Stock Appreciation Right vs ESOP

This article emphasizes the tax Implications of SARs and ESOPs and factors to consider when choosing between SARs and ESOPs.

SARs, or stock appreciation rights, are becoming more popular in the USA. This time, we have two financial concepts that are incredibly different. As a result, we will understand how these phrases vary from each other and discover the rights and expectations of a worker for an organization.

This article emphasizes the tax Implications of SARs and ESOPs, factors to consider when choosing between SARs and ESOPs, and key differences between SARs and ESOPs.

SARs and ESOP

Consider a company that intends to give its employees 1000 ESOPs or SARs with a one-year vesting period. Assume that the share price of the Company is $10 on the day of the award, the exercise price is also $10, and the fair value of the options is $3. Assume further that the Company anticipates its share price to be $12 at the end of the year.

When it comes to ESOPs, the company will record a total charge of $3000 in its income statement over a one-year period regardless of the actual share price at the time of exercise (i.e., 1000 ESOPs * $3, being the fair value of ESOPs as on the grant date).

The initial fee for SARs will be based on the same fair value of $3 as it is for ESOPs. However, if the actual share price at settlement turns out to be $12 per share, the total fee would come to $2000 (i.e. $2, which represents the difference between the share price at grant and the grant price multiplied by 1000 SARs). As a result, the charge in this situation would be lower than that under ESOPs, however, the quarterly charge may be more variable.

The employee is entitled to a portion of the company’s growth under the SAR program (paid in cash or equivalent). However, they are not given any shares, unlike with an ESOP, where the employee is given the shares (and consequently benefits from the company’s success).

Understand SAR

Stock Appreciation Rights are security that gives shareholders a portion of the ownership in the company in which they purchase the shares. Additionally, it implies an approach in which the participants, such as the company’s employees, directors, or subordinates, are expected to receive money when there is an increase in the value of the stocks, which is already a condition of ownership.

Understand ESOP

Employee Stock Ownership Plan (ESOP) is a benefit-oriented program that enables employees of an organization to acquire ownership-related interests in the firm, which often take the form of shares in the company’s shareholding. Employers mostly use this as a corporate finance approach to align the interests of the shareholders and employees, which enables them to work together toward a single objective.

How SARs and ESOPs Work

Employee Stock Ownership Plan (ESOP) is a benefit-oriented program that enables employees of an organization to acquire ownership-related interests in the firm, which often take the form of shares in the company’s shareholding. Employers mostly use this as a corporate finance approach to align the interests of the shareholders and employees, which enables them to work together toward a single objective.

Unlike stock options, SARs are frequently paid in cash and do not require the employee to possess any asset or contract. The employee may receive shares or cash equal to the growth in the share price’s net value, depending on the stock appreciation rights plan.

SARs: Granting and Exercising

SARs are granted at a defined price, which is used to estimate their appreciated value when you obtain them. It has an expiration date, a vesting period (i.e., ownership, a waiting period before receiving the award ownership), and a vesting term. Employees can use a vesting SAR at any time before the expiration date.

Unlike stock options, which require employees to pay an exercise price (also known as a purchase price), there is no need to make any upfront payments to obtain the awards.

ESOPs: Employee Ownership and Benefits

An ESOP is typically established to aid succession planning in a closely held company by allowing employees to purchase corporate stock. They are established as trust funds and can be financed in a number of ways by businesses, including by issuing freshly purchased shares to them, paying cash to buy existing shares, or borrowing funds through the corporation to do so.

ESOPs are employed by businesses of all sizes, including several large publicly traded enterprises. Companies use ESOPs to maintain participants focused on business success and share price growth.

Key Differences between SARs and ESOPs

The key differences are illustrated in the following table

| SAR (Stock appreciation rights) | ESOP (Employee stock option plan) |

|---|---|

| The employee is not required to make an upfront payment. | Before receiving the shares, employees are normally required to pay the exercise price. |

| Participants are not subject to taxation upon awarding or vesting. | Employees are taxed on the exercise price even if no cash is received. |

| It is possible to receive stock, cash, or a combination of both. | Actual shares must be issued, and shareholders' rights must be included. |

| It is taxed as perquisite. | Taxed as both capital gains and perks. |

Advantages and Disadvantages of SARs and ESOPs

For a long time, ESOPs were believed to be the best retention tool available for retaining employees and motivating them to perform more. But recently many startups have been buying back ESOPs.

Advantages of SARs for Employees and Employers

As an employer, you have complete control over all aspects of the SAR. However, as SAR is a contract, it is up to you to choose the format for the document. They are agreements that depend on how the company’s stock performs. The employee does not have any shares in the company. In reality, no cost is associated with employees exercising their rights under a SAR contract.

Advantages of ESOPs for Employees and Employers

ESOPs increase staff retention and lower staff turnover. Employers can also use ESOPs to reward hard work with stock rather than cash, eliminating the requirement for an immediate cash outflow. Employee data is not shared in ESOPs. This indicates that member data is safe and secret. They are a fantastic choice for retirement planning because they are simple to transfer.

