Shareholder Voting Agreement: What You Need To Know

A shareholder voting agreement is a contract between two or more shareholders who share their rights to vote on a particular common objective or goal.

Shareholder rights have become an integral part of any corporate governance system. These rights ensure that the shareholders can raise their voice and opinions on the initiatives and corporate actions that might not be useful for them. Shareholders use their voting rights in making numerous decisions in a company such as choosing the board of directors, approving new securities, and making any considerable changes in the company and its operations.

Shareholder Voting

Shareholders have the right to vote on corporate policies such as choosing directors, initiating corporate actions, and changing any aspect of the company’s operations, among other things. Provisions in the corporation’s bylaws govern the voting rights of shareholders. Shareholder voting rights differ from regular voting eligibility in this way. During shareholder meetings, significant policy decisions are voted on.

What is a Shareholder Voting Agreement?

A shareholder voting agreement is a contract between two or more shareholders who share their rights to vote on a particular common objective or goal. It gives a shareholder the right to cast their votes in favor of any proposal or cast it against any proposal. It is also termed a pooling agreement. A pooling agreement is a contract in which shareholders of a corporation combine their voting rights and transfer them to a trustee to form a voting trust.

Because it is used to control the corporation’s affairs, it is also known as a voting agreement or shareholder-control agreement. A shareholder agreement also maintains the relationship between shareholders, management of the company, ownership of shares. It protects the rights of the shareholders and also governs how the company runs. Voting agreements are also frequently used in business combination transactions to reassure the buyer that a majority will approve the proposed transaction of shareholders. It also allows the shareholders to transfer their votes to the trustee.

There are specific requirements for this shareholder voting agreement which are as follows:

- The contract should be in writing.

- A copy of the agreement must be deposited at the corporation’s principal office and should be available for inspection to all shareholders.

Why is a voting agreement important?

This agreement lays forth conditions under which stockholders of a target company commit to voting in favor of a merger. This Standard Document includes notes that include critical explanations as well as drafting and negotiation advice.

Significance of the voting agreement

A voting agreement to be utilized in connection with a public company acquisition. This agreement lays forth the terms and conditions under which stockholders of a target company commit to voting in favor of a merger.

Resolving the conflicts of interest

A voting agreement enables the shareholders to take control of the operations of the business. It also gives them the power to put forward their opinions and participate in the decision-making. If there are any disputes between the shareholders and the company, this agreement gives shareholders an edge to resolve them.

The common approach is to transfer the shares to a blind trust that has no knowledge of the trust’s ownership and no right to vote. There is the minimal conflict of interest between the shareholders and the investments in this manner.

Increment of shareholder voting

Individual shareholders have minimal power when voting and may not perform some responsibilities that large shareholders can. For example, to have the ability to convene meetings, shareholders must own a majority of the company’s shares. Shareholders who transfer their voting rights to more voting power than if they voted individually. Shareholders with combined voting power may take measures that they couldn’t handle if they voted individually.

Preventing the hostile takeover

Shareholders can put their shares in a trust when a company is threatened with a hostile takeover. Because a substantial number of stakes are locked up in a conviction for a defined period, the practice discourages the firm from pursuing the takeover and attempting to purchase a significant chunk of the target company’s shares.

Voting Agreement Template (SEC)

A voting agreement is made between a buyer and certain significant shareholders of a target company. The shareholders can include the company’s directors and senior officers. The agreement is to be implemented on the terms and conditions outlined between the buyer and the target company.

