Share Buybacks: Weighing the Pros and Cons for Your Company’s Financial Future

This article will cover the benefits and drawbacks of share buybacks and explain their impact on a company’s financial health.

Share buybacks have become necessary for corporations to return cash to their shareholders in the last two decades. Firms disclosed over $300 billion in fresh buyback authorizations in 2022.

Many shareholders, however, need more familiarity with share buybacks. The idea behind a firm purchasing its stock is indeed straightforward. However, many people still need to understand how share buybacks work or why a company would ever want to repurchase its shares of stock, much alone whether or not doing so would benefit investors.

Share Buybacks and the company’s Financial Health

When a firm wants to lower the overall number of its shares on the market, it may engage in a buyback, also called a share repurchase. Companies repurchase stock to boost the remaining share value and resist shareholder control.

Understanding Share Buybacks

Companies can engage in repurchase programs to reinvest in their future. The proportion of shares owned by investors will increase if there are fewer publicly traded shares. If a company feels that its shares are now low-cost, it may provide a return to its shareholders. The company reflects its confidence in its existing operations by increasing the allocation of profits per share in the buyback.

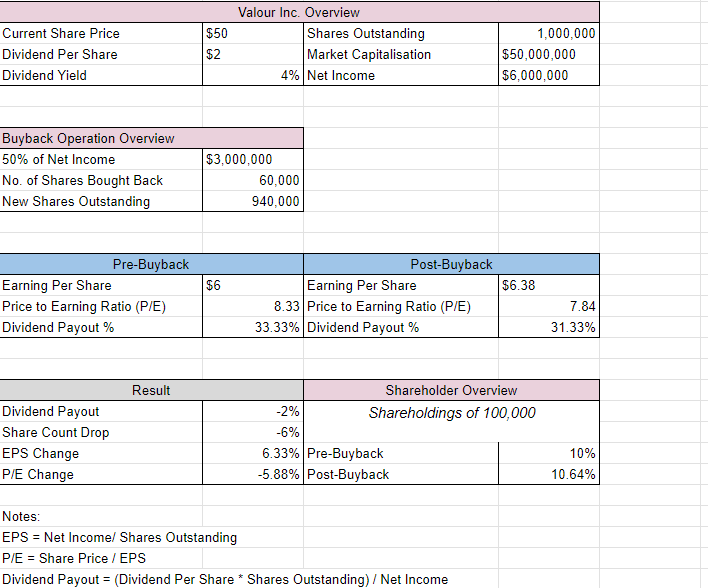

To understand the concept of Stock Buyback, let us take a simple example:

Valour Inc., a company with a market capitalization of $50 million and 1 million outstanding shares priced at $50 each, plans to utilize 50% of its net income, amounting to $3 million, to repurchase its outstanding shares.

Case Study For Share Buyback

Ray Inc. has 1 million outstanding shares, and the current market price per share is $50. The total market capitalization of Ray Inc. is, therefore, $50 million (1 million shares * $50 per share).

Ray Inc. decided to implement a share buyback program, and over a period of time, they repurchased 100,000 of their shares at the current market price of $50 per share. The total buyback cost is $5 million (100,000 shares * $50 per share).

After the buyback, Ray Inc. has 900,000 outstanding shares (1 million initial shares – 100,000 shares repurchased). The total market capitalization remains at $45 million (900,000 shares * $50 per share). However, existing shareholders’ earnings per share (EPS) increase because the company’s profits are now divided among fewer shares.

In this example, the share buyback by Ray Inc. has reduced the number of outstanding shares, potentially increasing metrics like earnings per share and making each remaining share represent a larger portion of the company.

If the stock price rises, the P/E ratio falls, or profits per share (EPS) rise, then the stock is a good investment. Repurchasing shares shows investors that a company has a healthy cash reserve and sees little chance of financial difficulties.

How do share buybacks work as a capital allocation strategy for companies?

Stock repurchase programs help companies invest in their future. If a firm finds shares of artificially lowered value, the best way to resolve this is to return money to its shareholders. By reducing the total number of shares in circulation, the share buyback increases the value of each remaining share.

Many companies may sometimes engage in a stock buyback to prevent current shareholders from being diluted by stock awards and stock options given to workers and management. This is an option to forestall a takeover proposal and maintain minority shareholder control.

Importance of share buybacks

The percentage of S&P 500 businesses that grew profits per share by a minimum of 4% year over year by decreasing the outstanding shares in Q3 of 2022 was the highest since 2019 (according to the data gathered by S&P Dow Jones Indices).

Share buybacks do not directly affect the market and investors, although they may result in smaller dividends than they would have been otherwise. Buying back shares of stock is an excellent strategy to generate value for shareholders if the stock is selling at a discount to its true worth.A corporation purchasing back its shares may raise a stock’s price, even if it’s only transferring cash on its balance sheet.

Buybacks have the potential to artificially inflate a company’s profit growth rate, which investors use alongside other measures like the price-to-earnings ratio and the price-to-book ratio.

