What Unicorn Companies Need To Know About Cap Table

In this article, we dive deep into the importance of a cap table for unicorn companies, and how unicorn companies create and manage one.

There are a million and one startups in the world. Some will progress beyond startup status to become full-fledged, self-sufficient businesses worth more than their initial investment. Others will not and will eventually fail. However, a few startups will do so well that they will be worth more than $1 billion. These startups appear only every so often. Though you may be familiar with a few, achieving a valuation of more than $1 billion is an extremely rare achievement. This is why these businesses are dubbed “unicorns”. In this article, we dive deep into the importance of a cap table for unicorn companies, and how unicorn companies create and manage one.

Cap table and unicorn companies

Unicorn companies are extremely rare due to the massive growth they built in a short time. To be able to get a value of over $1 billion is a challenge that most startups fail to achieve. Just like any other business, unicorn companies also have a cap table to summarize their equity ownership and present the cap table to venture capitalists for future funding.

What are unicorn companies?

A unicorn company is a private startup valuing more than $1 billion. Aileen Lee of Cowboy Ventures coined the term “unicorn” in 2013 to describe statistically uncommon companies, as a startup has a.00006% chance of becoming a billion-dollar company. Unicorns are extremely rare and necessitate creativity. Because of their size, unicorn investors are typically private or venture capitalists, making them out of reach for retail investors. There were only 39 unicorns on the market at the time. There are currently over 1200 unicorns in the world.

How do unicorn companies work?

It all comes down to their estimation. This can be determined by the company’s previous performance, growth potential, and overall market potential. Many startups will achieve a billion-dollar valuation through funding rounds and receiving a sizable cash injection from investors. It can also be obtained through acquisition. For example, when Facebook paid $1 billion for Instagram, it gave the company the valuation of an overnight unicorn.

Characteristics of a unicorn company

In the few unicorn companies around the world, there are a few common characteristics that makes these firms successful and have a massive growth:

- Disrupted industry – Almost all unicorns have disrupted their respective industries. Airbnb, for example, reimagined what it meant to book a hotel room. Netflix changed the way we rent movies.

- Advantage of first mover – Unicorns are frequently the first to bring their idea to market. They keep their first mover advantage by constantly innovating and expanding their product or service. Take, for example, Facebook. They were the first to launch an online network for college students and have since innovated and developed new applications to expand their user base.

- High growth rate – Unicorns are constantly growing, so investors can spot a rising unicorn by looking at user acquisition and the potential market. Grammarly announced just before reaching unicorn status that they had over seven million daily active users across all devices. Grammarly surpassed the billion-dollar mark less than a year later. At the same time, businesses do not have to be the first to become unicorns. Lyft, for example, was founded three years after Uber and is rapidly expanding.

- High investment – The investment history of a company is one of the best indicators that it is on track to become a unicorn. Soon-to-be or “baby unicorns” have a strong funding track record, particularly in their C and D fundraising rounds.

- Strong leadership – Strong leadership is required for a unicorn to succeed. This can make or break a business. Many unicorns fail as a result of executive turnover or mismanagement. For example, Evernote lost four top executives and has struggled to maintain its position in Silicon Valley since. Look for founders with prior experience in that industry and/or scaling other successful businesses.

What is a cap table?

A capitalization table lists a company’s securities, including common & preferred stock, options, SAFEs, convertible notes, and warrants. It also shows how much each investor owns of each security type, the value of their stakes, and their current ownership percentage. A cap table comprehensively lists everything an investor wants to know about a company’s ownership. While, as such, there is no standard format for a cap table, it should include the following information:

- Shares with authority

- Shares in circulation

- Unissued stock

- Shares set aside for stock options

- The last priced round’s valuation details (it includes pre-money valuation, amount of the new equity raised, per-share price, and number of shares)

- Complete shareholder list (it includes the type of shares they own, total shares, & percentage ownership stake)

How does a cap table work?

A capitalization table, a.k.a cap table, is a record of company ownership. Thus, startup cap table management is critical from the company’s inception to understand the actual ownership structure, which involves the various stakeholders – primarily founders, investors, & employees. The most vital role of the cap table is as follows:

Negotiations with investors – A well-organized and up-to-date cap table is a powerful tool during funding rounds. Since the company has been tracking all stock-related grants, vesting, & exit activities on the cap table, negotiations with investors have become smoother because both parties understand how incoming funds affect the company’s ownership structure.

Manage the complexities of equity distribution – The cap table contains information about all equity-related activities. These stock-related details change with each funding round, merger, or corporate restructuring. Cap table management ensures working through complex calculations when stock agreements become complicated.

Ensure data accuracy – This is the primary responsibility of startup cap table management. Throughout the life of a company, various classes of shares are issued to various stakeholders. Unless and until every move is meticulously documented, the company will be involved in legal disputes with stakeholders.

