Top 100 Seed Investments and Investors

Getting funds for a new business is always crucial and probably one of the hardest challenges new business owners go through. Most startups seek help from seed investments and investors to help their business through its early stages. Investors usually exchange funding for an equity stake of the business, giving them partial ownership, and business owners will receive the funding that will help their business grow.

One of the most crucial stages for company funding is through seed investments. Read more about what a seed investment is, its usage, and when is the best time to raise seed money. We also list out the top 100 seed investments and investors.

What is a seed investment?

Seed investment is a private investment of capital in a startup in exchange for equity. The money invested in a company as seed money typically ranges between hundreds and thousands of dollars. This range exists because venture capital firms typically won’t invest less than $1 million. This also represents the maximum you can expect or ask from seed investors.

Another major difference is that venture capital investments most often come from institutions. In contrast, seed funding typically comes from individual investors, such as angel investors, crowdfunding, and even family or friends.

Types of Seed Investments

There are different types of seed investments available for startups. It’s important to understand the different types of investors or potential investors since there are multiple sources you can get funding from:

- Crowdfunding

- Corporate Seed Funds

- Incubators

- Accelerators

- Angel Investors

- Personal Savings

- Debt Funding

- Convertible Securities

- VC Funding

- Angel Funds or Angel Networks

What is seed investment used for?

The main aim of getting seed funding for a company is to get a business off the ground. One major struggle that startups face is turning a profit simply because they lack the funding needed to get their business going. In addition to this, acquiring debt-based capital is not always easy. It is not easy because of the lack of cash flow and limited operating history. Seed funding provides a simple and effective funding solution. Key purposes of raising seed funding are:

- Additional time to set your business model.

- Extra time to connect with effective business partners.

- Assists in lower dilution and capital for future rounds.

- Extra flexibility to pivot and adjust course according to market demand.

Some of the most common sources of seed funding involve angel investors, accredited investors, and equity crowdfunding investors. With that said, it is not uncommon for a startup business’s founders to provide seed funding.

When to raise seed money?

If you have a game-changing business idea, most investors will want to back you and fund your startup. It is important to remember that investors want to see you succeed and accomplish your vision for your business. Before you go looking for investors, you must prepare your presentation, your story, your goals and vision. Know that when a founder is ready to tell their story and aim, they can raise money quickly.

For some founders, having an adequate story and a reputation is enough to raise money. Despite this, it will need an idea, a product, and customer adoption, a.k.a. traction for most. Fortunately, today’s software development ecosystem is such that a sophisticated web or mobile product can be built and delivered in a brief period at a low cost. Hardware can also be quickly prototyped and tested. However, investors also need persuading. Usually, a product they can see, use, or touch will not be enough. They will want to know that there is a product-market fit and that the product is undergoing real growth.

Therefore, founders should raise money to figure out their market opportunity and who their customers are. After delivering a product that matches your market’s needs, it’s important to keep working on your product and communicate with your customers to know how else to improve your product and what other features you can add. The more you work on your product and meet your market’s needs, the more investors you get.

