How to value a startup in Singapore?

The purpose of this article is to provide you with a guide around the process of valuing a startup in Singapore for your startup valuation needs.

The increasing trend toward the startup ecosystem throughout the world is quite evident. With innovative ideas and disruptive approaches to business, startups are known for creating new ways of thinking and reshaping the economic landscape. Singapore has been no exception to this and has witnessed a growing interest in the startup ecosystem in the last few years. But, have you thought about how you can value a startup in Singapore? Startup valuation is basically the process of estimating the worth of a startup. The purpose of this article is to provide you with a guide around the process of valuing a startup in Singapore for your startup valuation needs.

Startup valuation

Before diving deep into how to value a startup in Singapore, it is essential to learn what startup valuation actually is. Valuation, as a term, means an estimate of the worth or value of something. Startups are early-stage companies that are typically in their initial stages of development, research and testing. In this regard, startup valuation refers to determining a startup’s value or worth.

What is startup valuation?

In brief, startup valuation deals with estimating a startup’s worth when it is in its early stages of development. This process is quite complex due to the fact that startups generally have less or no historical data or comparative data for valuing them. As such, startups are valued based on a number of assumptions, estimates, projections and forecasts. It is crucial to note that the process of startup valuation is dynamic and requires extensive research and data gathering to arrive at an accurate value for the startup. So, when to perform startup valuation?

When do you need startup valuation in Singapore?

Well, there are various instances when you may require startup valuation. Whether it is for the purpose of financial reporting, tax purposes, investor funding, acquisition, exit strategies, decision-making, and so on, startup valuation in Singapore is an important determinant. While startup valuation should be regularly evaluated and updated, it can be performed at any point in time to understand the startup better. Therefore, throughout the lifecycle of a startup, there will be various time points when you may need to perform a startup valuation in Singapore.

Advantages of startup valuation

During the journey of a startup through its early stages, there are several considerations, planning, and strategies that a startup founder must make. Startup valuation in this regard can be quite helpful in making important decisions regarding the startup. Here are a few advantages of startup valuation:

- Fund your startup’s growth – Startups often require funding from investors to support their businesses’ growth and finance their operations. Potential investors will therefore have an interest in getting a sense of the startup’s value so as to assess the business potential of a given startup with respect to its sector.

- Strategic planning and decision planning – To set future startup goals and identify appropriate strategies, a startup valuation is often required in order to facilitate the decision-making process. This is because a startup’s valuation can help determine its potential worth and identify where future investments and improvements can be made.

- Benchmarking against competitors – The competitive landscape of the current business environment requires startups to position themselves strategically in the market. In this way, after the startup is valued, founders will get a sense of where they stand versus the competition and will therefore be able to target their business in the right direction strategically.

Understand pre-money valuation and post-money startup valuation

Startup valuation essentially involves estimating the value of a startup before and after receiving capital injections. Basically, this means that before receiving capital injections, the pre-money valuation of a startup is estimated, while post-money valuation is used after the startup receives capital injections.

You may be wondering why there is a need to make these distinctions when it comes to startup valuation. The answer lies in the fact that capital injections are mainly aimed at increasing the value of a startup business by improving its operations and to better understand the effect of the funding, it is highly useful to measure the value of a startup in both pre-money and post-money scenarios.

How to determine startup valuation?

Now that you have a basic understanding of startup valuation, you may wonder how to go about valuing a startup in Singapore. Well, there are various methods that can be used to determine the value of a startup. The process of valuing a startup involves making various calculations, assessments, and estimations. Below mentioned are some of the most popular valuation methods.

