Best stock option management software for your company

Check out and begin using Eqvista, which is the best stock option management software out there!

Offering employee compensation is a great tool for a company. It allows startups and cash strapped companies to offer an incentive for employees to work harder, or as a recruitment tool to hire highly qualified people to join the company. But offering equity as employee compensation comes with a lot of responsibilities and administrative work.

Let us dive into this and understand more about stock option administration.

Employee Stock Options

Employee stock options, also known as ESOs, are one of the main types of equity compensation offered to the employees in a company. Basically, this is a derivative financial instrument that allows the holders an option on the company stock. They offer the employees the right to purchase the stock of the company at a fixed price over a specific period of time. The terms of the ESOs are outlined in the employee stock options agreement given to employees by the company.

The biggest benefit of stock options comes into play only when the company stock price rises. And when the price of the shares increase, the options are exercised and the holder (who is the employee here) gets the stock of the company at a discounted price. The employee can then sell the stock in the open market for a profit or hold on to them for a longer period of time.

In case the employee decides to leave the company before getting all the stock options after they vest (vesting will be explained below), they get canceled. And just to be clear, the stock options do not offer any voting or dividend rights. The only benefit that the employees get is the profit earned by selling the shares after purchasing at a discount.

Here are some other benefits of ESOs that the employees can enjoy:

- A chance to get a share in the profit and success of the company along with the pride of ownership: This would motivate the employees to work harder and be more productive so that the stock price of the company increases.

- A tangible representation of how much their contribution is worth to the employer

- Based on the plan, they can enjoy tax saving benefits on the disposal or sale of the shares

The stock options plan does not just offer benefits to the employees, but also to the employers, which include:

- Incentivizes employees to work more productively and help the company succeed as they too will get a share of the success.

- It increases job satisfaction and financial well being of the employees by offering additional compensation.

- It is a valuable tool in recruiting the brightest and best employees in an increasingly integrated global economy where there is a high competition for talent in the industry.

- It can be used as a potential exit strategy for owners

Types of Stock Options

There are two kinds of stock option plans:

- Incentive stock options (ISOs): These are also called qualified options or statutory options. They are usually offered to top management and key employees. This plan offers better tax treatment, where the IRS considers the gains on the options as long-term capital gains and the profits are taxed at a lower rate.

- Non-qualified stock options (NSOs): Known as non-statutory stock options, these are offered to all the employees in a company, including board members as well as consultants. Profits on these are considered as ordinary income and are taxed as such. There are no such benefits like what ISOs have.

Vesting

With the above clear, the next thing you need to know about is vesting. There are two parties in the deal made when offering ESOs – the grantor, who is the employer and the grantee, who is the employee. The employees are given compensation in the form of stock options, but with specific restrictions, out of which the most important one is the vesting period.

A vesting period is the length of time that the employee has to stay in the company before they can exercise (officially own) their ESOs. The reason behind having a vesting schedule is so that the employee performs well and stays with the company for a long time before they are rewarded. Companies do not want employees to benefit from a quick gain and leave the company thereafter. Vesting follows a predetermined schedule set by the company when the grant is offered.

All these details of the plan are listed in the employee stock option agreement. You can negotiate the terms with the company, and key employees in the company may also request to have the shares vest faster or at a lower exercise price. The stock options vest in chunks over the time period on fixed dates as per the vesting schedule. For instance, if you get 2,000 options from the company and the vesting plan is for five years over a 15 year term, you will get 20% of the total shares after each year. This would be 400 shares per year, as shown in the table below.

| Year | Shares Vested | Percentage Vested of the Total Shares | Cumulative | |

|---|---|---|---|---|

| Year 1 | 400 | 20% | 400 | 20% |

| Year 2 | 400 | 20% | 800 | 40% |

| Year 3 | 400 | 20% | 1,200 | 60% |

| Year 4 | 400 | 20% | 1,600 | 80% |

| Year 5 | 400 | 20% | 2,000 | 100% |

| Total Vested Shares: | 2,000 | 100% | ||

The 15-year term means that starting from the day the plan commences, you would have 15 years to exercise all the options. If you miss this time, you will lose all shares. Also, if you decide to leave the company before the vesting period of 5 years, you will end up losing the remaining shares (unearned). In fact, this is why the vesting schedule is in place – so that you do not leave the company early.

Stock Options Management Software

Offering stock options means that you will also have to keep track and manage them well. That is where stock option plan administration software for startups comes in. They are created to help you track and manage all the stock options in the company.

The stock options management software comes with four main factors including accuracy, efficiency, security, and comprehensiveness. In addition to this, the software allows you to create vesting schedules and issue shares, while the application would handle all the complex calculations of how many shares are vested and when.

