First Chicago Method for Startup Valuation

Investors tend to invest in a startup that has the potential to grow, especially if the market is big. The bigger the market, the higher the returns from economies of scale. To invest in a startup, they need to determine the value of the startup as it is one of the main factors used in negotiations. During this process, there are many hurdles that influence the method you choose for valuation. Information used to derive the value of a company is scarce; startups lack historical data, have low or no data on similar comparable startups, and have a higher number of intangible assets.

First Chicago Method of Valuation

The First Chicago Method is also known as the Venture capital method. It is a valuation approach for businesses and is used by private equity and venture capital investors. The first Chicago method merges the elements of the discounted cash flow and a multiple-based valuation. Developed by and named after the First Chicago bank, the First Chicago method of valuation was initially discussed in 1987. The Chicago bank is the predecessor of the firms GTCR and Madison Dearborn Partners.

What is a startup valuation?

Startups may enter a deal for a specific price, and this price will be referred to as the “market valuation”. A startup valuation is a process in which the worth of the company is quantified. During the initial funding or the seed funding round, an investor gives funds for equity in the business. This is where the valuation comes in; the owner needs to know the business’s worth as they will be giving part of it to an investor through equity. A wrong valuation could lead to losses for the owner and an unfair advantage to the investor.

An entrepreneur will ascertain the amount of equity to give to the seed investor for funds. This goes both ways, as the investor also needs to know the amount of equity they will be receiving for the funds they invested in the seed stage. The startup valuation can be a major deal maker, depending on how it is done. Guesswork is not going to work while evaluating a startup based on related startups in the same niche.

Additionally, before going ahead and determining a value of the business, the founder needs to understand the workings of the valuation for the startup. If the founder does not have adequate knowledge about the process, they may quote a high figure, leading to no business revenue or investment.

This will lead to high expectations with higher targets; if these targets are not attained, they will have to go through another funding round, but this time with a substantially lower valuation. Thus a financial analyst uses various valuation methods for startups, and they are divided into two parts; pre-revenue and post-revenue.

| Pre-Revenue Valuation Methods | Post-revenue Valuation Methods |

|---|---|

| Venture Capital Method | Comparables Method |

| Scorecard Method | First Chicago Method |

| Risk Factor Summation Method | Discounted Cash Flow Method |

| Berkus Method | - |

A startup is a company that is newly created by entrepreneurs who develop unique products and launch them in the market. To encourage this process, they will need funding, and the key to funding is a valuation.

What is the first Chicago method of valuation?

The First Chicago Method of valuation is a method used for the valuation of early-stage companies by private equity investors and venture capitalists. This method is used for companies’ dynamic growth as it combines the components of fundamental analytical and market-oriented methods. Here is a step-by-step guide on the process of this startup valuation method.

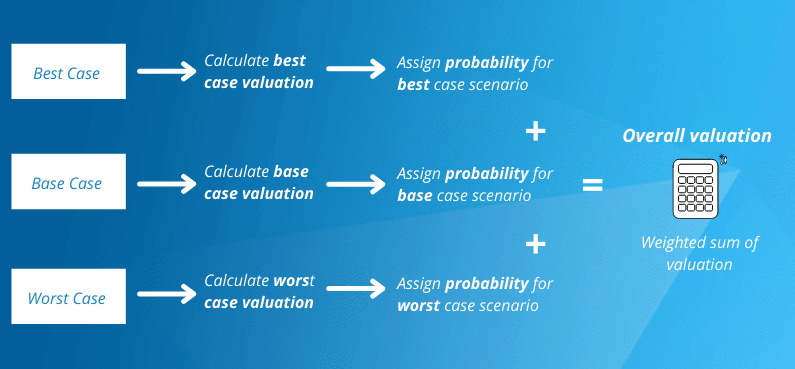

#1 Future Scenarios

One way to determine the future scenarios that the company may face is by creating three possible scenarios:

- Worst-case

- Mid-case

- Best-case

To determine the value of a startup through the first chicago method, you will need essential data such as the earnings, cash flows, exit-horizon, revenue, the financial forecast for each of the case scenarios, etc. You will also need a detailed analysis of the market trends of the industry in order to get a good estimate of the scenarios. Typically the mid-case scenario is the expectation of the analyst as it is the most likely outcome.

There is never a winner takes all scenario. You need to set a possibility of total loss in the worst-case scenario. This is why in companies that are driven by an extensive factor, it is best that the investor stays reasonable. There are cases where the outcome of the financial valuation is determined by the initial capital of the startup. Consider all the strategy-shifts as per the case scenario to have a more accurate valuation of the business and set up financial forecasts.

#2 Determine the Estimate Divestment Price

The exit price is also known as the disinvestment price. To determine the disinvestment price, you will need to estimate the terminal value of the startup at the time of exit. This is where we start to use multiples. You will have to determine a value of the company by using the transactions of other similar companies as a basis of comparison. While choosing the startup company that you will use for comparison, make sure that it is in the same stage, industry, and region.

For each class, there are numerous forms of suitable multiples. Professionals use multiples based on KPIs such as revenues and EBIT to determine the exit price. It is essential that the information of transactions used for the market-based approach is of similar startups. Information regarding the M&A within the venture industry is scarce, but there are market specializing data providers. Once you receive all the metrics and information required determine the disinvestment price.

#3 Estimating Required Return of Each Scenario

The majority of venture capitalists derive the return internally. The reason they do not trust the CAPM & WACC is because of the lack of data in the private market. It is not possible to replicate investments and the payoffs with an assets portfolio. Additionally, in the financial forecasts, the WACC cost of equity is reduced due to the lack of debt capital. This leads to vague assumptions during the valuation of a startup or an early-stage company. For each business, it is important to estimate the market risk in the industry, region, and stage to determine the risk premium.