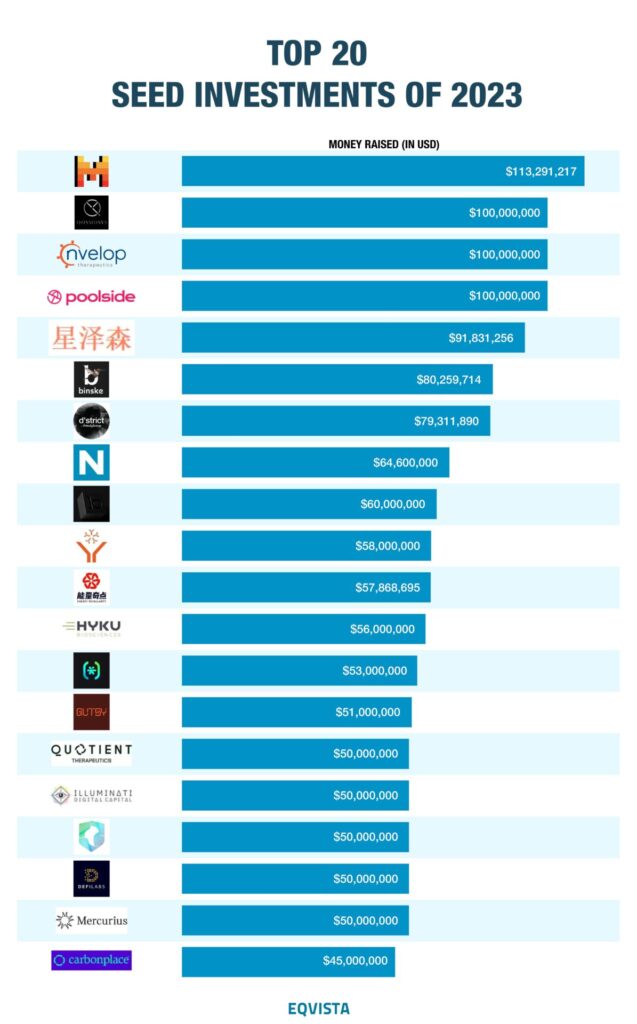

Top Seed Investments 2023

Here is a list of the top Seed Investments to date:

