Pre-IPO Stage: A Guide for Investors and Startups

This article highlights the due diligence in the Pre-IPO Stage and key challenges and mitigation strategies in pre-IPO stage.

The Pre-IPO stage is crucial for entrepreneurs intending to take their companies public as well as investors eager to capitalize on the potential of high-growth startups. It entails strategic planning, financial preparations, and cautious execution. The path to becoming a publicly traded firm is frequently complicated and loaded with numerous hurdles and possibilities.

Startups at pre-Ipo stage are often through a phase of rapid growth as they work to establish their market presence, scale their businesses, and get funding to support future expansion.

This article highlights the due diligence in the Pre-IPO Stage, key challenges and mitigation strategies in pre-IPO stage, pre -IPO stage significance in the startup ecosystem.

Pre IPO stage in startups

In startups, the Pre-IPO (Initial Public Offering) stage refers to the period in a company’s life cycle that happens before it goes public and lists its shares on a stock exchange. The business is now still privately held, which means that only a small number of investors, founders, and employees are allowed to possess shares, which are not traded on a public market.

Understand pre-IPO stage

A private firm goes through a reorganization process called the pre-IPO transformation stage as it prepares to become public. The corporation should choose executives that have experience doing so because that is the primary goal of public companies maximizing shareholder value.

Pre-IPO stage significance in the startup ecosystem

The Pre-IPO stage is crucial for startups in their lifecycle, leading up to their initial public offering (IPO). This stage focuses on scaling, gaining market dominance, and building a reputation. Companies can raise funds through private finance rounds, increasing investment in operations, growth, and research. Pre-IPO also enables founders, workers with vested stock options, and early investors to realize their shares’ value, facilitating liquidity and potential secondary market sales.

Key Challenges and Mitigation Strategies in pre IPO stage

The crucial pre-IPO (Initial Public Offering) period of a company’s development is fraught with difficulties and dangers of its own. It takes meticulous preparation and execution to go through this level successfully.

The main obstacles that were encountered during the pre-IPO stage are listed below, along with mitigating techniques for each:

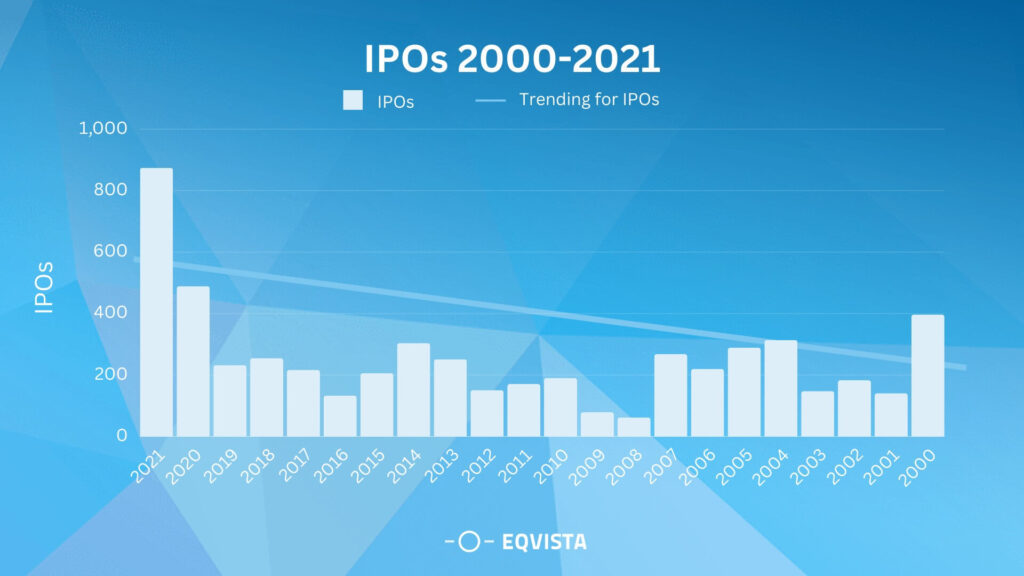

- Market Volatility and Timing Considerations – Market volatility refers to the variation in financial asset prices over time, influenced by factors like business performance, investor attitude, and market participants’ behavior. Timing considerations involve selecting when to acquire or sell assets based on market conditions, economic indicators, and personal investment objectives.

