Stock Certificate Template

Stock certificates, otherwise known as share certificates, are held by shareholders of a company.

If you have been trading in the share market as a buyer, seller, or a brokerage firm, by now you must be aware of the concept of stock certificates. If you possess one, you know that this document is a receipt of your share transactions. But do you know how these stock certificates are created? Who creates them? Is there an agreeable format? How does one know which information to include? In this article, we will try to answer these questions. Let us first discuss what stock certificates are.

Stock Certificates

Stock certificates, otherwise known as share certificates, are held by shareholders of a company. The company issues a stock certificate to its shareholder as proof of a share purchase. This certificate must state all details of the share issuer and the shareholder. As the number of shareholders increases owing to a growing business, it is beneficial to use a stock certificate template instead of creating one from scratch at every transaction. Before we break down this process of creating stock certificates, let us try to understand the motive of companies issuing stocks.

Why do companies issue stocks?

Companies need funds to operate at scale. As company operations expand, funds are raised in two ways – debt financing and equity financing. While debt financing is done by borrowing (bank loans), equity financing is done by offering company shares for sale in the stock market. The biggest advantage of equity financing is that unlike bank loans that mandate the return of the principal amount subject to high-interest rates, no money needs to be returned to investors who buy company shares and the concept of accruing interest does not apply as well. By equity financing, shareholders get part ownership in the company and the company gets the necessary funds to expand and operate efficiently.

Once an investor has purchased a company share, the company has to provide a stock certificate legitimizing this transaction. This stock certificate is a legal document and can be a physical one on paper or digital shared through an electronic medium. But it is always advisable for a company to use a stock certificate template to minimize discrepancies. In the next section, we will discuss how to create such templates. However, it is important to note that not all shares require certification. This will depend on the size of the corporation and the number of shares purchased.

