QSBS Tax Benefits: How Smart Companies Structure for Maximum Tax Savings [Survey]

Qualified Small Business Stock (QSBS) tax benefits under Section 1202 represent one of the most powerful wealth-building opportunities in the tax code, but are companies actually leveraging them? We surveyed founders across industries to find out how they’re structuring for QSBS tax benefits.

![QSBS Tax Benefits: How Smart Companies Structure for Maximum Tax Savings [Survey]](https://eqvista.com/wp-content/uploads/2025/11/QSBS-Tax-Benefits_-How-Smart-Companies-Structure-for-Maximum-Tax-Savings-1.png)

The data reveals that QSBS tax benefits aren’t just about savings, they’re a competitive advantage in recruiting talent, attracting investors, and building long-term value with up to $15 million in tax-free gains per stakeholder.

Key Survey Findings: QSBS Tax Benefits Adoption

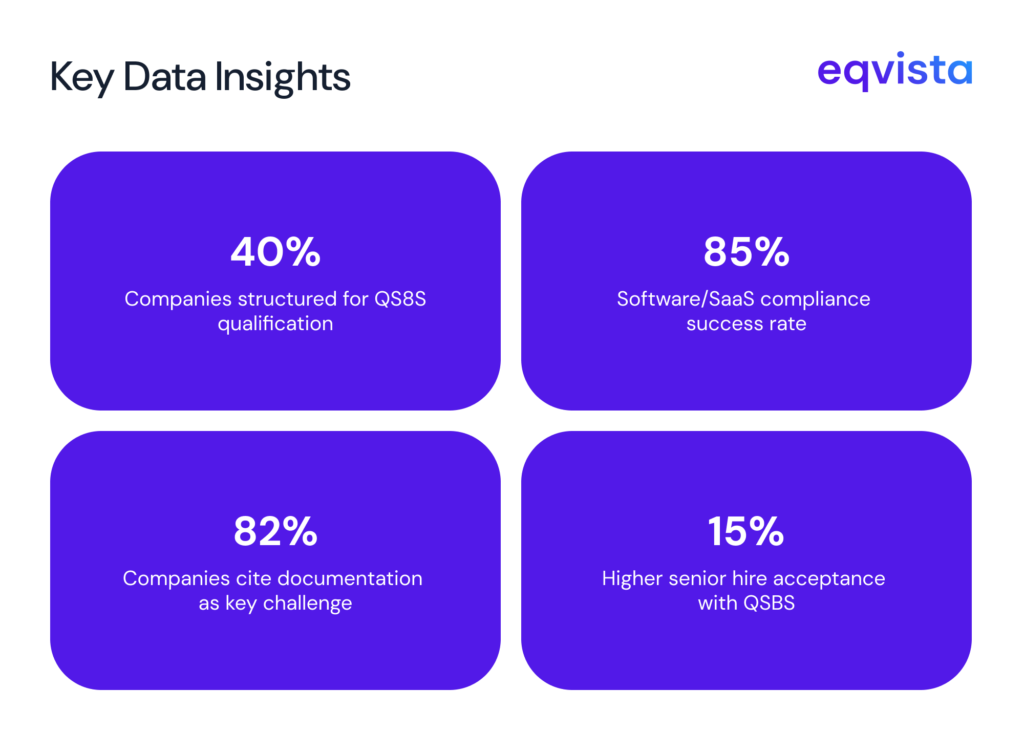

40% of Companies Leverage QSBS Tax Benefits

Approximately 40% of companies have structured for QSBS tax benefits, and place themselves for tax advantages. These companies have deliberately chosen C-corporation structures and implemented rigorous compliance frameworks to unlock what many call “the best-kept secret in startup taxation.”

Among QSBS-qualified companies, the commitment to maintaining compliance has become a strategic discipline. Maintaining the 80% active business asset test requires coordination between legal and financial teams, but the payoff—potential millions in tax savings—makes this effort worthwhile.

