Understanding Share Transfer or Transfer of Shares

This article will help you understand all about share transfer and the procedure for the transfer of shares in a company.

Before a company’s ownership can change hands, a number of formalities must be followed to ensure the process is legally valid and recorded. The movement of shares between parties is common in the business world, whether due to investment decisions, restructuring, or personal arrangements.

Understanding these is essential for those involved in corporate ownership. This leads us to explore the concept and process of share transfer, which governs how ownership rights in a company’s shares are officially passed from one individual or entity to another.

What is Transfer of Shares?

A share transfer is the process by which ownership of shares in a company is moved from one individual or entity to another, through various means, such as sale, gift, inheritance, or other legal mechanisms. The new owner gains all associated rights, including voting and dividend entitlements.

Key Parties Involved

- Transferor – The present owner of the shares who initiates the transfer.

- Transferee – The recipient who acquires ownership of the shares.

When a person purchases or receives a company’s stock, they get a certificate that shares the details of the ownership of the shares, known as the stock certificate. So, when this person decides to transfer the shares to someone else, they would have to perform a transfer using a share transfer form.

Possible Reasons for the Transfer of Shares

There are several common reasons why a shareholder may transfer their shares in a company:

- Selling the business or exiting the company – A shareholder may want to sell their shares and exit the company, either to cash out their investment or for other personal or business reasons.

- Bringing in new investors or partners – A company may transfer shares to new investors or business partners to raise capital or bring in strategic expertise and resources.

- Restructuring or reorganization – Companies may transfer shares as part of an internal restructuring, reorganization, or consolidation of ownership.

- Estate planning or gifting – Shareholders may transfer shares to family members, spouses, or others as part of estate planning or as a gift.

- Change in ownership or control – Share transfers can facilitate a change in the ownership or control of a company, such as when a majority shareholder sells their stake.

- Satisfying obligations or liabilities – Shares may be transferred to satisfy debts, liens, or other obligations or liabilities of the shareholder or company.

- Retirement or resignation – When a shareholder retires or resigns from the company, they may transfer their shares to other existing shareholders or new parties.

The transfer of shares allows shareholders to exit a company, bring in new investors, restructure ownership, engage in estate planning, change control, satisfy obligations, or facilitate retirement or resignation from the company.

Procedure for Transfer Of Shares

Here’s a short summary of the procedure for transfer of shares:

Step 1: Pre-transfer

- Sign a share transfer agreement between the transferor (seller) and transferee (buyer), specifying details like the company name, number of shares, price per share, transfer date, and signatures.

- The transferor must send a written notice to the company and all shareholders, providing information about the transferor, transferee, number and class of shares, consideration, and whether stamp duty is payable.

- Inform existing shareholders about their pre-emptive rights to purchase the shares before offering them to outside parties.

- Obtain written consent from existing shareholders approving the share transfer.

Step 2: Application

- Prepare the required documents, including the share transfer form, share certificates, board resolutions (if needed), ID copies, bought and sold notes, and the company’s Articles of Association.

- Both parties sign the share transfer agreement, and the transferee’s signature must be a certified accountant, or authorized officer.

- The transferee typically pays the stamp duty on the transfer, either through e-stamping or traditional methods.

- Submit the stamped transfer form and supporting documents to the company’s registrar (usually the secretary or a specialized registrar).

Step 3: Post-transfer

- The registrar reviews the documents, updates the company’s register of members, and cancels the old share certificates.

- The registrar issues new share certificates to the transferee, confirming the ownership transfer.

- The company must notify the Companies Registry about changes in members, shareholders, and directors separately within one month of the transfer.

The entire process typically takes 3 to 5 business days if all required documents are promptly available and approvals are obtained. It is suggested to seek professional help from a valuation Company like Eqvista well-versed in company law to ensure a smooth and compliant share transfer process.

Checklist for Transferring Shares

Here is a checklist for transferring shares in a company:

Pre-Transfer

- Review the company’s Articles of Association and any shareholders’ agreement for restrictions or conditions on share transfers.

- Ensure board approval or shareholder resolution is obtained for the share transfer.

- If pre-emptive rights exist, Offer the shares to existing shareholders first.

- Obtain written consent from existing shareholders approving the transfer.

- Sign a share transfer agreement between the transferor (seller) and transferee (buyer) specifying details like company name, number of shares, price per share, transfer date, etc.

- The transferor sends the company and all shareholders a written notice with transfer details.

Application

- Prepare the required documents: Application letter

- Bought and Sold Notes or Share Purchase Agreement

- Recent audited financial statements or management accounts

- Company resolution on dividend distribution (if applicable)

- Copy of Articles of Association

- Transferee’s ID and residential proof

- Share transfer form/instrument

- Details of any company land properties

Steps:

- Both parties sign the share transfer form, with the transferee’s signature certified by a professional.