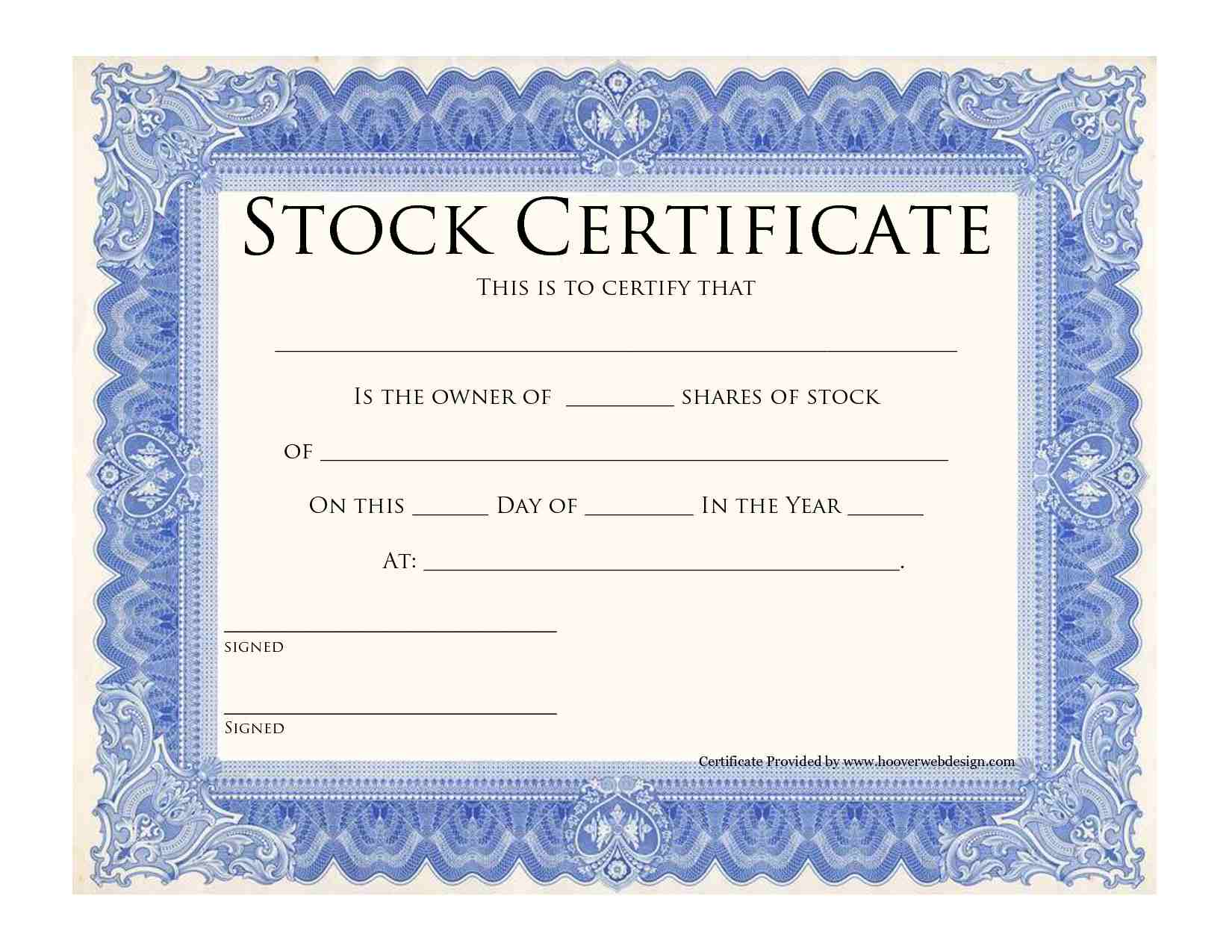

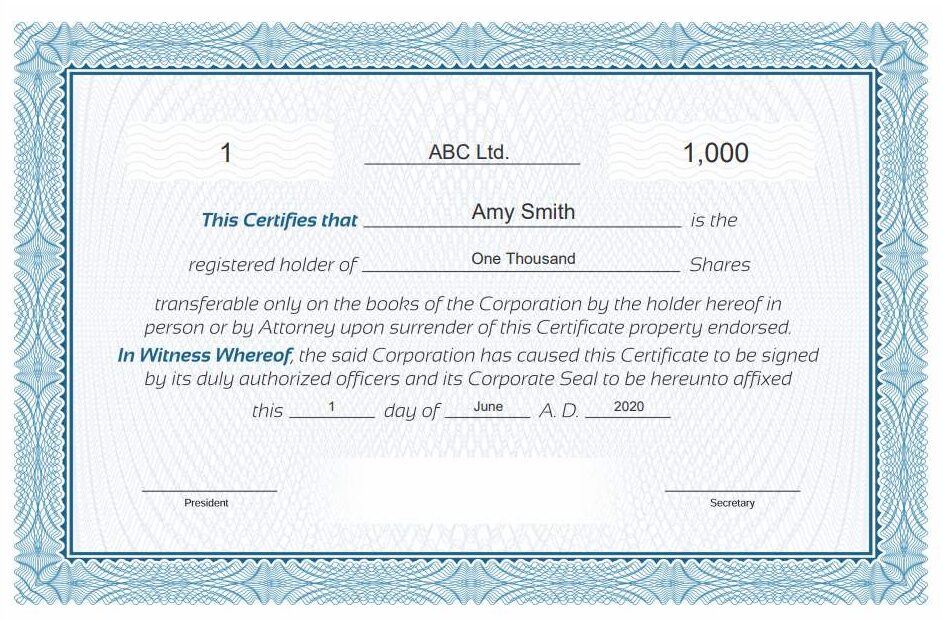

What is included in a stock certificate template?

It is standard practice to issue only one stock certificate collating details of all purchased shares. This means that a shareholder will receive only one stock certificate irrespective of purchasing one or a hundred shares. An exception to this rule happens when a shareholder owns stocks across two different asset classes. Only in such a scenario is more than one stock certificate issued. In the case of joint shareholding, though the names of both the shareholders are mentioned in the stock certificate, the contact details of only the first-named shareholder are included for correspondence.

Since a stock certificate is legally viable, companies must be careful about the information included in it. Minor errors in a stock certificate can raise questions on its authenticity. Here are some basic details included in a stock certificate template:

- The serial number of the stock certificate

- Date of issuance

- Name of the stock issuing company

- The registered address of the stock issuing company

- Name of the shareholder

- Number of purchased shares

- Share price

- Whether common stock or preferred stock

- Information regarding stock restriction

- Signatures of the corporation’s president, secretary, and treasurer

- Official company seal

As you can see, the details included in a stock certificate demand accuracy and confidentiality. To avoid errors in data, it is advisable to have a stock certificate template handy. This saves time and minimizes lapses when compared to creating new stock certificates every time from scratch. Additionally, by using templates, a company can customize its stock certificate to suit branding needs.

