How to exercise stock options?

Whether you’re currently in a position where stock options are part of your salary or are just looking at job offers that include, it’s normal to have questions regarding your equity. The most often asked question among stakeholders is, “How much are my stock options worth?”.

Gaining as much information as possible can help you get the most out of your equity options and shares. If the stock’s value increases when you exercise your options, you can sell your shares for much more than you bought. That’s the best-case scenario; the worst-case scenario is that your shares lose all their value.

When you figure out exactly when and how to exercise stock options, you can easily get on your path to financial wealth. Let’s answer all your questions about the stock option exercise here.

Stock Options Exercise

Stock options grant employees the right to purchase a fixed number of shares of a company’s stock at a predetermined price. They are a common component of remuneration packages, allowing employees to have a stake in the company’s growth and success.

This section deals with the basics of stock option exercise.

What are stock options?

The most well-known type of equity remuneration is most likely stock options. If you possess stock options, you have the legal right to purchase a certain amount of shares in the firm at a certain price, sometimes called the “exercise” or “strike price“. Option grants have a “vesting period” during which you become the legal owner of the options. Vesting signifies that you have “earned” the choices but still have to buy them.

Since your initial investment remains constant, you can gain from any stock value increase. The goal is to earn a higher price for your shares when you sell them than when you buy them. But the point of options is that you’re under no obligation to use them.

How do stock options work?

Stock options are typical for attracting new talent and keeping existing personnel. Vesting is a retention strategy that allows companies to support employees who have received stock options. Employees are more likely to remain with the company during the vesting period if they know they will eventually own the options awarded to them.

Let’s take an example where you received 10,000 shares, and each year after the four-year vesting period, you will get 2,500 shares. The first 2,500 choices are subject to a one-year minimum stay, while the remaining 10,000 options are subject to a four-year minimum stay. Usually, you have to remain with your business for the whole vesting term before you can get your full award.

Types of stock options

Stock options can be either incentive stock options or non-qualified stock options. The key difference between both is the timing and method of taxation.

- Employees who qualify for preferential tax treatment are the only ones who can get ISOs. However, those who possess them are liable to the alternative minimum tax (AMT), a complicated tax event. There are other limitations associated with ISOs, such as a $100,000 grant cap and an exercise price limit.

- Non-employees such as directors and vendors may receive NSOs. While they do not qualify for the preferential tax status accorded to ISOs, they have fewer constraints and a straightforward tax structure.

Benefits of stock options

Let’s look at some benefits that stock options offer employers and employees.

- Tax Benefits: Incentive stock options (ISOs) offer tax efficiency, with no immediate income recognition at exercise, potentially resulting in lower taxes. Holding ISOs for a specific period can lead to long-term capital gains taxed at a favorable rate.

- Employee Ownership: Stock options provide ownership stakes, fostering a sense of responsibility and alignment with the company’s goals.

- Morale and Motivation: Performance-linked rewards incentivize employees to work harder and enhance productivity, directly impacting their potential earnings.

- Employee Retention: Vesting schedules for stock options encourage staff retention, as the value of the award is realized over time, providing a financial incentive to stay with the company.

- Simplicity and Flexibility: Non-qualified stock options (NSOs) offer a straightforward and easily communicated tax structure, providing flexibility without stringent eligibility and grant limits.

When to Exercise Stock options?

Exercising stock options can significantly impact taxes, necessitating consultation with a tax advisor beforehand. Typically, companies impose a waiting period, often a year, and require the achievement of specific milestones before allowing stock option exercise.

- Exercise Stock Option After vesting – The process of earning the right to stock option exercise is termed vesting. Generally, you can only exercise vested stock options. Once you reach your vesting cliff, following the waiting period, you can exercise your vested options at your discretion, provided you remain employed.

- Exercise Stock Option When leaving the company – Upon leaving your job, most companies grant a 90-day post-termination exercise period (PTE or PTEP) for purchasing your shares. Some companies extend more generous PTE periods, matching your tenure.