Types of share buybacks

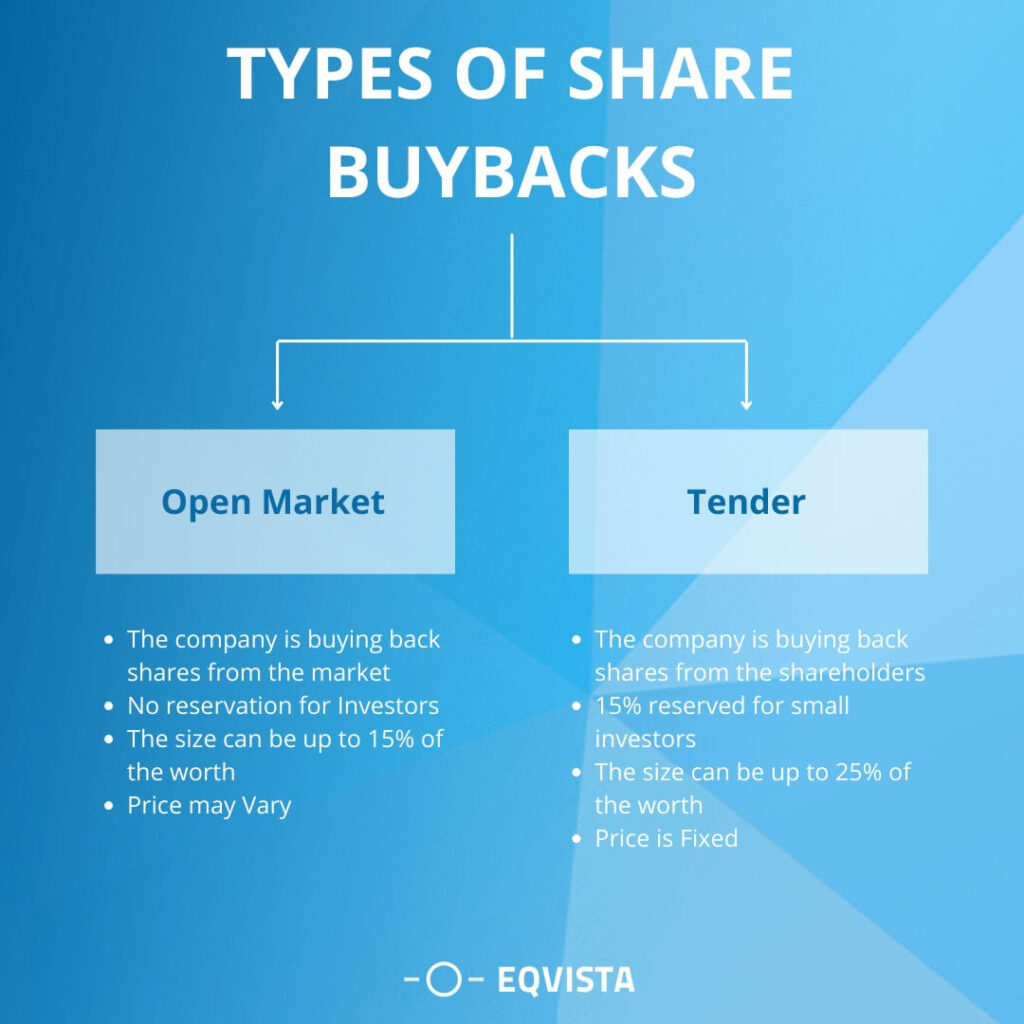

The board of directors chooses whether or not to participate in a share repurchase based on several considerations, including the company’s financial health, cash flow, growth potential, and its need to return values to investors. Both open-market buybacks and tender offers are typical forms of share buybacks.

Open market repurchases

The vast majority of share buybacks occur via open market repurchases. Over time, the corporation will repurchase its shares on the open market. The firm does not predetermine the purchase price or the number of shares to acquire but instead acts on the stock’s perceived undervaluation to make strategic purchases.

The company carries out the repurchases in response to fluctuating market circumstances and readily accessible capital because of this flexibility.

Tender offers

A tender offer can repurchase shares in a more targeted and time-limited manner. This approach makes an open offer to current shareholders to repurchase shares at a fixed price. Investors may choose whether or not to take part in the offer.

If shareholders offer more shares for sale than the firm plans to buy back, the company may buy the extra shares on a pro-rata basis.

Pros of share buybacks

Share buybacks are a good strategy for certain businesses but not others, depending on their situations and financial aims. The following are reasons why they can benefit your company’s financial future.

- Enhanced Earnings per Share (EPS) – When a firm buys back its shares, it reduces the number of outstanding shares, boosting profits per share (EPS). The stock is more valuable to investors because fewer shares are now outstanding but have the same profits.

- Shareholder Value Enhancement – Repurchasing shares may improve shareholder value since the firm returns cash to its owners. When a firm believes its stock has lesser value, it may repurchase it at a price lower than its estimated value.