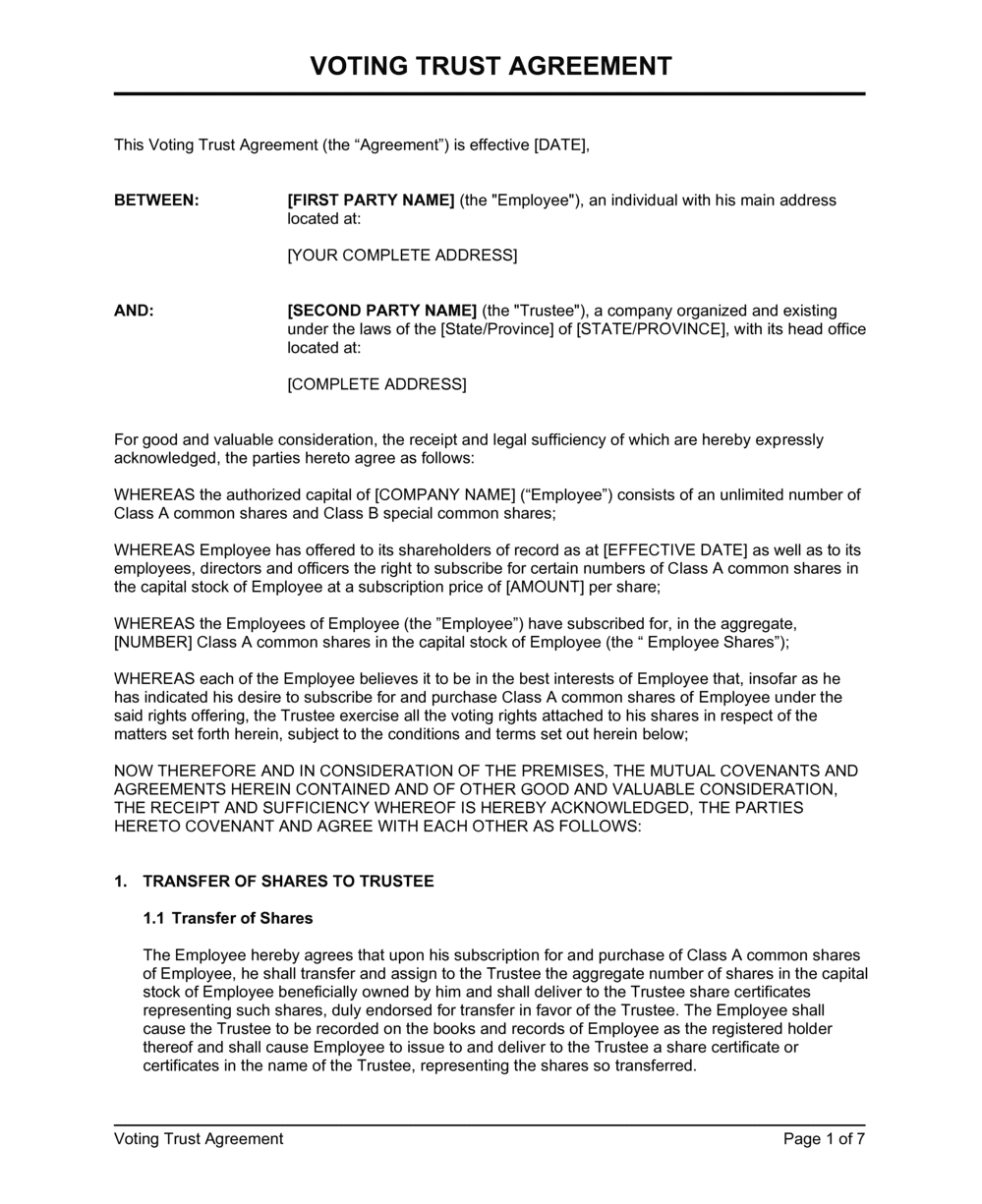

Here is a sample of the voting agreement template.

Voting Trust Agreement

A voting trust agreement is an arrangement between the company’s shareholders who want to transfer their voting rights to the trustee for a specific period. It is based on the criteria on the choice of the shareholder. Usually, two or more shareholders get the right to transfer the voting rights to the trustee legally. In some cases of the voting trusts, the trustee is also guaranteed some additional powers and benefits.

What is a voting trust agreement?

A voting trust agreement also goes under the name, pooling agreement. Two or more shareholders transfer their shares to a trustee under a voting arrangement. The trustee will then vote for those shares as a group following the agreement’s terms or the majority’s will. Shareholders in a voting trust have more voting power than if they voted independently.

Trustees are frequently required to vote by the preferences of participating shareholders.

A voting trust arrangement allows a shareholder to transfer his or her voting rights to another individual. A voting trust is established by a signed trust agreement in which the original stockholder transfers his shares to a trustee for safekeeping. Such arrangements aim to keep track of how the shares are voted on and give the trustee the right to do so.

A voting trust agreement requires the trustee to vote in certain ways. Section 6.251 of the Business Organizations Code provides:

- The voting trust agreement must be in writing and confer the right to vote on the trustee.

- The stock must be transferred into the name of the trustee.

- A copy of the voting trust agreement must be deposited with the corporation and made available for shareholder inspection.

How does a voting trust agreement work?

As a deterrent to hostile takeovers, voting trust agreements are normally managed by the company’s incumbent board. However, they can also be used to represent a person or group attempting to seize control of a corporation, such as creditors seeking to reorganize a failing company. Voting trusts are more frequent in smaller businesses because they are easier to manage.

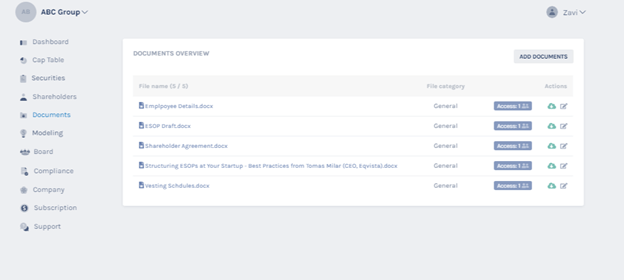

Upload Shareholder Voting Agreement with Board Resolution on Eqvista

On the Eqvista app, you can upload as many documents you want to share with your shareholders. It enables you to upload and share all of your critical financial records with your management and company shareholders. As a result, once you’ve uploaded the document, you’ll be able to share it with all of your shareholders. It is an easy procedure to follow.

Here is how to do it:

- Navigate to your company’s dashboard after logging in.

- Select the documents you want to add by clicking “ADD DOCUMENTS”.

- Click “Upload files” after you’re finished.

- Following that, go to “DOCUMENTS OVERVIEW” to see the whole list of documents you’ve uploaded, as seen below.

Manage Your Shareholder Voting Agreement With Eqvista

Managing the total shares and agreements is a complicated process and thus, it sometimes becomes difficult for the companies to maintain them. But with our application, we have made it super easy and convenient for you. Anyone who uses our application gets free training from us before starting the process.

We are here to help. Book your appointment and get a free consultation here.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!