Understanding ISOs and NSOs: A Comprehensive Guide to Employee Stock Options

This article throws light on key features of ISOs and NSOs, tax Implications of ISOs and NSOs, and examples of ISOs and NSOs.

Stock options are a type of equity compensation that businesses use to augment the wages of their employees. It assists in achieving crucial financial goals and in building wealth. To take full advantage of this opportunity, it is important to be aware of the nature of the stock options and how they operate. Incentive stock options (ISOs) and nonqualified stock options (NSOs) are the two most popular types of options, and each has a unique set of laws and tax implications.

This article throws light on key features of ISOs and NSOs, tax Implications of ISOs and NSOs, and examples of ISOs and NSOs.

ISO and NSO

According to a 2022 survey by the National Association of Stock Plan Professionals (NASPP), the median number of ISO options granted to employees in 2021 was 15,000. The median exercise price for ISO options was $10 per share.

The NASPP survey also found that the median number of NSOs granted to employees in 2021 was 10,000. The median exercise price for NSOs was $15 per share.

ISOs and NSOs grant you the right to purchase shares of the company’s stock at a later period and at a fixed price. ISOs and NSOs can be valuable incentives for employees, advisors, and consultants. However, it is important to understand the key differences between the two types of options, as well as the tax implications.

What is ISO?

An incentive stock option (ISO) is a business perk that enables employees to purchase company shares at a discount with the potential for tax benefits on the gain. The tax rate applied to profits from eligible ISOs is typically the capital gains rate and not the higher rate for regular income.

Generally, ISO stock is exclusively given to top management and highly valued staff. They are also known as statutory and qualified stock options.

What is NSO?

A non-qualified stock option (NSO) is a form of employee stock option in which you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.NSOs are easy to understand and more prevalent than ISOs. They are referred to as non-qualified stock options since they do not fulfill all of the standards of the Internal Revenue Code to be classified as ISOs.

How ISOs and NSOs Work?

When exercised, a non-qualified stock option (NSO) is treated as ordinary income. Additionally, upon execution of an NSO, a portion of its value may be liable for accrued income withholding tax.

On the other hand, with ISOs, no reporting is required until the profit is realized. ISOs, like non-statutory options, can be used in a variety of ways. They can be exercised in a cashless transaction or through a stock transfer, or the employee might pay cash upfront.

Key Features of ISOs and NSOs

- Incentive stock options (ISOs) provide future rights to company shares at a reduced price.

- The goal is to keep key employees or managers.

- Before selling an ISO, there must be a holding period of at least one year and a vesting term of at least two years.

- Non-qualified stock options necessitate the payment of income tax on the grant price less the exercise price.

- NSOs may be offered as an alternative to traditional forms of payment.

- Prices are frequently comparable to the shares’ market value.

Differences between ISOs and NSOs

ISOs and NSOs can be valuable incentives for employees, advisors, and consultants. However, it is important to understand the key differences between the two types of options, as well as the tax implications.

| Basis of Distinction | ISO | NSO |

|---|---|---|

| Eligibility | Only employees | Anyone (including staff members, directors, consultants, contractors, vendors, and even other third parties). |

| Vesting schedule | Required | Not necessary |

| Tax effects | Can be more challenging | It is simple |

| Tax on exercise | There is often no tax consequence.AMT taxes may apply if the FMV at exercise differs from the exercise price. | Spread ( the difference between the FMV at exercise and the exercise price) is taxed as ordinary income. |

| Tax at sale | Long-term capital gains tax (CGT) if held for more than a year after exercise and more than two years following the award. | When held for more than a year after exercising, the CGT is long-term. |

| Expiration | 10 years maximum from grant | Subject to agreement |

Granting Limits Of ISO Vs NSO

The main difference between ISOs and NSOs is the tax treatment when the options are exercised. ISOs are taxed as capital gains when exercised, while NSOs are taxed as ordinary income. Capital gains taxes are typically lower than ordinary income taxes, so ISOs are generally more favorable for option holders.

Suppose a company grants an employee 10,000 ISO options with an exercise price of $10 per share. The company’s stock is currently trading at $20 per share.

- Granting limit: The granting limit for ISOs is $100,000 per year. The fair market value of the options at the time of grant is $100,000 (10,000 options x $10 per share). Therefore, the company is within the granting limit.

- Exercise price limit: The exercise price limit for ISOs is $10 per share. The company’s stock is currently trading at $20 per share. Therefore, the employee is within the exercise price limit.

