ASC 805 vs IFRS 3: PPA Standards for Public Company Transactions

Purchase price allocation (PPA) is the method for allocating the acquisition cost to assets acquired and liabilities assumed, with any residual amount recognized as goodwill or a bargain purchase gain.

While the underlying objective of PPA is broadly consistent across accounting frameworks, the application can differ meaningfully between US Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

Hence, in this article, we will provide a detailed but brief outline of ASC 805 and IFRS 3, the respective accounting standards governing business combinations.

ASC 805: How Should You Account for Business Combinations in the US?

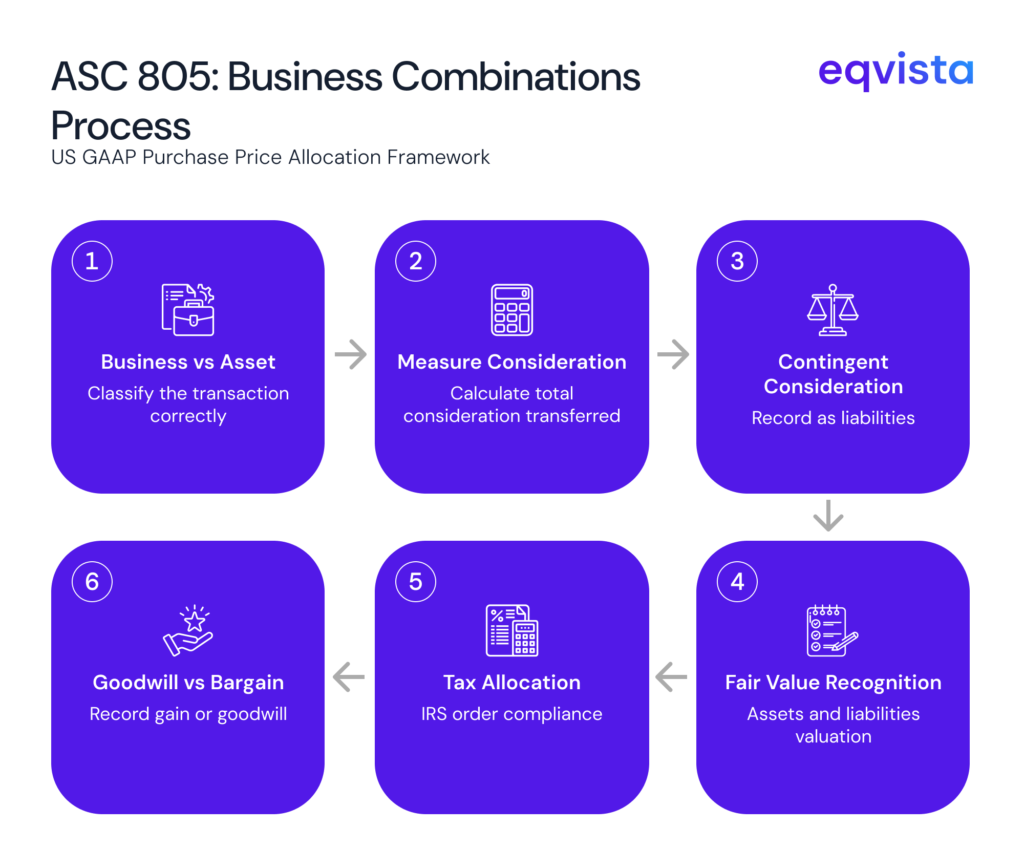

In the US, when you are recording business combinations, you must record the transaction as per ASC 805 in the following manner:

Step 1: Correctly Classify the Transaction as a Business or Asset Acquisition

Under Generally Accepted Accounting Principles (GAAP), businesses are defined as sets of activities and assets capable of being managed to provide economic returns. A business must include at least one input and one substantive process that together significantly contribute to the ability to create outputs.

Since business acquisitions and asset acquisitions have completely different accounting treatments, it is very important to identify whether you have acquired a set of assets or a business.

Step 2: Measure the Consideration Transferred

You can calculate the transaction’s consideration transferred using the following formula:

Consideration = Assets transferred from acquirer + Liabilities incurred by acquirer + Equity issued by acquirer

Step 3: Record Contingent Considerations as Liabilities

Calculate the fair value of contingent considerations weighted by the probability of those payouts and record them as liabilities for the acquirer.

Step 4: Recognizing assets and liabilities at fair value

Under ASC 805, you must recognize all related assets and liabilities at fair value, which is the price at which two knowledgeable parties will willingly exchange the object on measurement date. You must be careful not to overlook any intangible assets such as trademarks, non-compete agreements, customer relationships, copyrights, and intellectual property rights.