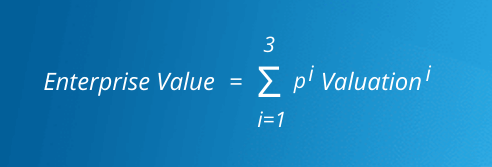

#4 Estimate Probabilities of all scenarios

In this step, you will have to designate a probability for each case. Naturally, these probabilities will be correlated to the number of scenarios and your definition of them. It is not possible to be precise in every case scenario when determining the probabilities. But the overall idea here is to take drastic outcomes in the valuation process. Finally, depending on the scenario calculate, the weighted sum of the valuations.

The first Chicago method is a valuation process with a broad scope. You can see this in the process, as in step 1, you are presented with the freedom to consider an event where there is a low probability of huge investment pay-off. Too much flexibility might also bring a bit of complexity to the process. In the second step, we use the information of similar companies. The selection of a multiple here will depend on the industry and structure of the business. This information is not easily available and can be very vague. Then we go on to investigate the market; this is done through a short-term analysis that concentrates on the business’s potential depending on the case scenario. It also identifies the fundamental market trends by focusing on the long-term analysis.

Pros and Cons of First Chicago Method

Many private investors and venture capitalists choose to use the first Chicago method of valuation, but that is not to say there is no downside to it. Here are some pros and cons about the First Chicago Method:

The pros of this method are as follow:

- This method is comprehensive and detailed.

- Every calculation is based on precise estimates of the values in the future and the cash flows.

- This method provides a series of potential results

- It keeps in account the high-risk scenarios where there is a huge potential of losses.

- This model provides better and more accurate results for early stage ventures that have a more dynamic growth model.

- This method is best used to evaluate early tech related startups.

The cons to this method are as follow:

- In some cases it can be time-consuming and very intricate.

- To evaluate a startup correctly, one needs to have detailed knowledge about the business and the estimates. Only then can one get an accurate valuation.

- It is not useful for startups with no revenue.

- The freedom of considering different events adds complexity to this method.

- This method applies to companies that are in an industry where there is insufficient data. If there is sufficient information, investors will use other methods.

Explaining First Chicago Method

While valuing a reporting company’s business, the use of the First Chicago Method is suitable. Anthony Inc is a security company that just acquired a subsidiary. The objective of the company is to provide protection services to the customers that use the internet services of the parent. In 2013 the subsidiary company incurred a loss under the parent. The current forecast predicts more losses in 2014. The company’s valuation date is at the end of the first quarter of 2014.

The company’s growth is expected to be at 30% for the next five years. The company’s operating gearing is high at 30.5%, capitalization rate is 5.7% at 17.5 times, selected using the build-up method. Here is a first chicago method example. The table below shows the three possible scenarios.

| Year to 30 Nov 2016 | $’000 | ||

|---|---|---|---|

| Failure | Survival | Success | |

| Revenue | 9,000 | 10,000 | 12,000 |

| Fixed Costs | 7,000 | 7,000 | 7,000 |

| Variable Costs | 1,350 | 1,500 | 1,800 |

| Operating Costs | 8,314 | 8,500 | 8,800 |

Based on the return required by the VCs, the 35% discount rate was derived.

| Failure | Survival | Success | |

|---|---|---|---|

| Pre-Tax Profit | 710 | 1,500 | 3,200 |

| Income Tax | 260 | (600) | (1,280) |

| Net Income | 390 | 900 | 1,920 |

The next step is to determine the Current fair value of all three scenarios.

| Year to 30 Nov 2016 | Failure | Survival | Success |

|---|---|---|---|

| Capitalized at 5.7% | 6,840 | 15,786 | 33,676 |

| 35% Discount Factor | 0.512 | 0.512 | 0.512 |

| Present Value | 3,502 | 8,082 | 17242 |

| Capital Required | (2,500) | (2,500) | (2,500) |

| Current Fair Value | 1,002 | 5,582 | 14,742 |

The management estimates the outcomes of these scenarios: Failure: 10%, Survival: 20%, and Success: 70%. The high end of the range of the fair value by combining them is $11,532,000.

| $’000 | |||

|---|---|---|---|

| Failure | Survival | Success | |

| Fair Value | 1,002 | 5,582 | 14,742 |

| Probability | 10% | 20% | 70% |

| Contribution to Fair Value | 100 | 1,116 | 10,316 |

They also estimated the worst situation to be 40%, 35%, and 25% which amounts to Worst case Scenario: $8,078,000

| $’000 | |||

|---|---|---|---|

| Failure | Survival | Success | |

| Fair Value | 994 | 5,564 | 6,704 |

| Probability | 25% | 35% | 40% |

| Contribution to FV | 248 | 1,948 | 5,882 |

When we use the startup valuation method or the first chicago method of valuation method, the fair value for the reporting unit is between $8,078,000 & $11,532,000. In an initial stage turnaround scenario, the normal range of the various methods can reach 20%. This spread should be more narrow for a stable business at around 10%.

Ready to use the First Chicago Method for your Startup?

The first Chicago method of valuation comprises all aspects of a similar industry to the concerned business. It is challenging to estimate the probabilities of the various scenarios in question, but numerous mathematical procedures help overcome this. For the company’s underlying risk drivers, one can consider addressing the highly skewed patterns for extreme possible cases. The uncertainty does not stop there since private companies trade assets infrequently and there is still vagueness of data.

To sum everything up, it is essential to have good detailed knowledge about the valuation. While performing a valuation you will need the assistance of tools, like a company Cap Table. Eqvista provides you with tools such as the cap table management and issuance of company shares that will help make such tasks less complex.