Public Disclosures Explained: What Every Company Needs to Know

In this article, we will summarize the public disclosure deadlines and the types of public disclosures expected from public companies.

Every year, the Securities and Exchange Commission’s (SEC) EDGAR system processes more than a million filings. The Electronic Data Gathering, Analysis, and Retrieval (EDGAR) supports fair and transparent investor assessment of assets worth trillions of dollars.

However, the true MVPs of this ecosystem of transparency are public company executives who adhere to extensive reporting obligations. For them, the stakes couldn’t be higher as inadequate or untimely disclosures can trigger SEC enforcement actions, shareholder lawsuits, and severe damage to market credibility.

Hence, in this article, we will summarize the public disclosure deadlines and the types of public disclosures expected from public companies to help executives tackle these obligations effectively.

SEC Periodic Disclosure Deadlines

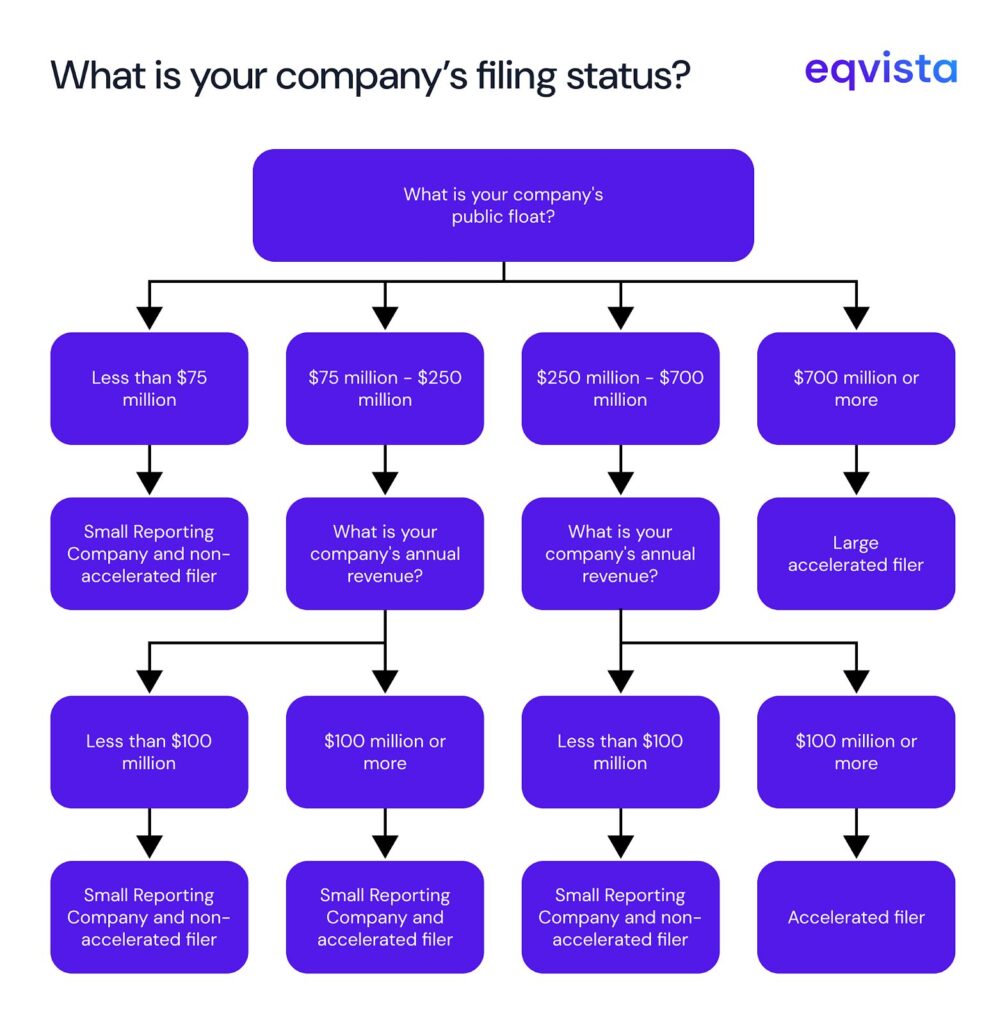

SEC filing deadlines depend on your company’s filing status, which in turn depends on its public float and annual revenue.