- Financial and Operational Preparedness – An organization’s resilience and success depend on its operational and financial preparation. They entail thorough preparation, effective management, and approaches to risks and difficulties.

- Addressing financial reporting and transparency requirements – Financial reporting and transparency are essential for accountability, trust, decision-making, and investor protection. Organizations must adhere to these standards to establish trust with stakeholders and avoid legal consequences, reputational harm, and loss of investor confidence.

- Enhancing operational efficiency and scalability – Businesses must increase operational effectiveness and scalability if they want to survive and change with the times in today’s competitive marketplace. Organizations can increase productivity, save costs, and better manage growth by optimizing processes and systems.

- Managing working capital and cash flow effectively – Effective working capital and cash flow management are crucial for a company’s financial stability and health. Working capital represents the difference between a business’s assets and liabilities, while cash flow represents the money flow over time.

- Communicating with investors during the Pre-IPO stage – Prioritize communication with investors during the Pre-IPO phase to create bonds, explain investment opportunities openly, and be honest about finances, performance, dangers, and prospects. Provide clear and accurate information to build trust and confidence, attracting investment.

Typical timeline from startup to IPO

The length of time taken between startup to IPO (Initial Public Offering) can vary greatly based on the particular business, the sector it operates in, and the state of the market. The normal stages and timetable are outlined in this generic overview.

| Stage of startup | Timeline |

|---|---|

| Seed Stage and Early Development | 0 to 2 years |

| Angel and Seed Funding | 2 to 3 years |

| Early Growth and Series A Funding | 3 to 5 years |

| Mid-stage Growth and Series B/C Funding | 5 to 7 years |

| Late-stage Growth and Series D/E/F Funding | 7 to 10 years |

| Pre-IPO | 9 to 12 years |

| IPO | 10 to 12 years |

Key considerations for a successful IPO

A successful Initial Public Offering (IPO) needs meticulous planning, preparation, and execution as it is a complicated procedure. Here are some crucial factors to keep in mind for a successful IPO:

- Building a strong foundation for future growth and investor interest – An Initial Public Offering (IPO) needs to be carefully planned, carried out, and based on a sound company strategy to build a solid platform for future growth and investor interest. A well-prepared team and a solid business foundation are important for garnering investor interest and ensuring a successful IPO because the process can be difficult and time-consuming.

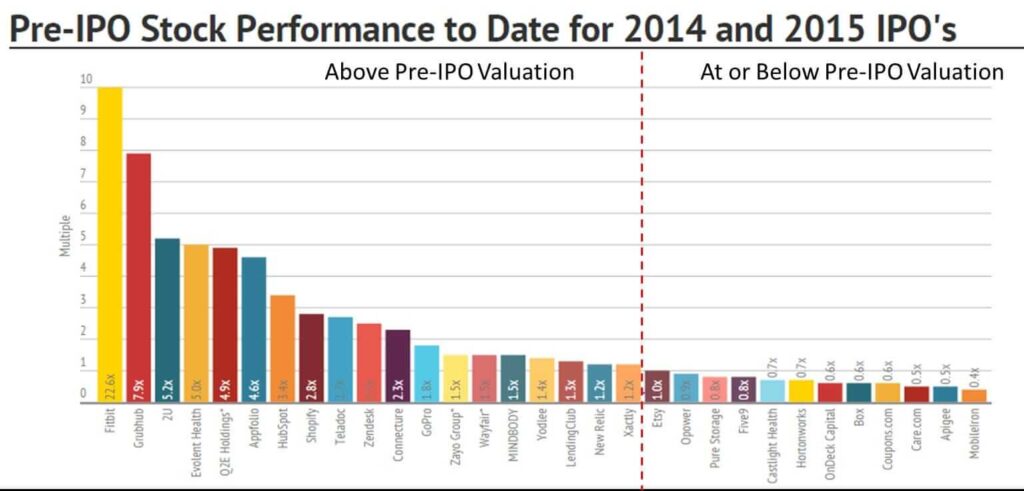

- Evaluating Pre-IPO Startups – Evaluating pre-IPO startups can be challenging due to their lack of extensive financial and operational history. To evaluate a startup, consider its market size, growth potential, management team, product/service offering, financial predictions, customer base, user adoption, funding history, valuation trends, market positioning, and potential exit strategy for investors.