Disadvantages of SARs for Employees and Employers

SARs are correlated with the issuer’s stock price performance by definition. So, the holder can financially exercise the SAR if the stock price rises within a defined period. In contrast, a SAR is worthless in the hands of the holder if the stock price declines within the designated period.Therefore, while taking SARs as payment, employees need to exercise caution. Furthermore, there is uncertainty in the capital markets.

There is no additional cash flow when an employee exercises the SAR because the employee does not own any stocks. It could cause liquidity problems for employers rather than providing additional capital.

Disadvantages of ESOPs for Employees and Employers

The performance of the company affects the share price. Without sustainable profits, the company’s value declines, which could cause the share price to change. Employees may need to time their exit based on company performance to maximize their ESOPs’ value.

The compensation will be less if you leave the business when the stock price is lower. The value changes according to the company’s performance, making retirement planning difficult.

Tax Implications of SARs and ESOPs

When you receive stock appreciation rights, there are no tax consequences at the federal level. However, it would be best if you recorded compensation income at the time of exercise based on the fair market value of the vested amount.

The shares granted to an employee under an ESOP constitute a capital asset, and any profit made on the sale of such shares is subject to capital gains tax. The difference between the sale price and the acquisition cost will be used to calculate the capital gains on the sale of shares.

Taxation of SARs for Employees and Employers

SARs are usually given out by employers together with stock options. They assist in financing options acquisition and pay off taxes due when the SARs are exercised. SARs and NSOs are taxed in the same manner. There are no tax repercussions on the grant date or when they become vested. Additionally, most employers will deduct additional federal income tax.

Taxation of ESOPs for Employees and Employers

When an employee owns an ESOP, it is taxed in two ways. The exercise of options comes first, followed by the sale of shares. In the first case, it is considered a perk and is subject to taxation as income under head salaries.

The second sale is recognized as a capital gain when it occurs on the open market.

Withholding Requirements

Employers are required to withhold (deduct) tax from employees’ compensation since the benefit from exercising options is taxable as a perquisite, or salary income.

Case studies of companies that use SARs and ESOPs

Nobis, a consulting firm that provides various engineering services to clients across the United States, has been doing well since 2003, with an average annual growth rate of 15% in 2008. Company leaders attribute the company’s resilience to the firm’s robust ownership culture and the Employee Stock Ownership Plan (ESOP) established in 2003. Over the next three to four years, CEO Nannu Nobis intends to transfer the remaining shares to the ESOP.

How have these plans impacted their businesses?

One of the biggest accomplishments at Nobis was the extent to which the company’s employees enjoyed the company’s commitment to frequent communication, employee participation, information sharing, and ensuring that employees gained a strong understanding of both the business and ESOP concepts.

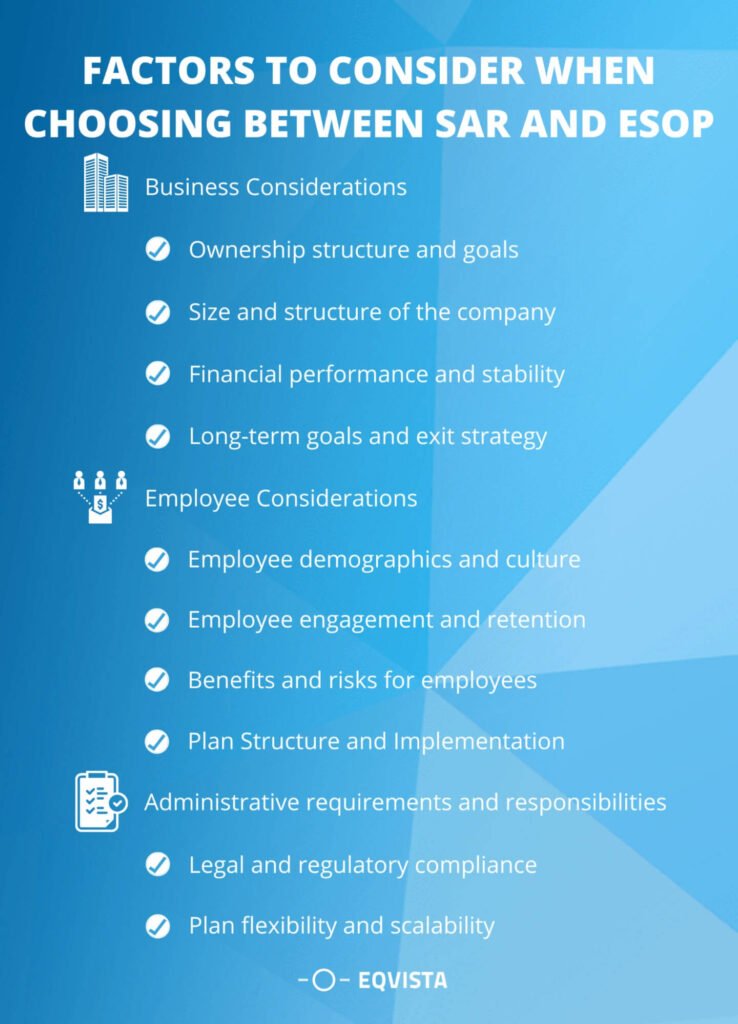

Choosing the Right Plan: Factors to consider when choosing between SARs and ESOPs

Every company is different, and so are the reasons why you might want to offer company stock to your employees as an incentive and compensation. How do you decide between ESOP and SAR? This is solved by analyzing the different factors to consider when choosing between SARs and ESOPs.

