Common Types of LBOs: Management Buyouts, Owner Buyouts, and Sponsor Deals

In this article, we will explore the common types of LBOs along with some real-world examples.

Leveraged buyouts (LBOs) are acquisitions where the buyer finances a majority of the purchase through borrowed funds. In such transactions, the assets of the buyer and the target company are used as collateral.

Thus, the LBO structure allows you to acquire substantially large companies while preserving capital and requiring fewer assets to be pledged as collateral.

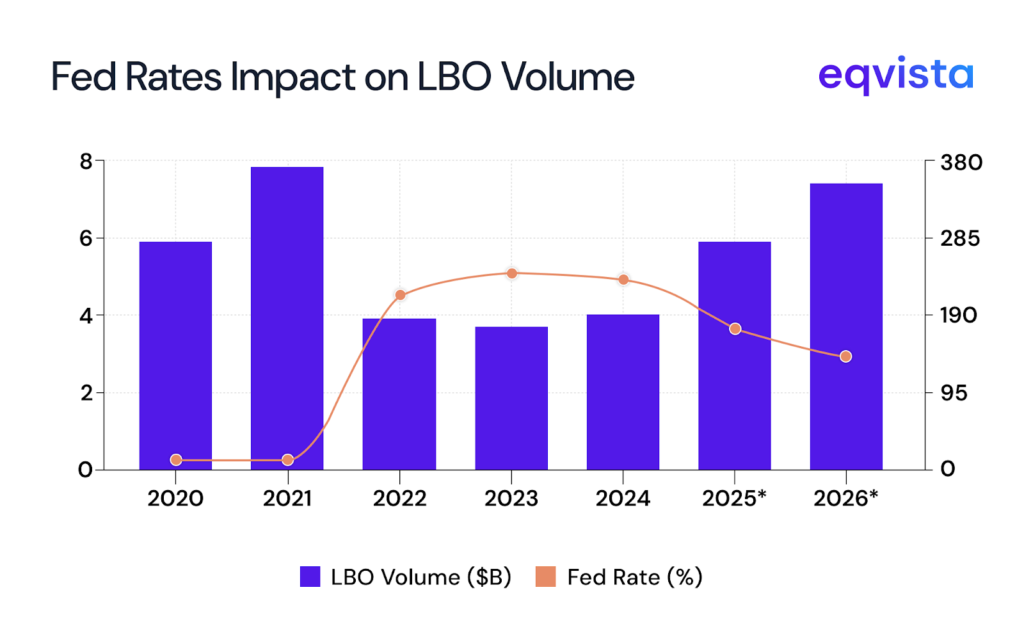

LBOs are especially popular when interest rates are low. For instance, in 2021, when the US Fed Funds rate was 0.25%, the total US LBO deal volume was $363 billion. As the Federal Reserve hiked interest rates to 4.5% in 2022, the US LBO deal volume fell by 48.76% to $186 billion.

Experts believe that the Federal Reserve will reduce interest rates three times this year. If these expectations bear fruit, we can expect 2026 to be conducive for LBOs.

Types of LBOs

In the mergers and acquisitions (M&A) space, you are likely to encounter the following kinds of leveraged buyouts (LBOs):

Management buyouts

In a management buyout, a company’s management, and sometimes employees, use debt to buy out their own company. You may see such deals when the management does not have enough capital for an all-cash deal.

