How Private Company Acquisitions Work: From Due Diligence to Deal Closure?

In July 2025, Chevron completed its $53 billion acquisition of Hess, marking the end of a nearly two-year journey that began with the initial announcement on October 23, 2023. The timeline for this acquisition got extended because of an arbitration case brought by rivals Exxon Mobil and the China National Offshore Oil Corporation.

This goes to show that even high-profile, well-structured deals can face unexpected hurdles.

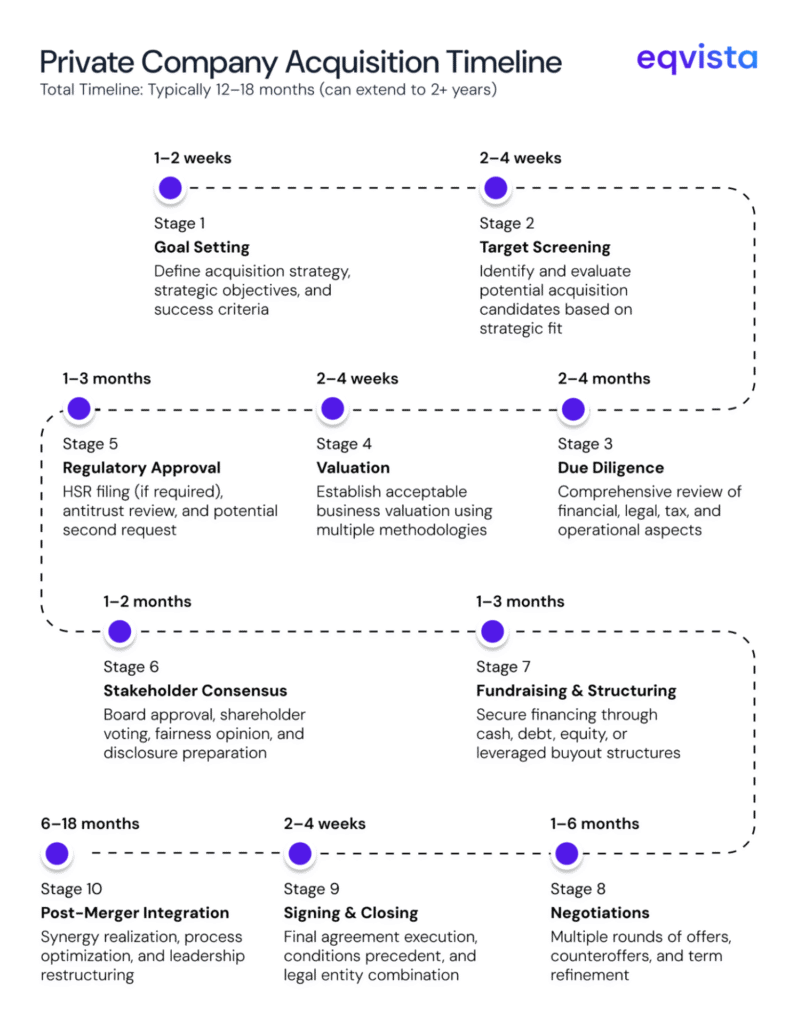

Why do M&A transactions take so long? The answer lies in the complexity of the acquisition process itself. From initial target screening to closure, acquisitions involve multiple critical phases, each requiring careful execution. Stakeholder approval, regulatory clearances, fundraising efforts, intense negotiations, and potential competitive objections all contribute to extended timelines.

In this article, we will walk through the key phases of private company acquisitions, helping you understand what each stage entails and how to navigate them effectively.

Key Phases in Private Company Acquisitions

Successfully executing a private company acquisition requires methodically progressing through the following distinct phases:

Screening Potential Targets

Before you start looking at potential targets, you must define your goals and needs. Are you seeking to expand market share, acquire proprietary technology, enter new geographic markets, or eliminate competition?

Once you have established the purpose, screen potential candidates based on criteria such as revenue size, growth trajectory, customer base, technological capabilities, and cultural fit. This preliminary assessment helps narrow your focus to targets that align with your strategic vision.

Due Diligence

Due diligence is the investigative phase where you verify the target company’s key characteristics and uncover potential risks. This comprehensive review typically involves examining the following key areas:

- Financial viability: Analyze historical financial statements, cash flow patterns, revenue quality, and profitability trends. Verify that accounting practices comply with the relevant standards (GAAP or IFRS) and make accurate financial projections.