- Flexible Capital Allocation – Companies may reallocate funds as they see fit with the help of share buyback programs. When a company believes its stock is cheap, it might buy back shares rather than reinvest earnings in internal initiatives or acquisitions.

- Signaling Management Confidence – Share buybacks indicate management’s optimism about the firm’s future. The decision to repurchase shares shows confidence in the stock’s undervaluation and a dedication to increasing the company’s worth for shareholders.

- Tax Efficiency – Share buybacks can be more advantageous from a tax perspective for owners than dividend payments in certain countries. They are a tax-efficient approach to restoring wealth to shareholders since, in many countries, the rate of capital gains is lower than the rate of dividends.

- Balancing Capital Structure – Reducing the number of outstanding shares is a way in which buybacks assist corporations in achieving a more optimal capital structure. The company’s financial health and creditworthiness may improve as a result of a more suitable ratio of debt to equity.

- Defensive Measure against Hostile Takeovers – Share buybacks are a defensive tactic companies might use to avoid hostile takeovers. Reducing the number of outstanding shares on the market via the buyback of a company’s stock makes a takeover attempt more difficult and costly.

- Employee Equity Incentives – Companies with stock grants or equity reward programs for their workers might reduce the dilutive impact of issuing additional shares to those workers by engaging in share buybacks. Many companies repurchase shares to prevent shareholder dilution.

- Supporting Capital Markets – Share buybacks may have a beneficial effect on the capital markets as a whole. They boost stock prices and investor confidence by lowering the number of shares on the market.

Cons of share buybacks

Although potentially valuable, share buybacks must be part of a holistic and ethical financial plan to increase shareholder value. Businesses must weigh the risks below and choose the best way to invest their money to fulfill their long-term objectives.

- Misuse of Funds – A company’s long-term expansion and inventiveness decrease if it utilizes many resources for share buybacks rather than investing in R&D, expanding operations, or enhancing the business.

- Short-Term Focus – The emphasis may shift from long-term investments vital to the company’s continued development and competitiveness to short-term gains in stock price and earnings per share due to share buybacks.

- Diverting Capital from Debt Reduction – If a firm decides to utilize its available cash for share buybacks rather than paying down debt, this might result in the company increasing its financial leverage, which would make the company more susceptible to economic downturns as well as increased interest rates.

- Market Timing Risks – Share repurchases’ timing is significant. A corporation risks wasting money and not increasing earnings per share or shareholder value if it repurchases shares while the stock is overpriced.

- Insider Trading Concerns – There is a risk of insider trading when firms repurchase their shares. There is a perception that insiders (executives or board members) take advantage of non-public information by repurchasing their company shares.

- Diminished Cash Reserves – Repurchasing shares uses up a company’s financial reserves. Prioritizing short-term gains in shareholder wealth may harm the company’s capacity to make long-term investments, fulfill operational objectives, or deal with unanticipated economic challenges.

- Effect on Employee Compensation – Share buybacks have a noticeable impact on workers’ pay if stock options and other equity incentives are a component of their overall compensation package. Buybacks may negatively impact employee drive and retention by decreasing the worth of current stock options, as they reduce the number of shares in circulation.

Share Buyback Impact on Financial Health

Share buybacks can influence a company’s capital structure by reducing the equity on the balance sheet. If the debt can fund share repurchases, equity will fall, but the debt will not change. Therefore, more financial leverage occurs due to a rise in the debt-to-equity ratio.

The debt-equity ratio rises due to the share repurchase since the equity value falls, but the debt level does not. Companies may achieve the desired capital structure more readily with a higher debt-equity ratio.

On the other hand, increased leverage may magnify shareholder profits in the event of solid corporate performance. The downside of additional debt is that it might make a business more vulnerable to market fluctuations and interest rate hikes.

Cash Flow Management and Debt Control

A company’s cash on hand, debt load, and anticipated financing requirements are all factors you must consider before deciding to engage in share buybacks.

Here are a few things to keep in mind in this regard:

- It is required for the companies to evaluate their cash flow production and liquidity to make sure there is enough money for continuing operations and new investments.

- The capacity to incur and service debt is a key performance indicator for businesses, as is an understanding of how rising debt loads affect interest payments and a company’s bottom line.

- Firms should emphasize the relative merits of share repurchases and investments in growth projects, which may provide greater long-term profits.

- Because increasing debt levels may raise financial risk, businesses should be aware of their risk tolerance and the extent to which they are vulnerable to economic downturns.

Need to manage your stock? Contact Eqvista!

Generally, companies that use share buybacks or dividends to return money to their shareholders do the right thing. Moreover, buybacks offer certain benefits over dividend payments in some circumstances, such as when a stock’s market price is far below its true worth.

Like other aspects of investing, however, whether share buybacks benefit or harm investors does not end with a simple yes or no. Each situation calls for a unique assessment. In this case, Eqvista can help you with a streamlined platform where you can quickly issue and manage your stocks.

We can help you understand the market conditions with which you can handle your stock administration with up-to-date standards. Need help getting started? Reach out to us now!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!