- Pay the required stamp duty, either through e-stamping or traditional methods.

- Submit the stamped transfer form and supporting documents to the company’s registrar.

Post-Transfer

- The registrar reviews documents, updates the register of members, and cancels old share certificates.

- The transferee will issue new share certificates.

- Notify the Companies Registry about changes in shareholders/directors within one month.

- Update the company’s bank records with the new member register.

How To Transfer Shares From One Shareholder to Another Person?

The transfer of shares in the company seems to be the same for all companies, but we know that there are different types of business entities, and each has its own kind of structures and processes. Keeping this in mind, we have shared the process of the transfer of shares for each main kind of company.

Transfer of shares in a Corporation

The shares in a corporation are freely transferable. Nonetheless, the Articles of Incorporation, the agreement between the shareholder, or the bylaws might place some reasonable restrictions on the transfer of shares. For being about to transfer shares, the shareholder would require the board members’ approval and the approval of all the other shareholders in the company. Once this is done, the share transfer form is filled in, and the new share certificate is issued accordingly to the person getting the shares.

Regarding tax implications, corporations themselves typically do not sell their shares. When shareholders sell their shares, they may be subject to capital gains tax at the individual level, often at preferential rates depending on the jurisdiction. Corporations pay tax on their income and gains from business operations, but capital gains from the sale of shares by shareholders are generally taxed only at the shareholder level.

However, if an individual shareholder is selling the shares, they would have to pay tax on the capital gains at the preferential individual tax rate.

Transfer of shares in S corporation

S corp is treated like a corporation for legal purposes but is a pass-through entity for tax purposes. The process for transferring shares is similar to that of a C corporation: board approval is usually required, followed by completing the share transfer form and issuing a new share certificate.

For tax, the S corporation itself generally does not pay tax on capital gains. Instead, gains and losses flow through to shareholders, who report them on their personal tax returns. When shareholders sell their shares, they pay capital gains tax at their individual rates, which may be preferential. The company’s records and capitalization table should be updated to reflect the transfer.

Transfer of shares in LLC

An LLC is governed by an Operating Agreement created when it is formed. This agreement provides the details on how the transfer of shares would be done in the company. If you are a shareholder in the LLC, you would have signed the operating agreement as well. And even though the operating agreement should have the rules that define the transfer of shares in the company, the LLC can also have a buy-sell agreement for it separately. It would share details taking into consideration every situation possible that can lead to the transfer of shares.

LLC may not issue share certificates but should document the transfer thoroughly. Once the board has approved the share transfer, and the conditions as per the agreement are met, the share transfer form must be filled and signed. As soon as it is signed, the shares are handed to the transferee, and the stock certificate is issued.

Transfer Shares on Eqvista

With all the above explained and now that you have understood everything, it is essential to record every transaction you make. Recording it means documenting the transaction in your cap table. And Eqvista is an advanced cap table software to help you record and manage all your equity transactions.

Before you begin, you will need to make sure that you have an account on Eqvista and have created your company account.

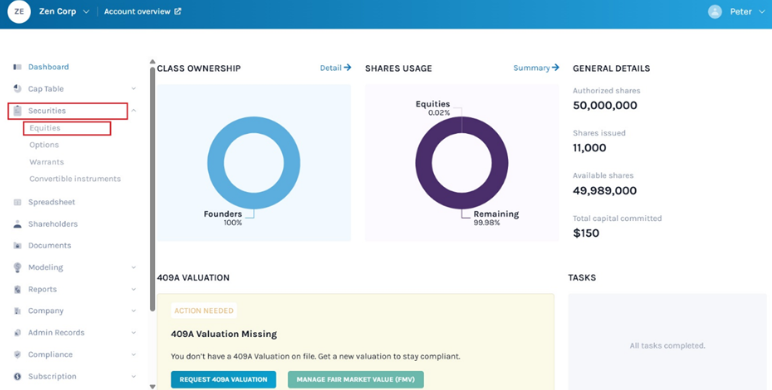

Step 1: Log into your account, select your company profile and from the dashboard, click on “Equities” under the “Securities” tab.

Here, click on the equity class from where the share transfer is about to take place. In this case, we select the option “Series B”.