Note: You can calculate your company’s public float as the value of shares held by non-affiliates. This would mean multiplying its share price by the shares held by the general public as opposed to insiders and related entities (such as subsidiaries and group companies).

Annual filing deadlines

Domestic issuers are required to file annual reports in the Form 10-K format, which is due:

- 60 days after the fiscal year end for large accelerated filers

- 75 days after the fiscal year end for accelerated filers

- 90 days after the fiscal year end for non-accelerated filers

On the other hand, foreign private issuers (FPIs) are required to file annual reports in the Form 20-F format, which is due 4 months after the fiscal year-end.

Quarterly filing deadlines

Companies must file quarterly reports in the Form 10-Q format. These reports are due 40 days after the fiscal quarter-end for large accelerated and accelerated filers, while non-accelerated filers get another 5 days to complete filing.

Types of disclosures public companies typically make

As a public company, you can be expected to make the following kinds of disclosures:

Financial information

In your annual and quarterly reports, you must attach your balance sheet, income statement, and cash flow statement for up to 3 fiscal year-ends and changes in stockholders’ equity and noncontrolling interests for the current and comparative year-to-date periods.

The balance sheet must present assets, liabilities, and shareholders’ equity as of the reporting date, while the income statement should detail revenues, expenses, and net income for the reporting period. Your cash flow statement must reconcile operating, investing, and financing activities, giving stakeholders insight into how your company generates and uses cash.

Beyond the three primary statements, you’ll also need to include notes to the financial statements that explain accounting policies, break down line items, and provide additional context on significant transactions or events.

Segment information

Under ASC 280, you must disclose information about your company’s operating segments by industry, geography, product classes, and major customers. This information should include descriptions, profits/losses, assets, and reconciliations to consolidated amounts for each segment.

This segmentation helps investors understand which business lines drive growth, where geographic expansion is occurring, and how diversified your revenue streams are.

Management discussion and analysis (MD&A)

MD&A included in periodic reports helps investors contextualize the company’s performance and key business decisions. SEC Regulation S-K Item 303 specifically requires you to address any material risks or trends that may affect your performance in the MD&A section. Ideally, you should quantify the financial impact of such trends and present an analysis of the underlying factors causing said trends.

Auditor’s report

The independent financial auditor’s report on Internal Control over Financial Reporting serves as an objective assessment of the accuracy and reliability of your company’s financial records.

If auditors identify material weaknesses in internal controls or significant deficiencies in accounting practices, these concerns must be disclosed.

Proxy statements

Whenever your company needs to take shareholder votes, it must disclose all the relevant information through a proxy statement in the Form DEF 14A format. You may need to issue proxy statements in events such as the election of directors, executive compensation proposals, and major mergers and acquisitions (M&As).

Fairness opinions

If your company is involved in a merger or acquisition, you must request a qualified third party to provide a fairness opinion on the deal terms. These fairness opinions must then be attached to the relevant proxy statement.

Material risks and conflicts of interest

Companies are required to make detailed disclosures on material risks that can potentially significantly impact share price or threaten the company’s survival. Additionally, any conflicts of interest for any parties involved in managing a company or the preparation of information in one of its key reports must be disclosed.

Some examples of conflicts of interest include:

- Directors holding leadership positions in competitor companies

- M&A deal advisors serving the buying as well as the selling side

- Compensation structures creating incentives for leadership to act against shareholder interests

Eqvista – Meticulous Reports for Trustworthy Disclosures!

Navigating public disclosure requirements represents one of the most critical ongoing responsibilities for any public company. From the precise timing of Form 10-K and 10-Q filings to the comprehensive nature of proxy statements and fairness opinions, each disclosure serves a vital function in maintaining market integrity and protecting shareholder interests.

While the complexity of these requirements can seem daunting, they ultimately create the transparency that allows capital markets to function efficiently and investors to make informed decisions.

Need a rigorous, independent fairness opinion for a merger or other major transaction? Eqvista’s valuation specialists provide SEC-ready analyses that give your board and shareholders confidence. Contact us to move forward with clarity and credibility!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!