- Exercise early Stock Options – Certain companies permit early stock option exercise before vesting completion. If allowed, you can exercise options immediately upon grant, with vesting continuing based on the original schedule.

| Advantages | Disadvantages |

|---|---|

| For Incentive Stock Options (ISOs), favorable tax treatment is possible by holding shares for at least two years post-option grant and one year after exercising. | Exercising options early requires using personal funds; selling stock to cover the shares isn't an option. |

| Early exercising initiates your holding period sooner, potentially qualifying you for the lower long-term capital gains tax upon selling Non-Qualified Stock Options (NSOs). | By waiting for the typical one-year vesting cliff, you gain insight into potential stock value growth, aiding in decision-making regarding option purchase. |

| Exercising options at grant time, buying at Fair Market Value (FMV), may mean no additional taxes. However, filing an 83(b) election within 30 days of exercise is crucial for favorable tax treatment. | - |

How to exercise stock options?

Knowing the ins and outs of stock options is critical as more and more organizations use equity-based compensation options. Let’s get into the details of exercising stock options to help those who want to use this potential to generate money. It is essential to comprehend expiration dates and vesting periods.

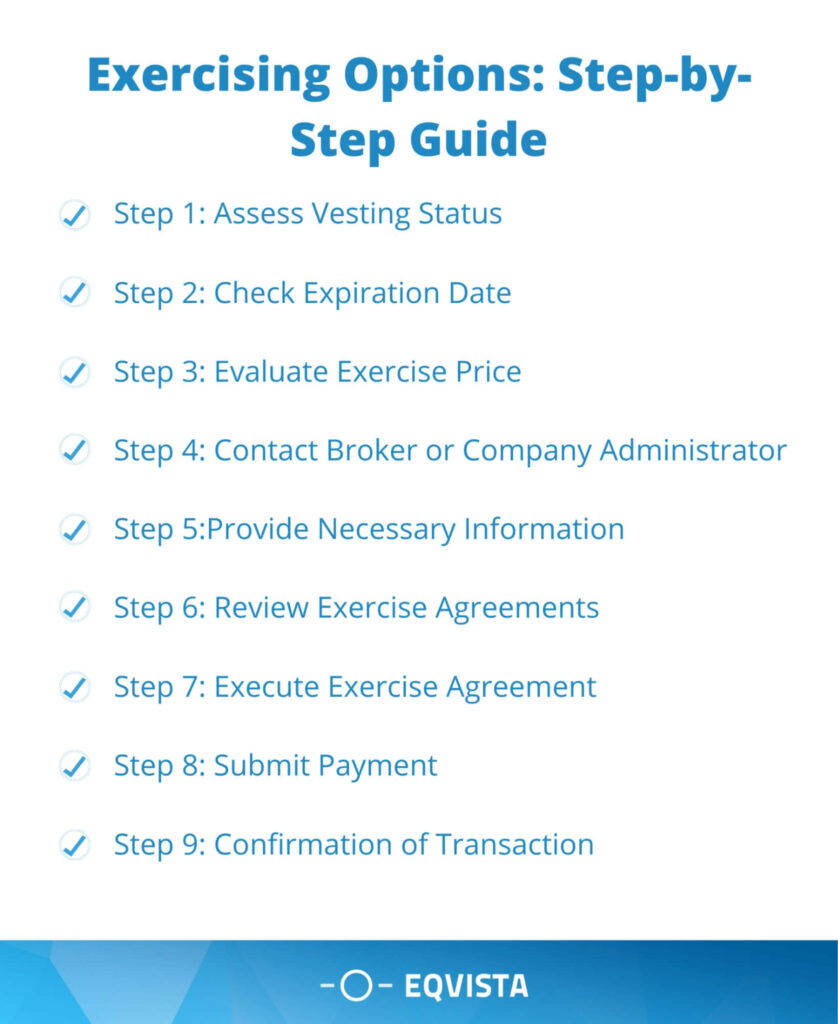

Exercising Options: Step-by-Step Guide

Our step-by-step guide below on stock option exercise will walk you through each process stage, from verifying your vesting status to getting your newly acquired shares.