How employers and employees benefit from stock option management software?

There are a lot of benefits offered to both employees and employers with the help of the best stock option management software. These include:

- The software would help the employers share the cap table and the various equity updates with the employees.

- Employers would be able to track where the shares are going.

- The advanced feature of creating and adding a vesting schedule to the plan would help both see how much shares are vested without the need for complex calculations.

- Save time by issuing and receiving electronic shares all online.

Stock Option Management Software from Eqvista

One of the best stock options management software applications in the market is Eqvista. It is a sophisticated stock option plan administration software for startups that would help you track, manage, and make intelligent decisions about the equity of your company. The application takes care of all the shareholder activities. Unlike many other applications available, we also help in incorporating your company and then managing the equity from there.

Some of our key benefits include:

- Eqvista helps in setting up your company and filing it with the state Division of Corporations.

- Issue shares and manage them directly on the application in a transparent manner.

- A cap table software created to offer you the best for your company’s equity.

- Offers extensive functionality for your Stock Option Plan Administration.

- Reduces the manual work and time spent.

- A direct communication link will be set between issuer and investor.

- Everything edited on the application is updated in real time. So, if you have shared the cap table with your shareholders, they will see the update too.

- Make use of financial models like our round modeling and waterfall analysis to understand what happens to the company ownership in various liquidity events.

- Stay compliant with the various equity-related regulations.

Creating an employee stock option plan

Let us help you understand how to create an employee stock option plan on Eqvista. But before you can do this, you will have to create an account on Eqvista and prepare your company profile.

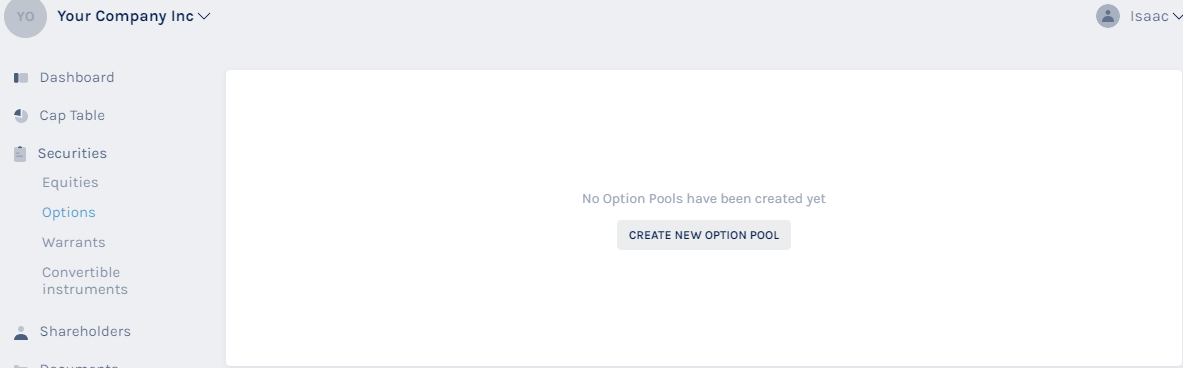

Step 1: On the company dashboard, click on “Securities” from the left hand side menu. From this drop down menu, click on “Options”, and you will be redirected to the following page.

Here, click on “Create New Option Pool” to create a stock option plan on this equity management software.

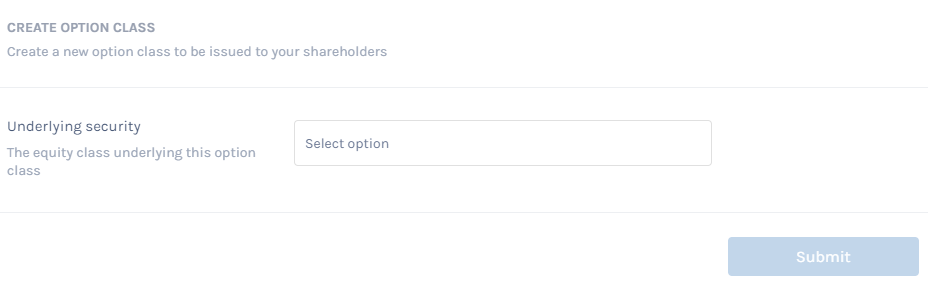

Step 2: You will then reach the next page where you will have to select the “Underlying Security Class” from which the shares would be added in the option pool.

For this, click on the field to get the various equity class plans. Select the one that you want to use for this. In this case, we selected “ESOPs”.

Note: To learn how to create an equity class, click here!