| S. No. | Organization Name | Money Raised (in USD) | Announced Date |

|---|---|---|---|

| 1 | Mistral AI | 113291217 | 13-06-2023 |

| 2 | Qosmosys | 100000000 | 17-10-2023 |

| 3 | Nvelop Therapeutics | 100000000 | 25-09-2023 |

| 4 | Poolside | 100000000 | 24-08-2023 |

| 5 | Xingzesen | 91831256 | 19-12-2023 |

| 6 | Binske | 80259714 | 17-01-2023 |

| 7 | d'strict | 79311890 | 08-02-2023 |

| 8 | NIMMSTA | 64600000 | 04-07-2023 |

| 9 | Black Ore Technologies | 60000000 | 07-11-2023 |

| 10 | Arialys Therapeutics | 58000000 | 12-09-2023 |

| 11 | Energy Singularity | 57868695 | 28-04-2023 |

| 12 | Hyku | 56000000 | 19-09-2023 |

| 13 | Descope | 53000000 | 15-02-2023 |

| 14 | Gutsy | 51000000 | 10-10-2023 |

| 15 | Quotient Therapeutics | 50000000 | 21-11-2023 |

| 16 | Illuminati Capital | 50000000 | 10-08-2023 |

| 17 | Hippocratic AI | 50000000 | 16-05-2023 |

| 18 | DECENTRALIZED FINANCE LABORATORIES LIMITED | 50000000 | 11-04-2023 |

| 19 | Mercurious Inc | 50000000 | 01-12-2023 |

| 20 | Carbonplace | 45000000 | 08-02-2023 |

| 21 | OH Credit | 45000000 | 06-05-2023 |

| 22 | Mynd.ai | 42219040 | 21-12-2023 |

| 23 | Tradealgo | 41769364 | 30-11-2023 |

| 24 | XPANCEO | 40000000 | 16-10-2023 |

| 25 | Charged | 40000000 | 28-08-2023 |

| 26 | DRONAMICS | 40000000 | 17-02-2023 |

| 27 | Ajras | 39989165 | 08-11-2023 |

| 28 | Vivodyne | 38000000 | 22-11-2023 |

| 29 | Liquid AI | 37600000 | 01-12-2023 |

| 30 | Maka Motors | 37600000 | 19-07-2023 |

| 31 | Dream Security | 33600000 | 21-11-2023 |

| 32 | Proof of Play | 33000000 | 21-09-2023 |

| 33 | Superluminal Medicines | 33000000 | 28-08-2023 |

| 34 | Plai Labs | 32000000 | 19-01-2023 |

| 35 | MADDE | 31591027 | 01-08-2023 |

| 36 | Solu Therapeutics | 31000000 | 01-08-2023 |

| 37 | Cosmic Wire | 30000000 | 19-07-2023 |

| 38 | Passage | 30000000 | 27-06-2023 |

| 39 | 2070 Health | 30000000 | 07-06-2023 |

| 40 | Voice of Zevok | 30000000 | 20-02-2023 |

| 41 | Fractal Homes | 30000000 | 09-01-2023 |

| 42 | Story Protocol | 29300000 | 17-05-2023 |

| 43 | Type One Energy | 29000000 | 28-03-2023 |

| 44 | Vectara | 28500000 | 30-05-2023 |

| 45 | Wenji Dental Network | 27410026 | 19-09-2023 |

| 46 | EarthGrid PBC | 27000000 | 18-10-2023 |

| 47 | CentML | 26805611 | 25-10-2023 |

| 48 | Rhythms | 26000000 | 07-12-2023 |

| 49 | Amber Bio | 26000000 | 03-08-2023 |

| 50 | poolside | 26000000 | 24-05-2023 |

| 51 | Poolside | 26000000 | 14-05-2023 |

| 52 | Flow48 | 25000000 | 09-11-2023 |

| 53 | Bastion | 25000000 | 18-09-2023 |

| 54 | Isometric | 25000000 | 17-07-2023 |

| 55 | Blue Laser Fusion | 25000000 | 27-07-2023 |

| 56 | Judo Bio | 25000000 | 21-11-2023 |

| 57 | Tenant | 25000000 | 08-08-2023 |

| 58 | MindsDB | 25000000 | 01-06-2023 |

| 59 | Karman+ | 25000000 | 01-03-2023 |

| 60 | Hopewell Therapeutics | 25000000 | 02-06-2023 |

| 61 | qlub | 25000000 | 17-03-2023 |

| 62 | Neuron Energy | 24389632 | 12-07-2023 |

| 63 | Selkirk Pharma | 24102603 | 06-09-2023 |

| 64 | Croissant | 24000000 | 27-07-2023 |

| 65 | ARTBIO | 23000000 | 21-06-2023 |

| 66 | M^0 Labs | 22500000 | 05-04-2023 |

| 67 | Effy | 21685505 | 29-03-2023 |

| 68 | Medallion | 21464892 | 01-09-2023 |

| 69 | Angell | 21362933 | 19-09-2023 |

| 70 | Constantinople | 21305423 | 16-05-2023 |

| 71 | Quobly | 21167062 | 12-07-2023 |

| 72 | Ingonyama | 21000000 | 09-11-2023 |

| 73 | Matchday | 21000000 | 08-03-2023 |

| 74 | Influence | 20800000 | 08-11-2023 |

| 75 | Haide Smart Energy | 20741724 | 05-11-2023 |

| 76 | ALT21 | 20439792 | 12-10-2023 |

| 77 | The Cumulus Coffee Company | 20300000 | 15-11-2023 |

| 78 | rabbit | 20000000 | 04-10-2023 |

| 79 | Conceivable Life Sciences | 20000000 | 01-08-2023 |

| 80 | Wing Cloud | 20000000 | 18-07-2023 |

| 81 | ADAR Technologies, LLC | 20000000 | 01-03-2023 |

| 82 | Chaos Labs | 20000000 | 21-02-2023 |

| 83 | Contextual AI | 20000000 | 07-06-2023 |

| 84 | Sundeck | 20000000 | 31-05-2023 |

| 85 | Fabric | 20000000 | 30-03-2023 |

| 86 | Together AI | 20000000 | 15-05-2023 |

| 87 | Nümi | 20000000 | 11-01-2023 |

| 88 | TDGA Holdings | 20000000 | 08-02-2023 |

| 89 | Konscious Foods | 19590852 | 01-08-2023 |

| 90 | Mana.bio | 19500000 | 10-10-2023 |

| 91 | Kratos Studios | 19366277 | 23-02-2023 |

| 92 | Meanwhile | 19000000 | 06-06-2023 |

| 93 | Semafor | 19000000 | 24-05-2023 |