How C-Corps unlock QSBS Tax Benefits

Companies structured as C-corporations from inception report QSBS as a crucial recruiting and fundraising differentiator. The ability to offer equity with potential tax-free gains of $15 million or more creates a “massive recruiting and fundraising advantage when competing for top talent.”

This advantage compounds over time. When employees understand that their equity could be worth significantly more after-tax compared to non-QSBS companies, offer acceptance rates increase dramatically—with some companies reporting 15% higher acceptance rates among senior hires.

Managing QSBS Tax Benefits: The $75 Million Threshold Challenge

The $75 million gross asset threshold (increased from $50 million in July 2025) requires proactive management but creates opportunities for strategic capital deployment. Forward-thinking companies implement quarterly asset monitoring protocols, allowing them to time equity grants and funding rounds strategically.

Some retail analytics companies that reached the threshold within seven months used this as an opportunity to accelerate equity grants to key employees, locking in QSBS eligibility before crossing the line. This proactive approach ensured their early team members could benefit from the full tax exclusion.

Manufacturing and hardware companies have found innovative solutions to manage asset levels. By structuring manufacturing relationships to keep domestic entities asset-light while maintaining IP and customer relationships in-house, these companies maintain QSBS qualification while scaling physical operations.

Documentation: Your Competitive Moat

Companies with pristine cap tables and well-documented QSBS qualification close funding rounds faster and command better terms. Investors increasingly view QSBS eligibility as a deal requirement, not a nice-to-have.

The most successful companies track:

- Every stock issuance date and the applicable holding period tier

- Clean cap tables with real-time accuracy

- The holding period start date for each shareholder

- Asset levels at each equity grant to verify $75 million threshold compliance

- Quarterly 80% active business asset test results

The upside is clear: companies that maintain careful QSBS compliance save millions in tax savings for their stakeholders.

Proven Structuring Approaches for QSBS

The Winning Formula

1. Strategic Early Incorporation: Leading companies incorporate as Delaware C-corps before raising capital, make sure original stock issuance occurs below the $75 million threshold. This single decision can create tens of millions in value for stakeholders.

2. Active Business Optimization: QSBS-qualified companies maintain clear product development and sales operations, avoiding consulting or passive income models. Companies that keep software development in-house and focus on scalable products find QSBS compliance natural and sustainable.

3. Investor Communication Excellence: Best-in-class companies include Section 1202 representations in every purchase agreement and provide investors with one-page QSBS briefs. This transparency builds trust and positions it as a key value proposition.

4. Employee Equity Education: Forward-thinking companies add QSBS eligibility explanations to every equity grant. The result? Higher offer acceptance rates, better talent retention, and employees who understand the true value of their compensation.