Types of stock certificate templates

Before we dive into the types of stock certificate templates, let us explore the basic stock market scenario. The stock market is divided into two main sections, the primary market and the secondary market. The primary market, also known as the new issue market, is the platform where companies sell their stocks to investors to raise capital. The secondary market however is dedicated to all other subsequent share purchases. The shares traded in the primary market are further categorized into two types:

- Common stocks – When an investor speaks of purchasing shares, it is usually common stocks. They represent ownership of a part of the company. Shareholders owning common stocks are granted voting rights of one vote per share. They use their voting rights to determine strategic corporate matters such as the appointment of directors, decisions on mergers, etc. Common stockholders gain when share prices of the company appreciate. But on bankruptcy, they suffer the maximum loss and have the last claim on company assets only after creditors and preferred shareholders.

- Preferred stocks – These resemble bonds. Shareholders owning preferred stocks are not granted voting rights in the company. Unlike common stockholders, preferred stockholders are promised fixed dividends instead of share price dependency. In the case of bankruptcy, they are ‘preferred’ over common shareholders to claim company assets.

Based on the above considerations, a company determines the stock certificate template to be used for a particular shareholder. Here are the two basic types of stock certificates:

- Registered stock certificates – This type of stock certificate proves the title of a shareholder. It acts as a personal record of share purchase for the shareholder mentioning their name on the certificate. The details of registered stock certificate issuance are found in the company’s shareholder register. To transfer ownership of registered shares, a share transfer has to be signed and deposited at the company’s registered office along with the original stock certificate.

- Bearer stock certificates – Unlike a registered stock certificate, this stock certificate is used to document only the bearer of stocks and not the stockholder personally. Hence, the name of the shareholder does not appear on these types of certificates. Bearer stock certificates are rare today but were once popular for offshore accounts and their apparent confidentiality. But in the long run, this proved to be unreliable. Since no names were mentioned on bearer stocks, it was difficult to track and replace them if stolen. Chances of fraud were high as well. To transfer ownership of bearer shares, the owner simply had to hand over the stock certificate to the new shareholder. There was no need to sign a share transfer in the issuing company’s register.

Now imagine you have an old stock certificate that has been handed down to you as family memorabilia. If you are a beginner in share trading, how will you determine the value and authenticity of this stock certificate? Here are some tips:

- Validate the company name – The first step is to check if the company is still in business. If it is, visit the company website and check for their credentials in the stock exchange. Further, check for the investor relations page for more details.

- Verify CUSIP number – Every security is assigned a unique CUSIP number. Whenever a change is made (rename, reorganization, split, etc), a new CUSIP number is assigned. If you search with the existing CUSIP number, it is possible to track down the current equivalent. You can consider consulting a brokerage firm who professionally handles CUSIP tracking.

- Location of incorporation – Each stock certificate is incorporated in a state. All records of this transaction are maintained in the office of Secretary of State who manages the entire database of shareholder activity of companies incorporated in that State.

Once you have gathered these three details, contact the company’s transfer agent. This transfer agent will help you evaluate the stock certificate. Once you have found the actual value of the stock certificate, analyze if it is profitable to sell its ownership rights. If positive, please keep these points in mind:

- Always operate through a transfer agent or a reputed brokerage firm.

- Transfer agents manage companies or individuals dealing with stocks.

- Authenticate transfer agents on the company website

- Research the stock value before selling

Free Stock Certificate Template

Investors purchase company stocks betting on the profitable future of a company. It is only natural that the receipt of share purchase must carry accurate details that are legally viable several years later as well. Using a stock certificate template supports this process. Irrespective of the person handling stock certificate issuance, a template standardizes the format, ensuring accuracy and compliance all through the process.

It is now easy to generate a free stock certificate. You can accomplish this is three simple steps:

- Choose from the type of stock certificate template available

- Add the necessary information and confirm the design

- Click to generate a free stock certificate.

Once the certificate is generated online, simply download it, print, and attest with signatures from authorized corporate officers. This process is far easier than creating a new certificate from scratch every time a share is purchased. You can also opt for a more sophisticated version of this with greater flexibility of customization with your share grant details on Eqvista.

Create stock certificates on Eqvista

Eqvista equity management software helps entrepreneurs record and manage company stocks with ease. Instead of engaging different services from varied platforms, Eqvista provides the added advantage of collating all company shares related services under one umbrella. You can now incorporate your company and manage equity all in one place. Sign up today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!