Why do unicorn companies need a cap table?

Displays how motivated the startup’s founders are – Investors prefer to see founders with significant stakes in their company, as this influences their motivation to drive the company forward. Previous financings have almost wiped out the founders’ stakes in a startup, which is a red flag.

Can predict future dilution – Seeing a lot of convertible debt or SAFEs on the cap table could indicate that an investor’s holdings will be significantly diluted. While not necessarily a red flag, this may warrant further investigation.

Demonstrates the startup’s ability to attract and retain talent – Employees in the startup world value stock options highly. Investors will likely want to see a large enough employee option pool to attract, retain, and motivate the talent required to fuel the startup’s growth.

A cap table also tells about other investors and how much money they have invested – The names – and ownership stakes – of the various other investors on the cap table can instill trust. Investors are also interested in how many other investors there are. If there are too many, the founders may have to spend significant time obtaining alignment from all parties, potentially complicating future negotiations.

Can assist them in determining how much to invest – Investors can estimate how much they should invest by looking at Pro-forma capitalization tables. For example, they may want to meet an internal IRR benchmark. They can determine an appropriate investment amount using the startup’s current valuation and estimate an “exit value”. Of course, this is never guaranteed because many factors can change (including future dilution).

How does the valuation of a unicorn play a unique role in maintaining a cap table?

Obtaining unicorn status does not imply success. There are numerous “zombicorns” “unicorpses” and “dead unicorns”. Flipboard, for example, struggled to maintain valuation after talks with Twitter fell through and is no longer considered a unicorn. A company’s valuation does not guarantee that it will remain a unicorn.

After all, being a “unicorn” has much to do with the hype and excitement that investors or the media place on companies. Some businesses struggle to keep up or quickly deplete their investment funds. Theranos is probably the most prominent example of this.

Even unicorns can have down exits. The Honest Company did raise a down round that took them below the $1 billion mark, but they’ve since recovered.

How to structure a cap table for a unicorn company

Most entrepreneurs use spreadsheets for creating capitalization tables at the beginning of a business. It should be structured carefully across a few key/vital elements.

Ownership stake refers to (founders, investors, or employees) whoever owns how much of the company & who has control over it. Because most startups require a voting agreement among common & preferred shareholders, this view identifies who must approve all the crucial company decisions like the company sale or reorganization. The section on ownership stakes will frequently list the names of shareholders and the number of shares they own.

Other variables in the cap table may be included depending on the specific business needs:

- Valuation – The total cost of your company’s shares

- Total number of authorized shares – The number of shares your company can sell.

- Total number of outstanding shares – The total number of shares held by all company stakeholders.

- Reserved Shares – The total number of shares available for employees, also known as reserved or restricted shares.

Additional dilution items are applied as the columns move from left to right to determine a person’s true ownership percentage of the company.

The cap table, as you can see, lays out the essential components of a transaction:

- The name of the shareholder, as on the name on the security

- Date of publication

- The number of shares or units that have been issued

Uses of cap table for unicorn companies

Unicorn companies can make use of a cap table for several reasons. For the most part, a cap table gives you and investors an overview of your company’s equity structure. Here are some uses of a cap table for unicorn companies:

- Understanding of equity structure – The most common application of the cap table is to showcase how decisions affect a company’s equity structure. Do you want to increase the number of employee options? Are you planning another round of funding? In either case, you can see the exact impact on your shareholder groups. When raising funds for the first time, one must understand exactly what you are giving up. The cap table will do just that & show the company’s proposed new structure.

- Hassle-free equity distribution – The cap table puts the company breakdown in writing when it’s the company’s initiation. It gets difficult to understand & talk about the initial equity distributions, but it’s a necessary conversation at the start of any business. The Outline distributions to its founding team & use the cap table to help you facilitate the conversation on the first day.

- Employee options management – You should align their incentives with the company’s goals when hiring new employees. Stock options are an excellent suit to accomplish the alignment. They allow you to match the employee’s contributions with the correct amount of stock. The cap table also indicates how many options are authorized or available for issuance at any given time. It also shows how many options have been used so far. When designing your cap table, include enough options to cover a 12-month rolling period.

- Negotiations of term sheets – You can run a what-if analysis on a financing round when you have a clear gist of your company’s ownership structure. Analysis of what happens to your ownership stake & control of the company at various valuation levels and other factors, such as whether new options are issued before/after financing. This gives an insight into what situations you’re comfortable with & where you should draw the line.

- Anti-dilution protection – Anti-dilution provisions help to protect an investor’s share value in the event of a down-round. Anti-dilution provisions can significantly impact the economics of a transaction and a founder’s ability to raise capital in the future. Protections aren’t set in stone; future investors can frequently change them.