Step 2: Once you do this, you will reach the next page, as below:

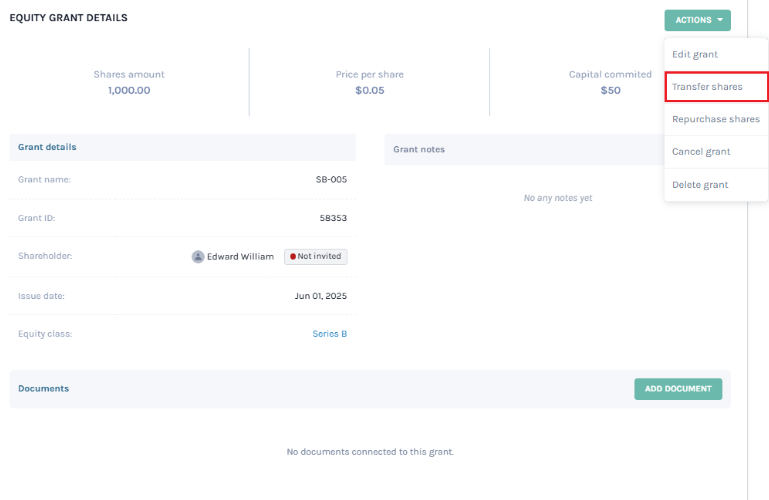

From here, select the certificate number of the shareholder whose shares are being transferred. In this case, we selected the option “SB-005”.

Step 3: This will take you to the page where you can see the details of this transaction. Next click on “Action” and then on “Transfer shares”.

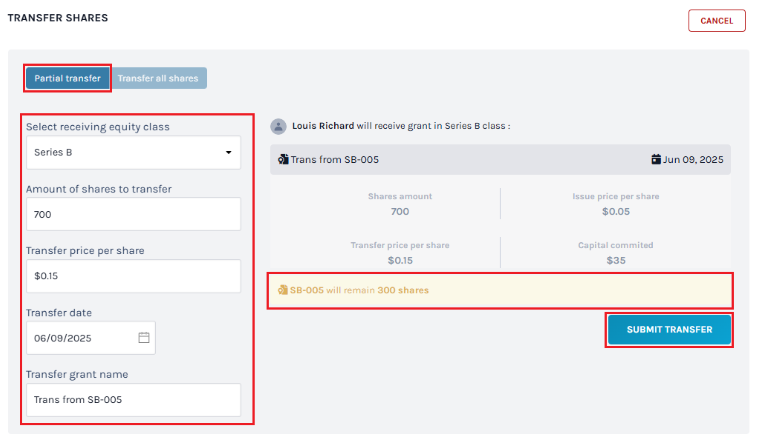

There are two kinds of transfers that you can make. One is the partial transfer and one is the transfer of all shares. Here we chose partial transfer, and type in the transferee’s name. When the name comes up, you will see a button beside it that says “Select”. Click on that.

Step 4: You will reach the next step where you need to add the number of shares that you want to transfer. Since it is a partial transfer, and the shareholder who is making the transfer has about 1,000 shares, we choose to make a transfer of 700 shares here.

You will also have to add the price of the share at the time of the transfer. In this case we add in the share price of $0.15, and click on Submit.

With this, the transaction will be complete, and you will be redirected to the transferor shareholder’s page.

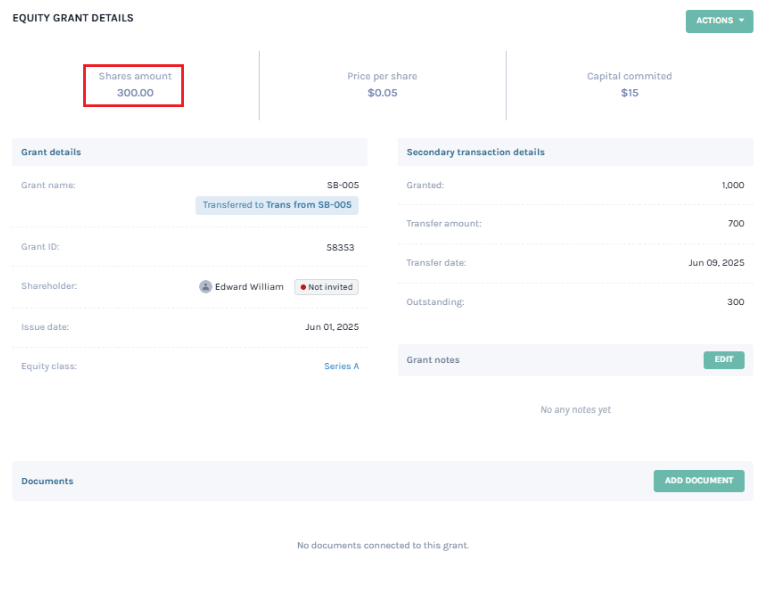

Step 5: This will take you back to the page where you can see the updated share number that Edward William has, which is after he just got some of his shares transferred.