- Legality of operations: Review all material contracts, intellectual property rights, pending litigation, regulatory compliance records, and employment agreements. Identify any legal liabilities that could transfer to your company post-acquisition.

- Tax hygiene check: Examine the target’s tax filing history, outstanding tax liabilities, and potential exposure to tax audits. Ensure the company has properly documented its tax positions.

- Verification of synergies: Assess whether projected synergies, such as economies of scale, increased market share, cost internalization, and reduction of redundancies, are achievable.

- Establishing an acceptable business valuation range: Quantify the potential benefits from the acquisition. Use multiple valuation methodologies to determine a fair value range for the target. This analysis serves as the foundation for your initial offer and subsequent negotiations.

Regulatory Approval

The Hart-Scott-Rodino (HSR) Act requires parties to file premerger notifications with the Federal Trade Commission (FTC) and the Department of Justice (DOJ) when transaction values exceed the reportability threshold ($126.4 million for 2025, adjusted annually for inflation).

Based on the transaction size, you may need to pay a filing fee ranging from $30,000 to $2.39 million. After filing, a waiting period of 30 days begins, during which the regulators review potential antitrust concerns. If regulators request additional information through a Second Request, this waiting period is extended by 30 days.

Building Consensus

For public companies, SEC regulations mandate specific disclosures through proxy statements and Form S-4 to help shareholders make informed voting decisions. These filings must include detailed financial information, risk factors, and often a fairness opinion from an independent financial adviser.

Private companies, while not subject to SEC requirements, may need to provide similar disclosures when there’s no majority shareholder.

The essence of these disclosures lies in providing independent third-party assessments of whether the deal terms are fair to shareholders and delivering transparent financial information along with comprehensive risk disclosures.

Raising Funds

Some of the common deal structures for M&A transactions are as follows:

- Cash acquisitions: You transfer cash to the target’s shareholders in exchange for their ownership stakes. This structure provides immediate liquidity to sellers but depletes your cash reserves.

- Share swaps: You issue your company’s shares to the target’s shareholders at a predetermined exchange ratio. This structure preserves cash and allows target shareholders to participate in future upside, though it dilutes your existing shareholders’ ownership.

- Leveraged buyouts: You borrow substantial amounts to fund the acquisition, using the target company’s assets as collateral. This approach maximizes returns on equity but increases financial risk and requires the target to generate sufficient cash flow to service the debt.

Negotiations

The negotiation phase often involves multiple rounds of offers and counteroffers. Your initial offer, whether solicited or unsolicited, establishes the starting point for discussions.

The target may counter your initial proposal or reject it outright if they believe the valuation is inadequate or the terms are unfavorable. In such cases, you must decide whether to improve your offer, walk away, or pursue alternative approaches.

Acquisition in stages represents a negotiation strategy where you initially acquire a minority stake before pursuing full ownership.

This phased approach offers two key advantages. Firstly, you have more time to evaluate long-term viability, operational performance, and profitability under different market conditions. Secondly, it creates dollar-cost-averaging benefits by spreading the investment across multiple transactions at potentially different valuations.

Deal Closure

Once all parties reach an agreement and regulatory approvals are secured, you can proceed to close the transaction. This involves transferring the agreed-upon consideration to the target’s shareholders.

If the transaction is structured as a merger rather than an acquisition, you must undertake restructuring activities to combine the two entities legally and operationally. Leadership changes often occur in both the acquiring and acquired companies as responsibilities are reallocated and reporting structures are adjusted.

Post-closure, you must focus on optimizing overlapping processes, eliminating redundancies, and realizing the synergies identified during due diligence.

From an accounting perspective, you must recognize the acquisition as per ASC 805, measuring all acquired assets, assumed liabilities, and goodwill at fair value as of the acquisition date.

Eqvista- Precision That Powers Confident Decisions!

Private company acquisitions demand rigorous analysis at every stage, from initial valuation to deal closure. Whether you are evaluating a potential target, preparing for stakeholder discussions, or seeking an independent fairness opinion, accurate valuations form the foundation of successful deals.

Eqvista specializes in providing comprehensive valuation services tailored to private companies navigating M&A transactions. Our team delivers defensible, unbiased valuations that strengthen your due diligence process and build stakeholder confidence.

Contact us today to ensure your next acquisition is built on a foundation of precision and expertise!