What Is a Family Office? Types And Core Functions

In this article, we will explore the core functions and types of family offices in an attempt to shed light on who actually needs a family office.

Family offices attend to the financial advisory and planning, as well as any other money-related needs of ultra-high-net-worth families. There’s a considerable overlap between the services of investment advisors and family offices. But the complexity of investment goals, sheer volume of wealth, and need to balance returns with other needs often exceed the scope and capacity of a single investment advisor.

Since the staffing costs of family offices can be significant, they are established by families with net worths of at least $25-30 million.

What Do Family Offices Do?

A family office is designed to meet every money-related need of a family, but it generally carries out the following functions:

Investment Advisory

An ultra-high-net-worth family is essentially a group of accredited investors or qualified purchasers. But if every member managed investments across all asset classes, there would be a lot of redundancy. Also, the family members may see portfolio management as tedious and might not want to make it their full-time occupation.

Estate Planning

In the US, the federal estate tax ranges from 18% to 40% and the state estate taxes can go up to 20%. So, with just one transfer of wealth, the estate’s post-tax value can potentially drop by 52%. If families ignore succession planning, within a few generations, their net worth will largely be taxed away.

Financial Education

Each successive generation may not have the skills and experience that the previous generation possessed. As a result, there is a need to educate the new generation about investing and tax planning.

Tax Planning

Due to their substantial wealth and influential networks, members of high-net-worth families are likely to become high earners themselves. When the family also controls a major corporation, these individuals may hold key leadership positions, further increasing their potential tax exposure. Without careful planning, they could face significant tax liabilities.

Who Needs a Family Office?

Whether you need a family office depends entirely on your net worth and the complexity of your financial needs.

According to Deloitte, the average cost ratio for a family office is 0.41%. This may appear cheap, but a family office’s operational costs can range from $700,000 to $24 million annually.

So, establishing a family office essentially allows ultra-high-net-worth families to access highly specialized financial services that are tailored to their unique needs at a fraction of the cost of comparatively generic investment products. For instance, hedge funds typically have a 2% management fee and a 20% performance fee.

List each one of your financial needs, from portfolio management to estate planning. Now, contemplate whether these needs are complex enough to warrant hiring a full-time team to cater to them. In many cases, the services of a combination of investment and tax advisors will suffice.