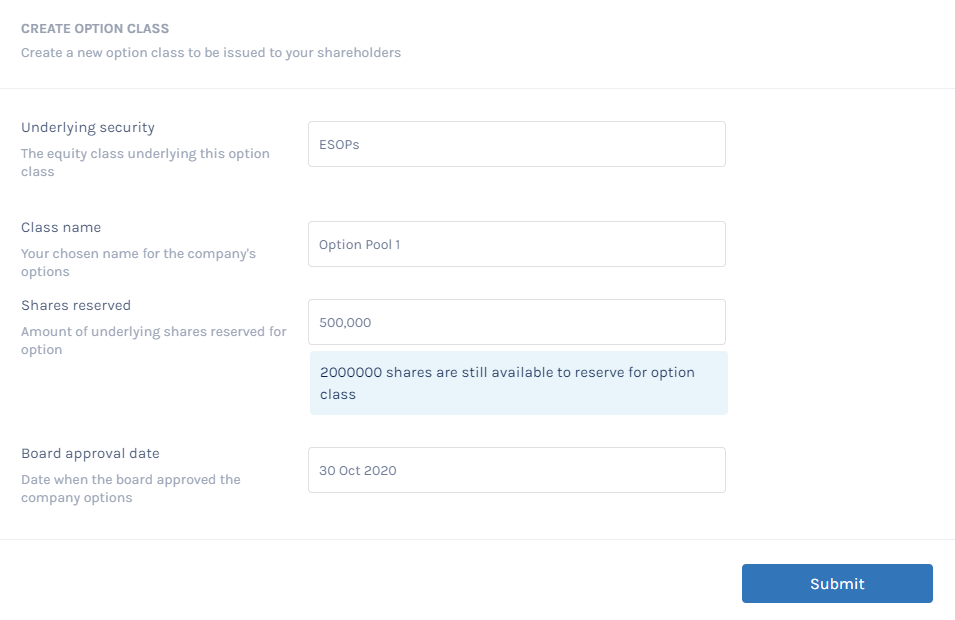

Step 3: Once you do this, a drop-down window will appear. Add in the option details click on “Submit”.

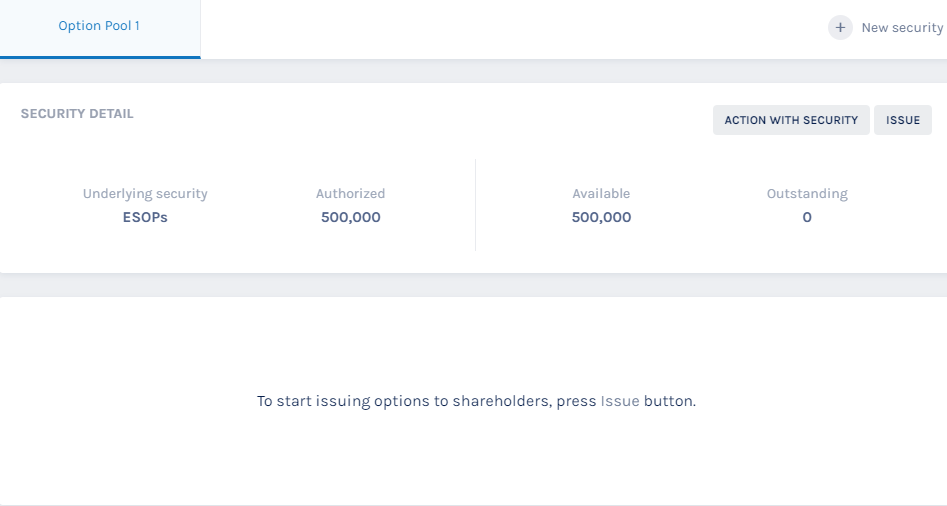

Step 4: The option pool would then be created. You will also be redirected to the page where you can see the option pool details.

You can now begin issuing grants to your employees from this option pool by clicking on the “Issue” button on the top right side.

Creating a vesting schedule

The next important thing you need to know how to do when issuing stock options to employees using this great stock option management software is how to create a vesting schedule. Here is how to do it on Eqvista:

Note: Remember to create a vesting schedule before you issue your stock options.