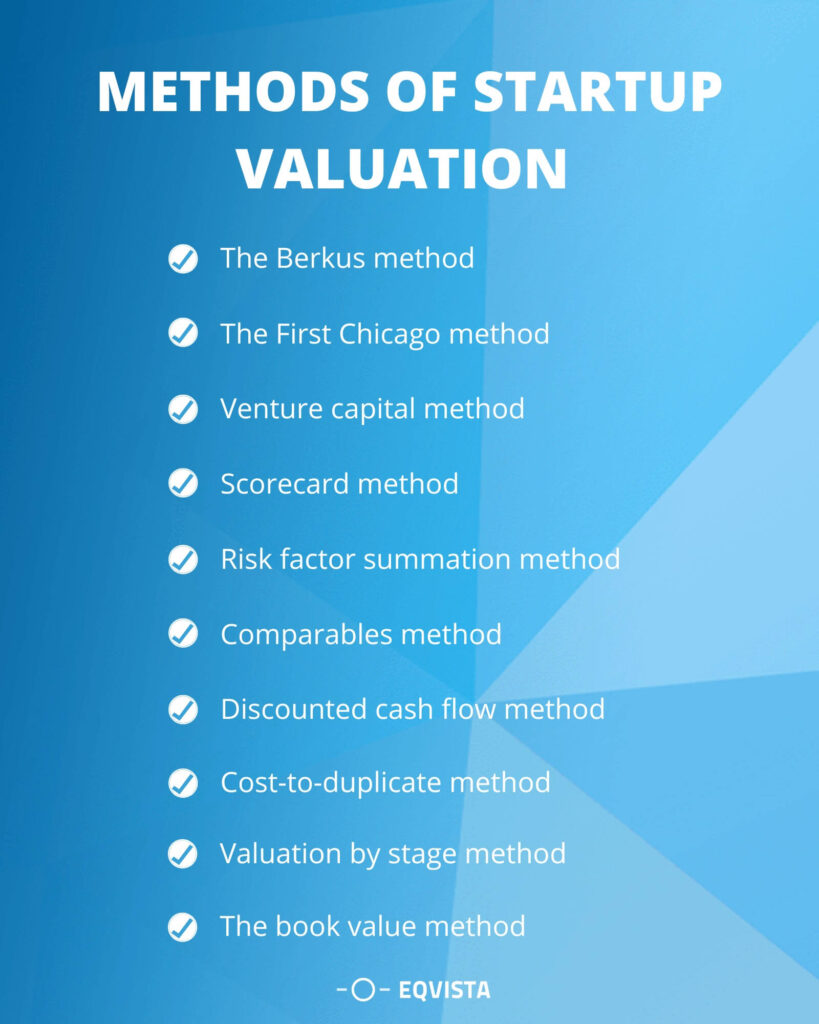

Methods of startup valuation

Following are the top 10 methods of startup valuation:

- The Berkus method – Dave Berkus, a well-known valuation expert, has developed a useful method of startup valuation that is based on five key indicators that include the sound idea, product prototype, quality of the management team, strategic relationships and initial sales. Based on these indicators, each factor is assessed in order to arrive at an estimated value of a startup. The Berkus method is complicated yet highly useful in determining the value of a startup. Hence, proper analysis and due diligence are recommended in order to obtain the most accurate results.

- The First Chicago method – The first Chicago method is another very useful model of startup valuation. A popular technique for valuing startups is the First Chicago method. With this approach, a startup is valued according to three projections: success, failure, and survival. To arrive at a final valuation, these three scenarios are averaged with weights. An in-depth understanding of the startup in regard is essential in order to arrive at an accurate valuation. However, the First Chicago method is considered to be an effective way of determining the value of a startup.

- Venture capital method – As the name suggests, this approach is used by VC or venture capitalists. Multiples-based metrics and a discounted cash flow (DCF) analysis are used to calculate the value of a startup. There are several multiples that VCs use to arrive at the value of a startup, including Price/Earnings (PE) and Revenue Multiple, while DCF is based on the future cash flows that are discounted to a present value. Usually, these methods are considered intensive and require substantial intelligence. Thus, these methods are best for professionals and experienced investors.

- Scorecard method – The scorecard method relies on a startup’s judgments and estimates. Essentially, the financial and non-financial criteria are considered which are further scored on a scale. The factors that are weighed in the valuation are the team’s effectiveness, the size and scope of the market, product development, funding, and a few other aspects. Based on these scores, analysts arrive at an estimated valuation of a startup. Therefore, realistic and accurate estimates are expected in order to come up with an accurate valuation.