Choosing between SARs and ESOPs involves consideration of a wide range of factors. They are business considerations, employee considerations, plan structure and implementation, tax implications, and expert advice.

Business Considerations

Before choosing between SARs and ESOPs directors and other members have to consider the structure and objectives of ownership, the size and organizational structure of the business, financial efficiency and stability, future objectives, and a strategy for exiting

- Ownership structure and goals – An ownership structure is concerned with the internal organization of a corporate entity as well as the rights and duties of the individual who has an equitable or legal interest in that enterprise. The goals typically determine the vision of the company based on which the management will decide between SARs and ESOPs.

- Size and structure of the company – A company’s organizational structure describes how actions are planned and carried out to meet objectives. These activities will typically contain the regulations to be followed as well as the roles and duties of employees within the firm. The scale of a company’s operations is referred to as its size. We gauge it using a variety of indicators, such as invested capital, market capitalization, the number of employees, assets, revenue, and production.

- Financial performance and stability – A company’s ability to employ resources from its mainstream business and create income is measured subjectively by its financial performance. Financial stability is a condition in which an economy’s systems for pricing, allocating, and managing financial risks (credit, liquidity, counterparty, market, and so on) function effectively enough to contribute to the economy’s performance.

- Long-term goals and exit strategy – A firm establishes long-term goals, which can be both financial and non-financial in nature, to reach its desired future condition. A good exit strategy can reduce losses and increase investment returns.

Employee Considerations

Employers take into account factors such as brand reputation, fairness in the hiring procedure, and website features. The main factors for potential employees are their public and private web platforms.

- Employee demographics and culture – An organization’s workforce can be described using a wide range of factors that are included in employee demographics. Gender identity, race, ethnicity, age, and national origin are a few examples. Workplace culture refers to the values, norms, and conduct of a group of individuals inside a work setting, such as a team, department, or entire enterprise.

- Employee engagement and retention – Employee engagement assesses how well your employees communicate with each other and with the business as a whole. Employee retention refers to your organization’s capacity to have a lower turnover rate, which means fewer employees are departing for other chances.

- Benefits and risks for employees – With qualified and experienced employees an organization can carry out its activities efficiently. The risk of hiring employees would be their intention to work less and pay more and it is obvious that if an employee finds better offers there are high chances of a trained employee leaving a company.

- Plan Structure and Implementation – A strategic plan, which specifies the approach taken to reach particular objectives or make decisions, serves as the foundation for an implementation strategy. Organizations can create strategic plans to direct the activities of any project or initiative, a specific department, or the corporation as a whole.

Administrative requirements and responsibilities

The management also considers the administrative requirements for granting SARs and ESOPs, the accounting treatment, tax implications, etc are the other crucial factors for consideration.

- Legal and regulatory compliance – It is the organization’s observance of rules, laws, directives, and specifications pertinent to its operational procedures.

- Plan flexibility and scalability – Management will select the most adaptable plan with the ability to modify in size or scale after assessing the facts and conditions of both the ESOP and SAR.

Tax Implications for Choosing Between ESOP and SAR

Are you struggling to choose between ESOP and SAR? Understanding the tax implications of each option is crucial. Making the right choice can save you a significant amount of money in the long run.

- Tax implications for the company and employees – ESOP and SARs have various tax implications. The company is in charge of withholding the tax and remitting it to the appropriate government within the allotted time.

- Implications for employee retirement and financial planning – The employees consider the best plan for their retirement by analyzing the various facts and circumstances of both plans. (SAR and ESOP)

- Potential tax benefits and incentives – The ESOP offers a number of tax advantages and incentives, including enhanced depreciation deductions and the delay of capital gains taxes. SARs will be considered a perk benefit for employees.

- Professional Advice and Resources – It emphasizes the value of consulting professionals, using resources for plan emergence and implementation, continued learning, and interaction. Numerous technical and administrative procedures, including setting up the proper reserves and recognizing expenses, are involved with ESOP and SARs.

- Resources available for plan design and implementation – For the effective creation and execution of stock option plans, the organization should have sufficient financial and human resources.

- Importance of ongoing education and communication – The company and the employees who are regarded as the participants in the ESOP and SARs should possess up-to-date knowledge about the complete provisions and effective communication enhances the credibility of both participants.

Manage your ESOP and SAR at ease with Eqvista

Companies can use ESOPs and SARs to reward employees financially for their work and encourage them to contribute to maximizing total shareholder value. There are numerous factors to take into account with the ESOP. It will be successful if you select the appropriate individuals to assist you in managing your ESOP plan. choose experts like Eqvista who are familiar with ESOP and its criteria. You can be sure that your ESOP strategy will succeed with our experts’ appropriate resources and direction. Sign up to Eqvista to learn more about our services, and click here to contact us.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!