| 94 | Monad | 19000000 | 14-02-2023 |

| 95 | constellr | 18807161 | 24-07-2023 |

| 96 | Astraveus | 18079952 | 27-06-2023 |

| 97 | Miaochang | 18019266 | 04-07-2023 |

| 98 | Keychain | 18000000 | 14-11-2023 |

| 99 | Innovac Therapeutics | 18000000 | 01-09-2023 |

| 100 | BlueWhale Bio | 18000000 | 07-09-2023 |

Below is the list of the top 10 seed investment companies:

1. Mistral AI

Founded in 2023, Mistral AI is a French startup revolutionizing AI solutions. We specialize in natural language processing and generative AI technologies, providing developers and businesses with fast, open-source, and secure language models. Our tailored solutions, leveraging private data and usage feedback, meet specific business needs. Explore our range, from the compact Mistral 7B transformer model to the advanced Mixtral 8x7B model, fluent in multiple languages and coding languages with a 32K context capacity. Join us in shaping the future of artificial intelligence.

2. Qosmosys

Qosmosys is a leading player in shaping the future of space exploration, founded in 2020 and headquartered in Singapore. Our pioneering spacecraft, ZeusX, redefines lunar missions with advanced robotics and resource extraction capabilities. We offer on-demand services across transportation, robotics & resources, and science & tech sectors, making lunar access more accessible and fostering a moon-based economy. Join us as we pioneer the next frontier of space exploration.

3. Nvelop Therapeutics

Nvelop Therapeutics, a 2022 founded biotech company based in Cambridge, US, is tackling a challenge in gene editing: delivering treatments safely and effectively within the body. Their mission is to create solutions for diseases currently considered “undruggable” due to limitations in treatment methods. Nvelop develops gene therapies that target severe genetic diseases. They utilize innovative delivery technologies to focus on editing genes in the right cells and tissues, with the goal of providing new treatment options for patients with critical unmet medical needs.

4. Poolside

Poolside is an artificial intelligence platform revolutionizing software development. It aims to unlock humanity’s potential by pursuing Artificial General Intelligence (AGI) for software creation, emphasizing specific capabilities over a general-purpose approach. Poolside AI, a French startup founded in 2023, specializes in creating large language models for software developers. The company envisions a future where AI accelerates software development, making it accessible to a broader audience. Join us in shaping this future with Poolside AI.

5. Xingzesen

Xingzesen, founded in 2020, is a Chinese company bringing edge cloud solutions to homes. They develop a platform to manage a vast network of devices and integrate edge computing into everyday equipment. Their focus is on content delivery networks (CDNs) and combining different network types to provide users with powerful edge computing capabilities. This allows Xingzesen to offer solutions for data storage, broadband sharing, and other applications powered by edge computing technology.

6. Binske

Binske is a Colorado-based cannabis brand striving to elevate the cannabis experience with artisan ingredients, expertly-crafted recipes, and premium-quality cannabis. Founded in 2015, one of the brand’s guiding principles is based on the founders’ belief in the value of community, connection, and conscientious products. Binske delivers cannabis, including a selection of flowers, vapes, edibles, extracts, and pre-rolls. Our products have licensing deals in 12 U.S. states and Canada and are currently available in dispensaries in Colorado, California, Nevada, and Florida. Join us as we redefine the cannabis experience with Binske.

7. D’stric

D’strict, a pioneering design agency founded in 2004, specializes in content and digital media technology. Providing customized content solutions and art services, the agency leverages expertise in digital media technology and visual creativity. Offering a TOTAL SERVICE approach covering master planning, content planning, system and space design, production, implementation, and technical training, D’strict collaborates with top experts to redefine possibilities in content creation and digital media technology. Join D’strict for innovative solutions that elevate the digital experience.