- Risk factor summation method – Along the same lines as the scorecard approach, this method also relies on estimates and judgments, however, it takes into account 12 risk factors only. Threats from competitors, legal disputes, technological, financial, management, funding, and market risks are evaluated and scored depending on the relative risks and their potential impact on the startup. As a result, a final valuation is determined by calculating the weighted average of these scores associated with each risk factor.

- Comparables method – Another approach to determining startup valuation is through comparable methods. This method involves establishing a database by looking for comparable business entities that are already in existence and have achieved similar success to the startups in question. Following this comparison, the startup’s value is calculated. Since this method relies on a database that is already available and well-researched, it is considered comprehensive though there may be some areas in which there might not be sufficient information to make an accurate comparison.

- Discounted cash flow method – The discounted cash flow (DCF) method is a popular technique for calculating the value of a startup. It is a method that relies on future cash flows that are projected generally for the next five years. Further, using a discount rate and the weighted average cost of capital (WACC), the future value of the cash flow is reduced to the present value. In this, the present value is known as the terminal value. Therefore, this method is considered to be an effective method for determining the value of a startup, however, it requires some calculations and estimations.

- Cost-to-duplicate method – Generally, the cost-to-duplicate approach involves calculating and adding up all of the costs and expenses related to the current startup, including development costs, marketing costs, sales and distribution costs, and any other startup-related costs, this method seeks to assess the worth of a startup. When the startup’s entire cost is established, its fair market value is calculated based on all of the associated costs. Basically, it calculates the cost of replicating the same startup that is being valued, and thus, its value is determined.

- Valuation by stage method – This approach involves conducting a thorough analysis at each stage of the startup’s development. At each stage, valuation is assigned by assessing the potential of the startup in achieving its goals and objectives. Basically, from the initial stage to maturity, an analysis is conducted for different stages, and then according to the projected development and progress, a valuation is determined. In order to undertake this method, it is essential to have a complete understanding of the current and future position of the startup. Thus, this method is best suited for professionals who have knowledge of the startup’s domain and operations.

- The book value method – In this approach, which is considered to be quite general, the value of the startup is determined on the basis of the current book value. The difference between the assets and liabilities listed in the startup’s balance sheet is considered, which is the book value. However, startups may not have sufficient data to calculate their book value, except for a few startups that have been operational for a long time and have substantial information about their assets and liabilities.

How to choose which valuation method is right for your startup?

The decision of which method would be appropriate to value a startup will depend on various factors, including the type of startup, its stages, requirements, availability of data, resources, and other factors. There is no one best method that is applicable to all startups, each method has its own advantages and limitations. Hence, proper analysis and understanding of each method are crucial, which would help in identifying the one that would be most suitable for your startup.

How can Startup valuation software help?

The era of the Internet has changed the landscape of business. With the advent of technology, startup valuation can be conducted in a much more streamlined way. Startup valuation calculators are available online and can be used to get an estimate of the worth of a startup quickly. Why should you still rely on manual valuation methods? It is time to switch over to an online platform that offers an array of features with just a click of a button. But, which one should you choose? Well, Eqvista would be the best choice for you.

Why should you choose Eqvsta’s Startup valuation software?

Compared to traditional valuation methods, startup valuation is time-consuming and involves many calculations that can become quite tricky. At Eqvista, we have come up with a solution that offers you a great level of convenience through our modern, expert-designed system. Combining the principles of various valuation methods, our system offers you a quick and accurate valuation that is as simple as a few clicks. By answering 30 multiple-choice questions based on five key factors Team/Management, Business, Product, Market, and Sales and Marketing, you can easily get a valuation report of your startup.

Get your startup valuation reports in minutes

In a matter of a few minutes, you can get your startup valuation report. Simply register and fill in the form with some basic information about your startup and answer the multiple-choice questions, and you are ready with a report. Isn’t that amazing? Save time by using our software and get the report in just a few minutes.

Get your startup valuation with Eqvista!

Are you still searching for the best way to value your startup? Well, your search ends here. With an expert-designed system and an assurance of accurate valuation, it is time to switch to Eqvista for the most accurate startup valuation report. Our team of experts is well-versed in the various valuation methods and ensures that your startup is accurately valued. Get in touch with us now to know more.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!