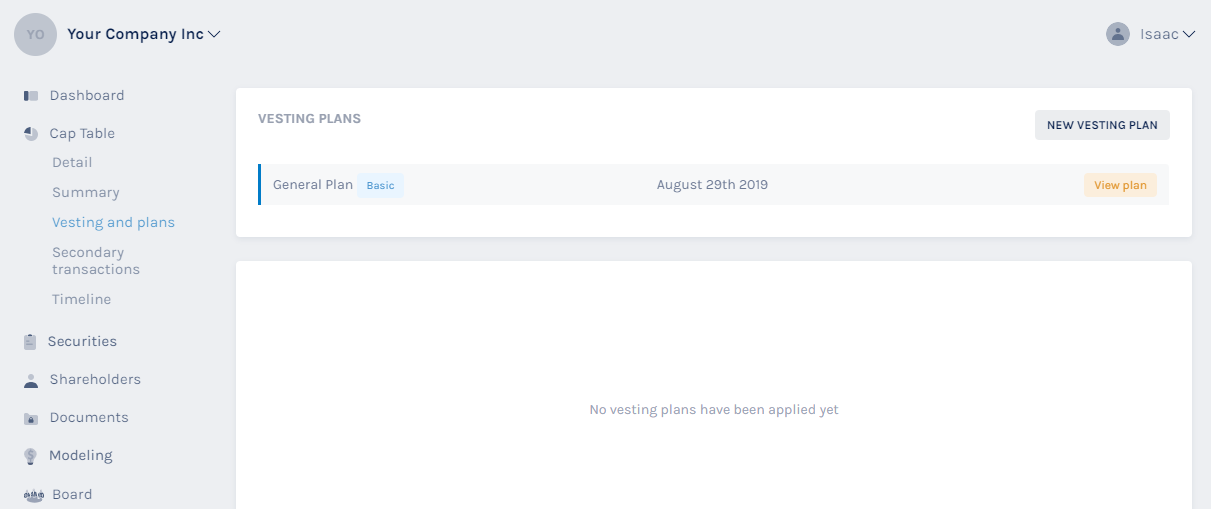

Step 1: From the dashboard or from whichever page you are on, click on the option “cap table” from the left side menu. A drop-down menu will appear. Click on the option, “vesting and plans” from here. You will reach the following page.

To create the plan, click on the button “New vesting plan” from the top right-hand side of the page.

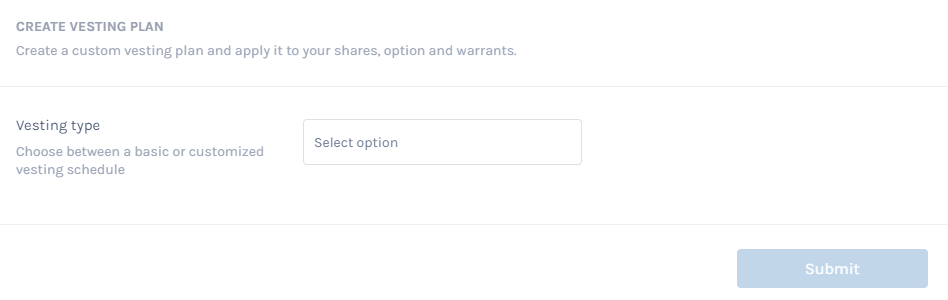

Step 2: Once you do this, you will reach the next page which looks like this.

Here, you need to select the kind of vesting plan you want. There are three types of vesting plans:

- Time based – where the options are given based on how long you stay in the company.

- Milestone based – the options in this plan are offered only when a set milestone or milestones are achieved.

- Hybrid – mix of the above two plans

To help you understand better, we selected the hybrid option.