8. NIMMSTA

In 2019, NIMMSTA introduced the world’s first Industrial Smart Watch, revolutionizing intralogistics. This groundbreaking device combines the smart features of a smartwatch with the robustness of an industrial scanner and the low power consumption of an E-Paper touch display. NIMMSTA is designed to enhance productivity and reduce errors in intralogistics operations. It integrates a smart watch, industrial scanner, and e-paper touch display, enabling employees to pick up and scan items seamlessly. With advanced technology, including a high-performance scanner capable of reading barcodes from up to four meters away, NIMMSTA improves productivity by up to 50% with a zero-error rate. Join us in redefining efficiency in intralogistics with NIMMSTA.

9. Black Ore Technologies

Black Ore Technologies, founded in 2022, is a pioneering AI-driven financial services company currently operating in stealth mode. Emerging with a substantial $60 million funding round, Black Ore is revolutionizing the sector with its flagship platform, Tax Autopilot. This cutting-edge AI solution automates the entire 1040 tax preparation process for CPAs and tax professionals, reducing employee hours and stress while increasing profit margins. By leveraging AI and machine learning technologies, Black Ore empowers CPAs to focus on higher-value client advisory work, driving firm growth and efficiency. Join us as we redefine financial services with Black Ore Technologies.

10. Arialys Therapeutics

Arialys Therapeutics, a young biotech founded in 2021, is pioneering a new approach to neurological and psychiatric diseases. They focus on the immune system’s role in brain health and illness, specifically how the body produces autoantibodies that attack the brain, leading to these conditions. Arialys develops targeted therapies to block these harmful antibodies within the brain. Their pre-clinical research holds promise for offering new treatments for a range of neuropsychiatric disorders.

Seed Investors

Aside from seed investments, startups can also seek funding from seed investors. Seed investors are somewhat different from seed investments, but nonetheless, they also offer funding for new businesses (especially for very early startups).

Who are seed investors?

Seed investors usually invest in the very early stages of startups. These investors can be the founders of the business, your friends and family, incubators and venture capital companies. One of the most common types of seed investors are called “angel investors”:

- Venture Capital (VC): VC is a type of private equity and a type of funding that investors provide to startups (especially for businesses that have potential for long-term growth).

- Corporate venture capital (CVC): Also known as corporate venturing, CVCs invest in innovative startups in order to obtain competitive advantage and get new ideas, markets and technologies. Compared to VCs, which prioritise ROI with their funding, CVCs aim for getting industry knowledge, market and brand reputation.

- Angel investors: Angel investors are wealthy individuals who provide capital for startups in exchange for convertible notes or ownership equity. They can provide either a one-time funding to help you get your business up and running, or an ongoing funding to help carry the business through the early stages (which can be difficult for most startups).

What do seed investors look for?

In order to get the attention of seed investors, there are several things you have to prepare. Aside from having a prototype of your product to present, it’s important to have a well-prepared business plan. There are many components in a business plan, but you should put your goals, vision, market analysis, products, and any other information that you deem important for your potential investors to know.

Top Seed Stage Investors

Here is a list of the top Seed investors:

| S. No. | Organization | Investor Type | Number of Exits | Number of Investments |