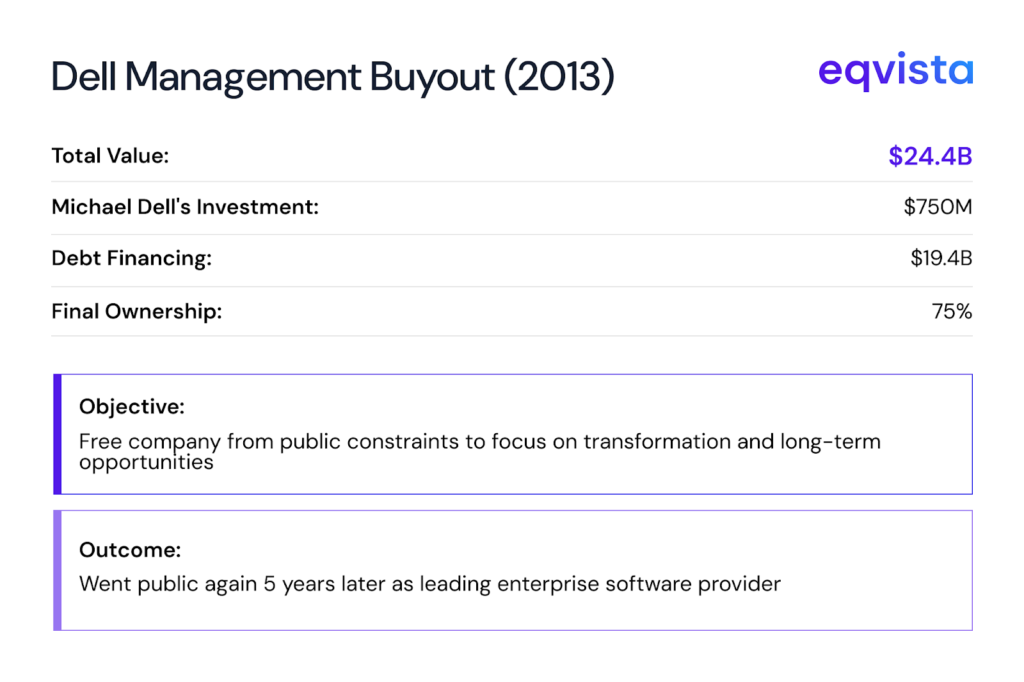

The most notable example of management buyouts would be when Michael Dell bought Dell, the company he founded, to take it private in 2013. Prior to this deal, Michael Dell’s stake in Dell was valued at more than $3 billion. With $750 million of his own funds and $19.4 billion raised from Silver Lake and a consortium of lenders, Michael Dell completed the purchase and came to own 75% of the company.

After a short hiatus, Michael Dell came back to lead Dell as its CEO in 2007 to steer the company out of a rough patch. However, due to poor results, Michael Dell was criticized by shareholders, especially by activist investor Carl Icahn.

The purpose of this management buyout was to free the company from its constraints as a public company, such as delivering on quarterly targets and shareholder expectations, to focus on its transformation and long-term opportunities.

Five years later, Dell went public once again, but this time as a leading enterprise software provider.

Owner buyouts

Owner buyouts involve an existing owner or owners acquiring additional shares to gain a controlling interest. Such transactions can be structured as leveraged buyouts if the existing owner does not have enough cash on hand.

The Kinder Morgan buyout of 2006 is a prime example of owner buyouts. Richard D Kinder, the company’s co-founder, chairman, and 18% owner, led an investor group to buy out the company at $15 billion. The investor group included William Morgan, co-founder of the company, his son Mike Morgan, as well as Goldman Sachs Capital Partners, American International Group, and The Carlyle Group.

Sponsor deals

In private equity, sponsors are the parties responsible for deal-sourcing and management. The three common types of sponsors are as follows:

Financial sponsors

These are private equity firms that pool funds from limited partners to invest in companies over the fund’s lifetime.

Example: Back in 2013, Berkshire Hathaway and 3G Capital Management teamed up to acquire Heinz in a deal valued at $28 billion after accounting for debt. In this deal, JPMorgan and Wells Fargo extended debt financing. This was one of the few times Warren Buffett teamed up with another party in an acquisition. He may have made an exception because he had long been eyeing the company, even admitting to keeping a file on it dating back to 1980.

Independent sponsors

Independent sponsors, or fundless sponsors, are expert dealmakers who identify acquisition targets but lack committed capital to go through with the purchase. Hence, independent sponsors raise funds on a deal-by-deal basis. Typically, independent sponsors are paid a closing fee, a management fee, and a carried interest.

Such deals are often not covered by the media due to their small size and because the parties may prefer keeping investment terms confidential.

Strategic sponsors

Strategic sponsors are large corporations that pursue acquisitions to improve their core business instead of simply pursuing investment returns.

Example: In a controversial takeover, InBev acquired Anheuser-Busch for $52 billion in 2008 to form Anheuser-Busch InBev (AB InBev), the world’s largest brewer. The deal received resistance from Anheuser-Busch’s management and was opposed by a long list of politicians, including Barack Obama, the former US President and then Senator of Illinois. InBev financed this deal by raising $45 billion from 10 banks. Eight years later, AB InBev took over SABMiller in a deal valued at over $100 billion.

Eqvista- Real-time insights for agile decision-making!

Leveraged buyouts (LBOs) enable buyers to acquire large companies primarily using debt, with the target’s assets often serving as collateral. Their popularity rises in low-interest environments, as seen in 2021, while higher rates sharply reduce activity.

Key types include management buyouts, owner buyouts, and sponsor-led deals, which may involve financial, independent, or strategic sponsors.

With expectations of rate cuts ahead, conditions for LBOs may soon improve. To seize opportunities with speed and confidence, leverage Eqvista’s real-time valuation software to strengthen your negotiations and avoid costly missteps. Contact us to know more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!