How does the acid-test ratio save small businesses?

In this article, we will explore the acid-test ratio, and your liquidity analysis by tracking the acid-test ratio along with other liquidity metrics.

In the US, the difference between median daily cash inflows and outflows is just $7 for small businesses. This leaves very little margin for error in working capital management, as the smallest emergency expense can send a business spiraling towards credit dependence.

What’s even more alarming is that 50% of businesses hold a cash buffer of less than a month.

Hence, liquidity analysis is indispensable for small businesses.

In this article, we will explore the acid-test ratio, a conservative measure of liquidity that offers valuable insights for small businesses. We will also explore how you can enhance your liquidity analysis by tracking the acid-test ratio along with other liquidity metrics. Read on to know more!

What is the acid-test ratio?

The acid-test ratio is another term for the quick ratio, a metric meant to measure a company’s ability to meet its current liabilities with its short-term assets. You can calculate this ratio with the following formula:

Acid-test ratio Quick ratio=Cash + Marketable securities + Accounts receivable/Current liabilities

When a business has just enough short-term assets to pay off its current liabilities, its acid-test ratio will be equal to 1. Such businesses may presently be able to keep up with their debt obligations. As the acid-test ratio falls below 1, it becomes increasingly challenging for the business to keep up with debt obligations and maintain positive relations with creditors.

So, an acid-test ratio of greater than 1 can be a sign of good financial health in the short term.

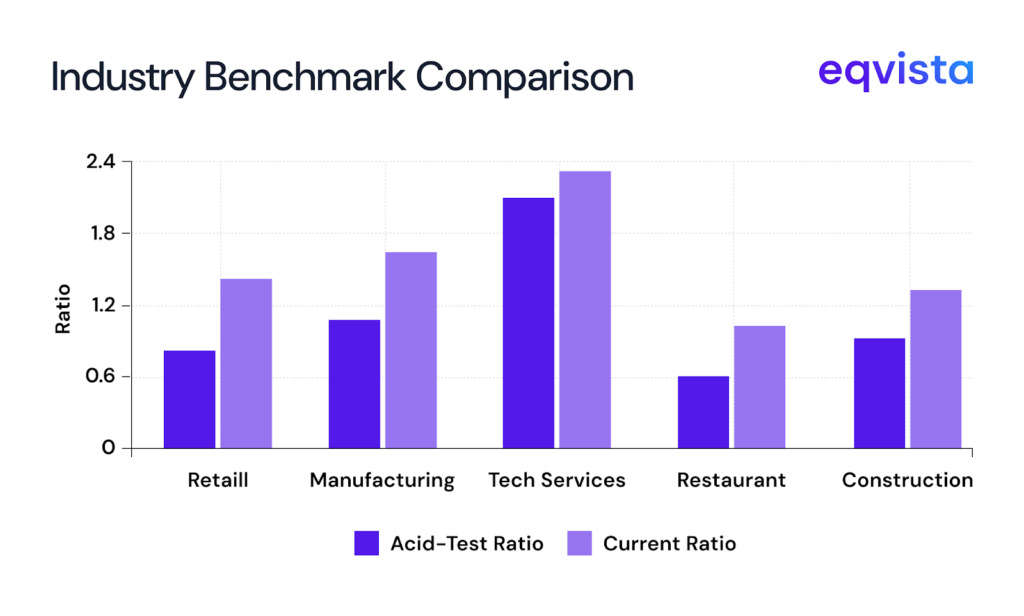

A 2025 study by Eqvista found that the ideal acid-test ratio varies by industry. This occurs because companies have varying business models and liquidity requirements. Some industries maintain larger cash reserves, while others operate with smaller ones.

This illustrates why it is crucial to consider these ratios in context when evaluating a company’s financial health and efficiency.

Why is the acid-test ratio relevant for small businesses?

The acid-test ratio can help small businesses assess their liquidity. It helps them evaluate whether they can withstand short-term financial pressures, maintain healthy relationships with creditors, and afford unforeseen expenses. Three reasons why the acid-test ratio is even more important in the case of small businesses are as follows:

- Limited access to funds – Compared to large corporations, small businesses have limited access to funds. To deal with working capital challenges, an established company can rely on lines of credit, a facility that is often unavailable to small businesses.

- Smaller brand – Small businesses have an underdeveloped brand compared to established players. So, even the smallest delays in debt repayments can strain relationships with creditors. To continue operating, the business must look for new lenders, suppliers, or business partners. This process can be extremely drawn out for a small business compared to a large corporation.

- Vulnerability to shocks – A small business is extremely vulnerable to changes in market conditions. Such businesses do not have sufficient diversification in the client base and supply chain to maintain operational stability in the face of adverse shocks. Shortages in the supply of key raw materials and demand fluctuations can very quickly affect the unit economics and ultimately, the cash reserves of small businesses.

How to enhance liquidity analysis?

In this section, we will go over some liquidity metrics that can be monitored in tandem with the acid-test ratio to gain deeper insights about liquidity.

Accounting for liquid inventory

Many small businesses are involved in the retail sector, where the inventory can be converted into cash within a year, sometimes within weeks or days. However, the acid-test ratio does not include inventory in its numerator. As a result, it portrays the situation more negatively than it is for small businesses in the retail sector and other businesses with liquid inventory.