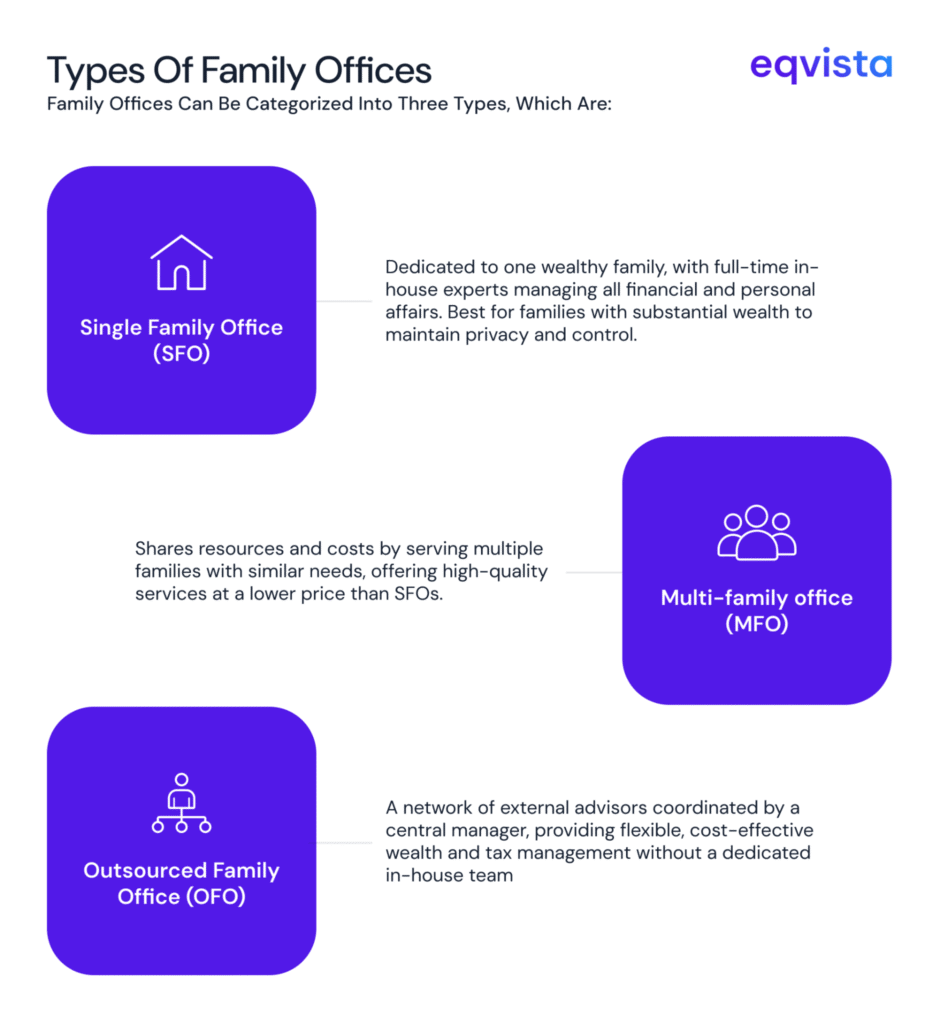

Types Of Family Offices

Family offices can be categorized into three types, which are:

Single Family Office (SFO)

As the name suggests, a single family office (SFO) caters to the needs of one single family. Since the staffing expenses can be significant, SFOs are established only if the family has accumulated substantial wealth to the tune of hundreds of millions of dollars. Each professional within the office is a dedicated, full-time employee, which helps minimize potential conflicts of interest.

Multi-family office (MFO)

A multi-family office (MFO) serves multiple families that share similar financial needs. By pooling resources, families with comparatively lower wealth levels can access the same high-quality financial and administrative services that a single family office provides, but at a fraction of the cost.

Outsourced Family Office

An outsourced family office is a network of advisors that manages investments, develops tax strategies, and addresses other specialized needs for a family. Typically, a central coordinator oversees these professionals to ensure alignment with the family’s goals and streamlined delivery of services.

Top 5 Largest Family Offices

The top 5 largest family offices discussed below have a combined assets under management (AUM) of $707 billion.

Walton Enterprises

AUM: $225 billion

Sam Walton established Walton Enterprises before establishing Walmart. Currently, it functions as a family office and is led by Jim C Walton, Sam Walton’s youngest son. It employs hundreds of professionals across Washington, Denver, and Jersey City. In addition to their business achievements, the Walton family is deeply involved in philanthropy and the arts.

Cascade Investment

AUM: $170 billion

Cascade Investment was founded by Bill Gates in 1995 and is managed by Michael Larson, the Chief Investment Officer (CIO). The family office has maintained long-term stakes in companies such as Four Seasons Hotels and Resorts, Republic Services, Ecolab, and Deere & Company, as well as an extensive real estate portfolio.

Pontegadea Inversiones

AUM: $115 billion

Founded in 2001, Pontegadea Inversiones serves as the family office of Amancio Ortega, the founder of Zara and a majority shareholder in Inditex. Pontegadea manages the Ortega family’s wealth primarily through Pontegadea Inmobiliaria, a real estate-focused company.

In recent years, the family office has diversified into renewable energy, investing heavily in wind and solar energy projects across Spain and France while maintaining significant stakes in logistics centers worldwide.

Bezos Expeditions

AUM: $108 billion

Bezos Expeditions is the family office managing Jeff Bezos’ private wealth and investments. The family office focuses on venture capital and private equity across sectors such as technology and healthcare. Its notable investments include Airbnb, Uber, Tenstorrent, and Plenty, alongside philanthropic contributions to institutions like Princeton University and Seattle’s Museum of History and Industry.

Mousse Partners

AUM: $89 billion

Mousse Partners is the New York-based family office of Alain and Gérard Wertheimer, heirs to the Chanel fortune. Led by Charles Heilbronn, the firm manages global investments across private equity, venture capital, real estate, and credit. Mousse Partners has backed companies such as Ulta Beauty, Beautycounter, Tonal, and Nature’s Fynd.

Securing Wealth for Generations: The Value of Family Offices

Family offices offer tailored wealth management and support for ultra-high-net-worth families, integrating investment, estate planning, and tax services. Choosing the right type helps families secure their financial future and enjoy lasting peace of mind.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!