|---|---|---|---|---|

| 1 | Y Combinator | Accelerator | 566 | 6,561 |

| 2 | Techstars | Accelerator, Venture Capital | 486 | 6,024 |

| 3 | MassChallenge | Accelerator | 207 | 3,176 |

| 4 | 500 Global | Accelerator | 376 | 3,121 |

| 5 | SOSV | Venture Capital | 77 | 2,726 |

| 6 | New Enterprise Associates | Venture Capital | 592 | 2,185 |

| 7 | Accel | Venture Capital | 374 | 2,010 |

| 8 | Sequoia Capital | Venture Capital | 388 | 1,939 |

| 9 | Plug and Play | Accelerator, Venture Capital | 171 | 1,861 |

| 10 | Bossanova Investimentos | Venture Capital | 185 | 1,685 |

| 11 | Andreessen Horowitz | Venture Capital | 220 | 1,543 |

| 12 | Google for Startups | Accelerator | 67 | 1,542 |

| 13 | IDG Capital | Venture Capital | 157 | 1,482 |

| 14 | SV Angel | Investment Bank, Venture Capital | 451 | 1,426 |

| 15 | FJ Labs | Micro VC, Venture Capital | 95 | 1,423 |

| 16 | Kleiner Perkins | Venture Capital | 337 | 1,416 |

| 17 | Bessemer Venture Partners | Venture Capital | 304 | 1,393 |

| 18 | Right Side Capital Management | Micro VC, Venture Capital | 201 | 1,372 |

| 19 | Lightspeed Venture Partners | Venture Capital | 237 | 1,359 |

| 20 | Antler | Accelerator, Venture Capital | 8 | 1,342 |

| 21 | Newchip Accelerator | Venture Capital | 8 | 1,308 |

| 22 | General Catalyst | Venture Capital | 199 | 1,292 |

| 23 | Khosla Ventures | Venture Capital | 167 | 1,200 |

| 24 | Tiger Global Management | Venture Capital | 141 | 1,159 |

| 25 | Index Ventures | Venture Capital | 244 | 1,145 |

| 26 | Advantage Capital | Private Equity Firm, Venture Capital | 124 | 1,132 |

| 27 | Google Ventures | Venture Capital | 243 | 1,113 |

| 28 | VentureOut | Accelerator, Incubator | 101 | 1,101 |

| 29 | European Innovation Council | Accelerator, Venture Capital | 27 | 1,092 |

| 30 | Sequoia Capital China | Venture Capital | 105 | 1,079 |

| 31 | Insight Partners | Private Equity Firm, Venture Capital | 219 | 1,075 |

| 32 | Goldman Sachs | Investment Bank, Venture Capital | 379 | 1,043 |

| 33 | Crowdcube | Venture Capital | 22 | 1,041 |

| 34 | Innovate UK | Entrepreneurship Program, Venture Capital | 60 | 995 |

| 35 | Global Founders Capital | Private Equity Firm, Venture Capital | 89 | 972 |

| 36 | Start-Up Chile | Accelerator | 36 | 953 |

| 37 | Qiming Venture Partners | Venture Capital | 78 | 941 |

| 38 | Norwest Venture Partners | Private Equity Firm, Venture Capital | 200 | 922 |