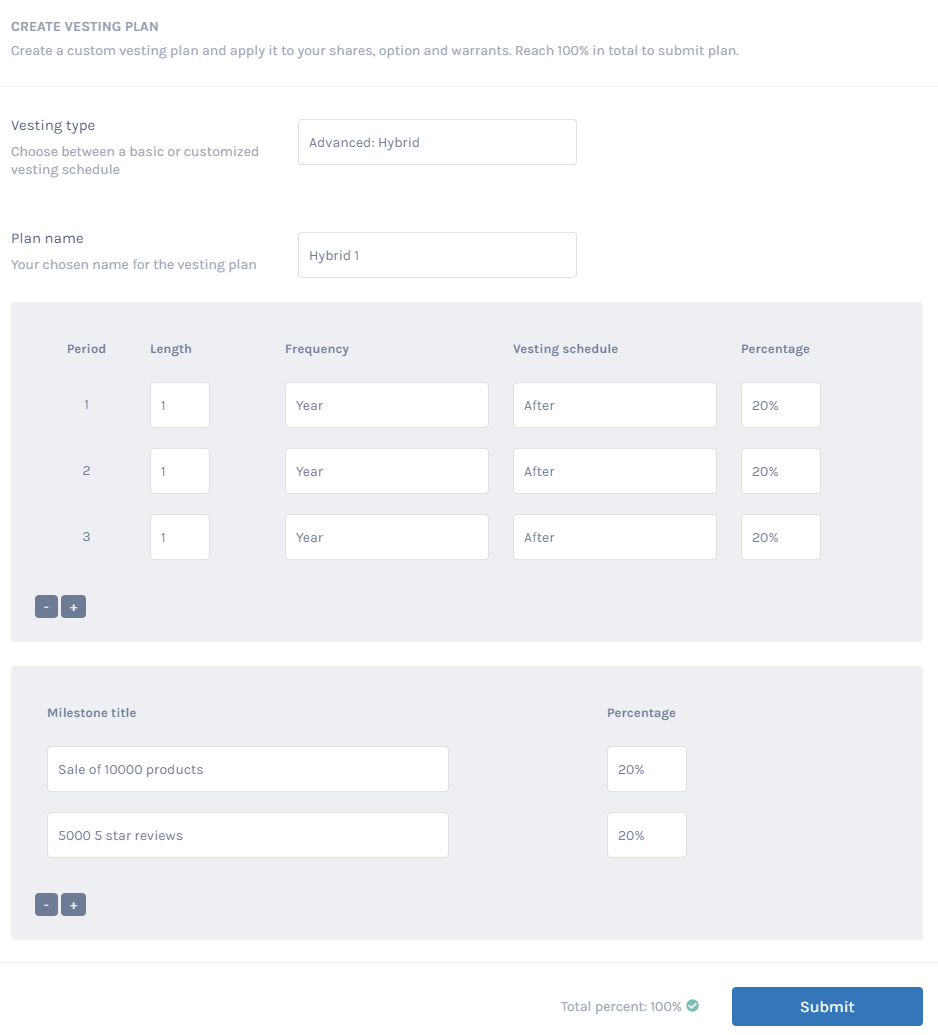

Step 3: When you do this, a drop-down window will appear where you need to add the details as shared below.

Note: Ensure that the total percent of the plan is equal to 100%.

Once done, click on “Submit”, and the plan will be created and you can now use it while issuing the stock options to the employees using this equity management software.

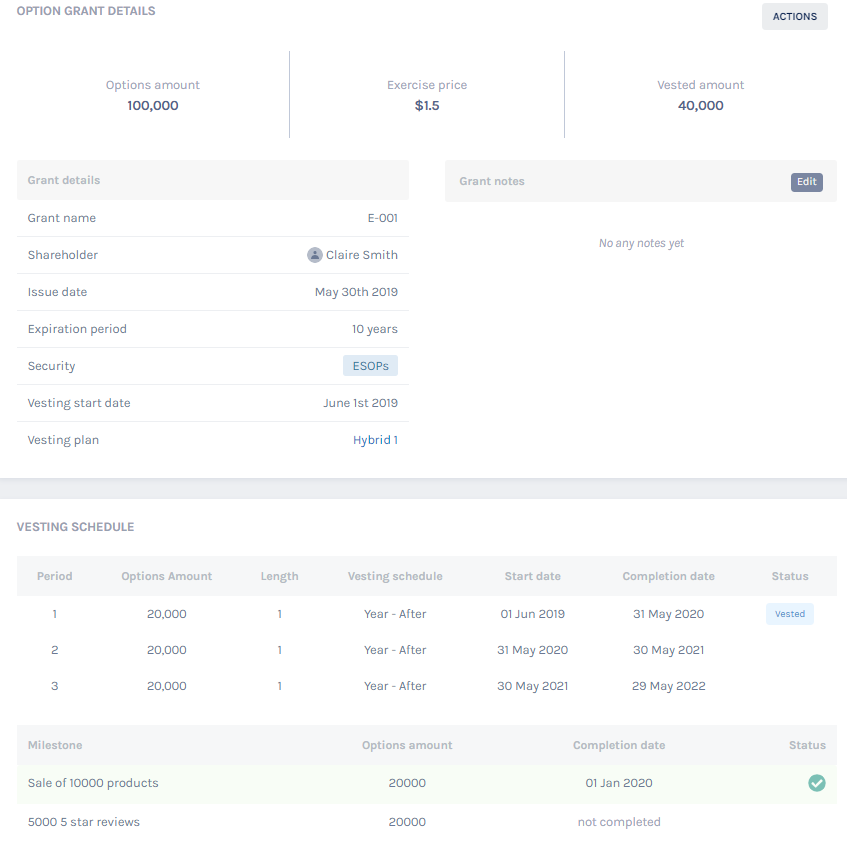

Here is how the vesting plan would look in an option grant:

And just like this, Eqvista can help you in issuing stock options and managing them easily using vesting plans. Learn more about it here and how to use the app here. Check out and begin using Eqvista, which is the best stock option management software out there!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!