Now, suppose a company grants an advisor 10,000 NSOs with an exercise price of $10 per share. The company’s stock is currently trading at $20 per share.

- Granting limit: There is no granting limit for NSOs. Therefore, the company is within the granting limit.

- Exercise price limit: There is no exercise price limit for NSOs. Therefore, the advisor is within the exercise price limit.

| Scenario | ISO | NSO |

|---|---|---|

| No Conversion | $100,000 | $0 |

| With NSO Conversion | $100,000 | Any amount exceeding $100,000 |

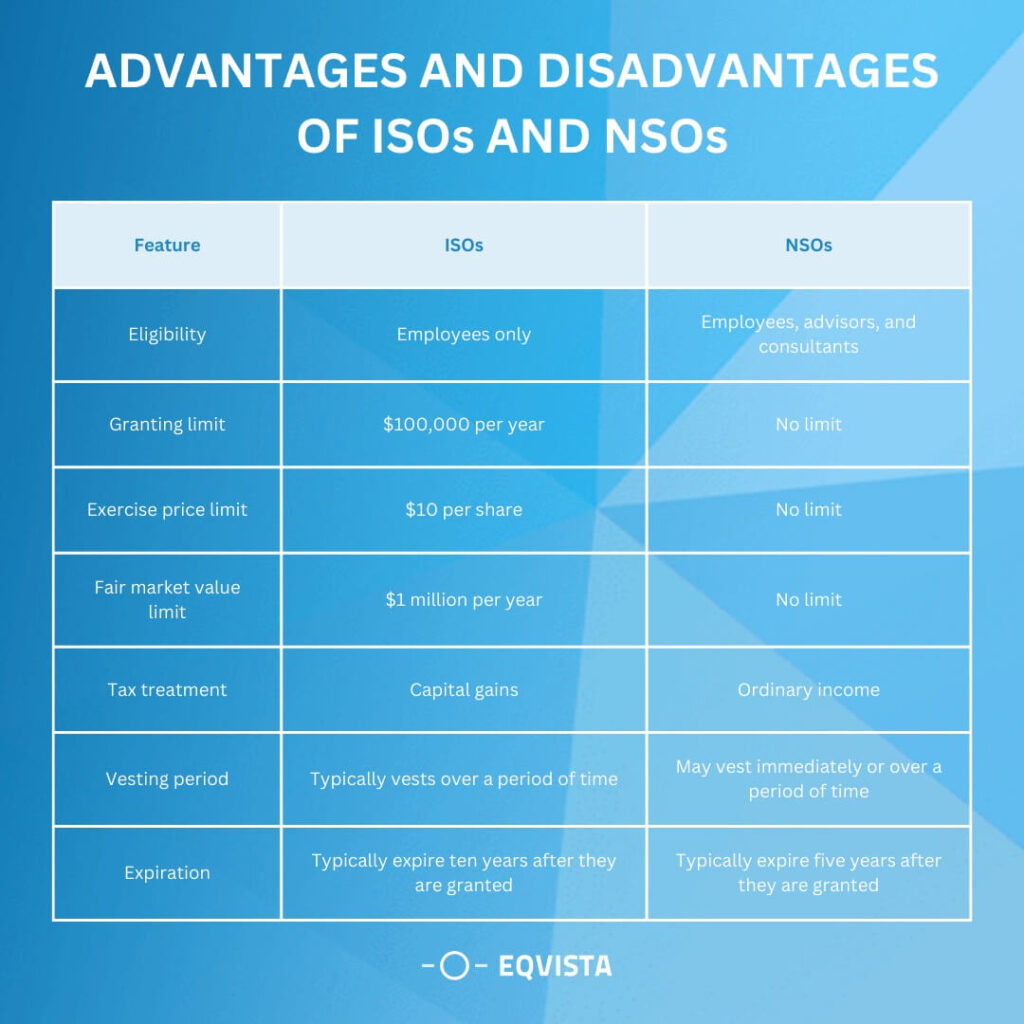

Advantages and Disadvantages of ISOs and NSOs

The various advantages and disadvantages of ISOs and NSOs are elaborated as follows. Here is a table that summarizes the key differences:

- It’s easy to exercise ISOs. It’s a simple procedure that you can approach in several ways based on your short- and long-term financial goals.

- Flexibility is one of the main benefits of ISOs.

- The ISO offers a more advantageous tax treatment than any other employee stock purchase plan, which is one of its most notable advantages.

- The tax burden on the sale revenue from your ISOs might be greatly reduced by qualified disposal.