- Criteria for assessing Pre-IPO companies – Investors must evaluate Pre-IPO companies because they are not publicly traded and endure higher risks. A few important considerations are financial statement analysis, estimation of the size and potential of the target market, evaluation of the unique selling proposition, management team background, assessment of the company model, and prospective merger or acquisition.

- Key financial metrics and indicators to consider – The management of the firm and prospective investors should carefully examine numerous financial measures and indicators when contemplating an Initial Public Offering (IPO) with a view to gauging the company’s financial performance and health. These indicators offer insightful information about the previous performance and perspective of the firm.

Due Diligence in the Pre-IPO Stage

The crucial process of due diligence during the pre-IPO (Initial Public Offering) phase entails a detailed examination and analysis of a company’s financial, legal, operational, and regulatory elements. Before going public, potential investors, underwriters, and other parties interested in the company’s IPO evaluate its potential and dangers.

- Assessing the management team, corporate governance, and culture – Understanding an organization’s overall health and potential for success requires evaluation of its management team, corporate governance, and culture. Each of these factors is extremely important in determining the direction, decision-making procedures, and overall performance of the business. It is also critical to analyze the industry and competitive landscape to produce an accurate assessment of the organization.

- Analyzing intellectual property, legal, and regulatory aspects – Analyzing intellectual property, legal, and regulatory concerns in an IPO is crucial for both the company and potential investors. This examination helps in assessing the company’s valuation, market standing, and prospects, aiding in smoother IPO management and enabling informed judgments.

Preparing for the IPO Journey

Preparing for an IPO is an exciting and challenging process that involves careful planning, comprehensive preparation, and attention to detail. Going public can provide your company with funding, improved visibility, and liquidity for shareholders.

Strategies for preparing a startup for the Pre-IPO stage

The Pre-IPO stage preparation for a startup is a crucial stage that necessitates meticulous strategy and execution.

- Building a scalable business model and growth strategy – Building a scalable business model and growth strategy needs rigorous planning, analysis, and execution. It’s critical to scale your operations as your firm expands. Make sure your production methods, customer service, and supply chain can handle rising demand without compromising quality.

- Strengthening financial reporting and governance practices – Maintaining openness, trust, and accountability to investors and stakeholders during the IPO process requires strengthening financial reporting and governance procedures. Companies that plan to go public must show that they have strong governance and financial reporting systems in place to safeguard the interests of their shareholders.

- Attracting Pre-IPO Investors – Attracting pre-IPO investors is critical for a company’s growth and expansion. As the company gets ready for its ultimate public offering, these investors provide funding and support during the pre-IPO stage. Treating potential investors as partners and establishing long-term connections are crucial.

- Creating a compelling investment story and value proposition – Developing an enticing investment story and value proposition is critical for getting investors and stakeholders to support your company or project. Practice presenting your investing narrative with passion and assurance.

- Positioning the startup for successful fundraising rounds – Positioning a startup for successful fundraising rounds and, eventually, an initial public offering (IPO) is a difficult but rewarding process. It necessitates thorough preparation, intelligent choice-making, and effective business model execution.

- Regulatory and Compliance Considerations – The knowledge of legal, financial, and accounting experts is necessary while navigating the regulatory and compliance landscape in an IPO. To ensure adherence to all pertinent laws and regulations and to ensure a successful IPO, businesses should carefully coordinate with their legal and financial consultants.

- Addressing potential risks and challenges – Addressing these possible risks and obstacles through careful planning, open communication, and sound decision-making can boost the probability of a successful IPO and position the company for post-IPO success.

Connect Eqvista for Strategic Planning and Prompt IPO Valuation

The Pre-IPO stage is essential for both entrepreneurs and investors. Both entrepreneurs and investors may position themselves for success in the IPO and beyond by approaching it with meticulous planning, in-depth research, good communication, and a focus on long-term objectives. It is a path that calls for commitment, teamwork, and a common goal of a thriving future. Eqvista may help you with your startup value for an IPO. Get in touch with us immediately to learn more about our services. Signup to receive updates.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!