| 39 | Founders Fund | Venture Capital | 148 | 903 |

| 40 | First Round Capital | Venture Capital | 201 | 902 |

| 41 | Liquid 2 Ventures | Venture Capital | 66 | 902 |

| 42 | HTGF | High-Tech Gruenderfonds | Venture Capital | 115 | 884 |

| 43 | Greylock | Venture Capital | 260 | 870 |

| 44 | Battery Ventures | Venture Capital | 210 | 851 |

| 45 | Gaingels | Syndicate, Venture Capital | 49 | 815 |

| 46 | Greycroft | Venture Capital | 135 | 805 |

| 47 | ZhenFund | Entrepreneurship Program, Venture Capital | 53 | 788 |

| 48 | Canaan Partners | Venture Capital | 164 | 788 |

| 49 | Menlo Ventures | Venture Capital | 181 | 783 |

| 50 | Redpoint | Venture Capital | 166 | 756 |

| 51 | Goodwater Capital | Venture Capital | 18 | 749 |

| 52 | Hiventures | Venture Capital | 7 | 748 |

| 53 | Foundation Capital | Venture Capital | 169 | 738 |

| 54 | Polaris Partners | Venture Capital | 189 | 729 |

| 55 | Matrix Partners China | Venture Capital | 48 | 713 |

| 56 | True Ventures | Venture Capital | 116 | 710 |

| 57 | BDC Venture Capital | Venture Capital | 167 | 697 |

| 58 | Technology Development Fund | Venture Capital | 13 | 694 |

| 59 | Benchmark | Venture Capital | 189 | 687 |

| 60 | Cleantech Open | Accelerator | 19 | 679 |

| 61 | CRV | Venture Capital | 163 | 672 |

| 62 | Mayfield Fund | Venture Capital | 195 | 668 |

| 63 | Matrix | Venture Capital | 154 | 666 |

| 64 | Peak XV Partners | Venture Capital | 75 | 660 |

| 65 | BoxGroup | Venture Capital | 117 | 658 |

| 66 | Bain Capital Ventures | Venture Capital | 133 | 652 |

| 67 | Lerer Hippeau | Venture Capital | 161 | 644 |

| 68 | DCM Ventures | Venture Capital | 137 | 640 |

| 69 | Global Brain Corporation | Venture Capital | 92 | 639 |

| 70 | Felicis | Venture Capital | 160 | 633 |

| 71 | East Ventures | Accelerator, Venture Capital | 54 | 615 |

| 72 | Almi Invest | Government Office, Venture Capital | 42 | 609 |

| 73 | Atlas Venture | Venture Capital | 185 | 601 |

| 74 | RRE Ventures | Venture Capital | 130 | 596 |

| 75 | Alchemist Accelerator | Accelerator | 57 | 588 |

| 76 | HAX | Accelerator | 14 | 586 |

| 77 | Startup Wise Guys | Accelerator, Venture Capital | 7 | 580 |

| 78 | Seedcamp | Accelerator, Micro VC, Venture Capital | 63 | 578 |

| 79 | U.S. Venture Partners | Venture Capital | 158 | 577 |

| 80 | Partech | Corporate Venture Capital, Venture Capital | 103 | 564 |

| 81 | Spark Capital | Venture Capital | 100 | 561 |

| 82 | Startupbootcamp | Accelerator | 44 | 549 |

| 83 | Wavemaker Partners | Micro VC, Venture Capital | 70 | 547 |

| 84 | LAUNCH | Accelerator, Venture Capital | 52 | 546 |

| 85 | Shenzhen Capital Group | Government Office, Venture Capital | 90 | 530 |

| 86 | SMBC Venture Capital | Investment Bank, Venture Capital | 72 | 529 |

| 87 | Northstar Ventures | Venture Capital | 27 | 526 |

| 88 | Eight Roads Ventures | Venture Capital | 108 | 523 |

| 89 | Mitsubishi UFJ Capital | Venture Capital | 79 | 523 |

| 90 | Initialized Capital | Venture Capital | 96 | 523 |

| 91 | gbeta | Accelerator | 11 | 513 |

| 92 | Madrona | Venture Capital | 102 | 512 |

| 93 | Orbit Startups | Accelerator, Venture Capital | 12 | 512 |

| 94 | Shunwei Capital | Venture Capital | 35 | 508 |

| 95 | Highland Capital Partners | Venture Capital | 149 | 504 |

| 96 | Founder Collective | Venture Capital | 146 | 501 |

| 97 | Soma Capital | Venture Capital | 44 | 500 |

| 98 | DCVC | Venture Capital | 104 | 500 |

| 99 | International Finance Corporation | Government Office, Venture Capital | 117 | 498 |

| 100 | Lux Capital | Venture Capital | 57 | 490 |

Manage Your Company Equity on Eqvista

Once you’ve gotten funding for your company, it’s important to manage your equity and shareholders with your cap table. Managing a cap table can be challenging, which is why Eqvista has created a platform where you can manage your cap table efficiently and with ease. We also provide complete company 409a valuations to value your company. Contact us to learn more!