Advantages of NSOs for Employees and Employers

- It lowers the possibility of a cash outflow and enables the business to keep more cash and liquidity for other purposes by acting as an efficient compensation technique.

- It also serves as a motivational tool for staff members, who are more likely to be devoted and driven to boost stock value once they have a stake in the firm.

- Employers like using NSOs because they can get a tax deduction equivalent to the amount of stock option income declared by the recipient (i.e., employee) when using them.

Disadvantages of NSOs For Employees and Employers

- The primary downside of NSO is that any profits gained from stock sales are subject to ordinary income tax, which might increase the employee’s tax burden.

- They are not eligible for preferential tax treatment.

- The rise in stock prices and the ability to benefit from it are not guarantees.

- For lower-income employees, cashless exercise might also mean losing substantial earnings and having to sell stock options right away. With cash exercise, some employees may not be able to afford to pay cash upfront.

Disadvantages of ISOs For Employees and Employers

- ISOs may become “underwater” if the stock price falls below the grant price, which can result in employees not realizing any gains while causing potential dilution for employers.

- Employees might face Alternative Minimum Tax (AMT) and intricate tax regulations, potentially increasing their tax burden, while employers must navigate complex accounting and administrative requirements.

- Until stock is sold, employees cannot access the potential profits tied up in ISOs, while employers issuing more shares through ISOs may dilute existing shareholders’ ownership.

- Employees holding ISOs might prioritize personal financial gain over long-term commitment to the company, posing retention and productivity concerns for employers

Tax Implications of ISOs and NSOs

Taxation of ISOs For Employees and Employers

- ISOs have more advantageous tax treatment than non-qualified stock options (NSOs) because they require the holder to retain the shares for a longer period.

- The profit from the selling of stock shares must be kept for more than a year for it to be classified as capital gains.

- In the case of ISOs, the shares must be kept for more than one year from the date of exercise and two years from the date of the award. Profits must satisfy both requirements to be classified as capital gains.

Taxation of NSOs For Employees and Employers

- When employees exercise NSOs, they are subject to ordinary income tax on the difference between the option’s exercise price and the fair market value at the time of exercise. This taxation applies regardless of whether the shares are sold immediately or held.

- Employers are generally not eligible for tax deductions when employees exercise NSOs, unless the options are issued as part of an employee compensation plan and meet certain criteria.

- Employees may face AMT implications when exercising NSOs, potentially leading to additional tax liability.

- If employees sell the shares acquired through NSOs after holding them for a specific period, any further gains are subject to capital gains tax rates, which can vary depending on the holding duration.

Choosing the Right Option for Your Business!

The decision of whether to offer ISOs or NSOs depends on various factors, including the company’s structure, goals, and the specific needs of the employees.

ISOs are typically reserved for employees and have more favorable tax treatment, but they also come with certain restrictions and limitations. NSOs can be granted to a broader range of individuals and provide more flexibility but may have less favorable tax treatment.

It’s important to consult with legal and financial professionals who specialize in equity compensation to determine the best option for your business and employees, as the specific circumstances may vary.

Factors to consider when choosing between ISOs and NSOs

Choosing the right option between ISOs and NSOs for a business depends on several factors, such as the company’s goals, financial situation, and employee needs. Here are some key considerations to keep in mind when deciding which option is right for your business

- Tax Implications – ISOs provide tax benefits to employees, while NSOs are typically taxed as ordinary income.

- Employee Needs – The employee’s needs should be taken into account when deciding which option to offer.

- Financial Situation – ISOs can help manage dilution, while NSOs can lead to significant share dilution and impact the company’s stock value.

- Restrictions – ISOs may be more suitable for smaller businesses with significant contributions, while NSOs may be more appropriate for larger businesses.

Other Considerations

- Tax treatment – ISO options are taxed as capital gains when exercised, while NSO options are taxed as ordinary income when exercised.

- Vesting – ISO options typically vest over a period of time, while NSO options may vest immediately or over a period of time.

- Expiration – ISO options typically expire ten years after they are granted, while NSO options typically expire five years after they are granted.

Manage Your Stock Options With Eqvista!

ISOs and NSOs are two types of employee stock options with different tax implications and eligibility requirements. ISOs provide preferential tax treatment, while NSOs are subject to standard income tax rates. ISOs are limited to employees and have specific vesting and holding period requirements. At the same time, NSOs can be granted to a broader range of individuals and have more flexibility in exercise timing.

Eqvista can help you manage your stock options. To learn more about employee’s stock options, click here. Feel free to contact us.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!