 | 2000000 |

| 70 | Ohai.ai | Seed | 2025-08-19 | - |

Data Source: Crunchbase

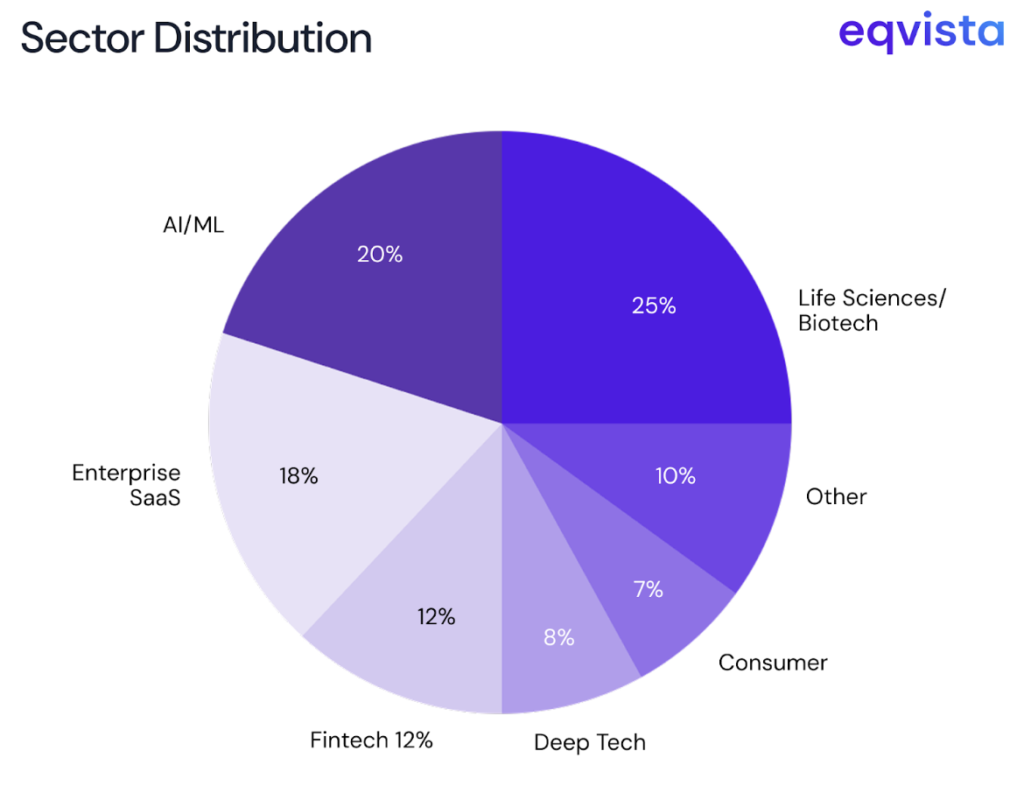

NEA Investment Sector Analysis

- Legal Tech and SaaS: Clio’s $500 million Series G round represents one of the largest investments in legal technology, signaling NEA’s confidence in vertical SaaS platforms that dominate their niches.

- Food and Consumer: Wonder’s $600 million Series D round demonstrates NEA’s willingness to back ambitious consumer concepts that reimagine traditional industries through technology and operational excellence.

- Deep Tech and Infrastructure: Investments in companies like TAE Technologies ($150M) and Swift Navigation ($50M Series E) show interest in foundational technologies that enable future innovation.

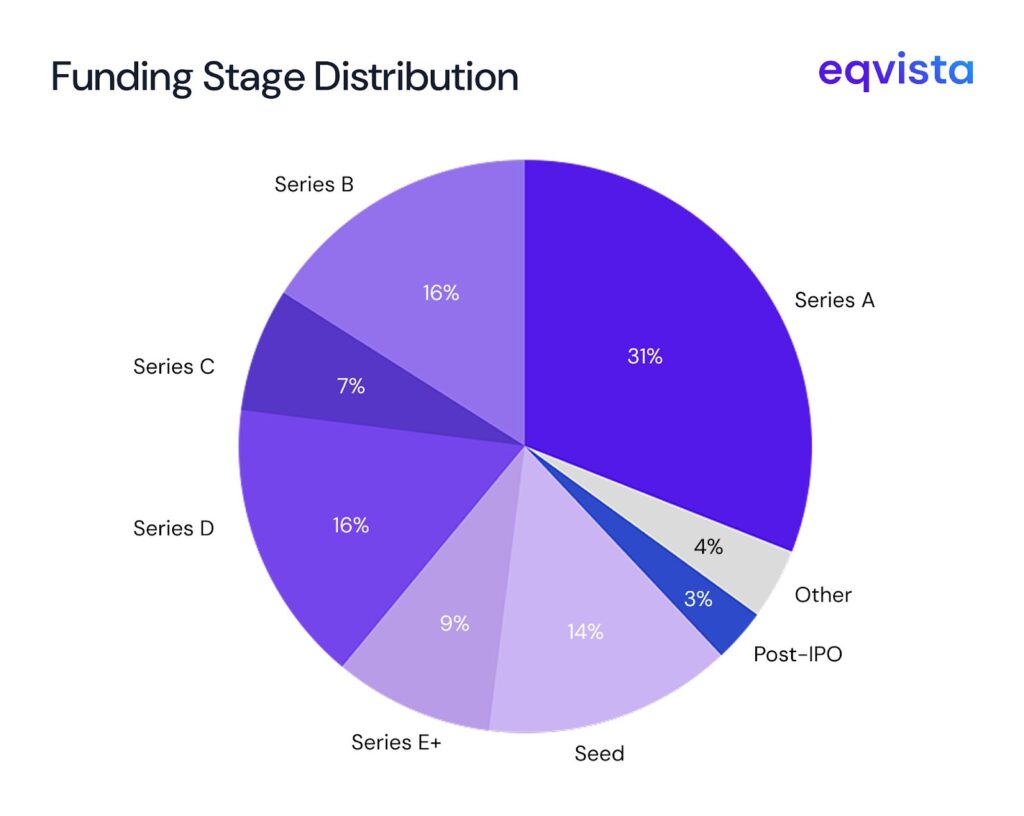

Investment Stage Distribution

NEA’s 2025 portfolio reveals a strategic emphasis on growth-stage companies:

This distribution shows NEA’s emphasis on companies with product-market fit and scaling their operations. The substantial Series A presence reflects the firm’s strategy of identifying promising companies early while maintaining meaningful ownership positions.

Top 10 NEA Investments in 2025

Here are the ten largest funding rounds of NEA during 2025:

1. Wonder – $600M Series D (May 2025)

Wonder continues its mission to transform food delivery by combining multiple restaurant concepts under one roof. The company operates both delivery-focused restaurants and Blue Apron, a meal-kit platform highlighting sustainable sourcing. The funding will support Wonder’s expansion plans, mainly in areas where quality food delivery remains strong.

2. Plaid – $575M Venture Round (April 2025)

Plaid has become essential infrastructure for fintech, connecting thousands of applications to users’ bank accounts securely. This investment round reflects the company’s critical role in the financial services and its expansion into new data connectivity services beyond banking.Plaid continues to innovate across areas such as income verification, identity authentication, and payment initiation.

3. Clio – $500M Series G (November 2025)

Clio, one of the leading cloud-based legal practice management platforms, serves over 150,000 legal professionals across 130+ countries. This funding will revitalize product development around AI-powered features and support development into enterprise clients. Cilo plans to improve its integrated payments infrastructure and pursue strategic acquisitions.

4. Strive Health – $300M Series D (September 2025)

Strive Health addresses a large gap in kidney care through its value-based care model. The company partners with nephrologists and health systems to treat patients with kidney disease while reducing costs. This funding enables Strive Health to expand its provider network and improve its care coordination platform.

5. Chaos – $275M Series C (April 2025)

Chaos develops advanced visualization and rendering software used by architects, designers, and visual effects artists worldwide. The company’s tools enable photorealistic 3D rendering and virtual production capabilities. This investment supports continued product innovation and expansion into emerging markets like real-time rendering for gaming and interactive experiences.

6. Uniphore – $260M Series F (October 2025)

Uniphore provides conversational AI and automation platforms for customer service operations. The company’s technology analyzes voice, video, and text interactions to improve customer experiences and agent performance. The funding will accelerate development of multimodal AI capabilities and expand the company’s global enterprise customer base.

7. Abcuro – $200M Series C (February 2025)

Abcuro is developing next-generation antibody therapeutics targeting difficult-to-treat cancers and autoimmune diseases. The company’s proprietary discovery platform identifies novel therapeutic targets and develops precision medicines. This funding advances multiple programs through clinical development, with several candidates entering pivotal trials.

8. ElevenLabs – $180M Series C (January 2025)

ElevenLabs is a leader in AI voice synthesis technology, offering realistic text-to-speech and voice cloning capabilities. The platform serves content creators, publishers, and enterprises seeking to scale audio production. The investment supports international expansion, particularly in non-English markets, and development of new features for enterprise customers.

9. Synthesia – $180M Series D (January 2025)

Synthesia pioneered AI video generation technology that enables users to create professional videos from text without cameras or actors. The platform is used by thousands of companies for training, marketing, and communications. This funding accelerates product development, including more natural avatar movements, expanded language support, and security features.

10. Tune Therapeutics – $175M Series B (January 2025)

Tune Therapeutics is developing genetic medicines using its proprietary epigenetic editing technology. Unlike traditional gene therapy, Tune’s approach controls gene expression without altering DNA sequences. The funding advances multiple programs targeting genetic diseases, with lead candidates entering clinical development.

NEA’s Strategic Direction

NEA’s 2025 investment activity shows priorities that will likely shape its 2026 focus. The firm’s significant backing of AI companies across multiple use cases suggests continued trust in AI as a transformative technology platform. Companies like Strive Health are interested in models that improve results while lowering costs, aligning with trends in the healthcare system.

Support for deep tech companies building foundational technologies positions NEA to benefit from long-term secular trends. Multiple investments target the integration of AI into enterprise workflows, suggesting confidence in accelerating enterprise AI spending. The firm’s nearly 5-decade track record, along with its active partnership approach, continues to attract exceptional founders building the next generation of industry-defining companies.

Empower Your Fundraising Journey with Eqvista

Looking to attract investments from top-tier venture capital firms like NEA? Your path to funding starts with professional financial documentation and company valuation.

Eqvista provides the essential tools growing companies need:

- 409A Valuations – Audit-ready reports that satisfy investor requirements and IRS compliance

- Cap Table Management – Keep your equity structure organized and investor-ready

- Equity Solutions – Comprehensive platform for managing stock options, vesting, and reporting

Trusted by over 23,000 companies from pre-seed to late-stage growth, Eqvista delivers the financial foundation that sets funded companies apart. Ready to prepare for your next funding round?