Acquisition Disclosures in M&A Transactions: Core requirements for public company acquisitions

This guide breaks down the essential disclosure requirements for public company acquisitions under Regulation S-X.

The M&A landscape is experiencing a remarkable resurgence in the US. In October 2025, the total deal value increased by 146.5% on a year-on-year basis. Another notable development is that transactions above $1 billion rose by 203% on a year-on-year basis.

As this wave of M&A activity intensifies, public companies must navigate complex SEC disclosure requirements that can significantly impact transaction timelines and success.

At the core of these disclosure requirements lies the Regulation S-X. This guide breaks down the essential disclosure requirements for public company acquisitions under Regulation S-X, helping you avoid costly delays and compliance pitfalls.

When do you need to make financial disclosures?

Regulation S-X is an SEC rule that lays out requirements for financial statements published by public companies. It also requires you to submit pre-acquisition financial statements for:

- Significant acquired businesses as well as acquisition targets (Rule 3-05)

- Significant acquired or to be acquired real estate operations (Rule 3-14)

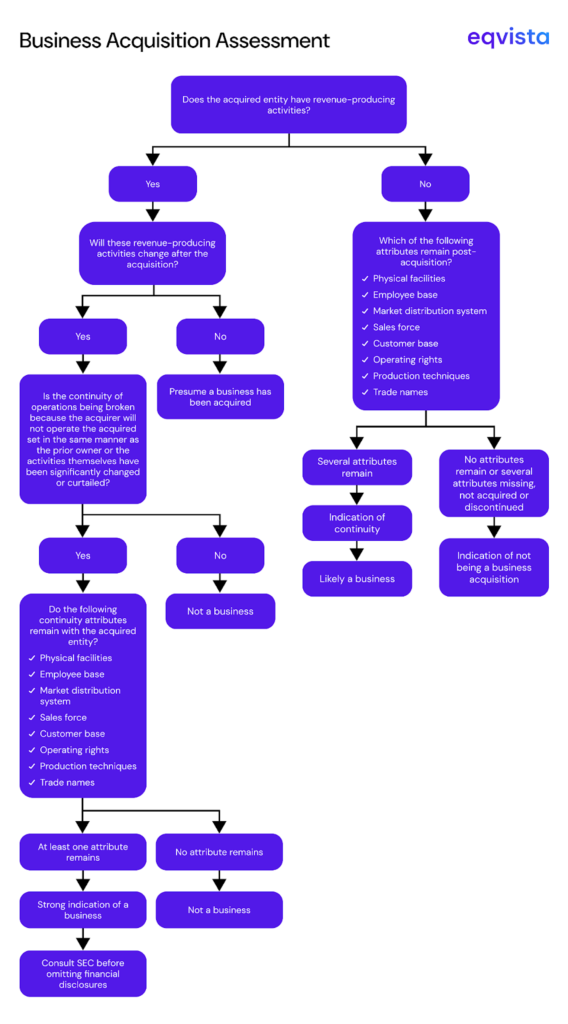

The SEC’s definition of a business centers around the continuity of operations of the acquired entity. This definition is best summarized by the following decision tree:

If you have indeed acquired a business as per the SEC definition, your next step should be to check its significance using the following tests:

| Test | Method for calculating significance |

|---|---|

| Investment test | Acquirer’s investment into the target ÷ Target’s common equity’s aggregate worldwide market value If the worldwide market value is not available, use total assets as the denominator. |

| Asset test | Target’s consolidated total assets ÷ Acquiror’s consolidated total assets |

| Income test | Significance is met when both of the following conditions are met: 1. Income component (Acquiror’s share of target’s pretax income ÷ Acquiror’s pretax income) ≥ 20% 2. Revenue component (Acquiror’s share of target’s revenue ÷ Acquiror’s revenue) ≥ 20% If both conditions are met, the lower of the two components is considered for determining financial disclosure requirements. |

Under Rule 3-05, the highest significance percentage from the three tests is considered to determine the disclosure requirements in the following manner:

| Significance percentage | Required financial disclosures |

|---|---|

| Less than or equal to 20% | None |

| Greater than 20% but less than 40% | 1. Most recent financial year 2. Latest year-to-date interim period before the acquisition date |

| Greater than 40% | 1. 2 most recent financial years 2. Latest year-to-date interim period before the acquisition date 3 Same interim period of the previous year |

Timeline for M&A-Related Financial Disclosures

If your company is involved in an acquisition, you must keep the following disclosure-related deadlines in mind:

Pre-acquisition

If you try to finance the acquisition by offering securities, you must provide the target’s financial statements and related pro forma before the acquisition is completed.

In addition to Rule 3-05-related disclosures, you may also need to submit Form S-4 along with financial statements and additional disclosures. In this form, you will also need to mention deal terms such as:

- Historical market value of the target’s securities being acquired

- Percentage of votes required for acquisition held by directors, executive officers, and their affiliates

- List and status of federal or state regulatory approvals needed for acquisition

- Tax consequences of the transaction

- Statement on whether the dissenters’ right of appraisal exists

Post-acquisition

You must file a Form 8-K within 4 business days of completing the acquisition, and you will have another 71 calendar days to amend this form. Also, under ASC 805, your company must recognize all acquired assets, liabilities, goodwill, intangible assets, and bargain purchase gains at fair value.

Ongoing updates

While your company is considering an acquisition, if the previously disclosed financial statements become stale, you may need to update the financial information in amended or future registration statements.

How to prepare financial statements for M&A disclosures?

Here, we discuss the best practices for preparing financial statements for M&A disclosures:

Preacquisition Financial Statements

Generally, preacquisition financial statements of the target must be prepared as if they were SEC-registered. Although certain accounting standards have different adoption dates and disclosure requirements for public and non-public entities, in the case of disclosures under Rule 3-05, the financial statements must be prepared as if the target is a public entity.

Pro Forma Financial Statements

To put it simply, pro forma financial statements are projections made with certain assumptions. In case of M&A-related disclosures under Rule 3-05, the following pro forma financial statements may be required:

- Latest balance sheet as if the transaction were completed as of the balance sheet date

- Latest annual financial income statement and the latest interim income statement, assuming the transaction was completed at the beginning of said financial year

In the explanatory notes, you can also choose to present your management’s adjustments to the pro forma financial statements based on the synergies identified.

Eqvista – Accuracy That Inspires Trust!

Navigating acquisition-related disclosures requires a clear understanding of when an acquired entity qualifies as a business, how significance tests apply, and what specific financial statements are required both before and after closing.

As deal activity accelerates, particularly in the large-cap segment, public companies must maintain disciplined processes to ensure compliance with SEC rules, avoid delays in transaction timelines, and provide investors with transparent, decision-useful information.

If your team is preparing for an acquisition, especially of a private company, consider engaging Eqvista, the private equity valuation experts. We deliver accurate and defensible valuations that not only streamline SEC disclosures but also strengthen the financial narrative you present to investors and regulators. Contact us to know more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!