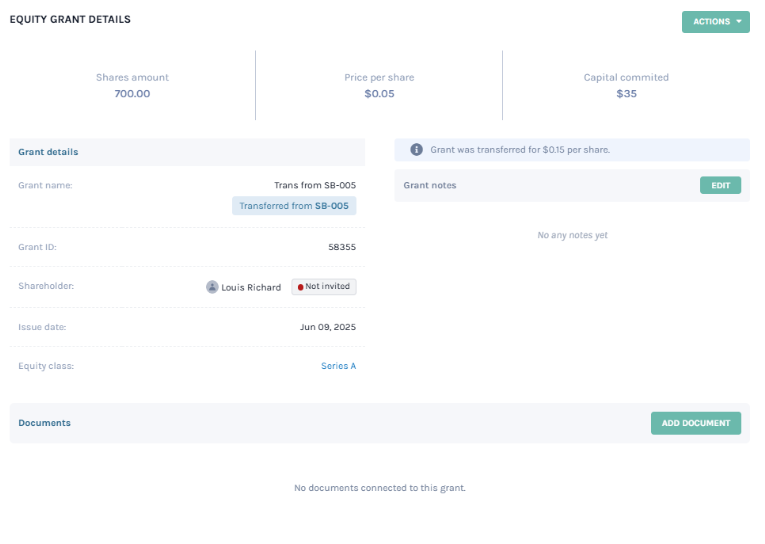

Step 6: Click the new grant’s name in the Grant details session (Transferred to Trans from SB-005) and you will reach the page where you can now see the details of this transfer.

Kindly note that the transfer price won’t show on the grant details page but the original price.

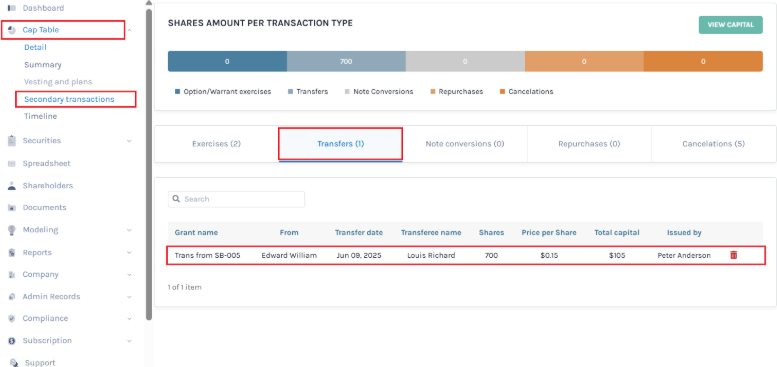

Step 7: To see the transfer and its effect on the secondary transactions of your cap table, you need to click on “Cap table” from the left side menu and then on “Secondary transactions”. This will take you to the following page.

Here, click on the “Transfers” tab to see the transfer transaction as shown below.

And just like this, you can easily make the transfer of shares in the company through Eqvista. To know more about the Eqvista app and how to use it, check out our knowledge center or contact us today!

FAQs

Here are a few frequently asked questions about the transfer of shares in companies:

What documents are required for a share transfer?

The main documents required are the share transfer instrument, bought/sold notes, board resolution approving the transfer, company’s articles of association, latest audited accounts or management accounts, and details of the new shareholder(s).

How long does the share transfer process typically take?

The share transfer process in a company is typically efficient, taking 3 to 5 business days. This is, of course, provided all required documents are promptly available and approvals are obtained. Seeking professional guidance is recommended for full compliance with regulations

How can I expedite the share transfer process?

Advance preparation, which includes having all the necessary documents ready, coordination among parties, and adherence to regulatory requirements, are crucial for a smooth and timely share transfer process. Getting advice from corporate service experts is recommended, especially for complex transactions.

What are the consequences of not complying with share transfer regulations?

Not following proper procedures can invalidate the transfer, cause shareholder disputes, lead to penalties, and prevent updating the company’s records—jeopardizing legal ownership and rights.

How does the pre-emptive right affect share transfers?

The pre-emptive right gives existing shareholders priority and the first opportunity to purchase any shares being transferred before they can be sold to an outside party. Adhering to this right is crucial for the validity of share transfers in companies.

Transferring Shares Through Eqvista!

Understanding the transfer of shares is important for easy ownership changes and maintaining compliance with corporate laws and company rules. No matter what, if you’re dealing with corporations, S corporations, or LLCs, knowing the proper procedures helps avoid legal pitfalls and ensures valid transfers. For businesses and shareholders looking to navigate this complex process efficiently, expert guidance is invaluable.

Eqvista provides an online platform to digitally manage the entire share transfer process – from adding new shareholders to issuing/transferring shares and generating electronic documents and certificates.

Ready to simplify your share transfer process? Contact Eqvista today for professional support and streamlined equity management solutions tailored to your needs.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!