Maximizing QSBS Value

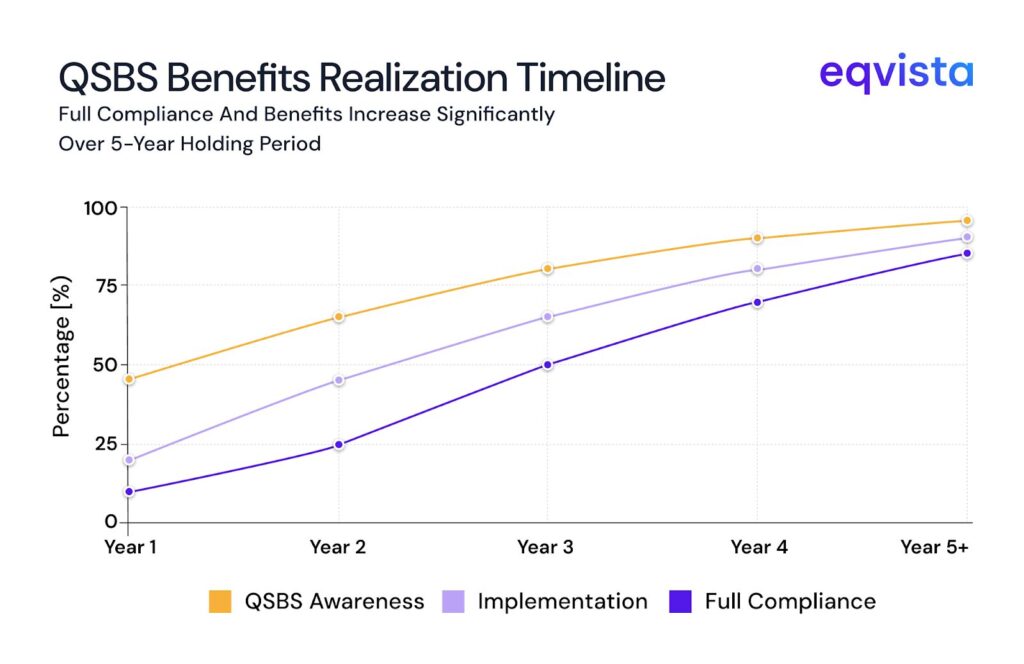

Strategic Timing of Option Exercises: Companies encourage early option exercises to start the QSBS holding period sooner, maximizing the window for tax-free gains upon exit. With the new tiered structure, employees can see benefits as early as three years.

Clean Cap Table Maintenance Cap Table Maintenance: Regular cap table audits prevent issues that could challenge QSBS status, protecting value for all stakeholders. This includes tracking which stock was issued before vs. after July 4, 2025, as different rules apply.

Quarterly Compliance Reviews: Building QSBS audits into board reporting causes potential issues early, when they’re still fixable. Key metrics to watch are:

- Gross assets vs. $75 million threshold

- Active business assets as % of total (must exceed 80%)

- Upcoming funding rounds that might trigger threshold crossing

- Redemption activity that could disqualify QSBS

Asset Deployment Strategy: Strategic companies deploy cash into R&D and active business operations rather than passive investments, maintaining the 80% active business threshold while accelerating growth.

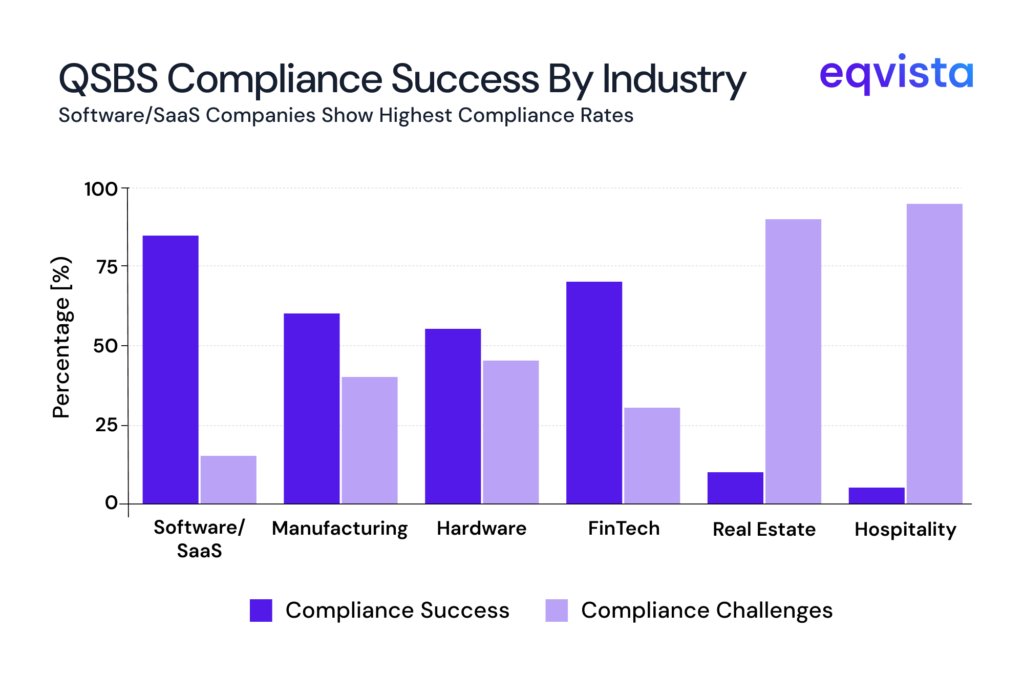

QSBS Tax Benefits by Industry

Software and SaaS

Technology companies find QSBS compliance straightforward when focused on product development. The structure aligns with qualified business activities, making QSBS smooth and part of the growth strategy. Companies tracking asset levels during rapid scaling have successfully maintained qualification through multiple funding rounds,even with the previous $50million threshold,and now have even more room with the $75million limit.

