NFT Valuation – Everything you need to know

In this article, we will dive deep into the subject of NFTs and understand how to calculate the value of one.

The rise of non-fungible tokens (NFTs) has introduced a new chapter to the digital economy, where uniqueness and authenticity are encoded on the blockchain, transforming intangible creations into verifiable assets.

The NFT market has experienced dramatic volatility, evolving from a niche digital curiosity to a multi-billion-dollar asset class that demands sophisticated valuation approaches. The global non-fungible token market size was USD 29.96 billion in 2024 and is projected to grow to USD 212.59 billion by 2033, at a CAGR of 24.32%. Today, approximately 250,000 individuals engage in NFT trading on OpenSea every month, highlighting the importance of understanding valuation methodologies in this rapidly maturing but highly speculative digital asset ecosystem.

This article is a comprehensive overview of the key factors and methods used to determine NFT values.

What is an NFT Valuation?

NFT valuation is a complex process that involves assessing various factors unique to non-fungible tokens, which are distinct digital assets representing ownership of digital or real-world items.

An NFT is a form of crypto asset that operates on a blockchain and gives each collected object a unique identifier. Because the identifier cannot be copied, one becomes the proprietor of that digital item. NFTs can’t be exchanged for money, and they’re typically built with the same code that underpins cryptocurrencies. Unlike other crypto assets, they cannot be traded or exchanged for one another.

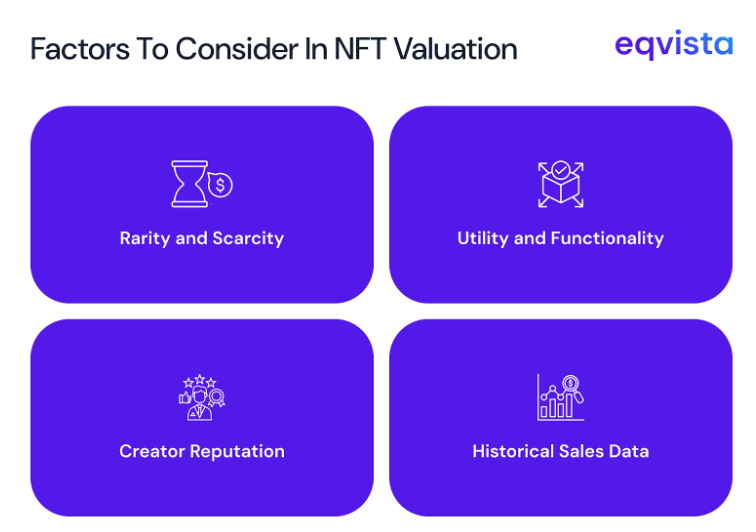

Core Valuation Factors

The value of NFT is weighted variably among four components depending on the asset that the NFT represents. They are utility, history of its ownership, value in the future, and artist reputation.

Key factors influencing the NFT valuation are:

- Utility and Functionality: NFTs that provide additional benefits beyond ownership typically command higher values than purely aesthetic pieces.

- Historical Sales Data: Floor prices (lowest current listing prices) and recent transaction volumes provide market benchmarks for similar NFTs within a collection or category.

- Rarity and Scarcity: The most fundamental driver of NFT value is how rare or unique the digital asset is within its collection. This includes trait rarity (specific visual characteristics) and overall supply limitations.

- Creator Reputation: The artist’s or project’s track record, social media following, and previous sales history significantly impact valuation. Established artists or successful project teams often see premium pricing.

How do NFTs work?

Each token has its place on the blockchain; hence, NFTs are a safe mechanism to express ownership of a unique object since the blockchain cannot be modified or removed. Tokens contain important information and have a value determined mostly by the market and demand; they can be purchased and sold similarly to other tangible sorts of art pieces. The unique data of NFTs makes it simple to verify and authenticate their ownership as well as the transaction of tokens amongst owners.

Where can you use NFTs?

People who trade cryptocurrencies and acquire artwork often utilize NFTs. Individual NFTs can cost hundreds of thousands of dollars at upscale internet collections like OpenSea. They may be purchased on Nifty Gateway for as little as a few hundred dollars. Aside from that, it has a few more applications, which are described below:

- Content for digital platforms – NFTs boost content producers’ revenues by powering a creator economy in which artists cede ownership of their property to the platforms that disseminate it.

- NFTs for gaming – In most online games, you may purchase goods for your character. You may recover your investment with NFTs by selling them after you’ve done with the items. NFTs may give several advantages to players.