Step 5: Tax-Compliant Purchase Price Allocation

The IRS requires you to allocate the purchase price to the assets acquired as part of the business combination in the following order:

- Cash and general deposit accounts

- Actively traded securities

- Assets marked to market annually

- Inventory and property held for sale

- Other assets

- Intangible assets other than goodwill and going concern value

- Goodwill and going concern value

So, if the fair values of net assets do not equal the considerations transferred, you may need to recognize a bargain purchase gain or loss.

Step 6: Accounting for purchase gains/losses

If the net assets are greater than the considerations transferred, you simply need to recognize a bargain purchase gain. However, if the opposite is true, the difference between the fair values of net assets and considerations transferred would be allocated to goodwill.

IFRS 3: How Do You Account for Business Combinations as Per International Standards?

Here, we will discuss the steps involved in accounting for business combinations for businesses following the International Financial Reporting Standards (IFRS). Under this framework, IFRS 3 is the standard that governs accounting for business combinations.

Step 1: Identify Whether the Transaction Is a Business Combination

IFRS has the same definition for business acquisitions but a slightly different definition for businesses. In this framework, a business is defined as an integrated set of activities and assets capable of being conducted and managed to provide goods or services to customers, generate investment income, or earn other income from ordinary activities.

Move to the next step only if the transaction meets this definition of business combinations.

Step 2: Apply the Acquisition Method

You (acquirer) must use the acquisition method to recognize the identifiable assets acquired, the liabilities assumed, and any non-controlling interest (NCI) in the acquiree.

Be careful not to overlook any intangible assets, including in-process research and development. These assets acquired in a business combination are recognized separately from goodwill if they arise as a result of contractual or legal rights, or if they are separable. In these circumstances, the recognition criteria laid out in IAS 38 are always considered to be satisfied.

Step 3: Measure Assets and Liabilities at Fair Value

Assets and liabilities are measured at their fair values (with a limited number of specified exceptions) at the date the entity obtains control of the acquiree. The definition of fair value is consistent across IFRS and ASC standards.

You can use provisional value for initial accounting, but the provisional amounts must be adjusted within one year of the acquisition date if new information becomes available about facts and circumstances that existed at that date.

Step 4: Measure Non-Controlling Interests (NCIs)

The acquirer can elect to measure the components of NCI in the acquiree that are present ownership interests and entitle their holders to a proportionate share of the entity’s net assets in liquidation using one of two methods:

- At fair value, or

- At the NCI’s proportionate share of the net assets

You must apply this election consistently for each business combination.

Step 5: Record Contingent Consideration at Fair Value

Calculate the acquisition-date fair value of contingent consideration and recognize it as part of the business combination. Changes to contingent consideration resulting from events after the acquisition date are recognized in profit or loss.

Step 6: Accounting for Goodwill or Bargain Purchases

If the consideration transferred exceeds the net of the assets, liabilities, and NCI, that excess is recognized as goodwill. However, if the consideration is lower than the net assets acquired, you simply need to recognize a bargain purchase gain in profit or loss statements.

Step 7: Expense Acquisition-Related Costs

All acquisition-related costs (e.g., finder’s fees, professional or consulting fees, costs of the internal acquisition department) are recognized in profit or loss statements when incurred. The only exceptions are costs to issue debt or equity, which are recognized in accordance with IFRS 9 and IAS 32.

Step 8: Account for Business Combinations Achieved in Stages

If the acquirer increases an existing equity interest to achieve control of the acquiree, the previously-held equity interest is re-measured at acquisition-date fair value, and any resulting gain or loss is recognized in profit or loss statements.

Key Difference of ASC 805 and IFRS3

| Aspect | ASC 805 | IFRS3 |

|---|---|---|

| Business Definition | Input +substantive process | Integrated set for goods/services |

| NCI measurement | Not explicitly addressed | Choice: fair value or proportionate share |

| Contingent Consideration | Recorded as liability | Post acquisition changes: Through P&L |

| Acquisition costs | Not explicitly detailed in steps | Expense immediately(except debt/equity costs) |

| Step Acquisitions | Not explicitly addressed | Remeasure existing interest at fair value |

Eqvista- Precise Valuations for Confident Business Combination Accounting

The differences between ASC 805 and IFRS 3 begin with the subtle variation in the definition of businesses. Other differences relate to the measurement options available for non-controlling interests and the subsequent accounting treatment of contingent consideration.

While both standards rely on fair value measurement, the differences can sometimes lead to significantly different accounting execution.

If your in-house team primarily specializes in IFRS-based accounting but you now need to pivot to ASC-compliant bookkeeping, consider relying on Eqvista. Our seasoned valuation analysts provide independent, ASC 805-compliant valuation services to enable agile execution of business combinations. Contact us to know more!