Manufacturing and Hardware: Strategic Asset Management

Physical product companies have developed sophisticated strategies to maintain QSBS qualification. By contracting manufacturing and keeping entities asset-light, these companies scale operations while protecting QSBS tax benefits. The key is maintaining IP and customer relationships in-house while keeping capital-intensive operations external.

International Operations: Global Growth with US Tax Benefits

Companies with global operations structure US parent C-corporations with foreign subsidiaries, capturing QSBS tax benefits for US investors while serving international markets. This structure provides the best of both worlds, global reach with powerful US tax advantages.

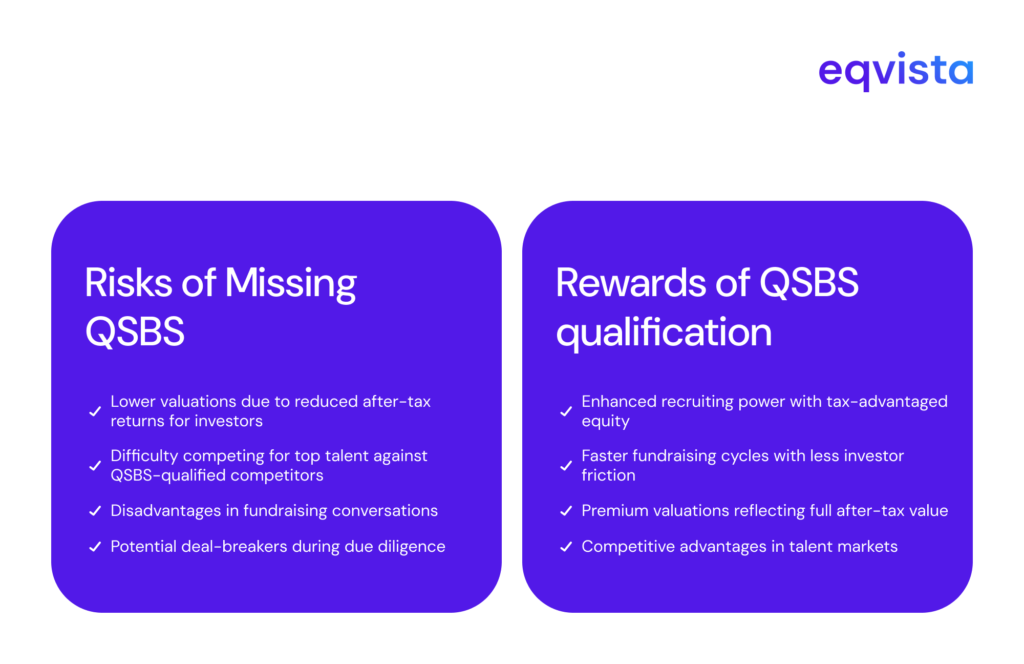

The Competitive Advantage for Venture-Backed Companies

For today’s venture ecosystem, QSBS isn’t optional, Institutional investors increasingly expect QSBS qualification as a baseline requirement. Major venture capital firms view this eligibility as “table stakes for the deal”.

Companies that neglect QSBS structuring face avoidable disadvantages in fundraising and valuation.