- Domain Name – This functions similarly to a website domain name that makes the IP address more identifiable and desirable, generally based on its length and relevancy.

- Collateral NFTs for DeFi – The foundation for both NFT and Decentralized Finance (DeFi) is identical. DeFi programs allow you to borrow funds using collateral.

NFT Valuation Approaches

NFT valuation employs several approaches, each with distinct methodologies and applicability depending on the characteristics and available data:

Market Approach

It establishes the value of an NFT based on the price of similar assets recently sold in the same category or collection. This method might be applied if there is sufficient transaction history or similar data are available.

Example:

Recently, comparable NFTs of similar characteristics were sold at:

$1,800, $2,000 and $1,950

($1,800 + $2,000 + $1,950) / 3 = $1,917 is the average comparable selling price.

Thus, the approximated Value = $1,917

Income Approach

It values an NFT based on the income or benefits it provides, such as event access, staking rewards, or content unlocks. The methodology can be applied to NFTs offering yield, access, or membership.

Example:

The NFT enables access to $50/month worth of online content.

The duration for this is 12 months.

Value of Total Utility = 12 × $50 = $600

The discount rate is 10%.

Present Value = $600 / 1.10 = $545.45

Estimated valuation is $545.45

Cost Approach

It calculates the value of the NFT by factoring in the cost incurred in its minting and creation.

It’s commonly applied to recently launched products with little or no market information.

Example:

Artist’s time taken: 8 hours × $50 per hour = $400

Minting fee is $50.

The listing fee is $10.

This provides $460 as the valuation floor.

Rarity-Based Method

It gives a value to an NFT based on how rare its traits are in relation to the other pieces of the collection. Rarity is one of the factors that determine the value of an NFT. The frequency of a specific NFT in a collection can be called its NFT rarity. In most cases, the value rises with its rarity.

Example:

A unique trait occurs in only 0.1% of the collection.

Average NFTs sell for roughly $500

NFTs with this rare trait have sold for roughly $5,000.

Estimated Value = $5,000 (Rarity-based multiple = 10x)

NFT valuation challenges

Most purchasers lack the logical abilities required to determine the worth of NFTs and base their estimates on guessing. It is also difficult for sellers to predict what they will get in exchange for their tokens. NFT valuation is influenced over time by a reputation over which neither buyers or sellers may have any control.

The most common challenges faced in NFT valuation are:

- Lack of standardized valuation metrics and models.

- High subjectivity due to personal preferences and speculative nature.

- Market volatility and rapid price fluctuations.

- Limited comparable sales for many NFTs, especially new or unique ones

An NFT art piece may be in high demand for a certain period, with potential purchasers believing it is uncommon and expected to gain value shortly. Then they may realize that the digital picture is freely accessible on the Internet, and there may be no customers left for the NFT.

FAQs on NFT Valuation

Here are some frequently asked questions (FAQs) about NFT valuation.

How is an NFT’s value different from traditional assets?

NFTs are unique digital assets validated by blockchain, so traditional valuation methods for stocks or private companies don’t apply directly.

Are NFTs subject to taxes?

Yes, NFT transactions are taxable. Income from sales or trades must be reported, and capital gains taxes apply. Determining fair market value for tax purposes can be complex due to NFT uniqueness.

Why should you value NFTs?

NFTs are unique digital assets stored on a blockchain that certify ownership of items like art, collectibles, or in-game assets. Their value depends on factors such as rarity, utility, creator reputation, and market demand, and they can be bought or sold on specialized marketplaces using cryptocurrency.

Can the previous sale price of an NFT predict its current value?

It is not a reliable predictor because NFT prices are highly speculative and depend on market sentiment and buyer interest at the time.

Are NFTs with tangible or physical connections valued differently?

Yes, NFTs linked to physical items or real-world assets often have additional tangibility value, which can enhance their worth compared to purely digital-only NFTs.

Should I consult an expert to value my NFT?

Given the complexity and lack of standardized valuation, consulting professionals or platforms specializing in NFT valuation can provide more accurate assessments.

Get expert help valuing your digital assets with Eqvista!

NFT valuation is difficult due to a lack of guidelines, regulations, and structure. If you want to know how much your NFT is worth, you would need to consult an expert. With business valuation for assessing the economic worth of any asset, you can determine the worth of your digital assets.

For businesses and investors to navigate complex landscapes with confidence, leveraging specialized equity management platforms like Eqvista can provide crucial support in tracking, managing, and valuing assets effectively, ensuring informed decision-making in the fast-paced market.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!