Cap table management software for unicorns

Cap table management software is an automated cap table that allows for complete business equity management. Instead of manually maintaining cap tables on spreadsheets, Cap table management software gets hosted online on secure servers. These are inaccessible without proper authorization. Furthermore, regardless of the events that trigger equity distribution, the software is designed to handle multiple cap table functions in real-time.

How can unicorns get benefits from cap table management software?

A capitalization table, a.k.a a Cap table, is a record of company ownership. Thus, startup cap table management is critical from the company’s inception to understand the exact ownership structure involving the various stakeholders, primarily founders, employees & investors. Below are some benefits of using a cap table management software:

- Negotiations with investors – A well-organized and up-to-date cap table is a powerful tool during funding rounds. Since the company has been tracking all stock-related grants, vesting, and exit activities on the cap table, negotiations with investors have become smoother because both parties understand how incoming funds affect the company’s ownership structure.

- Manage the complexities of equity distribution – The cap table contains information about all equity-related activities. These stock-related details change with each funding round, merger, or corporate restructuring. Cap table management enables working through complex calculations when stock agreements become complicated.

- Ensure data accuracy – This is the primary responsibility of startup cap table management. Throughout the life of a company, various classes of shares are issued to various stakeholders. Unless and until every move is meticulously documented, the company will be involved in legal disputes with stakeholders.

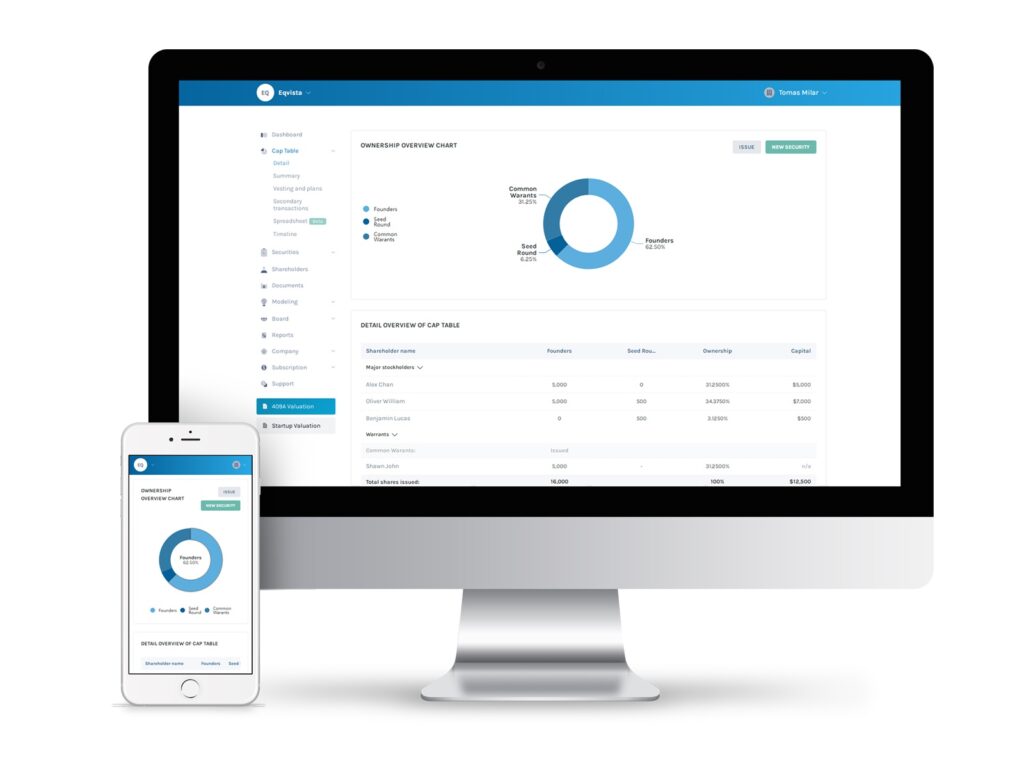

Create your unicorn company’s cap table on Eqvista

On Eqvista, building a cap table is a breeze. You just need to register for the platform using our website, fill out the registration form with information about your business, and establish a corporate profile.

When you are finished, you will arrive at the dashboard, which has detailed information about the business you just registered. You are ready to start distributing shares using the Eqvista cap table tool.

For instructions on how to use the program for each stage, see these support articles! Check out the knowledge center to teach yourself any legal jargon or topics you’d want to learn more about.

How is Eqvista the best platform to maintain your unicorn company’s cap table?

Unicorns are innovative businesses with a high potential for success. These firms might become the next big thing in their respective fields through careful strategy and execution. As a result, these companies may benefit from creating a cap table. Eqvista provides cap table management software to assist unicorn firms in expanding. Eqvista may help unicorn startups manage shareholder information. To learn more about managing cap tables with Eqvista, get in touch with us right now!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!