- Step 1: Assess Vesting Status – Verify that your stock options have reached the required vesting period, ensuring they are eligible for exercise. Vesting is a gradual process, often spanning several years, and is crucial for unlocking the right to exercise.

- Step 2: Check Expiration Date – Identify the expiration date associated with your stock options. Failure to exercise before this date may result in the forfeiture of your options. Stay vigilant to avoid any loss of potential gains.

- Step 3: Evaluate Exercise Price – Understand the exercise price and the predetermined cost to buy each share. Compare this price with the stock’s current market value to make informed decisions about the financial implications of the stock option exercise.

- Step 4: Contact Broker or Company Administrator – Initiate the exercise process by contacting your designated broker or the administrator in charge of company-sponsored plans. They can provide essential guidance and initiate the necessary procedures.

- Step 5:Provide Necessary Information – Furnish key details such as the specifics of your option grant, the quantity of options you intend to exercise, and your preferred payment method. Clear communication ensures a smooth transaction process.

- Step 6: Review Exercise Agreements – Thoroughly review any stock option exercise agreements provided by your broker or company administrator. These documents outline the terms and conditions of the exercise, ensuring you are fully aware of the implications.

- Step 7: Execute Exercise Agreement – Sign and submit the exercise agreement confirming your intent to purchase the specified number of shares. This formal step solidifies your commitment to the exercise process.

- Step 8: Submit Payment – Transfer the required funds to cover the exercise cost. Follow the payment instructions provided by your broker or company-sponsored plan. Ensure timely and accurate payment to avoid any delays.

- Step 9: Confirmation of Transaction – After completing the transaction, expect to receive confirmation detailing the exercised options, including information about the purchased shares. This confirmation serves as documentation of the executed stock option exercise.

How much are my stock options worth?

The value of your stock options is unpredictable, so you can’t be sure how much money you’ll gain from them. Because if the company’s exit value rises, so will the value of your options. If you’re holding options, you should know there’s no certainty of a successful exit and that exit valuation greatly affects their worth. Let’s discuss them in this section.

Determining the Value of Stock Options

To precisely assess their worth, one must have a sophisticated grasp of two essential elements: the computation of intrinsic value and the link between the present market price and the strike price.

These components are essential for making well-informed decisions in investing in options.

- Current Market Price vs. Strike Price

CMP is the current trading price of the underlying stock in the open market.

Significance of Strike Price: The strike price is the predetermined price at which an option holder can buy (call option) or sell (put option) the underlying stock.

The option holds intrinsic value if the CMP exceeds the strike price (in-the-money). Conversely, if the CMP is below the strike price (out-of-the-money), the option is valued solely based on time and volatility. The greater the difference between CMP and strike price, the higher the option’s intrinsic value. It influences the overall value and attractiveness of the stock option.

- Intrinsic Value Calculation

Intrinsic value is the measure of how much an option is in-the-money. It represents the actual worth of the option if exercised immediately. It is a critical metric in assessing the attractiveness of an option, helping investors make informed decisions.

- The intrinsic value for a call option is the CMP minus the strike price. If positive, it’s considered in-the-money. For example, If CMP is $50 and the strike price is $45, the intrinsic value is $5.

- The intrinsic value for a put option is the strike price minus the CMP. If positive, it’s in-the-money. For example, If the strike price is $55 and the CMP is $60, the intrinsic value is $5.

- If the calculated value is zero or negative, the option is out-of-the-money, relying solely on time and volatility factors.

Issue and Manage Stock Options With Eqvista!

If you want to provide stock options, you must also know how to handle and monitor them properly. Software for managing stock option plans in startups is useful in this regard. Their purpose is to facilitate the management of all corporate options by providing a means of tracking them.

Eqvista’s software lets you issue shares and set vesting schedules, with the program taking care of the complicated calculations for when and how many shares vest. If you want additional information about your alternatives but are still unsure, Eqvista can assist. You can stay on top of all deals and up-to-date using Eqvista’s cap table application. With Eqvista’s vesting plans, it’s easy to issue stock options and keep track of their progress. Start using Eqvista, the most reliable stock option management program available!