Such businesses can use the current ratio as their primary liquidity metric and turn to the acid-test ratio only when sales volumes are declining. You can calculate the current ratio with the following formula:

Current ratio=Current assets/Current liabilities

Addressing cash flow fluctuations

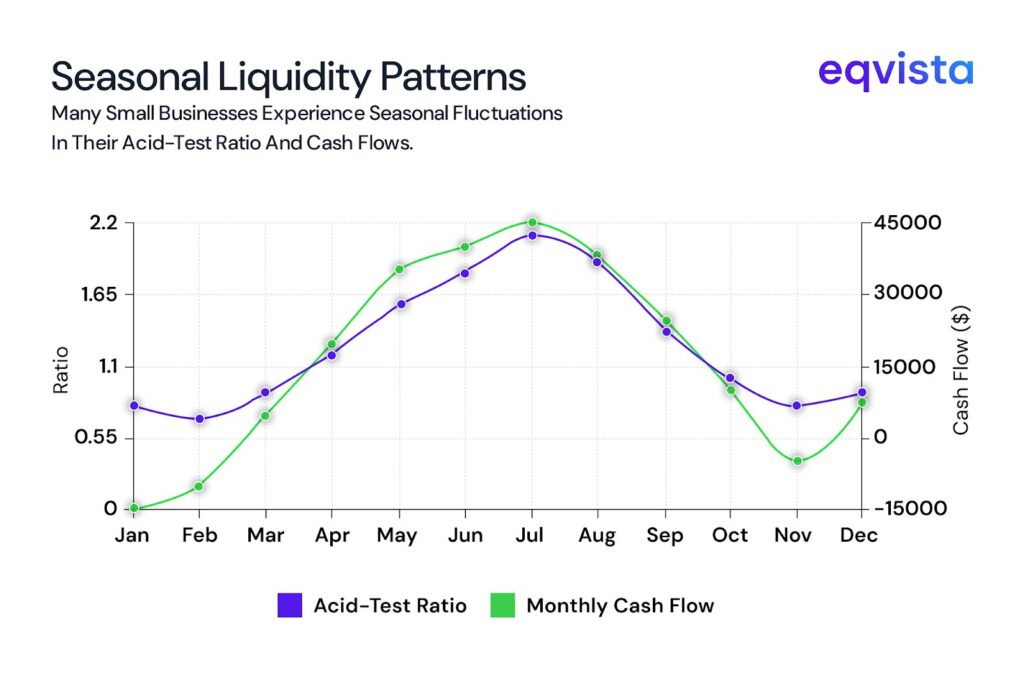

Businesses with seasonal demand will often have a higher acid-test ratio in their peak season than in their production season. Similarly, high variance in the acid-test ratio can be seen for businesses suffering from fluctuations in cash flows. So, the date of capture can heavily influence the acid-test ratio.

If such circumstances are a reality for your business, you must perform a cash flow analysis. This would involve tracking the amount of cash being generated by business activities, cash received through financing, and the cash outflow towards expenses. The purpose of such analysis is to forecast working capital shortfalls and the extent of these shortfalls.

To better facilitate such analysis, you should consider maintaining financial records on a cash basis.

Addressing delays in collections

Whether you can convert your accounts receivable into cash in the short term depends largely on external factors. For businesses with long collection cycles, such as real estate companies, accounts receivable may not always function as a current asset.

If this applies to your business, you should monitor the following metrics along with the acid-test ratio:

- Accounts receivable as a percentage of current assets – This metric shows the share of your current assets tied up in receivables. A high percentage may indicate that a significant portion of assets is illiquid during cash conversion delays.

- Accounts receivable turnover ratio – This ratio helps you understand how often your company converts its accounts receivable in a given period, usually a year. You can calculate this ratio as:

- Accounts receivable turnover ratio = Net credit sales ÷ Average accounts receivable

- Where:

- Net credit sales = Total credit sales – Sales returns – Sales allowances

- Average accounts receivable=Accounts receivable at the start of the period + Accounts receivable at the end of the period/2

Navigating volatility in marketable securities

Marketable securities are defined as financial instruments that can be quickly converted into cash. This definition is broad enough to include volatile assets such as the common stock, options, and futures of publicly traded corporations.

However, a business cannot rely on volatile assets to meet immediate liabilities. So, when the markets are volatile or when you simply want a more conservative measure of your business’s liquidity, you should monitor its cash ratio, which can be calculated as follows:

Cash ratio = Cash + Cash equivalents/Current liabilities

Cash equivalents are assets that can be easily converted into cash without a significant loss of value. This definition excludes volatile marketable securities, such as stocks, while including money market instruments.

Eqvista – Unlocking actionable valuation insights!

The acid-test ratio can provide valuable liquidity insights. However, comprehensive liquidity analysis requires a deep understanding of qualitative factors in addition to such quantitative factors.

The core idea behind liquidity analysis is evaluating whether a company can sustain operations with its existing working capital conditions. This requires an understanding of the key industry dynamics, such as inventory liquidity, seasonality, cash conversion cycles, customer payment patterns, supplier credit terms, and access to short-term financing.

At Eqvista, our valuation team goes beyond just numbers by uncovering the narrative behind qualitative factors to deliver accurate and actionable valuation insights. Contact us to know more about our services!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!