Practical Implementation Guide

Building and maintaining QSBS eligibility starts with intentional structuring and disciplined record keeping. The steps below outline a practical roadmap for founders,from day one formation decisions to ongoing compliance practices as the company grows.

| Stage | Category | Action Item |

|---|---|---|

| Early-Stage Companies | Immediate Actions | Incorporate as a Delaware C-corp before any investment Implement quarterly asset testing protocols from day one Document every stock grant with board minutes and clean stock ledgers |

| Quick Wins | Add QSBS language to all equity documents Create a one-page QSBS brief for investors and employees Schedule quarterly cap table reviews Train managers on QSBS tax benefits and the new 2025 changes |

|

| For Growing Companies | Strategic Priorities | Build QSBS audits into quarterly board reporting Time equity grants and funding rounds around the $75 million threshold Avoid redemptions around financing events Monitor revenue mix to maintain active business status |

| Value Protection | Document asset deployment decisions in board minutes Maintain clean records of when options are exercised Review business activities quarterly for compliance Plan secondary sales carefully to preserve QSBS status Track separately: pre-July 4, 2025 stock ($10M cap, $50M threshold) vs. post-July 4, 2025 stock ($15M cap, $75M threshold) |

View QSBS as a growth tool, not just a tax benefit. Use it to attract better talent, close bigger rounds, and build sustainable value. Work with experienced professionals from the start. Retroactive fixes are expensive and often impossible.

QSBS Compliance: The Eqvista Solution

While the strategic benefits are clear, the compliance requirements can be complex and time-consuming. This is where professional attestation services become invaluable.

The Challenge of QSBS Documentation

As mentioned throughout this survey, careful documentation is the difference between capturing millions in tax savings and losing eligibility. Companies face challenges:

- Tracking stock issuances and holding periods for every shareholder

- Verifying the 80% active business asset test at each equity grant

- Monitoring the $75 million gross asset threshold across funding rounds

- Maintaining audit-ready documentation for IRS compliance

- Providing shareholders with proper attestation letters for tax filing

Missing any of these elements can disqualify QSBS tax benefits; not just for one shareholder, but potentially for the entire company.

Eqvista’s QSBS Attestation Service

Eqvista provides comprehensive QSBS attestation services designed to eliminate compliance risk while maximizing tax benefits for your stakeholders. Here’s how the service works:

Integrated Cap Table Management. Since Eqvista already manages your cap table, the attestation process is seamless. There’s no need to submit redundant financial records—the team has direct access to your equity data and verifies QSBS eligibility with every 409A valuation.

Why Professional Attestation Matters

Investors request QSBS attestation during Seed through Series B funding rounds. Having professional attestation in place:

- Speed up fundraising by giving immediate verification to investors

- Demonstrates governance sophistication that appeals to institutional capital

- Protects employee equity value by ensuring proper documentation

- Reduces legal and accounting costs during due diligence

- Eliminates last-minute scrambles when shareholders need tax documentation

- Ensure compliance with both pre-and post-July 2025 rules

For companies serious about maximizing QSBS tax benefits, professional attestation isn’t optional; it’s a strategic necessity that protects millions in potential tax savings.

Get started with Eqvista’s QSBS Attestation Service:

- Free initial consultation to assess your eligibility

- Smooth integration with cap table management

- Expert guidance from NACVA-certified professionals

- Audit-defensible documentation that protects your stakeholders

The Bottom Line: QSBS as Strategic Advantage

QSBS represents more than tax savings; it’s a strategic tool that creates measurable business advantages:

- $15 million in tax-free gains per stakeholder on successful exits

- 15% improvement in senior hire acceptance rates through tax-advantaged equity

- Faster fundraising with VC firms that prioritize QSBS qualification

- Premium valuations reflecting full after-tax returns for investors

- Expanded eligibility with new $75 million threshold.

The companies that succeed with QSBS share three characteristics: deliberate structure from inception, rigorous documentation practices, and steady focus on qualified business activities.

The choice is clear: structure for QSBS early and reap compounding benefits throughout your company’s growth journey, or face competitive disadvantages in talent acquisition, fundraising, and ultimate exit value.

As the data shows, smart companies treat Section 1202 qualification as a core strategic priority, right alongside product development and customer acquisition.

Ready to Maximize Your QSBS Tax Benefits? Schedule Your Free QSBS Consultation with Eqvista Today

Disclaimer: This article consists of findings from a comprehensive survey of companies regarding their QSBS tax benefits strategies. Survey data is for informational purposes only and does not constitute legal or tax advice. Consult professionals for guidance specific to your QSBS tax benefits situation.